Bitcoin Rally May Not Have Hit Top Yet, Here’s Why

May 03 2023 - 3:00PM

NEWSBTC

The historical pattern in this Bitcoin on-chain indicator may

suggest that the ongoing rally hasn’t reached its top yet. Bitcoin

1-Year Inactive Supply Has Continued To Go Up Recently According to

a post from the on-chain analytics firm CryptoQuant, the 1-year

inactive supply hit a high back in March of this year. The “1-year

inactive supply” is an indicator that measures the total percentage

of the Bitcoin supply that hasn’t moved on the blockchain since at

least one year ago. This supply belongs to one of the two major

cohorts in the BTC market: the “long-term holders” (LTHs). This

group includes all investors who bought their coins more than six

months ago, so the 1-year inactive supply metric doesn’t measure

their entire supply, only a segment of it (although a rather large

one). The LTHs hold a special place in the Bitcoin economy as they

comprise the most resolute investors in the market. The selling and

buying behavior of this cohort can, therefore, have long-term

implications for the sector. Related Reading: Ethereum Sees Inflows

Of $505M Into Binance, Sign Of Selling? Here is a chart that shows

how the 1-year inactive BTC supply has changed over the lifetime of

the cryptocurrency and how it has seemingly taken its place in the

different price cycles: Looks like the value of the metric has been

on the rise in recent days | Source: CryptoQuant As the above graph

shows, the Bitcoin 1-year inactive supply has historically trended

up during the bear markets. This means these investors generally

participate in accumulation in the leadup to and during the bear

markets. The LTHs then continue to hold onto their filled-up bags

and expand as they transition toward a bullish period. These

investors show this behavior throughout the bull market buildup

phase; when the rally starts reaching its last stages, these

holders start selling to take their profits. This pattern has

repeated throughout the different cycles, showing that the LTHs’

behavior hasn’t changed too much. However, one thing that differs

between the cycles is that their supply has been going up overall.

This would partly be attributed to all the Bitcoin that has been

getting lost due to wallet keys becoming inaccessible. Related

Reading: $24,400 May Be Next Major Level Of Support For Bitcoin,

Here’s Why The percentage of the circulating supply held by this

Bitcoin investor segment hit an all-time high just back in March of

this year, reaching a value north of 67%. These investors have shed

some coins since then, but the difference in their supplies between

then and now is negligible (13.1 million BTC vs. 13 million BTC).

The April 2019 rally, which resembles the current one, also saw the

LTHs holding tight until midway through the rally, when they

started selling, and the cryptocurrency reached the top just a

while later. Suppose the Bitcoin price and the 1-year inactive

supply will follow the same pattern in this current rally as during

all these past bullish periods. In that case, it seems likely that

the top hasn’t been hit since the LTHs haven’t started

participating in any significant distribution yet. BTC Price At the

time of writing, Bitcoin is trading around $28,300, down 4% in the

last week. BTC has gone stale in the past day | Source: BTCUSD on

TradingView Featured image from Kanchanara on Unsplash.com, charts

from TradingView.com, CryptoQuant.com

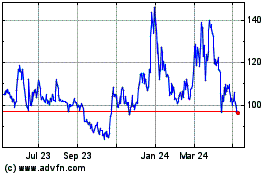

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

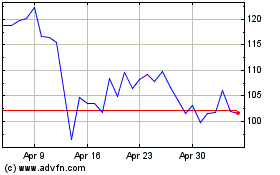

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024