Altcoins Hotlist: Expert Identifies Top 6 Coins To Track Amid Bitcoin’s Rise To $72,000

April 08 2024 - 7:00PM

NEWSBTC

As Bitcoin (BTC) continues its upward trajectory, regaining its

bullish momentum after brief range-bound price action and inching

closer to its all-time high (ATH) of $73,700, crypto analyst Miles

Deutscher shared insights on several altcoins to watch for

potential gains this week. Altcoins With Strong Potential

First, Deutscher observes a robust recovery in Bitcoin following

its recent dip below the $65,000 level on April 3rd. The analyst

notes that Bitcoin’s structure appears positive, with $73,8000

being the critical level to watch as it represents the previous ATH

and the cryptocurrency’s last resistance before further

gains. According to Deutscher’s analysis, BTC’s ability to

break through this level could signal further upward momentum for

the market leader. Related Reading: Polygon (MATIC) In Buy Zone

That Earlier Led To 112% & 87% Surges Despite recent network

congestion issues, Deutscher remains optimistic about Solana’s

long-term prospects, as it is the first of several altcoins on the

analyst’s radar this week, promising further gains on top of its

already 23% uptrend over the past month. The analyst

highlights that sentiment around Solana has deteriorated slightly

but emphasizes that these issues are unlikely to significantly

impact the medium to long term. Next on the list, Deutscher

identifies BTC’s equivalent to non-fungible tokens (NFTs),

Ordinals, as a strong performer within the BRC-20/BTC narrative

ecosystem. With the Bitcoin halving scheduled for the

last half of April just days away, Deutscher remains bullish on the

ORDI token ahead of the event. While the narrative surrounding the

halving remains relatively quiet, Deutscher continues to suggest

that Ordinals stands out as a leader in the space. Orion And

Altlayer Deutscher has expressed interest in Altlayer, an altcoin

closely associated with the EigenLayer protocol, due to recent

rumors surrounding the upcoming EigenLayer airdrop. According to

the analyst, Altlayer’s proximity to the airdrop and its

involvement in the restaking narrative contributes to its

appeal. Given these anticipated developments, Deutscher sees

a potential boost for the token as the market prepares for the

airdrop. The token is up 14% in the last month alone and over 4% in

the previous 24 hours. Similarly, Deutscher highlights ORN as

the first restaking rollup on EigenLayer and emphasizes the limited

opportunities to get exposure to EigenLayer before its official

launch. This factor, combined with Orion’s rebranding to

LUMIA, has attracted positive market sentiment, the analyst said,

noting that recent weeks have demonstrated the market’s positive

response to token rebrands, further increasing Orion’s potential.

Dogecoin’s ‘Doge Day’ Next on the altcoin watchlist, Deutscher

notes the upcoming “Doge Day” on April 20, which has historically

seen increased interest and speculation surrounding the dog-themed

meme coin. According to the analyst, the possibility of Elon

Musk tweeting about the meme-inspired cryptocurrency has fueled

expectations for potential price moves. Deutscher suggests

monitoring DOGE for strength and considering it as a viable

short-term trading opportunity. Related Reading: XRP Price Drops

After Massive Whale Dump, Casting Doubt On $1 Target In April

Finally, Deutscher points to previous instances where early

altcoins airdrop participants experienced initial selling pressure,

followed by potential rebounds. Wormhole’s native token, W,

is facing a similar scenario as the token has fallen over 30% since

trading began on April 3. Deutscher advises watching how the

token reacts around the significant support level of $1. Once

the initial selling pressure potentially subsides, Deutscher notes

that a positive reaction can be expected, but whether the $1

support holds will be key to determining the cryptocurrency’s next

moves. Featured image from Shutterstock, chart from

TradingView.com

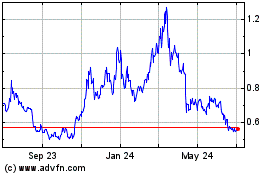

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

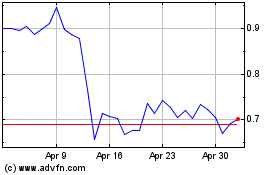

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024