L'Oreal's 2Q Slowdown Overshadows Strong 1st Half -- Earnings Review

July 31 2019 - 7:28AM

Dow Jones News

By Anthony Shevlin

L'Oreal SA (OR.FR) posted its first-half results after market

close on Tuesday and recorded its strongest first-half

like-for-like growth in more than a decade, but its first-half net

profit came in slightly below analyst expectations.

Shares in the cosmetics and consumer-goods company are down in

trading on Wednesday as investors react to a slowdown in growth in

the second quarter, missing analyst forecasts.

SALES: L'Oreal posted first-half sales of 14.81 billion euros

($16.51 billion) compared with EUR13.39 billion the year prior--and

in line with a forecast provided by FactSet.

NET INCOME: The French company's first-half net profit came in

slightly below analyst expectations. Net profit for the six months

ended June 30 rose 2.3% to EUR2.33 billion, but it missed a FactSet

forecast of EUR2.46 billion.

WHAT WE WATCHED:

-Eyes were on L'Oreal's luxe division which posted sales of

EUR5.15 billion in the first half, a rise of over 13% on a

like-for-like basis.

-Analysts expected L'Oreal's organic growth to continue its

strong momentum, with Bernstein forecasting growth of 7.6% in the

second quarter. However, L'Oreal disappointed with growth of 6.8%.

"When 2Q sales are strong, but miss expectations... this is more

important than meeting margin/EPS expectations," Bernstein

said.

-The company's performance in Asia Pacific remained strong,

implying continued strength in the crucial China market. L'Oreal's

performance in other markets was subdued, however, notably in North

America. Bryan Garnier said the company's consumer products

division was penalized by the U.S. makeup market.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

July 31, 2019 07:13 ET (11:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

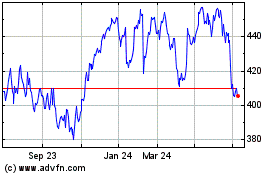

LOreal (EU:OR)

Historical Stock Chart

From Mar 2024 to Apr 2024

LOreal (EU:OR)

Historical Stock Chart

From Apr 2023 to Apr 2024