TIDMEDEN

RNS Number : 0778O

Eden Research plc

29 September 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

29 September 2023

Eden Research plc

("Eden" or "the Company")

Half Yearly Report

Eden Research plc (AIM: EDEN), the AIM-quoted company focused on

sustainable biopesticides and plastic-free formulation technology

for use in the global crop protection, animal health and consumer

products industries, announces its interim results for the six

months ended 30 June 2023.

Financial highlights

-- Revenue for the period of GBP1.14m (H1 2022: GBP1.04m)

-- Product sales of GBP1.09m (H1 2021: GBP1.01m)

-- Operating loss for the period of GBP1.2m (H1 2022: GBP1.3m)

-- Adjusted loss (excluding a non-cash intangible assets

impairment of GBP5.0m*) for the period of GBP0.9m, loss of GBP5.9m

including impairment (H1 2022: GBP1.0m, impairment of GBPnil)

-- Cash and cash equivalents of GBP0.5m (H1 2022: GBP0.9m)

-- Cash and cash equivalents at 31 August 2023 of GBP1.73m

following a tax refund and proceeds from the unconditional

placing

-- On track to meet 2023 market expectations for product sales revenue and EBITDA

*See note 9 for further details.

Business highlights

Expanding regulatory approvals in key territories, including the

US, new commercial agreement, and new product areas

-- First commercial order received for Ecovelex(R) , Eden's new

seed treatment product (August 2023)

-- Materially increased Eden's global addressable market with

label extensions and new regulatory approvals, most notably the

addition of the US following various state approvals

-- Authorisation for Cedroz(TM) received in the key state of

California with Mevalone(R) authorisation anticipated in due

course

-- Eden's first 'non-professional' (home garden) uses for 3logy(R) granted in Italy

-- Mevalone(R) received regulatory authorisation in Poland,

which is acting on behalf of the EU Central Zone, thereby paving

the way to central EU approvals

-- Authorisation for Mevalone(R) (Novellus) received in New Zealand

-- Submission made to the EU and UK authorities for Eden's seed

treatment product, Ecovelex(R) , which was developed with Corteva

Agriscience

-- Steps to expand the use of Mevalone(R) in France to include

powdery and downy mildew are well underway

-- Return to commercial production of Cedroz Ô following

previous manufacturing issues. Continue to actively monitor

customer feedback

-- Use of Cedroz Ô expanded to include the control of wire worm

in potatoes through the granting of an emergency use approval in

Italy

-- New distribution agreement signed with Anasac for Mevalone(R) in Colombia

-- 140 field trials run by potential distribution partners in

2023, following significant interest in the evaluation of Eden's

developmental insecticide

Corporate highlights

Strengthening of the Company's financial position and team to

allow the business to grow apace

-- Successful firm Capital Raising of GBP1.1 million, Minimum

Conditional Capital Raising of GBP7.9 million and Retail Offer of

GBP0.4 million, all before expenses (Announced in July 2023)

-- Strengthening of the Commercial Team underway

Lykele van der Broek, Chairman of Eden Research, commented:

"It was with great pleasure that in May this year we were

finally able to announce, in conjunction with our partner Corteva

Agriscience ("Corteva"), the development of our new bird repellent,

seed treatment product Ecovelex(R) .

Ecovelex(R) is the result of a three-year collaboration with

Corteva with significant effort, work and determination from

everyone involved in the project and is a direct result of the

fundraise that took place in March 2020, without which this would

not have been possible.

Ecovelex(R) represents Eden's first commercial activity in

broad-acre crops and seed treatments and highlights the versatility

that the Company's technologies and products can bring to the

market. The initial commercial opportunity on maize in Europe is

significant by itself, but there are numerous additional others

that we can now look to exploit using the same, proven

platform.

The first half of the year also saw several important regulatory

approvals come through, such as Mevalone(R) in New Zealand, where

botrytis is prevalent and Poland, off the back of which we expect

to receive approvals in the other central EU zone countries in

fairly short order, and state approvals in the US for both

Mevalone(R) and Cedroz Ô .

Each of these approvals unlocks our route to product sales and

increases our addressable market.

At the end of July, the Company announced that it had completed

a firm placing of GBP1.1m and conditional placing of at least

GBP7.9m (up to a maximum of GBP9.4m), both before expenses.

The Board of Eden considered very carefully the right approach

to ensure the future viability and growth prospects of the business

and it was concluded that, with the much-appreciated support from

institutional and retail shareholders, strengthening the Company's

financial position through a fundraise was the right course of

action.

From this new position of strength, we can now expeditiously

develop and commercialise our products which, the Board believes,

will, on balance, substantially benefit the Company and its

shareholders."

For further information contact:

Eden Research plc www.edenresearch.com

Sean Smith

Alex Abrey 01285 359 555

Cavendish Securities plc (Nominated

advisor and broker)

Giles Balleny / George Lawson (corporate

finance)

Michael Johnson (sales) 020 7397 1961

Hawthorn Advisors (Financial PR)

Simon Woods eden@hawthornadvisors.com

Felix Meston

Chief Executive Officer's Statement

At Eden Research, we aim to create innovative and sustainable

crop protection solutions to empower farmers worldwide to tackle

destructive pest infestations and plant diseases effectively and

without causing harm to the environment. The first half of 2023 has

seen further progress towards these aims. With our three

plant-derived active ingredients and proprietary microencapsulation

technology, Sustaine (R) , we are making good progress with our

efforts to develop a portfolio of products to address a multitude

of challenges that go beyond our initial focus on treating

grapevine fungal diseases.

Demonstrating development excellence in seed treatments

One such example is our recently unveiled, new seed treatment,

Ecovelex (R) . Without doubt, this has been the highlight of the

first half of the year and is the result of more than three years

of intensive development alongside our partner Corteva Agriscience.

In its initial use case, Ecovelex (R) will be deployed as a seed

coating for maize seeds, acting as a repellent against bird

infestation and protecting farmers' crop yield at the earliest

point in the growth cycle.

Ecovelex (R) represents an alternative to currently available

bird repellent seed treatments widely used across the arable

farming community. One of the most popular seed treatments,

containing conventional synthetic active ingredients, is likely to

be removed from the market in the EU without there being any other

bird repellent available in the shorter term. We see not only a

significant opportunity for Ecovelex (R) to act as a replacement in

this regard, but are also proud that we can offer the maize-growing

community a method to protect their seeds using naturally occurring

compounds that help protect soil and bird health. Furthermore,

extensive field trials have demonstrated that our product is

equally effective when compared with the incumbent product

currently used by farmers.

Alongside announcing Ecovelex (R) in May, we also indicated to

the market that we have submitted a dossier and application to the

Austrian regulator, who will act as the interzonal rapporteur

member state ("RMS") on behalf of the EU. Approval by the RMS will

provide the key to entry into the rest of the European Union single

market, subject to each state requesting further information before

local authorisations are granted. In July, we also announced that

we had submitted the equivalent application to the Chemicals

Regulation Division in the UK for authorised use in our home

country. In both these instances, it is expected that review and

authorisation of Ecovelex (R) will take between 18 and 24 months,

although it should be noted that the pace of regulatory actions

lies solely in the control of the relevant authorities.

During this time, the Eden management and regulatory teams will

work closely with each regulator to ensure they have all the

necessary tools and information required to grant authority as soon

as possible. We are also exploring other means to bring Ecovelex

(R) to the market sooner, such as via emergency authorisations

which could see the product being used as early as the 2024 growing

season. However, such authorisations are not guaranteed, and we are

working to ensure that we obtain full authorisation in a timely

manner.

Widening geographic presence, growing the label

A large part of our commercial progress this period has been

linked to our two existing products, Mevalone (R) and Cedroz(TM).

Here, our strategy has been to introduce these biopesticides to new

markets and expand the list of allowed uses, known as 'the label',

beyond existing uses.

Following receipt of our landmark Environmental Protection

Agency (EPA) approval in the US at a national level for both

Mevalone (R) and Cedroz Ô in September of last year, we are

delighted to have been able to secure individual state approvals in

17 US states, as announced in March and May of this year. These

include the lucrative markets of Florida and California (Cedroz

only), where high-value fruit and vegetables are grown. Not only

are these attractive markets in terms of production, but also with

respect to their favoured use of natural pesticides and other

agricultural inputs over conventional alternatives. We now look

forward to receiving approval for Mevalone in California where we

will be predominantly focused on the wine market in high profile

regions such as Napa Valley, Sonoma, Monterey, and Santa

Barbara.

In April, we were pleased to have been granted approval for

Mevalone (R) in Poland for use on wine and table grapes, as well as

on apples. Poland is the EU's largest producer of apples,

accounting for a total annual production of approximately 2.5

million tons. As with the case in a number of other countries, the

Mevalone approval extends to pre-harvest application for

post-harvest effect given its exemption from maximum residue

levels, thereby helping to prevent food waste in the very early

stages of the supply chain. More importantly, this one approval

represents a significant landmark in that it provides the

opportunity for entry into Central Europe where we can ultimately

access the nearby markets of Austria, Hungary, and Germany, where a

high concentration of wine production is found. Efforts are being

made by our regulatory team to actively pursue these opportunities

through eventual regulatory approval in each member state.

Elsewhere, we continue to build our geographic presence in the

Southern Hemisphere with regulatory approval for Mevalone in New

Zealand, where the product is marketed as a Novellus(R). This

builds on our existing presence in Australia where we are once

again targeting another significant wine region. New Zealand's damp

conditions and fluctuating temperatures across its wine growing

areas provides an ideal environment for Botrytis cinerea to thrive

and we forecast this will create strong demand for our product,

particularly for use on its most famous grape varietal, Sauvignon

Blanc, which is highly susceptible to bunch rot given how close the

berries grow to one another.

Eden has also made its first move in South America having

appointed Anasac as its exclusive distribution partner for Mevalone

(R) in Colombia. Here, Eden is pursuing the registration of

Mevalone (R) on ornamental crops such as cut flowers to prevent and

cure outbreaks of Botrytis cinerea. Colombia is one of the world's

largest cut flower exporters with the United States acting as the

primary export market. The US imports over $1.35 billion of cut

flowers annually. Building on our presence in Mexico, where we

already have regulatory approval and are selling product, and in

Colombia, where we expect regulatory approval to be granted in due

course, we are intent on widening our influence in Latin America,

working alongside our regional partners.

Closer to home, we have secured our first domestic

(non-professional use) approval with the authorisation of Mevalone

(R) for home-use in Italy. This will afford Italian gardeners the

same access to sustainable biopesticides as farmers and provide

them with a biocontrol tool to prevent and treat several

destructive plant pathogens such as Botrytis cinerea and powdery

mildew.

Building robust cashflow

While much of our effort is directed at ensuring that we are

well-placed geographically and targeting the right pests and

diseases, our partnerships form an important part of our commercial

success. We are proud to have formed close ties with some of the

industry's largest and high-profile leaders such as Corteva,

Sipcam, SumiAgro and others, who play a key role in distributing

our pesticides across the globe.

We have also benefitted from sales made in the United States

following EPA approval obtained last year, and the various

approvals across individual states obtained subsequently.

As has been the case in recent years, the 2023 growing season

has not been without its challenges. In our primary market of

Southern Europe, we have seen severe drought and high temperatures

which can adversely affect demand for certain fungicides,

particularly those that target botrytis. We remain cautiously

optimistic that more favourable growing conditions will return

toward the end of the season thereby helping to ensure appropriate

inventory levels and a reasonable post-season restocking

period.

Across the interim period, Eden reported revenues of GBP1.14

million, a marginal increase on the previous H1 2022 period of

GBP1.04 million. Product sales have also marginally increased to

GBP1.09 million from GBP1.01 million in H1 of last year.

Earnings remained consistent with H1 2022 with an overall loss

before tax of GBP0.9 million compared with GBP1.0 million,

(excluding a non-cash intangible assets impairment during the

period of GBP5.0 million). Including impairment, the total H1 2023

loss after tax was GBP5.9 million. See note 9 for details of the

impairment.

As at 30 June 2023, Eden's cash and cash equivalents balance

stood at GBP0.5 million. Post period end, we have seen cash and

cash equivalents increase to GBP1.73m as at 31 August 2023

following a tax refund and proceeds from the unconditional

placing.

As the 2023 harvest season approaches and we near a key

pesticide application period for botryticides, we remain on track

to meet market expectations for product sales.

Strengthening the financial position

In Q3 2023, Eden announced a fundraising round by means of firm

and conditional placings, as well as a retail offer to existing

shareholders. In total, once the fundraising is complete, which is

expected in the coming weeks, we expect to have raised a total of

GBP10.0 million before expenses. This fundraise not only provides

us with additional capital to commercialise further existing

products and fund new areas of the business, but it also serves to

strengthen our balance sheet and provide greater flexibility during

this high-growth period.

Firm placing and rights issue

The use of proceeds raised from the firm placing and retail

offer will primarily be allocated towards the funding of materials

to build up stocks for our new seed treatment. We will also be

looking to grow the Ecovelex (R) label through further lab

screening and field trials, and formulation development, as well as

expand our territorial presence in new regions such as Latin

America and South-East Asia. Lastly, we intend to bolster our

commercial team with the appointment of a new commercial director

and a market development and product manager.

Conditional placing

The net proceeds from the conditional capital raise will be used

towards new product development, further development of our

insecticides as partnering discussions progress, and as additional

working capital towards Ecovelex's (R) label expansion. These

proceeds will also be used to establish a US-based team to help

support the Company's growth across the US and North America. In

the announcement made by the Company on 28 July 2023 regarding its

Capital Raising, it noted that the Conditional Placing was subject,

inter alia, to (i) the approval of the Resolutions at the General

Meeting, (ii) the Advanced Assurance being obtained from HMRC,

(iii) the Capital Reduction becoming effective and (iv) Second

Admission.

The first three conditions have now been met and, as such, the

Company expects to complete the Second Admission and Conditional

Placing shortly.

As at 31 August 2023, Eden's post-period cash and cash

equivalents balance stood at GBP1.73 million, following a tax

refund and receipt of capital raised at the recent unconditional

placing and rights issue.

There are currently no near-term plans to pay a dividend.

However, the Board continues to review the Company's dividend

policy.

Following an independent impairment review, the Board agreed to

write down the value of its intangible assets by GBP5.0m. For

further details, please see note 9.

Extending our product line

We have made great advancements with our product development

pipeline with the limited working capital available to us before

the post-period fundraise. The second notable product that we are

working to bring to market next is our insecticide, the development

of which was funded by the capital we raised three years ago. Our

lead product candidate targets key pests that attack plants such as

spider mites, whitefly, aphids, and thrips. Extensive greenhouse

and field trials by Eden and its partners have been conducted

throughout the past two years, and the results have so far proven

to be promising with good efficacy and consistency against our

targeted pests. We intend to launch this product as soon as

practicable, with regulatory applications planned for submission in

late 2023 or early 2024, subject to the outcome of ongoing trials

and data analysis. Pending a positive and prompt regulatory

decision, we estimate product launch and first sales as early as

2024/25 in the US and 2025/26 in the EU.

We are continually assessing applicable use of our biopesticide

products across crops and pests outside our existing remits such as

cannabis, black sigatoka, potato blight and wireworm. In each case,

initial evaluations have been conducted and have produced

encouraging results. Eden is also exploring the use of its

proprietary technologies in the consumer products and animal health

industries. While we have long indicated the possibility of

expanding our scope in this regard, the consumer and animal health

segments are still considered non-core to our business for the time

being, although we still maintain good relationships and active

discussions with potential partners.

Reflecting on the half-year period, I am very proud of what we

have been able to achieve in such a short space of time. These

milestones serve as a reminder of the company's potential and, with

the additional resources expected to come at our disposal, we are

committed to ensuring we can continue to deliver on our growth

objectives. I'd like to take this opportunity to thank our

shareholders, our team and the Board for their support and

efforts.

Sean Smith

Chief Executive Officer

28 September 2023

Eden Research plc - Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2023

Six

Six months Year ended

months ended 31 December

ended 30 30 June 2022

June 2023 2022 GBP GBP

GBP unaudited unaudited audited

Revenue (note 18) 1,142,371 1,040,036 1,827,171

--------------- ------------ -------------

Cost of sales (710,337) (626,342) (997,011)

--------------- ------------ -------------

Gross profit 432,034 413,694 830,160

--------------- ------------ -------------

Administrative expenses (1,250,541) (1,295,770) (2,749,240)

Amortisation of intangible assets (264,557) (246,325) (495,818)

Share based payments (note 17) (119,083) (152,135) (152,135)

--------------- ------------ -------------

Operating loss (1,202,147) (1,280,536) (2,567,033)

181 28 192

Investment revenues (9,539) (9,868) (22,046)

Finance costs 11,857 (33,351) (52,736)

Foreign exchange gains/(losses) (4,968,529) - -

Impairment of intangible assets

(note 9)

Share of loss of equity accounted

investee, net of tax (note 10) (25,111) (9,849) (31,444)

--------------- ------------ -------------

Loss before taxation (6,193,288) (1,333,576) (2,567,595)

Income tax income 317,230 345,424 323,716

--------------- ------------ -------------

Loss for the financial period (5,876,058) (988,152) (2,243,879)

Attributable to:

Equity holder of the company (5,887,194) (997,630) (2,237,262)

Non-controlling interest 11,136 9,478 (6,617)

--------------- ------------ -------------

Total Comprehensive Income (5,876,058) (988,152) (2,243,879)

Earnings per share (note 7)

Basic (pence per share) (1.54) (0.26) (0.59)

Eden Research plc - Consolidated Statement of Financial Position

as at 30 June 2023

30 June

2023 30 June 2022 31 Dec 2022

GBP GBP GBP

unaudited unaudited audited

NON-CURRENT ASSETS

Intangible assets (note 9) 3,641,058 8,330,644 8,447,226

Property, plant & equipment

(note 12) 167,175 222,712 198,786

Right of Use assets (note 13) 265,141 339,179 332,814

Investments in associate (note

10) 305,133 351,839 330,244

4,378,507 9,244,374 9,309,070

CURRENT ASSETS

Inventories (note 14) 651,394 459,424 625,458

Trade and other receivables

(note 15) 930,000 1,564,652 658,866

Taxation 640,946 918,009 323,716

Cash and cash equivalents 492,766 1,852,019 1,994,472

2,715,106 4,794,104 3,602,512

CURRENT LIABILITIES

Trade and other payables (note

16) 1,818,582 1,638,945 1,813,341

Lease liabilities 138,808 114,478 139,547

1,957,390 1,753,423 1,952,888

NET CURRENT ASSETS 757,716 3,040,681 1,649,624

NON-CURRENT LIABILITIES

Lease liabilities 147,780 247,742 215,776

147,780 247,742 215,776

NET ASSETS 4,988,443 12,037,313 10,742,918

EQUITY

Called up share capital 3,811,089 3,803,402 3,808,589

Share premium account 39,308,529 39,308,529 39,308,529

Warrant reserve 640,741 769,773 701,065

Merger reserve (note 19) - 10,209,673 10,209,673

Retained earnings (38,807,554) (42,094,661) (43,309,440)

Non-controlling interest 35,638 40,597 24,502

TOTAL EQUITY 4,988,443 12,037,313 10,742,918

Eden Research plc - Consolidated Statement of Changes in Equity

as at 30 June 2023

Non-control-ling

interest

Share Share Merger Warrant Retained

capital premium reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP GBP

Six months

ended 30 June

2023

Balance at

1 January 2023

(audited) 3,808,589 39,308,529 10,209,673 701,065 (43,309,440) 24,502 10,742,918

(Loss)

/profit and

total

comprehensive

income - - - - (5,887,194) 11,136 (5,876,058)

Transactions

with owners

- Transfer

of merger reserve - - (10,209,673) - 10,209,673 - -

- Options granted - - - 119,083 - - 119,083

- Options

exercised/

lapsed 2,500 - - (179,407) 179,407 - 2,500

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Transactions

with owners - - (10,209,673) (60,324) 10,389,080 - 2,500

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Balance at

30 June 2023

(unaudited) 3,811,089 39,308,529 - 640,741 (38,807,554) 35,638 4,988,443

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Six months

ended 30 June

2022

Balance at 1

January 2022 3,803,402 39,308,529 10,209,673 937,505 (41,460,753) 31,119 12,829,475

(audited)

(Loss)/profit

and total

comprehensive

income - - - - (997,630) 9,478 (988,152)

Transactions

with owners

- Xinova write

off (note 17) - - - - 43,855 - 43,855

- Options granted - - - 152,135 - - 152,135

- Options

exercised/lapsed - - - (319,867) 319,867 - -

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Transactions

with owners - - - (167,732) 363,722 - 195,990

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Balance at 30

June 2022

(unaudited) 3,803,402 39,308,529 10,209,673 769,773 (42,094,661) 40,597 12,037,313

------------ ----------- --------------- ---------- ------------- ----------------- ------------

Eden Research plc - Consolidated Statement of cash flows for the

six months ended 30 June 2023

Six months Six months

Year ended

ended ended 31

30 June December

30 June 2023 2022 2022

GBP GBP GBP

unaudited unaudited audited

Cash flows from operating

activities

Cash outflow from operations

(note 8) (1,018,716) (1,528,470) (1,586,531)

Interest on lease liabilities - (9,868) -

R&D tax credit received - 330,660 903,244

Net cash used in operating

activities ( 1,018,716) (1,207,678) (683,287)

Cash flows from investing

activities

Development of intangible

assets (426,918) (657,189) (1,023,262)

Purchase of property, plant

and equipment (1,875) (21,790) (30,929)

Interest received 181 28 192

------------- ------------ ------------

Net cash used in investing

activities (428,612) (678,951) (1,053,999)

------------- ------------ ------------

Cash flows from financing

activities

Issue of shares 2,500 - -

Payment of lease liabilities (59,196) (57,370) (128,301)

Interest on lease liabilities (9,539) - (22,046)

Net cash used in financing

activities (66,235) (57,370) (150,347)

------------- ------------ ------------

Decrease in cash and cash

equivalents (1,513,563) (1,943,999) (1,887,633)

Cash and cash equivalents

at

beginning of period 1,994,472 3,829,369 3,829,369

Effect of exchange rate

fluctuations on cash held 11,857 (33,351) 52,736

------------- ------------ ------------

Cash and cash equivalents

at

end of period 492,766 1,852,019 1,994,472

============= ============ ============

Cash and cash equivalents comprise bank account balances.

Notes to the Interim Results

1. Reporting Entity

Eden Research plc is a public limited company incorporated in

the United Kingdom under the Companies Act 2006. The Company is

domiciled in the United Kingdom and is quoted on the Alternative

Investment Market (AIM).

These condensed consolidated interim financial statements

('Interims') as at and for the six months ended 30 June 2023

comprise the Company and its Subsidiaries (together referred to as

'the Group'). The principal activities of the Group are the

development and commercialisation of encapsulation, terpenes and

environmentally friendly technologies to provide naturally

occurring solutions for the global agrochemicals, animal health,

and consumer product industries.

2. Basis of Preparation

These Interims have been prepared in accordance with IAS 34

'Interim Financial Reporting' and should be read in conjunction

with the Group's last annual consolidated financial statements as

at and for the year ended 31 December 2022 which were approved by

the Board of Directors on 4 May 2023 and have been delivered to the

Registrar of Companies. The report of the auditors on those

financial statements was unqualified, did not contain an emphasis

of matter paragraph and did not contain any statement under section

498 of the Companies Act 2006.

The Interims do not include all of the information required for

a complete set of financial statements prepared under UK-adopted

International Accounting Standards and do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. However, selected explanatory notes are included to explain

events and transactions that are significant to an understanding of

the changes in the Group's financial position and performance since

the last annual financial statements.

Comparative information in the Interims as at and for the year

ended 31 December 2022 has been taken from the published audited

financial statements as at and for the year ended 31 December 2022.

All other periods presented are unaudited.

The Board of Directors and the Audit Committee approved the

interims on 28 September 2023.

3. Going Concern

The directors have, at the time of approving the Interims, a

reasonable expectation that the Group has adequate resources to

continue in operational existence for at least 12 months from the

approval of the financial statements. Thus, the Interim financial

statements have been prepared on a going concern basis which

contemplates the realisation of assets and the settlement of

liabilities in the ordinary course of business.

The Group has reported a loss for the first half of the year

after taxation of GBP5,876,058 (H1 2022: GBP988,152). Net current

assets at that date amounted to GBP 757,716 (H1 2022:

GBP3,040,681). Cash at that date amounted to GBP 492,766 (H1 2021:

GBP1,852,019). The Group is reliant on its current cash balance to

fund its working capital.

The Directors have prepared budgets and projected cash flow

forecasts, based on forecast sales provided by Eden's distributors

where available, for a period of at least 12 months from the date

of approval of the Interims and they consider that the Company will

be able to operate with the cash resources that are available to it

for this period.

The forecasts adopted include only revenue derived from existing

contracts. They do not include potential upside from on-going

discussions and negotiations with other parties not yet contracted,

as well as other 'blue sky' opportunities.

In addition, the Group has relatively low fixed running costs

and, while mitigating actions are not forecast to be required to

support the going concern basis, the Directors have previously

demonstrated its ability to postpone certain other costs, such as

Research and Development expenditure, in the event of unforeseen

cash constraints and are willing and able to delay costs in the

forecast period should the need arise.

Furthermore, in July 2023, Eden completed a firm Capital Raising

of GBP1.1 million and Retail Offer of GBP0.4 million (July 2023)

together with a Conditional Capital Raising of a minimum of GBP7.9

million, all before expenses.

Consequently, the directors are confident that the Company will

have sufficient funds to continue to meet its liabilities as they

fall due for at least 12 months from the date of approval of the

half year report and therefore have prepared the half year report

on a going concern basis.

4. Adoption of new and revised standards and changes in accounting policies

These condensed consolidated Interims have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2022, except for

the application of the following standard at 1 January 2023:

-- Amendments to IFRS 3, IAS 16, IAS 37 and the 2018-2020 IFRS Annual Improvements cycle

The adoption of these new standards would not result in any

material changes to the Interims.

The accounting policies have been applied consistently for the

purposes of preparation of these condensed Interims.

5. Principal risks and uncertainties

The Company's prime risk is the on-going commercialisation of

its intellectual property, which involves testing of the Company's

products, obtaining regulatory approvals and reaching a

commercially beneficial arrangement for each product to be taken to

market. This is measured by comparing actual results with forecasts

that have been agreed by the Company's Board of Directors.

The Company's credit risk is primarily attributable to its trade

receivables. Credit risk is managed by running credit checks on

customers and by monitoring payments against contractual

agreements.

The Company monitors cash flow as part of its day-to-day control

procedures. The Board considers cash flow projections at its

meetings and ensures that the Company has sufficient cash resources

to meet its on-going cash flow requirements.

Due to the nature of the business, there is inherent risk of

infringement of Eden's intellectual property rights by third

parties. The risk of infringement is managed by taking (and acting

on) the relevant legal advice as and when required.

There is also inherent uncertainty surrounding the regulatory

approval of products in terms of both timing and outcome. This risk

is managed by retaining appropriately experienced staff and

contracting with expert consultants as needed.

6. Ukraine

Eden does not currently have any business activities in Russia

or Ukraine and, as such, has not experienced, nor does it expect,

any direct impact on its business.

The knock-on effect of the conflict on other countries is still

being understood, though we do not envisage significant disruption

to the current business in the short term.

7. Earnings per share

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022 2022

2023 Pence unaudited Pence

Pence unaudited audited

(Loss)/profit per ordinary share

(pence) - basic (1.54) (0.26) (0.59)

================= ================= =============

Loss per share - basic has been calculated on the net basis on

the loss after tax of GBP5,876,058 (30 June 2022: GBP 988,152 , 31

December 2022: GBP2,243,879) using the weighted average number of

ordinary shares in issue of 380,912,474 (30 June 2022: 380,340,229,

31 December 2022: 380,549,518).

Diluted earnings per share has not been presented as the Group

is currently loss making and as a result, any additional equity

instruments have the effect of being anti-dilutive.

8. Reconciliation of loss before income tax to cash used by operations

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

unaudited unaudited audited

(Loss)/profit after tax (5,876,058) (988,152) (2,243,879)

Adjustments for:

Share of associate's losses 25,111 9,849 31,444

Amortisation charges 264,557 246,325 495,818

Impairment of intangible assets 4,968,529 - -

Share based payment charge 119,083 152,135 152,135

Xinova loan balance written

off - 43,855 43,855

Depreciation of property,

plant and equipment and right

of use assets 101,159 88,159 191,622

Finance costs - 9,868 22,046

Foreign exchange currency

losses/(gains) (11,857) 33,351 (74,782)

Finance income (181) (28) (192)

Tax credit (317,230) (345,424) (323,716)

Inventory provision - - 76,250

Doubtful debt provision - - 107,188

Movements in working capital:

(Increase)/decrease in trade

and other receivables (271,134) (678,066) 125,720

(Decrease)/ Increase in trade

and other payables 5,241 (162,269) (9,683)

Decrease/(increase) in inventory (25,936) 61,927 (180,357)

------------ ------------ --------------

Cash used by operations (1,018,716) (1,528,470) (1,586,531)

============ ============ ==============

9. Intangible assets

Intellectual Licences Development Total

property and trademarks Costs

GBP GBP GBP GBP

COST

At 1 January 2022 9,407,686 456,684 8,150,140 18,014,510

Additions - - 657,189 657,189

------------- ---------------- ------------ -----------

At 30 June 2022 9,407,686 456,684 8,807,329 18,671,699

Additions 99,371 - 266,702 366,073

------------- ---------------- ------------ -----------

At 31 December

2022 9,507,057 456,684 9,074,031 19,037,772

Additions - - 426,918 426,918

------------- ---------------- ------------ -----------

At 30 June 2023 9,507,057 456,684 9,500,949 19,464,690

============= ================ ============ ===========

AMORTISATION

At 1 January 2022 6,936,629 448,896 2,709,205 10,094,730

Charge for the

period 105,174 648 140,503 246,325

------------- ---------------- ------------ -----------

At 30 June 2022 7,041,803 449,544 2,849,708 10,341,055

Charge for the

period 105,172 648 143,671 249,491

------------- ---------------- ------------ -----------

At 31 December

2022 7,146,975 450,192 2,993,379 10,590,546

Charge for the

period 132,588 780 131,189 264,557

Impairment 1,705,122 2,545 3,260,862 4,968,529

------------- ---------------- ------------ -----------

At 30 June 2023 8,984,685 453,517 6,385,430 15,825,242

============= ================ ============ ===========

CARRYING AMOUNT

At 30 June 2023 522,372 3,167 3,115,519 3,641,058

============= ================ ============ ===========

At 31 December

2022 2,360,082 6,492 6,080,652 8,447,226

============= ================ ============ ===========

At 30 June 2022 2,365,883 7,140 5,957,621 8,330,644

============= ================ ============ ===========

Background

The impairment review that was undertaken as part of the

Company's 2022 accounts preparation resulted in headroom over the

carrying value of only GBP0.9m (down from GBP8.3m in 2021), a

rather small margin given intangible assets amounted to GBP8.4m at

that time.

Given the marginal headroom and general downward trend, the

management team and Audit Committee agreed it was appropriate to

undertake a further impairment review of the Company's intangible

assets, as part of the preparation of the Company's 2023

Interims.

The need for an impairment review was also driven by external

factors such as continuing high interest rates and inflation which

it was felt might impact the discount rate used in the Company's

CGU calculations.

The Board agreed to appoint an independent advisor to undertake

an impairment review, based on the current position of the Company

and the current financial environment.

Based on the advisor's review, it was reported that there was an

indication of impairment of GBP5.0m which had arisen primarily due

to an increase in the discount rate used and increased forecast

development costs.

Accordingly, the Board agreed to impair intellectual property by

GBP1.7m and development costs by GBP3.3m.

The Board will continue to assess the carrying value of its

intangible assets on a regular basis to check for any indications

of impairment.

Details

In 2003, the Group acquired Eden Research Inc., primarily

obtaining intellectual property assets worth GBP9,181,967.

Recently, the Group has taken steps to establish its own research

and development facility, comprising a skilled team proficient in

formulation, chemistry, and biology. Over the past three years, the

Group has significantly expanded its internal knowledge base,

historically reliant on external parties. The Directors have

concluded that none of the old formulations, or formulation

techniques acquired from Eden Research Inc. are now relevant to the

Group's current, or future product portfolio. As a result, it is

highly probably that the intellectual property acquired in the past

has substantially decreased in value.

On review of the estimated timeline for product development and

given the slow pace of development to commercialisation of products

in the crop protection industry, the Directors have forecasted that

most of the future revenues for product development projects will

start at the end of the current forecasting timeline of 2030. Given

the general uncertainty as to what the products and their

addressable markets would be, it is not reasonable to include them

within any produce sales revenue forecasts. Therefore, the

Directors felt it was prudent to complete an impairment assessment

based on the projected revenues that have already been sold or have

licences for.

Further to the above, in the period to 30 June 2023, the

Directors have observed a decrease in the expected gross profit and

budgeted operating loss within the Agrochemicals CGU. The Group is

currently evaluating whether this decline is a short-term trend

linked to the current uncertainty of wider the economic environment

or whether this is part of a boarder, long-term trend.

Based on the above, an impairment review has been undertaken by

the Directors. Of the total carrying value of the intangible

assets, GBP8,523,296 have been allocated to the Agrochemicals Cash

Generating Unit (CGU).

The recoverable amounts of the intangible assets has been

determined based on value in use calculations based on the

Agrochemicals CGU.

Assumptions

The Directors have prepared a discounted cash-flow forecast,

based on product sales forecasts including those provided by the

Group's commercial partners, and have taken into account the market

potential for the Group's products and technologies using third

party market data that the Group has acquired licences to. The

discounted cash-flow forecast is limited to those products which

are already being sold, or are expected to be sold in 2023, or

early 2024.

The forecast covers a period of 7.5 years, with no terminal

value, reflecting the useful economic life of the patent in respect

of the underlying technology. Financial forecasts are based on the

approved budget. Financial forecasts for 2024-2025 are used on the

approved long-term plan. Financial forecasts for 2026-2030 are

extrapolated based on a long-term growth rate.

The discount rate is derived from the Group's weighted average

cost of capital, taking into account the cost of equity and debt,

which specific market-related premium and company-related premium

adjustments are made. The discount rate used was 16.36%.

Tax rate is assumed at 25% which is in line with the rate in the

years the Group have earnings, however the current losses brought

forward as at 30 June 2023 exceed GBP30m so not tax charge has been

included in the forecasted years where the Group is profitable.

Based on the above assumptions, the value in use of the

intangible assets was GBP4,970,139 lower than the carrying value of

the intangible assets indicating that an impairment of intangible

assets is required at 30 June 2023.

The cash flows used within the impairment model are based on

assumptions which are sources of estimation uncertainty and small

movements in these assumptions could lead to further impairment.

Management have performed a sensitivity analysis on the key

assumptions in the impairment model using reasonably possible

changes in these key assumptions.

Increase Effect on value

in assumption in use calculation

(GBP)

Discount rate 1% (270,020)

Working capital investment as a % of

revenue growth 1% (137,499)

Average exchange rate 0.30 (682,654)

The impairment charge of GBP4,968,529 has been charged

immediately to the statement of comprehensive income.

10. Investment in associate

Six months Six months Year ended

ended ended

30 June 2023 30 June 2022 31 December

2022

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Percentage ownership interest

and proportion of voting rights 29.90% 29.90% 29.90%

GBP GBP GBP

Non-current assets 347,094 409,425 378,271

Current assets 340,873 310,173 382,753

Non-current liabilities (57,155) (98,806) (92,341)

Current liabilities (386,531) (269,026) (365,430)

Net assets (100%) 244,281 351,766 303,903

Company's share of net assets 73,040 105,178 90,867

Separable intangible assets 118,965 133,533 126,249

Goodwill 412,649 412,649 412,649

Impairment of investment in

associate (299,521) (299,521) (299,521)

Carrying amount of interest

in associate 305,133 351,839 330,244

Revenue 297,304 255,912 497,292

Profit/(loss) from continuing

operations (59,620) (8,579) (56,440)

Post tax profit from discontinued - - -

operations

100% of total post-tax profits (59,620) (8,579) (56,440)

29.9% of total post-tax profits (17,827) (2,565) (16,876)

Amortisation of separable intangible

assets (7,284) (7,284) (14,568)

Company's share of loss including

amortisation of separable intangible

asset (25,111) (9,849) (31,444)

11. Subsidiaries

Details of the company's subsidiaries at 30 June 2023 are as follows:

Name of undertaking Country of Ownership Voting power Nature of business

incorporation interest (%) held (%)

TerpeneTech Republic of 50.00 50.00 Sale of biocide

Limited Ireland products

Eden Research Republic of 100.00 100.00 Dormant

Europe Limited Ireland

TerpeneTech Limited ("TerpeneTech (Ireland))", whose registered office is

108 Q House, Furze Road, Sandyford, Dublin, Ireland, was incorporated on

15 January 2019 and is jointly owned by both Eden Research Plc and TerpeneTech

(UK), the company's associate.

Eden has the right to appoint a director as chairperson who will have a

casting vote, enabling the Group to exercise control over the Board of Directors

in the absence of an equivalent right for TerpeneTech (UK). Eden owns 500

ordinary shares in TerpeneTech (Ireland).

Eden Research Europe Limited, whose registered office is 108 Q House, Furze

Road, Sandyford, Dublin, Ireland, was incorporated on 18 November 2020 and

is wholly owned by both Eden Research plc.

Non-controlling interests

The following table summarises the information relating to the

Group's subsidiary with material non-controlling interest, before

intra-group eliminations:

30 June 30 June 31 Dec

2023 2022 2022

GBP GBP GBP

unaudited unaudited audited

NCI percentage 50% 50% 50%

Non-current assets 86,291 99,563 92,927

Current assets 34,983 - 6,076

Non-current liabilities - - -

Current liabilities - (18,371) -

Net assets 121,274 81,192 99,003

---------- ---------- ---------

Carrying amount of NCI -

Revenue 28,907 25,591 50,038

Profit/(loss) 22,271 18,955 (13,234)

OCI - - -

---------- ---------- ---------

Total comprehensive income 22,271 18,955 (13,234)

Share of NCI (50% of net Total

comprehensive income) 11,136 9,478 (6,617)

Cash flows from operating activities - - -

Cash flows from investment activities - - -

Cash flows from financing activities - - -

Net increase/(decrease) in cash

and cash equivalents - - -

---------- ---------- ---------

Dividends paid to non-controlling

interests - - -

---------- ---------- ---------

12. Property, plant and equipment

Land

and buildings Total

GBP GBP

COST

At 1 January 2022 302,027 302,027

Additions 21,790 21,790

--------------- ---------

At 30 June 2022 323,817 323,817

Additions - owned 9,139 9,139

--------------- ---------

At 31 December 2022 332,956 332,956

Additions 1,875 1,875

--------------- ---------

At 30 June 2023 334,831 334,831

=============== =========

AMORTISATION

At 1 January 2022 69,749 69,749

Charge for the period 31,356 31,356

--------------- ---------

At 30 June 2022 101,105 101,105

Charge for the period 33,065 33,065

--------------- ---------

At 31 December 2022 134,170 134,170

Charge for the period 33,486 33,486

--------------- ---------

At 30 June 2023 167,656 167,656

=============== =========

CARRYING AMOUNT

At 30 June 2023 167,175 167,175

=============== =========

At 31 December 2022 198,786 198,786

=============== =========

At 30 June 2022 222,712 222,712

=============== =========

13. Right of use assets

Land and

buildings Vehicles Total

GBP GBP GBP

COST

At 1 January 2022 443,777 86,073 529,850

Additions - 23,194 23,194

Disposals - (35,865) (35,865)

----------- ----------- ---------

At 30 June 2022 443,777 73,402 517,179

Additions - 64,034 64,034

----------- ----------- ---------

At 31 December 2022 443,777 137,436 581,213

At 30 June 2023 443,777 137,436 581,213

=========== =========== =========

AMORTISATION

At 1 January 2022 119,865 37,198 157,063

Charge for the period 45,438 11,364 56,802

Eliminated on disposal - (35,865) (35,865)

----------- ----------- ---------

At 30 June 2022 165,303 12,697 178,000

Charge for the period 45,438 24,961 70,399

At 31 December 2022 210,741 37,658 248,399

Charge for the period 45,438 22,235 67,673

At 30 June 2023 256,179 59,893 316,072

=========== =========== =========

CARRYING AMOUNT

At 30 June 2023 187,598 77,543 265,141

=========== =========== =========

At 31 December 2022 233,036 99,778 332,814

=========== =========== =========

At 30 June 2022 278,474 60,705 339,179

=========== =========== =========

14. Inventories

30 June 31 December

30 June 2023 2022 2022

GBP GBP GBP

Raw materials 533,227 114,562 115,929

Goods in transit - 251,985 411,181

Finished goods 118,167 92,877 98,348

651,394 459,424 625,458

Inventory above is shown

net of a provision off

Provision for obsolete inventory 76,250 - 76,250

76,250 - 76,250

15. Trade and other receivables

30 June 31 December

30 June 2023 2022 2022

GBP GBP GBP

Trade receivables 479,311 1,166,042 322,489

VAT recoverable 252,336 231,407 179,214

Other receivables 99,140 66,410 67,410

Prepayments and accrued

income 99,213 100,793 89,753

930,000 1,564,652 658,866

Trade receivables are shown

net of a provision for doubtful

debt of:

Provision for doubtful debt 107,188 - 107,188

107,188 - 107,188

Trade receivables disclosed above are measured at amortised cost.

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value.

16. Trade and other payables

30 June 31 December

30 June 2023 2022 2022

GBP GBP GBP

Trade payables 1,171,433 1,306,597 1,150,873

Accruals and deferred income 420,310 212,193 515,860

Social security and other

taxation 55,434 47,541 52,849

Other payables 171,405 72,614 93,759

1,818,582 1,638,945 1,813,341

17. Share based payments

Long-Term Incentive Plan ("LTIP")

Since September 2017 Eden has operated an option scheme for

executive directors, senior management and certain employees under

an LTIP which allows for certain qualifying grants to be HMRC

approved. Details on options issued in prior periods can be found

in the annual report for the year ended 31 December 2022.

Options

Number of share Weighted average

options exercise price (pence)

30 Jun 30 Jun 30 Jun 30 Jun

2023 2022 2023 2022

Outstanding at 1 January 16,312,649 18,680,044 7 7

Granted during the period - 2,006,939 - 5

Exercised during the period (250,000) - 1 -

Lapsed during the period (3,500,000) (3,500,000) 6 6

----------- ----------- -------------------- ------

Exercisable at 30 June 12,562,649 17,186,943 8 8

=========== =========== ==================== ======

The following information is relevant in the determination of

the fair value of options granted during 2022 under the LTIP

Replacement Award.

Grant date 30/06/2022

Number of awards 2,006,939

------------------

Share price GBP0.04 - GBP0.05

------------------

Exercise price GBP0.01 - GBP0.06

------------------

Expected dividend yield -%

------------------

Expected volatility 63%

------------------

Risk free rate 0.95%

------------------

Vesting period One year

------------------

Expected Life (from date of grant) 3 years

------------------

The exercise price of options outstanding at the end of the period

ranged between 6p and 10.4p (H1 2022: 1p and 10.4p) and their

weighted average contractual life was 1.4 years (H1 2022: 2.1

years).

The share-based payment charge for the period, in respect of options,

was GBP119,083 (H1 2022: GBP152,135). The charge in H1 2023 is

in respect of the options granted in 2022 under the LTIP Replacement

Award.

During the period, 3,500,000 of options lapsed and GBP171,251

(H1 2022: GBP171,251) was transferred from the warrant reserve

to retained earnings.

Also, during the period, 250,000 of options were exercised and

GBP8,156 (H1 2022: GBPnil) was transferred from the warrant reserve

to retained earnings.

Warrants

Number of share Weighted average

options exercise price (pence)

30 Jun 30 Jun 30 Jun 30 Jun

2023 2022 2023 2022

Outstanding at 1 January - 2,989,865 - 19

Granted during the period - - - -

Exercised during the period - - - -

Lapsed during the period - - - 25

-------- --------------- ---------- -------------

Exercisable at 30 June - 2,989,865 - 15

======== =============== ========== =============

There were no warrants outstanding at 30 June 2023.

The exercise price of warrants outstanding at 30 June 2022 ranged

between 12p and 30p and their weighted average contractual life

was 1.0 year. None of the warrants had vesting conditions.

The share-based payment charge for the period, in respect of warrants,

was GBPnil (H1 2022: GBPnil).

Xinova liability

In September 2015, the Company entered into a Collaboration and

Licence agreement with Invention Development Management Company LLC

(part of Intellectual Ventures, now called Xinova LLC). As part of

this agreement, upon successful completion of a number of different

tasks, Xinova became entitled to a payment which is calculated

using a percentage (initially 3.17%, reduced to 1.6% following the

fundraise in March 2020) of the fully diluted equity value, reduced

by cash and cash equivalents, of the Company on the date on which

payment becomes due which is expected to be 30 September 2025. This

has been accounted for as a cash-settled share-based payment under

IFRS 2.

An amount of GBP67,462, being the estimated fair value of the

liability due to Xinova, was recognised during 2016 and included as

a non-current liability. It is not believed that the value of the

services provided by Xinova can be reliably measured, and so this

amount was calculated based on the Company's market capitalisation

at 31 December 2016, adjusted to reflect the percentage of work

completed by Xinova at that date based on a pre-determined schedule

of tasks.

During H1 2022, Eden was informed that Xinova had begun to wind

down its operations.

As a consequence, Eden began communications with an agent acting

on behalf of Xinova to effect the wind down in respect of the

liability owed to Xinova by Eden.

On 22 April 2022, Eden signed a 'full and final' settlement

agreement with Xinova which resulted in Eden paying an amount of

GBP43,855, which represented a c. 50% discount to the liability of

GBP87,740 as at 31 December 2021, in line with the then existing

contract.

At 30 June 2023, an amount of GBPnil (30 June 2022: GBPnil) was

owed to Xinova.

18. Segmental Reporting

IFRS 8 requires operating segments to be reported in a manner

consistent with the internal reporting provided to the chief

operating decision-maker. The chief operating decision-maker, who

is responsible for the resource allocati on and assessing

performance of the operating segments has been identified as the

Executive Directors as they are primarily responsible for the

allocation of the resources to segments and the assessment of

performance of the segments.

The Executive Directors monitor and then assess the performance

of segments based on product type and geographical area using a

measure of adjusted EBITDA. This is the result of the segment after

excluding the share-based payment charges, other operating income

and the amortisation of intangibles. These items, together with

interest income and expense are not allocated to a specific

segment.

The segmental information for the six months ended 30 June 2023

is as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- ------------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- ------------

Milestone payments - - - -

-------------- ---------- -------- ------------

R & D charges - 4,943 - 4,943

-------------- ---------- -------- ------------

Royalties - 28,907 - 28,907

-------------- ---------- -------- ------------

Product sales 1,108,521 - - 1,108,521

-------------- ---------- -------- ------------

Total revenue 1,108,521 33,850 - 1,142,371

-------------- ---------- -------- ------------

EBITDA (751,178) 33,850 - (717,328)

-------------- ---------- -------- ------------

Share Based Payments (119,083) - - (119,083)

-------------- ---------- -------- ------------

Adjusted EBITDA (870,261) 33,850 - (836,411)

-------------- ---------- -------- ------------

Amortisation (257,941) (6,636) - (264,577)

-------------- ---------- -------- ------------

Impairment (4,968,529) - - (4,968,529)

-------------- ---------- -------- ------------

Depreciation (101,159) - - (101,159)

-------------- ---------- -------- ------------

Finance costs, foreign exchange

and investment revenues 2,499 - - 2,499

-------------- ---------- -------- ------------

Income Tax 317,230 - - 317,230

-------------- ---------- -------- ------------

Share of Associate's loss - (25,111) - (25,111)

-------------- ---------- -------- ------------

(Loss)/Profit for the Year (5,878,161) 2,103 - (5,876,058)

-------------- ---------- -------- ------------

Total Assets 6,971,889 121,274 - 7,093,613

-------------- ---------- -------- ------------

Total assets includes:

-------------- ---------- -------- ------------

Additions to Non-Current

Assets 428,793 - - 428,793

-------------- ---------- -------- ------------

Total Liabilities 2,085,170 20,000 - 2,105,170

-------------- ---------- -------- ------------

The segmental information for the six months ended 30 June 2022

is as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- -----------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- -----------

Milestone payments - - - -

-------------- ---------- -------- -----------

R & D charges - 3,232 - 3,232

-------------- ---------- -------- -----------

Royalties - 25,591 - 25,591

-------------- ---------- -------- -----------

Product sales 1,011,213 - - 1,011,213

-------------- ---------- -------- -----------

Total revenue 1,011,213 28,823 - 1,040,036

-------------- ---------- -------- -----------

EBITDA (822,740) 28,823 - (793,917)

-------------- ---------- -------- -----------

Share Based Payments (152,135) - - (152,135)

-------------- ---------- -------- -----------

Adjusted EBITDA (974,875) 28,823 - (946,052)

-------------- ---------- -------- -----------

Amortisation (239,689) (6,636) - (246,325)

-------------- ---------- -------- -----------

Depreciation (88,159) - - (88,159)

-------------- ---------- -------- -----------

Finance costs, foreign exchange

and investment revenues (43,191) - - (43,191)

-------------- ---------- -------- -----------

Income Tax 345,424 - - 345,424

-------------- ---------- -------- -----------

Share of Associate's loss - (9,849) - (9,849)

-------------- ---------- -------- -----------

(Loss)/Profit for the Year (1,000,490) 12,338 - (988,152)

-------------- ---------- -------- -----------

Total Assets 13,931,631 99,563 - 14,038,478

-------------- ---------- -------- -----------

Total assets includes:

-------------- ---------- -------- -----------

Additions to Non-Current

Assets 702,173 - - 702,173

-------------- ---------- -------- -----------

Total Liabilities 1,982,793 18,371 - 2,001,164

-------------- ---------- -------- -----------

The segmental information for the year ended 31 December 2022 is

as follows:

Agrochemicals Consumer Animal Total

products health

-------------- ---------- -------- ------------

Revenue GBP GBP GBP GBP

-------------- ---------- -------- ------------

Milestone payments - - - -

-------------- ---------- -------- ------------

R & D charges 75,334 14,309 - 89,643

-------------- ---------- -------- ------------

Royalties 17,694 100,038 - 117,732

-------------- ---------- -------- ------------

Product sales 1,619,796 - - 1,619,796

-------------- ---------- -------- ------------

Total revenue 1,712,824 114,347 - 1,827,171

-------------- ---------- -------- ------------

Adjusted EBITDA (1,841,805) 114,347 - (1,727,458)

-------------- ---------- -------- ------------

Share Based Payments (152,135) - - (152,135)

-------------- ---------- -------- ------------

EBITDA (1,993,940) 114,347 - (1,879,593)

-------------- ---------- -------- ------------

Amortisation (482,546) (13,272) - (495,818)

-------------- ---------- -------- ------------

Depreciation (191,622) - - (191,622)

-------------- ---------- -------- ------------

Finance costs, foreign exchange

and investment revenues 30,882 - - 30,882

-------------- ---------- -------- ------------

Impairment of investment - - - -

in associate

-------------- ---------- -------- ------------

Income Tax 323,716 - - 323,716

-------------- ---------- -------- ------------

Share of Associate's loss - (31,444) - (31,444)

-------------- ---------- -------- ------------

(Loss)/Profit for the Year (2,313,510) 69,631 - (2,243,879)

-------------- ---------- -------- ------------

Total Assets 12,812,579 99,003 - 12,911,582

-------------- ---------- -------- ------------

Total assets includes:

-------------- ---------- -------- ------------

Additions to Non-Current

Assets 1,141,418 - - 1,141,418

-------------- ---------- -------- ------------

Total Liabilities 2,168,664 - - 2,168,664

-------------- ---------- -------- ------------

Geographical Reporting

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

GBP GBP GBP

UK 33,850 28,823 114,347

Europe 1,108,521 1,011,213 1,712,824

----------- ----------- -------------

1,142,371 1,040,036 1,827,171

=========== =========== =============

The revenue derived from Milestone Payments relates to

agreements which cover a number of countries both in the EU and the

rest of the world.

All of the non-current assets are in the UK.

19. Merger Reserve

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

GBP GBP GBP

Merger reserve - 10,209,673 10,209,673

============= =========== =============

During the period, the carrying value of the intellectual

property which had arisen from an acquisition in 2003 had been

reduced to zero. As such, under the Companies Act 2006, the full

balance of the merger reserve of GBP10,209,673 was transferred to

retained earnings.

20. Subsequent Events

Capital Raising

On 28 July 2023, the Company announced that it had raised GBP1.1

million through a firm placing and subscription of new Ordinary

Shares ("Firm Capital Raising") and a further GBP0.4 million

through a Retail Offer and had conditionally raised a minimum of

GBP7.9 million by way of a Placing of new Ordinary Shares

("Conditional Capital Raising"), all before expenses.

The Conditional Capital Raising is expected to complete

shortly.

LTIP grant

On 31 August 2023, the The Company made a LTIP grant to the

Executives, in respect of 2022 in order to ensure continuity of

long term incentive, of options over 8,698,909 new Ordinary Shares

in Eden ("the Options"), at a strike price of 5.05p each, being the

2022 Volume Weighted Average Price, in the amounts of 4,968,000

awarded to Sean Smith and 3,730,909 awarded to Alex Abrey.

The Options expire on 31 August 2027 and vest as follows:

1/3 upon grant

1/3 12 months from the date of grant

1/3 24 months from the date of grant

Separately, the Board agreed that it would extend the exercise

date to 31 December 2023 for the 3,500,000 options (2,000,000

awarded to Sean Smith and 1,500,000 awarded to Alex Abrey) with a

strike price of 6p which were granted to the Executives in April

2021 under the Company's LTIP and which were due to expire on 30

June 2023.

The extension was agreed to due to the unusually long closed

period that the Executives were placed in prior to the options'

expiration date.

Notes to Editors:

Eden Research is the only UK-listed company focused on

biopesticides for sustainable agriculture. It develops and supplies

innovative biopesticide products and natural microencapsulation

technologies to the global crop protection, animal health and

consumer products industries.

Eden's products are formulated with terpene active ingredients,

based on natural plant defence metabolites. To date, they have been

primarily used on high-value fruits and vegetables, improving crop

yields and marketability, with equal or better performance when

compared with conventional pesticides. Eden has two products

currently on the market:

Based on plant-derived active ingredients, Mevalone(R) is a

foliar biofungicide which initially targets a key disease affecting

grapes and other high-value fruit and vegetable crops. It is a

useful tool in crop defence programmes and is aligned with the

requirements of integrated pest management programmes. It is

approved for sale in a number of key countries whilst Eden and its

partners pursue regulatory clearance in new territories thereby

growing Eden's addressable market globally.

Cedroz (TM) is a bionematicide that targets free living

nematodes which are parasitic worms that affect a wide range of

high-value fruit and vegetable crops globally. Cedroz is registered

for sale on two continents and Eden's commercial collaborator,

Eastman Chemical, is pursuing registration and commercialisation of

this important new product in numerous countries globally.

Eden's Sustaine(R) encapsulation technology is used to harness

the biocidal efficacy of naturally occurring chemicals produced by

plants (terpenes) and can also be used with both natural and

synthetic compounds to enhance their performance and ease-of-use.

Sustaine microcapsules are naturally-derived, plastic-free,

biodegradable micro-spheres derived from yeast. It is one of the

only viable, proven and immediately registerable solutions to the

microplastics problem in formulations requiring encapsulation.

Eden was admitted to trading on AIM on 11 May 2012 and trades

under the symbol EDEN. It was awarded the London Stock Exchange

Green Economy Mark in January 2021, which recognises London-listed

companies that derive over 50% of their total annual revenue from

products and services that contribute to the global green economy.

Eden derives 100% of its total annual revenues from sustainable

products and services.

For more information about Eden, please visit: www.edenresearch.com .

Follow Eden on LinkedIn , Twitter and YouTube .

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VVLFLXKLFBBV

(END) Dow Jones Newswires

September 29, 2023 02:01 ET (06:01 GMT)

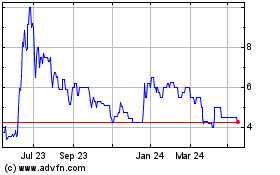

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

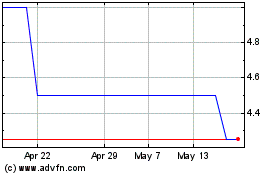

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024