Safilo Aims To Axe Net Debt By 2015, Armani License Pending

September 29 2011 - 6:07AM

Dow Jones News

Italian eyewear maker Safilo SpA (SFL.MI) said Thursday it aims

to eliminate its current EUR240 million in net debt by 2015 as well

as boost sales by around 7% a year until then.

Safilo said in a statement it expects to post revenue of up to

EUR1.45 billion in 2015, and raise its gross operating profit

margin to 15% of sales that year.

Safilo is on course to post EUR1.1 billion in group revenue this

year and achieve an earnings before interest, taxes, depreciation

and amortization ratio of 11%. Ebitda is a measure of gross

operating profitability.

The company said it is still in talks about renewing its license

with Giorgio Armani SpA, a prized contract that provides around

EUR170 million in annual revenue.

The license with Armani expires in 2012. Armani himself owns a

4.9% stake in Safilo's larger rival, Luxottica SpA (LUX).

Aafilo Chief Executive Roberto Vedovotto will present the

company's business plan to analysts in Paris later Thursday.

-By Christopher Emsden, Dow Jones Newswires; +39 06 6976 6920;

chris.emsden@dowjones.com

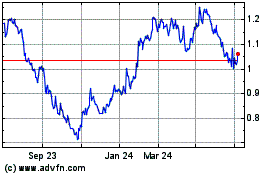

Safilo (BIT:SFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Safilo (BIT:SFL)

Historical Stock Chart

From Apr 2023 to Apr 2024