4th UPDATE:Australia Government Extends Chinalco, Rio Tinto Review

March 16 2009 - 3:12AM

Dow Jones News

Australia's government has extended a review of Aluminum Corp.

of China, or Chinalco's, proposed US$19.5 billion investment in Rio

Tinto Ltd. (RTP) in a sign that the deal faces intense

scrutiny.

News of the extension Monday came as one of Rio's Australian

institutional investors voiced "deep concerns" over the Chinalco

deal, pointing to potential conflicts of interest.

The extension of the review by 90 days had been widely expected,

as the government wrestles with the pros and cons of a deal that

will provide the miner with a much needed cash injection but would

also see a state-backed group from a key customer country increase

its interests in Australia's key mining sector.

Australia's Treasury department confirmed the extension Monday

to "enable due consideration" of the proposed deal. A 90-day

extension of an initial 30 day review period is normal procedure

under the Australian system when more time is needed by the Foreign

Investment Review Board, or FIRB, for its deliberations.

When the Chinalco deal was announced last month Rio said it

expected to hold shareholder meetings to approve the transaction in

May, but with a government decision now likely to come as late as

mid June these meetings look set to be delayed.

"Shareholder meetings are expected to take place after the FIRB

decision is made public," a Rio Tinto spokeswoman said.

Chinalco lodged an application with FIRB last month after it

announced the deal, which is the biggest ever foreign investment by

China and a policy headache for an Australian Government that is in

the middle of attempting to strike a free trade deal with

China.

Rio Tinto is banking on the Chinalco deal to ease its US$38.7

billion debt burden, with the Chinese group to pay US$19.5 billion

to lift its stake in the miner to as much as 18% and take stakes of

between 15% and 50% in a number of Rio's key assets.

A spokesman for Chinalco declined to comment on the extended

review.

The deal has sparked debate in Australia about Chinese

Government investment and has also drawn the ire of some

institutional shareholders, who are angry that their holdings will

be diluted by the issue of stock to the Chinese group while they

have no chance to participate.

The latest shareholder to raise its voice against the deal is

Australian Foundation Investment Co. Ltd. (AFI.AU), which Monday

said Chinalco is being given significant influence without a

premium being paid.

"We are deeply concerned about Chinalco becoming involved with

the running of the business," the investment group said in a

presentation to shareholders.

Don Argus, chairman of Rio Tinto's rival and former predator BHP

Billiton Ltd. (BHP), is a non-executive director of AFI and sits on

the group's investment committee.

While BHP has abandoned its all-share offer for Rio Tinto, the

miner has made it clear it is still interested in some of Rio's

assets, singling out its stake in the Escondida copper mine in

Chile.

AFI, which had a holding in Rio worth A$111.9 million at Feb.

28, said the Chinalco deal raised corporate governance issues and

the potential for conflicts of interest, with the Chinese group to

win two seats on the board and access to the decision making

process and information flows.

AFI also held A$413.9 million worth of BHP shares as at Feb.

28.

Chinalco is backed by a sovereign government that is both a

customer and competitor of Rio Tinto, AFI said.

AFI also raised concerns about the convertible bonds being

issued to Chinalco, arguing that existing shareholders have not

been given the chance to participate and that preference had been

given to one shareholder.

The Melbourne-based group said it has made its views known to

Rio Tinto and is seeking a response.

Rio Tinto argues that the deal with Chinalco not only allows it

to pay down debt but will give it stronger links with the nation

driving world commodity demand and open up opportunities for

development of mines in China.

The Anglo-Australian miner may have the opportunity to leverage

its ties with China to refinance some of its debt as well, with

Export-Import Bank of China, or Exim Bank, offering a line of

credit to develop key mining projects in Australia, China and

around the world if the Chinalco deal goes ahead.

"To further facilitate the cooperation between Chinalco and Rio

Tinto, China Exim Bank has been discussing the possibility

of...providing a long-term loan facility to Rio Tinto to fund

joint-venture projects with Chinalco and/or other eligible Chinese

companies," Exim Deputy General Manager Feng Zengbing wrote in a

"financing support" letter, dated Feb. 12.

"We are highly confident of our ability to provide the proposed

debt financing," said the letter, which was addressed to Rio Tinto

Chief Financial Officer Guy Elliott.

-By Alex Wilson, Dow Jones Newswires; 61-3-9671-4313;

alex.wilson@dowjones.com

(Lyndal McFarland in Melbourne, Rachel Pannett in Canberra and

Chen Juan in Beijing contributed to this story)

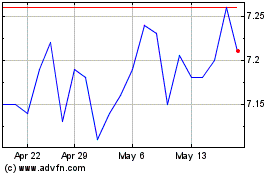

Australian Foundation In... (ASX:AFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

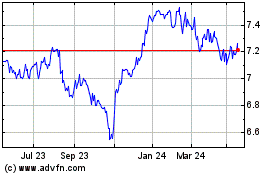

Australian Foundation In... (ASX:AFI)

Historical Stock Chart

From Apr 2023 to Apr 2024