Alchimie Announces Its 2023 Revenues

January 31 2024 - 11:45AM

Business Wire

- 2023 revenues of €11.3 million, in line with the guidance

announced in October

- Further diversification of the business mix with the launch

of videowall and 42videobricks solutions

- Positive 2023 EBITDA

- Cash position of €5.2 million at December 31, 2023

Regulatory News:

ALCHIMIE (FR0014000JX7 – ALCHI – PEA-PME eligible), a

channel factory enabling brands, media and companies to create,

design and animate their own themed video channels and stream their

video contents, today announces its 2023 consolidated revenue1 at

December 31, 2023

Pauline Grimaldi d'Esdra, CEO of Alchimie, comments: "The

year 2023 was highlighted by the strategic development of new

growth drivers, with the diversification of our offering towards

SaaS and VPaaS (Video Platform as a Service) models. Most of our

resources were devoted to their technical and commercial

deployment, enabling us to sign our first contracts. However, the

sales cycle for these offerings is longer than anticipated, which

led us to revise our revenues target from October onwards. In 2024,

we will continue to step up our marketing pressure to capitalize on

the commercial traction that has been initiated. In view of these

factors, we are approaching 2024 with confidence and will be

careful to maintain a healthy cost structure”.

Business activity: pursuing diversification of

offerings

Revenue for the year to December 31, 2023 amounted to €11.3

million, in line with the announced guidance and mainly due to the

termination of service with Orange in January 2023. In 2023,

Alchimie benefited from the solid resilience of its historical

subscriber bases both in France and Germany. In addition, the

Company's strategic reorientation to market new SaaS and VPaaS

offerings, videowall and 42videobricks, got off to a slower start

than expected. Despite the efforts to market these new offerings,

few revenues were generated in 2023.

As previously announced, from the first half of 2023, Alchimie

implemented its strategy to capitalize on its Tech expertise by

offering companies a range of features from its video streaming

platform through two distinct and complementary offerings:

- videowall, offering companies a SaaS

video platform based on a European cloud and totally no-code,

enabling them to improve the impact of their communication and

their image thanks to a single video streaming platform;

- and 42videobricks, dedicated to

businesses and professionals wishing to enhance their applications

with video and streaming functionalities. This flexible solution,

available via API in SaaS mode, enables developers or partners to

free themselves from the technical complexities of integrating

video streaming functionalities into their environment without

additional investment in new infrastructure and dedicated skills or

software licenses.

These two offers cover all corporate video needs, and also

provide access to several hundred hours of video content from the

Alchimie catalog.

Strategy and 2024 outlook

In 2024, Alchimie will pursue the deployment of its new offers

with the aim of further monetizing its technical assets. In

particular, the Company plans to intensify its external

communication with targeted campaigns to maximize the visibility of

these two growth drivers. Alchimie thus intends to capitalize on

the signing in 2023 of the first contracts for its two

offerings.

In parallel with its business development, the Company will

strive to remain among the most innovative players in its sector

and will implement new features such as: live broadcasting, event

replay, additional billing options and an improved dashboard, to

offer customers an ever more comprehensive and intuitive solution.

In addition, Alchimie will pursue its channel editing activities,

regularly enriching its content catalog.

Given these factors, the Company is targeting for 2024 revenues

above €8 million, with revenues from new activities not yet

sufficient to offset the decline in revenues generated by the

historical subscriber bases. Despite ongoing efforts to optimize

structural costs, Alchimie does not plan to generate positive

EBITDA in 2024.

In terms of financial resources, the Company is maintaining a

controlled cost structure and does not plan to call on the market

in 2024, given its cash position of €5.2 million at December 31,

2023.

***

Next financial publication: 2023 annual results, on April

25, 2024 after market close.

About Alchimie

Alchimie is a unique video streaming platform allowing companies

and creators to build their own video channel, their internal

communication media and partners. Alchimie also offers

42videobricks, the SaaS access to the technological building blocks

(via API) for operating video and streaming functions. Alchimie has

a catalog of video content from more than 300 prestigious partners

(Arte, France TV distribution, ZDF Entreprises or Zed). For further

information: https://www.alchimie-finance.com /

http://www.alchimie.com

1 Data in accordance with the Company's accounting policies,

unchanged from 2022; 2023 figures are unaudited.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240131670527/en/

Alchimie Pauline Grimaldi d’Esdra Chief Executive Officer

investors@alchimie.com

NewCap Thomas Grojean/Aurélie Manavarere Investor

Relations alchimie@newcap.eu 01 44 71 94 94

NewCap Nicolas Merigeau Media Relations

alchimie@newcap.eu 01 44 71 94 98

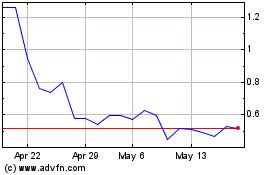

Alchimie (EU:ALCHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alchimie (EU:ALCHI)

Historical Stock Chart

From Apr 2023 to Apr 2024