Are Silver ETFs Back on Track? - ETF News And Commentary

September 12 2012 - 6:37AM

Zacks

After peaking in April of 2011, silver prices have had trouble

regaining their lofty levels. The white commodity has instead

briefly flashed above the $04/mark in the late summer of 2011

before returning to a level around the $25/oz. range.

While the metal appeared to be back on track to start 2012, this

soon dissipated as the dollar strengthened in the face of European

woes and investors shunned commodities for stocks once more.

However, this trend appears to be reversing yet again as silver

prices have taken off in recent weeks and have finally breached the

$30/oz. level for the first time in months (also see Platinum ETF

Investing 101).

This recent bullish trend in the silver market is undoubtedly

driven by the Federal Reserve. The central bank seems poised to

initiate another round of QE in hopes of boosting sagging growth

levels, although many believe that this will curtail the dollar’s

value and boost precious metals in the process.

Furthermore, although the metal is more impacted by industrial

events than its cousin gold, the metal is also more volatile due to

its more ubiquitous nature and lower price point. This has allowed

silver to greatly outperform gold in recent weeks and the trend

could continue in a bull market phase for precious metals, making

silver an intriguing choice at this juncture (read Silver ETFs

Outshine Gold).

In fact, a recent look at the ETF space reveals a very

interesting path for silver ETFs over the past few weeks. According

to data from XTF.com, of the top eight best performing

non-leveraged ETFs in the past month, five had a focus on

silver.

This represents a pretty big reversal from many of these

products performances’ over the trailing one year period in which

all were down more than 20% in the time frame. Potentially, it

suggest that a trend shift is underway in the silver market and

that it could especially move if Bernanke and Company authorize

another round of bond purchases before the year is over (read The

Five Best ETFs over the Past Five Years).

For these reasons, it could be time for some investors to take a

closer look at the silver market once again. Clearly, Bernanke is

putting a floor underneath silver prices in the near term, and a

robust recovery seems quite unlikely at this point, suggesting that

more QE will probably be used sooner rather than later.

If investors are looking for an ETF approach, we have

highlighted six of the top performing ETFs in the space—which have

all added more than 13% in the last month-- briefly below. Any of

these options could be great picks for investors seeking more

silver exposure before more easing is inevitably unleashed on the

economy:

- PowerShares DB Silver Fund (DBS) – One of the

top performing ETF with a focus on bullion, DBS utilizes futures in

order to achieve silver exposure. The fund charges a somewhat high

79 basis points a year in fees and volume is quite light, but it

has managed to outperform in shorter time periods (although this

trend is reversed over longer time frames).

- E-TRACS UBS Bloomberg CMCI Silver ETN (USV) –

Although relatively unpopular, this silver ETN is actually the best

performing silver product over the trailing one month period. The

note has just edged out its peers putting up a gain of roughly

19.4% in the time frame, although it should be noted that trading

volumes are quite low, suggesting wide bid ask spreads.

- Global X Silver Miners ETF (SIL) - This Global

X fund has been the best performing silver-focused mining ETF over

the past month, thanks in part to its equity focus. The product

charges investors 65 basis points a year in fees but has 30

components in its basket, with Canadian firms taking the top spot

at 53% of assets (see Time to Consider the Silver Miners ETF).

- iShares Silver Trust (SLV) – This is easily

the most popular silver ETF on the market today with nearly $10

billion in assets and over 13 million shares changing hands on a

daily basis. The fund is in the middle of the road for expenses,

but the volume is unmatched, making it a solid choice for traders

seeking tight bid ask spreads.

- iShares MSCI Global Silver Miners Fund (SLVP)

– This low cost choice in the silver mining space charges

just 39 basis points a year in fees, but sees paltry volume levels

and wide bid ask spreads. However, the fund does provide similar

exposure to SIL at a lower cost, making it a potential replacement

for those unconcerned with low trading volumes and a heavy

concentration in the top securities (see more in the Zacks ETF

Center).

- ETF Securities Silver Trust (SIVR) – The

cheapest ETF, bar none, in the silver market is this one from ETF

Securities which charges just 30 basis points a year in fees.

Volume is also pretty solid on this product while AUM is pretty

good as well. Additionally, the bullion is stored in secure vaults

in Europe where random audits and bar number lists are present in

order to give investors more peace of mind over their

investments.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Long silver bullion

PWRSH-DB SILVER (DBS): ETF Research Reports

GLBL-X SILVER (SIL): ETF Research Reports

ETF-SILVER TRST (SIVR): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

ISHARS-M GL SLV (SLVP): ETF Research Reports

E-TRC UBC SILVR (USV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

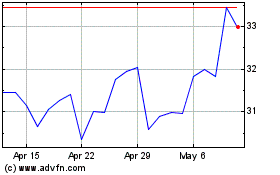

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

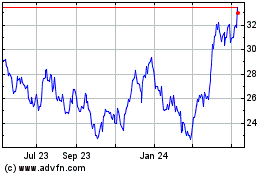

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Apr 2023 to Apr 2024