Investors have been betting on clean energy ETFs for years with

disappointing results across the board. Many funds in this space

have lost double digits --if not worse-- in years past, as a

reduction in government subsidies, low prices for traditional fuel

sources, and a general lack demand for these risky companies have

combined to dull the investment case for alternative energy

ETFs.

However, investors have seen a bit of a reversal in the market

so far in 2013, as a number of pieces of good news hit the segment.

Many solar companies have posted solid guidance levels while other

firms—such as investment all-star Tesla

(TSLA)—have boosted optimism over the entire space (Read

Go Green with These 3 Clean Energy ETFs).

In fact, of the 12 ETFs we currently classify as alternative

energy ETFs, all have seen positive performances in the

year-to-date time frame, with fully two-thirds of the group beating

out the S&P 500 in the period. Thus, we are seeing a dramatic

turnaround in the market, suggesting that the clean energy world

might finally be getting back on track.

How to Play

Given this dramatic move higher in the space, one can certainly

argue that clean energy is finally in a bull market environment. As

a result, investors might want to look to any of these top

performing ETFs as the go-to way to play a continued surge in this

volatile corner of the ETF world:

Market Vectors Global Alternative Energy ETF

(GEX)

This ETF tracks the Ardour Global Index, focusing on companies

that are primarily engaged in the business of alternative energy.

The fund holds about 30 stocks in its basket, charging investors 62

basis points a year in fees for the exposure.

Assets are well spread out despite the low number of holdings,

with roughly one-third going to industrials, one-third to

technology, and the rest in utilities, consumer discretionary, and

energy firms. From a cap perspective, there is a definite tilt

towards smaller securities, while the national profile is skewed

towards the U.S. (53%), but Europe (27%) is well represented too

(read Behind the Rebound in Energy ETFs).

In terms of performance, GEX has done quite well, adding about

57% in the trailing six month time frame. And, in the past month,

GEX has moved higher by an impressive 23.8%, suggesting that the

bullish momentum has really been building lately.

First Trust Nasdaq Clean Energy Green Energy Index

(QCLN)

This product also follows a benchmark of clean energy companies,

giving exposure to about 40 firms in total. Fees are bit less in

this product at 60 basis points a year, but volume is relatively

light as well.

Technology firms dominate this ETF, accounting for just over

two-thirds of the assets. Beyond technology though, consumer stocks

make up about 16% (thanks entirely to TSLA), while energy,

industrials and basic materials round out the rest (also see Clean

Energy ETFs: Thrive with these Two Broad Funds).

For market cap levels, the fund is extremely diversified with

just 16% of assets going to large cap stocks. The fund is almost

entirely focused on the U.S. market though, so don’t look for much

from QCLN in terms of international diversification.

The performance for this ETF has been even more impressive

lately, as the fund has surged higher by about 69% in the last six

months. Interestingly, the product is up about 31% in the last four

weeks, largely thanks to the incredible run by top holding Tesla

Motors.

Guggenheim Solar ETF (TAN)

For a concentrated clean energy play, investors have

Guggenheim’s TAN, focusing in on solar companies. The ETF holds

about two dozen companies in its basket, charging investors 65

basis points a year in fees for exposure (see 3 Energy ETFs for

America’s Production Boom).

Unsurprisingly, the ETF is heavily concentrated in the

technology sector, while small and mid cap stocks dominate from a

cap perspective. Top holdings include First Solar

(FSLR) at nearly 20% of assets, along with China-based GCL

Poly Energy Holdings (9.9%), Power-One (PWER), and

SunPower Corp (SPWR).

Solar has turned out to be the real winner lately, adding a

robust 111% in the past six months alone. And in the past month,

the ETF has surged by nearly 47%, suggesting an incredible level of

positive momentum lately.

Bottom Line

The alternative energy sector has been extremely hot, crushing

the broad market in the past few months by a pretty wide margin. By

and large, most of the gains have actually happened in the past few

weeks though, as strong data from solar companies and bullish

reports from emerging companies have carried the sector sharply

higher.

Whether this incredible run can continue is anyone’s guess, but

a pullback from these lofty levels—due to some short-term profit

taking—seems likely. Still, it is important to remember that many

alternative energy ETFs have a long way to go to get back to

all-time highs, so there still could be plenty of room to run in

this intriguing, but often overlooked, space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

FIRST SOLAR INC (FSLR): Free Stock Analysis Report

MKT VEC-GLBL AE (GEX): ETF Research Reports

NASDAQ-CL EDG G (QCLN): ETF Research Reports

GUGG-SOLAR (TAN): ETF Research Reports

TESLA MOTORS (TSLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

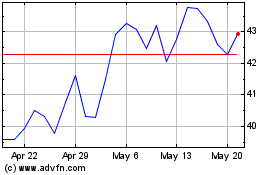

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Apr 2024 to May 2024

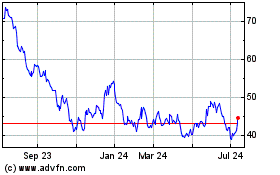

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From May 2023 to May 2024