2nd UPDATE: National Australia Bank, Westpac Raise Mortgage Rates

November 12 2010 - 2:02AM

Dow Jones News

National Australia Bank Ltd. (NAB) and Westpac Banking Corp.

(WBK) on Friday became the last two of Australia's big four banks

to hit homeowners by raising rates on mortgages beyond the

country's central bank, adding to stress on consumers already

struggling with surging inflation and a recent rise in the

country's unemployment rate.

Australia's second and fourth largest lenders to home buyers

join Commonwealth Bank of Australia (CBA.AU) and Australia &

New Zealand Banking Group Ltd. (ANZ) by hiking their standard

variable home loan interest rates. Westpac increased its rate by 35

basis points to 7.86%, while NAB raised its lending rates by 43

basis points to 7.67%. Commonwealth's rate is 7.81% and ANZ's rate

is 7.80%.

Westpac, which last week announced an 84% rise in net profit, is

the country's second largest home lender with a mortgage book of

about A$250 billion (US$249.82 billion). The moves by the country's

four big banks follow the Reserve Bank of Australia's decision last

week to raise its cash rate by 25 basis points to 4.75% and

threatens to have a broad economic impact given consumer spending

makes up roughly two-thirds of Australia's economy.

"This is around A$1000 (a year) on a A$300,000 home loan and

it's exactly what Australian homeowners didn't want in the run up

to Christmas. It's exactly what Australian small businesses didn't

want in the lead up to the festive season," said Shadow Treasurer

Joe Hockey, a vocal critic of the country's big four banks.

Coupled together, the increases add even more pressure on the

government to rein in banks on concerns that Australia's economy is

overheating on China's insatiable demand for the country's iron ore

and coal, pushing the cost of living higher. In the past week,

government officials have increasingly called into question the

tactics of the country's big banks, with Treasurer Wayne Swan

promising a banking reform package aimed at taking more mortgages

off of the big four's books and even threatening punitive

measures.

"The government will unveil further reforms...to ensure

competition in this market," Australia's Finance Minister Penny

Wong said at a doorstop in Sydney. "There isn't any justification

for any major bank putting in place an interest rate rise above the

official interest rate."

Banks have countered by saying the higher lending rates were

needed because the average cost the banks pay to fund its lending

to customers, both from overseas and through deposits, has been

rising and is expected to continue to rise for the foreseeable

future.

ANZ's rate increase adds about A$90 a month to payments on the

average A$300,000 mortgage, according to a Dow Jones Newswires

calculation, with Westpac's moving adding about A$80. Combined, the

country's big four banks hold roughly 90% of the country's

mortgages on their books, compared with nearly 60% four years ago

as a collapse in securitization markets have left smaller lenders

weak.

Smaller lenders use securitization markets as their primary

source of funding.

In addition to raising rates, NAB joined ANZ by saying it will

abolish early exit fees on new and existing home loans, something

the government has already promised would be a part of its

reforms.

But Australian real estate experts say the lowered exit fees do

little to temper the affect of rising rates, with cost of living

concerns further compounded by data on Thursday showing the

country's unemployment rate rose to 5.4% from 5.1% last month.

About 90% of Australian home owners have variable loans.

Sam White, deputy chairman of Australia's largest mortgage

broker, Ray White, said it's not just the country's ongoing

property price boom that will be hit by the interest rate raises,

but also the cost of living.

"Most people were surprised when the RBA moved and then the

compounding affect of the banks has been more than just a

double-whammy for Australian families," said White.

White noted homeowners are already changing mortgage originators

in the wake of Commonwealth Bank's move. His firm arranges about

A$600 million worth of home loans a month with smaller firms such

as Suncorp-Metway Ltd. (SUN.AU) and Bendigo and Adelaide Bank Ltd.

(BEN.AU) now seeing an uptick in business. After large banks

regularly had about a 90% share of the loans Ray White originated

since the global financial crisis, that figure has recently dipped

to about 60%.

In addition to helping smaller lenders through securitization

markets, the government has also said it hopes foreign banks,

including Citigroup Inc. (C) and ING Groep NV (ING), will step up

efforts in Australia's mortgage market.

"Foreign investment is welcome and if there were further

participants who wanted to work in the Australian market, we would

welcome that," said Treasurer Swan from the G-20 meeting in

Seoul.

-By Geoffrey Rogow, Dow Jones Newswires; +61-2-8272-4686;

geoffrey.rogow@dowjones.com

(David Fickling contributed to this report)

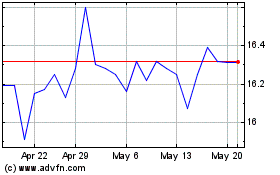

Suncorp (ASX:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

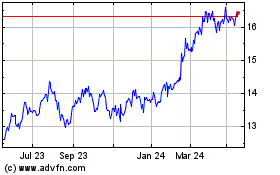

Suncorp (ASX:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024