HAL's Safilo Bond Offer Extended To Nov 27

November 18 2009 - 12:40PM

Dow Jones News

Dutch investor HAL Holding NV (HAL.AE) said Wednesday it has

extended the offer to Safilo Group SpA's (SFL.MI) bondholders to

November 27 adding that as of Wednesday 43.01% of bonds were

tendered.

In an emailed statement, HAL said that the new settlement date

will be Dec 2.

HAL, which owns a 2% stake in the company, agreed last month to

increase its stake in Safilo to between 37.23% and 49.9% and to

help in the recapitalization by injecting around EUR283 million

into the Italian debt-laden company.

The agreement is conditional on HAL buying at least 60% of

EUR195 million worth of outstanding high-yield 2013 notes linked to

Safilo.

Last week Safilo, the world's second-largest maker of eyewear

after Luxottica (LUX), said in a statement that in the event that

HAL's tender offer wasn't successful, "the company would again be

in a highly leveraged situation and will, in all likelihood,

default under its banking facilities by the year end".

At the end of September, Safilo's net debt was EUR586.3 million.

Its main creditors are Italy's two biggest banks Intesa Sanpaolo

SpA (ISP.MI) and UniCredit SpA (UCG.MI).

-By Sabrina Cohen and Chiara Vasarri, Dow Jones Newswires, +39

02 5821 9906; sabrina.cohen@dowjones.com

Safilo (BIT:SFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

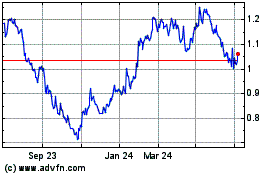

Safilo (BIT:SFL)

Historical Stock Chart

From Apr 2023 to Apr 2024