MARKET COMMENT: S&P/ASX 200 Set to Reach Fresh Multiyear Highs

February 19 2013 - 6:23PM

Dow Jones News

2252 GMT [Dow Jones] Australia's S&P/ASX 200 is poised to

hit a fresh multiyear high Wednesday, as a sharp improvement in

German investor sentiment and merger-and-acquisition speculation in

the U.S. fueled a 1.1% gain in Europe's Stoxx 600 and 0.7% rise in

the S&P 500. Any rise could be magnified by strength in BHP

(BHP.AU). Analysts are predicting a positive reaction to the news

that Andrew Mackenzie, the current head of BHP's non-ferrous metals

division, will replace Marius Kloppers when he retires as CEO from

May 10. The market will also be dissecting results from BHP,

Woodside (WPL.AU), Woodside (WPL.AU), Fortescue (FMG.AU), Suncorp

(SUN.AU), Toll TOL.AU) and Aurizon (AZJ.AU). Germany's ZEW investor

sentiment index for January jumped to a 48.2, its highest level in

almost three years. Office Depot and OfficeMax surged after The

Wall Street Journal reported that the two office supply retailers

were in merger talks. Commodity prices were mixed overnight--LME

prices continued to weaken, with spot gold down 0.3%, nickel 2.3%

lower, and copper falling 0.8%. Spot iron ore jumped 0.5% to US$158

and Nymex crude oil rose 0.8%. (david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

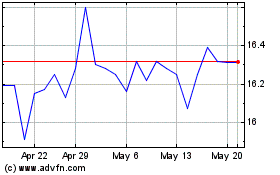

Suncorp (ASX:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

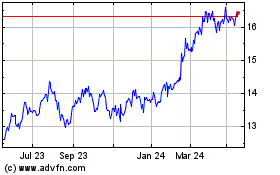

Suncorp (ASX:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024