BNB Dumps 6% As CFTC Sues Binance And CEO For Non-Compliance

March 28 2023 - 6:30AM

NEWSBTC

BNB, the native currency of the Binance ecosystem, is down 6% in

the past 24 hours, trackers on March 28 show. BNB Slips 6% As Sell

Pressure Mounts As the coin remains under pressure, it is

underperforming the broader cryptocurrency market, trailing

Bitcoin, Ethereum, and others within the same period. As an

illustration, Ripple (XRP) is up 24% in the last day, a performance

divergent from the state of affairs in BNB, topping the top 50 in

the last week of trading. Related Reading: Binance Sees $218

Million In Outflows Following CFTC Lawsuit BNB is now trading at

$309, down 6% in the past 24 hours. With increasing participation

levels as trading volumes show, the coin has also broken below a

critical support line as visible in the BNBUSDT daily chart. A

notable observation is that the coin is edging lower, mirroring the

bearish bar of March 22 when the United States Federal Reserve

(Fed), raised interest rates as expected by economists, forcing

crypto assets, including BNB, lower. At the time of writing on

March 28, BNB was relatively stable after yesterday’s drawdown.

However, considering the bearish engulfing bar that drove prices

below $320, and the failure of buyers to drive prices higher today,

there are hints of weaknesses. Based on the present candlestick

formation, there are suggestions indicating that the coin could

post more losses unless buyers step in in the sessions ahead.

Presently, the level marking March 22 lows at $320 has turned to

resistance and might be level chartists closely watch.

Specifically, technical indicators, especially moving averages are

“bearish” within the last six to 24 hours, reflecting the dump of

BNB prices during that time. Meanwhile, overbought and oversold

indicators like the Bollinger Bands, Relative Strength Index, and

Stochastic are mostly “neutral” in all time frames. Binance Buys

BNB, Sued By The CFTC On March 13, the BNB coin was among the

top-performing assets in crypto, together with Bitcoin. Then, the

CEO of Binance, Changpeng Zhao said the exchange will be converting

the $1 billion of the Industry Recovery Initiative Fund, to among

other coins, BNB and Bitcoin. Given the changes in stable coins and

banks, #Binance will convert the remaining of the $1 billion

Industry Recovery Initiative funds from BUSD to native crypto,

including #BTC, #BNB and ETH. Some fund movements will occur

on-chain. Transparency. — CZ 🔶 Binance (@cz_binance) March 13, 2023

BNB’s price rose on this news and CEO Changpeng Zhao, while

justifying this decision, cited regulatory changes, especially

relating to stablecoins and the banking crisis, as the reasons

behind the move. A few days earlier, the Silicon Valley Bank (SVB)

had experienced a bank run, impacting USDC which briefly de-pegged.

Although BNB remains bullish for longer time frames, the

cryptocurrency might be negatively impacted in the days ahead. The

United States Commodity Futures Trading Commission (CFTC) is suing

Changpeng Zhao and Binance for violating trading laws and giving

access to citizens. Related Reading: CFTC Vs. Binance: Cumberland

Outlines 3 Scenarios For Bitcoin And Crypto The lawsuit also states

that Binance has been obfuscating the identity of its chief

executives stating the exchange’s “reliance on a maze of corporate

entities to operate the platform is deliberate; it is designed to

obscure the ownership, control, and location of the Binance

platform.” Featured image from Canva, chart from TradingView.com

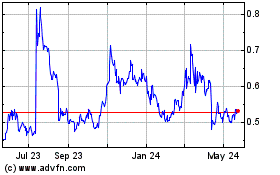

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024