Are Investors Abandoning the PIMCO Total Return ETF? - ETF News And Commentary

September 04 2013 - 2:02PM

Zacks

As bond yields rise, investors are finally seeing some losses in

their fixed income holdings. This is probably quite the shock to

most investors as it signals the end of the nearly 30 year bull

market in fixed income.

Thanks to this, many are exiting fixed income securities entirely

and are putting their capital to work in stocks or even commodities

instead. This is leading to huge outflows for many of the top bond

products out there, including arguably the most famous, the

PIMCO Total Return Fund (PTTRX).

The enormous bond fund, which has over a quarter trillion in assets

under management, has been losing assets for four straight months

now, with the outflows picking up as of late. Outflows are moving

out at a rate of at least $7.5 billion for each of the past three

months, putting the total YTD outflows at $23.2 billion for the

benchmark product (see all the Total Bond Market ETFs).

Trend Across the Board?

Clearly, investors are pulling out of the product to a decent

degree, and this is followed up by bond outflows in a number of

other key mutual funds and popular ETFs lately. However, it is

worth noting that for the ETF form of the PIMCO Total Return

product, outflows really haven’t been that bad this summer.

The

PIMCO Total Return ETF (BOND) has actually

seen outflows of just $73 million in the past month, and roughly a

quarter billion since the quarter began. Furthermore, the ETF has

actually added about half a billion in assets so far in 2013, going

against the trend both in the broad space and in terms of its

counterpart mutual fund product as well (read Forget BOND, Focus on

These Junk Bond ETFs Instead).

Granted, BOND has just a fraction of the assets that PTTRX has—just

over $4 billion—but it still suggests that there is a bit of a

divergence developing between the two key products lately. This is

surprising since BOND has a higher expense ratio than PTTRX, though

the performances of the two could be a clue for why the ETF hasn’t

been abandoned yet.

Performance

In terms of YTD performance, BOND has clearly outperformed its

mutual fund counterpart (by roughly 100 basis points), though both

are posting a loss in year-to-date time frames. And in shorter time

frames, this trend continues as both in the trailing three and one

month periods BOND has beaten out PTTRX.

If that wasn’t enough, BOND is still holding its ground when

compared to other popular bond ETFs in terms of trailing one year

performances. If investors compare BOND to

AGG and

BND, two of the most popular total bond market

ETFs out there, the PIMCO product is a clear winner.

The ETF has lost just half a percent in the trailing one year time

frame, compared to 3% losses for both AGG and BND in the same

period. While BOND has certainly faced more turbulence lately, it

is still maintaining a degree of outperformance, though it looks to

be more volatile in the months ahead (also read 3 ETFs for Rising

Interest Rates).

Bottom Line

Given this performance though, it is easy to see why investors

haven’t abandoned BOND the same way that they have PTTRX lately.

The product has held up remarkably well, and it is still

outperforming a number of other bond products too.

While this might seem strange since BOND is supposed to implement

the same strategies and techniques as its mutual fund counterpart,

it is important to remember that due to some regulatory issues, it

can’t use derivatives as PTTRX does.

So it is possible that some of the swaps and other derivative

instruments that have been utilized in PTTRX have actually dragged

down the return as of late, and could be at least part of the

reason for the relative underperformance (see 3 Important Questions

to Ask About Your ETF Portfolio).

Lastly, just because investors have started to give up on the

mutual fund version of the total return strategy, it doesn’t mean

that the ETF has been experiencing the same issues. The ETF has

actually been holding up quite well, so don’t write off this

version of the total return fund just yet.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

PIMCO-TOT RETRN (BOND): ETF Research Reports

Get Your Free (PTTRX): Fund Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

US Aggregate (AMEX:AGG)

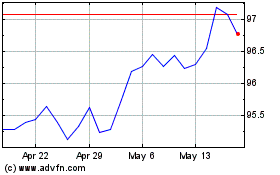

Historical Stock Chart

From Mar 2024 to Apr 2024

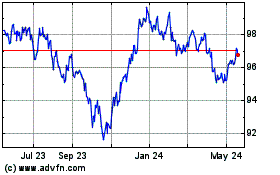

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Apr 2023 to Apr 2024