Cardano Price Rejected at $0.36, How Long Will The Correction Last?

May 16 2023 - 8:00PM

NEWSBTC

The price of Cardano has been following a bearish trajectory for

the past couple of weeks. However, in recent trading sessions,

there were bullish attempts as buyers tried to push the price

higher. Unfortunately, selling pressure emerged again, causing

Cardano to trade near its crucial support level. The technical

outlook for ADA is bearish. The chart’s demand and accumulation

indicators have been depreciating, suggesting a lack of buying

interest in the market. Moreover, the broader market strength

remains uncertain, with Bitcoin recently dipping below the $27,000

price zone in the recent past. This has resulted in many major

altcoins, including Cardano, facing rejection at their immediate

resistance levels. Related Reading: Why Litecoin Is The Most

Undervalued Asset in Crypto Currently, Cardano finds itself at a

critical price point. If it manages to move above the overhead

resistance, it could initiate a recovery for the coin. However, if

the price falls from its current level, it would struggle to

sustain itself above the crucial support, potentially leading to

bearish dominance. If Bitcoin trades above the $27,000 mark, it

might positively impact Cardano’s price and potentially lead to a

recovery. However, for a significant price turnaround, it is

essential for buying confidence to resurface in the market. The

decline in Cardano’s market capitalization indicates that sellers

have dominated the market. Cardano Price Analysis: One-Day Chart At

the time of writing, Cardano (ADA) was priced at $0.367. Over the

past 24 hours, ADA experienced a 1.3% decline in price, while there

hasn’t been any significant movement on the weekly chart. The key

resistance level for ADA is at $0.37, which has proven to be a

strong barrier that the bulls have failed to break through in

recent weeks. If ADA surpasses the $0.37 resistance, it can reach

$0.39, resulting in a significant price increase. However, if the

price falls from its current level, it could drop below the crucial

support line of $0.35, which the bulls have been defending thus

far. The trading volume of ADA in the last session was in red,

indicating a decrease in the number of buyers participating in the

market. Technical Analysis Throughout the month, ADA has displayed

weak buying strength. This is evident from the Relative Strength

Index (RSI) staying below the 40-mark, indicating a prevalence of

selling strength rather than buying strength. However, if ADA

surpasses its immediate price ceiling, it could lead to a recovery

in buying strength. Moreover, ADA has also fallen below its

20-Simple Moving Average (SMA) line, further confirming that

sellers have been driving the price momentum in the market.

Contrary to previous observations, ADA showed buy signals on the

one-day chart. The Awesome Oscillator, which indicates momentum and

trend reversal, displayed green histograms associated with buy

signals. This suggests a potential price appreciation in the

upcoming trading sessions. Related Reading: Historical Crossover

Suggests Ethereum (ETH) Top Is In The Bollinger Bands, which

represent price fluctuation and volatility, were also parallel and

wide. This indicates a higher likelihood of price fluctuations.

Featured Image From UnSplash, Charts From TradingView.com

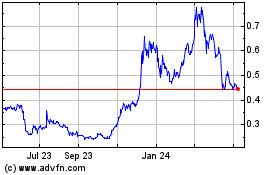

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

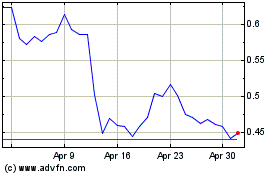

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024