EU Trade Commissioner Urges Pushes China On Rare Earths

March 17 2011 - 1:45AM

Dow Jones News

The European Union's top trade official Thursday said the Group

of 20 biggest economies needs to urgently agree a markets based

framework on the supply of raw materials and criticised China's

quota policy on rare earths.

Karel De Gucht, the European Commissioner for Trade, said the

rapid development of emerging nations will squeeze the supply of

raw materials and governments need to establish transparent trading

rules.

"It is urgent," de Gucht said in an interview. "For a region

like Europe, it is very important that markets in raw materials

remain open."

De Gucht said there is a risk suppliers of essential raw

materials will opt for country-to-country trade pacts rather than

selling their exports on the open market. "We want to have a very

formal, rules based, commercial system where markets can play their

role," said the official.

The policy push is likely especially aimed at China, which

produces 90% of the world's supply of rare earths and has been

cutting export quotas. Rare earths are a suite of elements used in

applications from high-powered magnets to fuel refining.

"China certainly has to play its role at the G20 table," said De

Gucht, citing that country's changes to export rules. "These kind

of sudden changes, we have difficulty accepting them."

Last October, shipments of Chinese rare earths to their major

customer Japan dropped off amidst a diplomatic spat between the two

countries, prompting concerns that Beijing was attempting to use

its control of the commodity for strategic ends. China denied any

relationship between the tightening of its export quotas, announced

three months earlier, and the diplomatic dispute.

De Gucht noted the world's supply of rare earths deposits isn't

just confined to China, citing Greenland's and the U.S.

reserves.

Australia also has several large rare earths deposits, with the

Mt Weld deposit operated by Lynas Corp. Ltd. (LYC.AU) in Western

Australia expected to account for an extra produce its first

refined rare earths by the end of this year and other deposits

being developed by Arafura Resources Ltd. (ARU.AU) and Alkane

Resources Ltd. (ALK.AU).

At present, China accounts for 103,300 tons of the world's

114,800 tons annual rare earths production, according to a Lynas

Corp. presentation last month, but Mt Weld will account for a

further 22,000 tons a year and 20,000 tons will also be produced by

Molycorp Inc.'s (MCP) Mountain Pass mine from next year.

De Gucht discussed the topic of rare earths supply with

Australia Trade Minister Craig Emerson Wednesday and said both

parties will engage in talks on common research and development and

the legal structures but deals will be done between private

companies.

"The actual deals are the responsibility of the private

companies concerned," said De Gucht

-By Enda Curran and David Fickling, Dow Jones Newswires;

61-2-8272-4687; enda.curran@dowjones.com

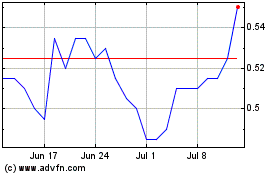

Alkane Resources (ASX:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

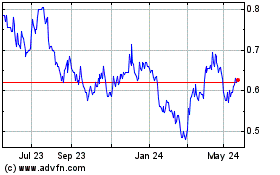

Alkane Resources (ASX:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024