Snam Sees Cost Of Debt Staying Below 4% After Tapping Market

April 24 2012 - 11:00AM

Dow Jones News

Snam SpA (SRG.MI), Italy's biggest natural gas transmission

company, expects its average cost of debt to stay below 4.0% this

year as it seeks to tap into capital markets to reschedule its

debt, Chief Financial Officer Antonio Paccioretti said Tuesday.

Snam expects its average cost of debt this year to be between

3.6% and 3.7% before the refinancing operation, while after the

refinancing operation it estimates the cost to be below 4.0%, the

CFO said on a conference call on the company's first-quarter

results.

The Milan-based company said it expects to tap the bond and

banking markets directly in the third quarter of the year. Snam's

net debt was EUR10.94 billion at the end of March.

Snam has so far raised financing through controlling shareholder

Eni SpA (E).

The Italian government has decided that Eni must relinquish its

52% controlling stake in Snam as part of the country's efforts to

boost competition in the energy sector to lower costs. With Eni's

exit, Snam must repay its debt to the Rome-based company.

The government has said it will issue the rules setting out

Eni's exit by the end of May. Eni will have until September 2013 to

give up control of Snam, although Eni Chief Executive Paolo Scaroni

has said he expects this to take place before the deadline.

Snam CEO Carlo Malacarne said on Tuesday's call that he can't

comment on a report that said a merger with government-controlled

Terna Rete Elettrica Nazionale SpA (TRN.MI) is a possibility,

because the government's rules on Eni's exit aren't yet

available.

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

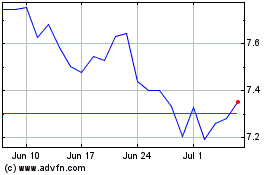

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

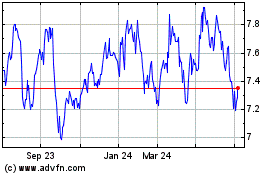

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From Apr 2023 to Apr 2024