The End of Tether? Why A Structural Shift In The Market Spells Trouble For USDT

May 29 2023 - 4:30PM

NEWSBTC

Tether (USDT) is the largest stablecoin in the market, with a

market capitalization of over $86 billion as of May 2023. Despite

the concerns about the current state of the cryptocurrency market,

Tether has continued to dominate the stablecoin space, with its

supply growing significantly since the beginning of 2023. However,

there are signs that new competitors may challenge its dominance in

the future. Related Reading: Bitcoin Rally Hopes Still Alive, If

This Metric Is To Go By USDT’s Reign Over? According to the

researcher and founder of DeFiance Capital, ArthurOx, one factor

that may limit Tether’s growth is the emergence of new stablecoins.

As investors become more concerned about the risks associated with

Tether, they are likely to seek alternatives that offer greater

transparency and accountability. For example, USDC (USD Coin)

is a stablecoin fully backed by US dollars held in reserve by

regulated financial institutions, and its supply has been growing

rapidly in recent years. Another factor that may limit Tether’s

growth is the emergence of decentralized stablecoins. These

stablecoins are built on blockchain platforms, offering a

decentralized alternative to centralized stablecoins like

Tether. Decentralized stablecoins eliminate the need for a

central authority to manage the reserves, as the reserves are held

in smart contracts on the blockchain. This offers high transparency

and security and eliminates the risk of a central authority

mismanaging the reserves or engaging in fraudulent activities. One

example of a decentralized stablecoin is DAI, built on the Ethereum

blockchain. DAI is backed by a basket of cryptocurrencies held in

smart contracts on the blockchain. This ensures that the value of

DAI remains stable while offering high transparency and security.

In addition to these factors, there are also regulatory risks

associated with Tether. The stablecoin has come under scrutiny from

regulators in the US and other countries, with some calling for

greater transparency and oversight. If regulators impose stricter

regulations on Tether, this could limit its growth and open up

opportunities for other stablecoins to gain market share. Tether

And USDC Show Resilience Amid US Debt Ceiling Drama According to a

recent report by Kaiko, USDT and USDC have shown little volatility

amid the ongoing drama surrounding the US debt ceiling. Despite

concerns over a potential US default, USDT and USDC saw little to

no price movement over the past two weeks. This suggests that the

markets did not view default as the base case scenario and that

investors remained confident in the stability of these stablecoins.

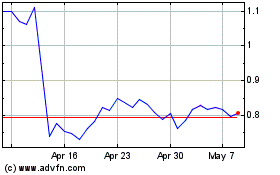

Interestingly, USDT and USDC have increasingly been trading in

tandem during periods of market stress. For example, when Binance

temporarily halted withdrawals for Bitcoin (BTC) earlier this month

due to network congestion issues, both stablecoins rose above $1,

as seen in the chart above. This suggests that USDC may have gained

some safe-haven appeal as U.S. banking troubles eased. The

resilience of USDT and USDC during the debt ceiling drama reflects

a wider trend in the cryptocurrency market, where stablecoins have

become an increasingly popular way for investors to hedge against

volatility. Related Reading: Bearish Sentiment Hits EOS As Bulls

Lose Control, What Lies Ahead? These developments underscore the

growing importance of stablecoins in the cryptocurrency ecosystem.

As more investors seek to hedge against market volatility and

regulatory uncertainty, the demand for stablecoins will likely

grow. Moreover, the emergence of new decentralized finance (DeFi)

applications that require stablecoins as a means of exchange and

collateral is also fueling demand. Featured image from Unsplash,

chart from TradingView.com

EOS (COIN:EOSUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOS (COIN:EOSUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024