Michael Saylor Brings The Thunder To Venezuelan Bitcoin-Only Podcast

July 23 2021 - 4:33AM

NEWSBTC

If someone is doing his part, that’s Michael Saylor. The

MicroStrategy CEO proved that he’s a stand-up guy by sharing the

knowledge on a medium-sized podcast that’s usually in Spanish.

Saylor went in on the topics du jour and revealed

never-before-heard secrets. What does he think about El Salvador?

What’s up with the infamous Mining Council? Is MicroStrategy in a

vulnerable position? Keep reading for those answers and more.

Related Reading | Michael Saylor Clarifies His Company’s Bitcoin

Strategy On US’s National TV One of Michael Saylor’s first lines

is, “I think that the next decade it’s going to be all about

digital transformation of propertry.” After that, it’s gem after

gem. What Does Michael Saylor Know About The Venezuela Situation?

The podcast is called “Satoshi En Venezuela.” The episode is titled

“Bitcoin is Hope for Venezuela.” Since that name derives from a

Michael Saylor quote, it figures that the first question was a why

disguised as a how. How is Bitcoin hope for Venezuela? “Now you can

put your property into a Bitcoin and put the Bitcoin on your mobile

device. And I think the reason that that represents hope to the

world is, eight billion people are going to be able to afford a

mobile device. And 8 billion people can have property on the mobile

device. Bitcoin is like a bank in cyberspace run by incorruptible

software.” That sounds amazing, but, specifically speaking,

why is Bitcoin good for Venezuela? “Well, every economy works

better if it has an incorruptible bank that allows everyone to

store their monetary energy. It helps return rationality and

long-term perspective. Hope is about believing that in a decade

your life will be better than it is now.” Beautiful. Michael Saylor

also believes that, for this to work, “We have to give people

property rights. And we’ve got to give them the ability to store

their economic energy in something that they have control of.” By

that, he means Bitcoin and only Bitcoin. BTC price chart on

Coinbase | Source: BTC/USD on TradingView.com Does Bitcoin’s

Volatility Affect MicroStrategy? How Does Their Playbook Look Like?

His company, MicroStrategy, famously was the first to put Bitcoin

on their balance sheet. And then, they kept buying and buying.

“We’re basically converting our working capital from the weakest

asset to the strongest asset,” Michale Saylor clarifies. Then, he

gives you his strategy’s play by play: The way that we manage

the volatility is, we make sure that we have enough Dollars to pay

all of our bills for the next 12 months, based upon whatever

volatility. So, we wouldn’t really ever need to liquidate any

Bitcoin unless we had like a one in a hundred event. Then, we might

sell a little bit in order to pay our bills, but that hasn’t

happened before.” He expects reasonable scenarios. Other currencies

will print and print. There will only be 21 million bitcoin. Lots

of businesses and people will integrate with the Bitcoin protocol.

So, it’s not that risky. In a long time frame, it’s a “responsible

business strategy.” It would be risky with a short time frame and a

short-dated debt strategy. In short, MicroStrategy’s

financial strategy protects them from volatility. If in 10 years

Bitcoin is down and not up, then and only then they’ll be in

trouble. A Mining Council In An Open Network The host, Bitcoin

philosopher Criptobastardo, questions Michael Saylor with the basic

objections that the Bitcoin community has with the Mining Council.

Saylor answers: “The council exists to gather information, to run

surveys, and to educate. It’s not a government body. I agree that a

governing council probably wouldn’t be the right thing. It’s really

just a voluntary and open asociation of Bitcoin miners to gather

information, share best practices and educate.” According to him,

someone has to respond to attacks. The Bitcoin community has to

take control of the narrative, produce data, give info to

decision-makers. “The people that need to know are Wallstreet

investors, mainstream media journalists, and politicians.” These

are powerful allies, and, “when they tell us that they’re under

pressure from their constituency to get an answer, we should do our

best to give them the answer.” Related Reading | Can Bears Force

Michael Saylor To Sell His Bitcoin? Analyst Shared Bullish Theory

Is Michael Saylor Going To El Salvador? According to the

MicroStrategy CEO, one would need 21st-century infrastructure to

solve a current problem. That’s what the Salvadoran government is

trying to do with The Bitcoin Law. What will they get out of all of

this? Well, according to Michael Saylor: “I think there are two

benefits you get when you adop the bitcoin standard if you’re a

country. One benefit is the macroeconomic benefit. You end up with

a treasury asset that is appreciating in value instead of

depreciating in value. You put your entire economy on stronger

bases.” The El Salvador experiment is crucial to mankind. If

everything goes as planned in there, the economic growth they’ll

have over the next few years will be unmatched. Michael Saylor

continues and closes: “The second benefit is a technology benefit.

It’s possible to use the Bitcoin protocol, or in this case

Lightning. The combination of Lightning and Bitcoin transactions in

order to provide digital currency to every citizen of the country.

So, two thirds of El Salvador dont have a bank. If I want to create

a bank, I want to give them a mobile phone and a digital wallet.

And a digital currency, which is the Dollar. On top of a digital

asset, which is Bitcoin.” That sounds like a tank to us. Featured

Image by FelixMittermeier from Pixabay - Charts by TradingView

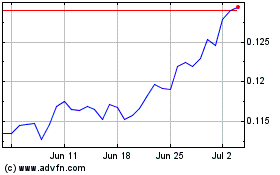

TRON (COIN:TRXUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

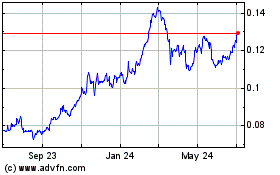

TRON (COIN:TRXUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024