RELX 2022 Pretax Profit Rose But Failed to Meet Consensus

February 16 2023 - 2:56AM

Dow Jones News

By Anthony O. Goriainoff

RELX PLC said Thursday that 2022 pretax profit rose due to

higher adjusted pretax profit but failed to meet consensus, and

that momentum remained strong across the group.

The London-listed information-and-analytics group made a pretax

profit of 2.11 billion pounds ($2.54 billion) for the year,

compared with GBP1.8 billion for 2021, and consensus of GBP2.31

billion, taken from FactSet and based on eight analysts'

forecasts.

Adjusted pretax profit--one of the company's preferred

metrics--rose on a constant-currency basis was GBP2.48 billion

compared with GBP2.08 billion the year before.

Revenue rose to GBP8.55 billion from GBP7.24 billion in the year

prior. Revenue consensus for the year was GBP8.45 billion, also

taken from FactSet and based on 14 analysts' estimates.

The board declared a dividend of 54.6 pence a share, up from

49.8 pence a year prior.

The company said it intends to deploy a total of GBP800 million

in share buybacks in 2023

RELX said it expects revenue and adjusted operating profit

underlying growth rates to remain above historical trends and drive

strong growth in adjusted earnings per share on a constant currency

basis in 2023.

"The improving long-term growth trajectory is being driven by

the ongoing shift in our business mix towards higher growth

analytics and decision tools that deliver enhanced value to our

customers across market segments," Chief Executive Officer Erik

Engstrom said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

February 16, 2023 02:41 ET (07:41 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

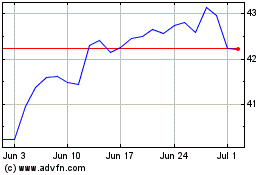

RELX (EU:REN)

Historical Stock Chart

From Apr 2024 to May 2024

RELX (EU:REN)

Historical Stock Chart

From May 2023 to May 2024