UPDATE: Enel Mulling Cap Hike Of Up To EUR7 Billion - Sources

March 05 2009 - 11:40AM

Dow Jones News

Italy's Enel SpA (ENEL.MI) is considering a capital increase

worth up to EUR7 billion to slash debts ahead of next week's key

strategy presentation, two people familiar with the matter said

Thursday.

Enel is still working on the details of the share sale, as it

discusses the eventual deal with banks before deciding which ones

will help it arrange the rights issue, said the two people, who

asked not to be named.

The Rome-based utility is working on the capital increase ahead

of next Thursday's presentation of its 2009-2013 strategy plan. The

market will be looking to the strategy plan for measures to slash

Enel's debt pile, as well as a possible rights issue announcement,

both of which would reduce the likelihood of a rating cut by credit

agencies.

Enel's net debt is expected to top EUR60 billion after it agreed

last month to buy a 25% stake in Endesa SA (ELE.MC), bringing its

total holding in the Spanish utility to 92%. It also faces EUR13.4

billion in maturing debt in 2010, including a EUR2.2 billion

revolving credit facility that can be extended to 2012.

The possible share price discount of the rights issue could be

up to 30%, the people told Dow Jones Newswires Thursday. The timing

of the capital increase is unclear at this time, they added.

Four banks are expected to lead the capital increase deal, said

the people. Italy's Mediobanca SpA (MB.MI) and Intesa Sanpaolo SpA

(ISP.MI) are very likely to be two of them, with the other two

expected to be selected among heavyweights Goldman Sachs Group Inc.

(GS), Morgan Stanley, Credit Suisse Group (GS) and J.P. Morgan

Chase & Co. (JPM). There is concern among credit agencies over

Enel's growing debt pile amid a deepening global financial crisis.

Enel's net debt at the end of December was about EUR50 billion.

Enel has set aside noncore assets to sell off and thus trim its

debt load. In December, the utility agreed to sell its high-voltage

power lines for about EUR1.15 billion. It stared the bidding

process for the disposal of a majority stake in natural gas

network. It is also seeking to sell a stake in its renewable energy

operations.

Standard & Poor's Rating Services warned in January it may

downgrade its "A-" long-term corporate credit rating on Enel. It

cited the company's "weak" capital structure, delays in its asset

disposal program and "significant" refinancing risk as some of its

concerns.

In the event a capital increase is planned, Enel shareholders

are expected to have to approve it at an extraordinary meeting.

Enel is controlled by the Italian Treasury, which has a stake of

about 32%. Treasury Minister Giulio Tremonti declined to comment

Thursday at a conference in Rome.

Last Friday, Enel said a capital increase was one of the options

it was considering. Since then Enel's shares have she about 13% of

their value.

At 1548 GMT, Enel shares were EUR0.04, or 1.09%, lower at

EUR3.64, less than the 4.69% drop in Italy's benchmark S&PMib

Index.

Company Web site: www.enel.it

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

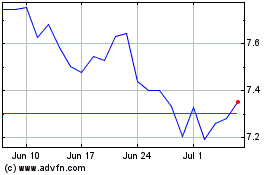

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From May 2024 to Jun 2024

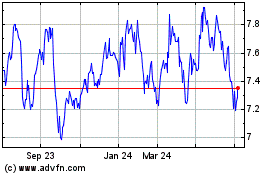

Terna Trasmissione Elett... (BIT:TRN)

Historical Stock Chart

From Jun 2023 to Jun 2024