Uniswap Who? Trader Joe’s AMM Takes DeFi By Storm

April 07 2023 - 6:00PM

NEWSBTC

In the fast-evolving world of decentralized finance (DeFi), new

players are constantly emerging with innovative solutions to

address the challenges of trading and liquidity provision. One

platform that has been making waves in the DeFi ecosystem is Trader

Joe, which has gained steam with its capital-efficient

decentralized exchange (DEX). According to a recent Twitter

post by Chase, a researcher at Messari, the heart of Trader Joe’s

success is its Liquidity Book (LB), a concentrated liquidity model

that is being hailed as a game-changer for liquidity providers in

the DeFi space. Related Reading: DYDX Tumbles 5% As

Ethereum-Based DEX Wind Down Operations What Makes Trader Joe

Different From Other DeFi Protocols? Competing with established

players like Uniswap V3, Trader Joe’s LB is quickly gaining

traction, being the fastest-growing DEX over the last 180 days. The

platform’s surging growth is a testament to its appeal to traders

and liquidity providers. Trader Joe and Uniswap are decentralized

exchanges allowing users to trade cryptocurrencies without relying

on centralized intermediaries. However, there are several key

differences between the two platforms: Liquidity Model: Trader

Joe’s uses a concentrated liquidity model called the Liquidity

Book, as said before, while Uniswap uses a constant product market

maker model. The LB can be more capital-efficient and

cost-effective for liquidity providers, while the construct product

model is simpler and more widely used in the DeFi ecosystem.

Furthermore, its LB is a liquidity provision model developed by

Trader Joe’s. It allows liquidity providers to concentrate their

funds in a specific price range rather than spreading them out

across the entire price spectrum. Additionally, the LB can be

more cost-effective for smaller liquidity providers, who may not

have the capital to provide liquidity across the entire price

spectrum on other Automatized Market Makers (AMMs) Fees: Trader

Joe’s charges lower fees than Uniswap. This can make it more

attractive to traders and liquidity providers looking to minimize

costs. Development: Trader Joe’s is community-driven,

allowing users to propose and vote on changes on the platform. On

the other hand, Uniswap is governed by a protocol controlled by a

small group of stakeholders. Keys Behind Trader Joe’s Current

Success In DeFi According to Chase, one key factor behind

this success is Joe V2’s higher base fees. This means liquidity

providers earn more fees on every trade in the pool. Joe V2 adds a

volatility fee, further increasing liquidity providers’

profitability. According to data compiled by Chase, 36.5% of

Joe V2’s WETH-USDC liquidity on Arbitrum falls within the +/- 2%

price range, significantly higher than the 19.9% for Uniswap V3 and

the 4% for SushiSwap. This concentration of liquidity is likely

driven by the lower liquidity provider management costs on Joe V2

compared to Uniswap V3. Despite the success of Trader Joe’s

V2 pools regarding liquidity provider profitability and liquidity

concentration, the platform still faces significant competition

from established players like UniSwap. Per the researcher,

over the last 2 weeks, UniSwap V3 has averaged $10 million in daily

ARB-ETH volumes from 1inch, while Joe V2 has only averaged $9,800.

Chase claims that to compete with UniSwap and attract more trading

volumes, Joe V2 must either cut its fees or grow its

liquidity. As of this writing, the circulating market

capitalization of Uniswap is worth over $4.5 billion, down 2% in

the last few days. In contrast, Trader Joe’s market cap is

currently at $195 million, with a trading volume of $29 billion.

This is significantly lower than Uniswap’s trading volume, which is

$831 billion. Despite the differences between Trader Joe and

Uniswap, the fast growth of Trader Joe, and the continued dominance

of Uniswap in the decentralized exchanges (DEX), the DeFi ecosystem

seems poise to grow. Competition and further innovations in the

ecosystem can attract more users and investors to the nascent

industry and its technologies. Related Reading: Cardano (ADA) Takes

A Step Closer To Full Decentralization, Here’s How Featured image

from Unsplash, chart from TradingView.com

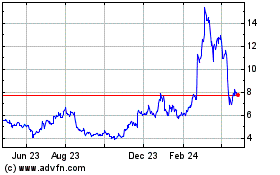

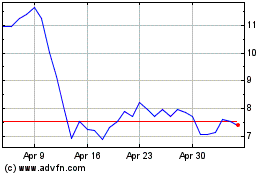

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024