Bitcoin Investors On Edge As Whales Take Profits, Ending Price Rally

March 31 2023 - 7:55AM

NEWSBTC

Bitcoin has been a wild ride for investors lately, with the world’s

most valuable cryptocurrency breaking through the $29,000 mark,

only to be swiftly rejected. However, on-chain data is now

revealing a concerning outlook for the future of Bitcoin. It seems

that some traders and whales are cashing in following weeks of

gains, which has sparked fears of an imminent decline. This

development has left many investors concerned, wondering whether

this is just a temporary pullback or the start of a larger

correction. CoinMarketCap shows the current price of Bitcoin (BTC)

is $27,779.40, down 3.6% in the last 24 hours. Despite the recent

dip, Bitcoin’s 14-day increase is 10.1%, and the 30-day rally is

19.6%. This shows that Bitcoin’s overall trend is still bullish,

but the recent pullback has some investors concerned. Related

Reading: This Little-Known Crypto Is Shooting Up Nearly 90% –

Here’s Why On-Chain Data Suggests Bitcoin Traders And Whales Are

Selling In the past week, CryptoQuant’s Spent Output Profit Ratio

data has surged above 1, indicating that certain traders and whales

are cashing out after a period of steady gains. This can be seen in

the rising count of hefty transactions that are transferring

Bitcoin from exchanges to private wallets. This indicates

that some investors are taking their profits and transferring their

digital assets to cold storage or off-exchange wallets. #Bitcoin –

What a lovely fakeout. This is why you don’t chase green candles

pic.twitter.com/oJzrMoRi20 — IncomeSharks (@IncomeSharks) March 30,

2023 $29,000 Breach A ‘Fakeout’ Bitcoin made a brief foray into the

$29,000 territory on Thursday, only to experience what market

participants have labeled a “fakeout.” This term is often used in

the world of technical analysis to describe a false breakout –

where Bitcoin’s price breaches a key level – only to swiftly

retreat below it. Essentially, the fleeting incursion past

the mark was an indication that the rally was not yet sustainable.

While this may have disappointed some investors who were hoping for

a sustained move above $29,000, it is important to remember that

Bitcoin is a highly volatile asset. It is not uncommon for the

price to experience sharp pullbacks after extended periods of

gains. BTC total market cap currently at $539 billion on the

daily chart at TradingView.com Related Reading: These Top 5 Meme

Coins Are Bleeding As March 2023 Ends – Here’s Why #Bitcoin $BTC

The yellow dotted line indicates the beginning of 2023. Note the

volume – the past 5 days are the weakest this year. Last time

similar was observed in June 2022. Paradoxically, just before the

drop from 30k. pic.twitter.com/JKtEpYhP6G — Lukasz Wydra

(@lukasz_wydra) March 30, 2023 Adding to the air of caution, Lukasz

Wydra, a prominent Bitcoin and crypto analyst, on Twitter

highlighted that the current trading volumes are at their lowest

for the year 2023. This is an ominous similarity to what occurred

in June 2022, when a similar lull preceded the drop from

$30,000. His message is clear: with the current state of

affairs, investors should keep their wits about them and keep a

close eye on market developments. -Featured image from

Virtualization Review

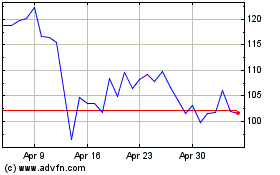

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

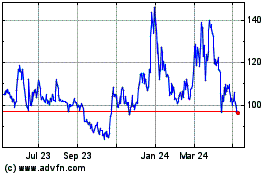

Quant (COIN:QNTUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024