Bitcoin Price Retakes $21,000 And May Keep Rising Due To These Factors

November 04 2022 - 11:18AM

NEWSBTC

The Bitcoin price is regaining bullish momentum over today’s

trading session, retracing the losses seen early in the week. Once

again, the cryptocurrency is under the influence of macroeconomic

forces working in its favor for the first time in months. Related

Reading: Shiba Inu Off To Weak Start This November As SHIB Faced

Selling Pressure In Last 7 Days At the time of writing, the Bitcoin

price trades at $21,000 with a 4% profit in the last 24 hours and

seven days, respectively. Other cryptocurrencies in the crypto top

10 are displaying similar strength, with Binance Coin (BNB) and

Dogecoin (DOGE) leading the altcoin rally. Bitcoin Price Barrels

Through Resistance Levels Data from Material Indicators show a

spike in buying pressure from investors with orders of about

$100,000. These Bitcoin whales are positively reacting to today’s

U.S. economic data, which signals a slowdown in this country’s job

market. An analyst at Material Indicator said: Unemployment came in

at 3.7% which is 0.2% higher than forecasted and BTC whales see it

as a sign that FED rate hikes may be working. Note, that one

month’s report doesn’t make a trend, but right or wrong, this

market reacts to every data point. As reported by NewsBTC, the U.S.

Federal Reserve (Fed) is trying to mitigate inflation in the

dollar. The financial institution is implementing a monetary

tightening program by hiking interest rates and reducing its

balance sheet. For the first time in months, the Fed plans seem to

be working, or at least, the data hints at this possibility.

Ironically, adverse reports favor the Bitcoin price and risk-on

assets in the current economic scenario. Another analyst said the

following about the recent price action: Unemployment is rising

which is what the FED wants. Markets reacting positively to bad

news which is good news. It’s sad that we are at the point where

they want people to lose their jobs to fix inflation. Related

Reading: Cardano (ADA) Investors Watch For Nov. 18, Hoskinson

Teases Announcement In addition to economic data, the U.S. dollar

is trending to the downside and could re-test previous support

after months in an upside trend. This downside price action is

contributing to the Bitcoin price upside momentum. The hourly $DXY

chart shows a confirmed fakeout earlier in the session. Still

clinging to 111.80 for now, though. pic.twitter.com/ZSYvJocjHi —

Justin Bennett (@JustinBennettFX) November 4, 2022

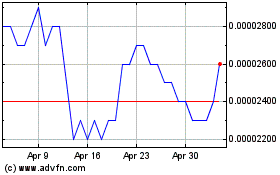

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

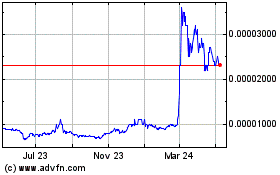

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024