BNP Paribas Posts Third-Quarter Profit Rise, Launches EUR900 Million Buyback

October 29 2021 - 1:40AM

Dow Jones News

By Cristina Roca

BNP Paribas SA on Friday posted higher-than-expected net profit

and revenue for the third quarter, and announced a new

share-buyback program.

The Paris-based lender will buy back 900 million euros ($1.05

billion) worth of its shares starting Nov. 1. The program will run

no later than Feb. 8, when the bank will present its new strategy

along with its 2021 results.

Third-quarter net profit came in at EUR2.5 billion, up from

EUR1.89 billion a year earlier and ahead of analysts' expectations

of EUR2.29 billion, according to a FactSet consensus estimate.

The bank's bottom line was helped by lower loan-loss provisions,

which came in at EUR706 million, down from EUR1.25 billion in the

same period a year ago when banks were still preparing for

potentially huge losses on loans to consumers and businesses due to

the pandemic.

Revenue rose to EUR11.4 billion from EUR10.89 billion a year

earlier. It had been expected at EUR11.25 billion, according to

FactSet.

BNP's common equity Tier 1 ratio--a key measure of capital

strength--stood at 13% as of Sept. 30, compared with 12.9% at the

end of June.

Write to Cristina Roca at cristina.roca@wsj.com

(END) Dow Jones Newswires

October 29, 2021 01:25 ET (05:25 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

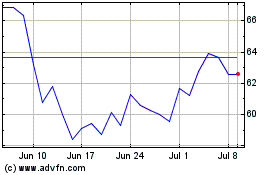

BNP Paribas (EU:BNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

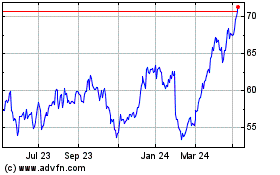

BNP Paribas (EU:BNP)

Historical Stock Chart

From Apr 2023 to Apr 2024