UPDATE: Luxottica's Net Profit Up; In Talks With Armani On License

October 24 2011 - 2:13PM

Dow Jones News

Eyewear maker Luxottica Group SpA (LUX), is in talks with

Giorgio Armani SpA to produce glasses for the designer under

license, in a push to add one of the fashion world's most highly

coveted labels to its stable of brands, Chief Executive Andrea

Guerra said in an interview.

Landing an agreement with Armani, a household name around the

world, would be a major coup for Luxottica. Smaller rival Safilo

SpA (SLF.MI) currently holds the Armani contract, which expires at

the end of this year. Safilo could not be reached for comment.

"We are in talks with Armani for the license that is expiring,"

Guerra said, confirming months of speculation that Armani would

return to Luxottica.

The comments came as the world's largest eyewear maker posted a

4% increase in third-quarter adjusted net profit Monday as its

sunglasses brands, retail and wholesale businesses all posted solid

growth.

The Armani contract has been generating EUR170 million in annual

revenue for Safilo, which has held the license since 2003. Prior to

that, Luxottica produced Armani prescription and glass for 14

years, and in 2001 the license accounted for about EUR240 million

in Luxottica revenue. The unlisted Giorgio Armani SpA, which could

not be reached for comment, owns a 4.9% stake in Luxottica.

Luxottica beat expectations. Third quarter net profit (adjusted

to exclude a one-time gain and non-recurring costs) rose to

EUR106.1 million from EUR101.9 million a year earlier.

Sales rose 4% to EUR1.52 billion from EUR1.46 billion, and were

up 10% at constant exchange rates.

Luxottica, which makes eyewear under license for several

companies, said its premium and luxury brands posted good growth,

citing the Chanel SA, Prada SpA (1913.HK), Burberry Group PLC

(BRBY.LN), Tiffany & Co (TIF) and Ralph Lauren labels.

Ray-Ban and Oakley also made a strong contribution, Guerra said

in a telephone interview.

Luxottica's wholesale division posted a 10.7% increase in sales

after currency fluctuations, helped by key contributions from

China, Brazil and the Middle East, along with Germany, Italy and

the UK. Revenue for the retail unit was EUR550 million.

Third-quarter sales at the retail division were impacted by the

weaker U.S. dollar, since approximately 80% of retail revenue comes

from the U.S. At constant exchange rates, the retail division's

sales grew 9.6% to EUR968.7 million; at current exchange rates, the

increase was 2.4%.

Guerra said Luxottica was on track to meet its target of opening

90 new stores in Brazil, with around 15 opened by year-end. In

China, the company aims to open 65 new stores by year-end, and 65

more next year, in order to meet its target of having 500 stores

there in three years' time. It currently has about 230 stores in

China.

Luxottica doesn't rule out acquisitions in the future, targeting

China, India, Mexico, Turkey and Brazil.

"We will continue to target Latin America in the next six to

nine months," Guerra said.

-By Jennifer Clark, Dow Jones Newswires; 39 02 58 91 99 04;

jennifer.clark@dowjones.com

Order free Annual Report for Luxottica Group

Visit http://djnweurope.ar.wilink.com/?ticker=IT0001479374 or

call +44 (0)208 391 6028

Order free Annual Report for Luxottica Group

Visit http://djnweurope.ar.wilink.com/?ticker=IT0001479374 or

call +44 (0)208 391 6028

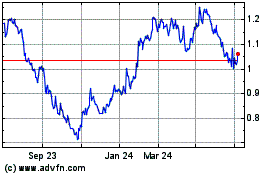

Safilo (BIT:SFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Safilo (BIT:SFL)

Historical Stock Chart

From Apr 2023 to Apr 2024