Italian Bond ETFs: High Risk, High Reward - ETF News And Commentary

February 07 2012 - 6:01AM

Zacks

As by far the largest of the PIIGS economies, Italy occupies a

special place among investors concerned about the euro zone crisis.

That is why when the country’s benchmark 10 year notes saw spiking

yields in late 2011 and early 2012, many panicked, assuming that

spiking yields in Italy were a sign of things to come across the

smaller, but equally troubled members of the common currency bloc.

After all, while small markets such as Greece and Portugal can

likely be contained by bailout funds and more capital from the ECB,

a nearly two trillion dollar economy—Italy—could potentially take

down the entire region, if not the broader world economy as

well.

However, while bond yields briefly broke above the key 7%

barrier, they have begun to slump back down below this key figure

in recent days. In fact, yields are now approaching the 5.5% level,

representing a huge slump in just a few weeks for payouts on these

fixed income securities. With this drop, yields on Italian bonds

are now at their lowest point since mid October of last year,

possibly signaling that the European situation may at least be

temporarily under control and that further gains could be had in

the space (read Three bond ETFs For A Fixed Income Bear Market).

While it may not be possible for most investors to directly

invest in the Italian bond market, there are some relatively new

Italian bond ETNs that can act as a good proxy for exposure.

These products, the PowerShares DB Italian Treasury Bond Futures

ETN (ITLY) and the PowerShares DB 3x Italian Treasury Bond Futures

ETN (ITLT) have both been star performers so far in 2012, far

outpacing many of their broad based peers. Both funds—ITLY is

unleveraged while ITLT tracks a 300% leveraged version of the same

benchmark—track the performance of a long position in Euro-BTP

Futures which are debt securities issued by the Republic of Italy.

The funds have a focus on the middle part of the curve, offering

exposure to securities that have a maturity of at least 8.5 years

but no more than 11 years. This gives the products medium levels of

duration risk ensuring that the funds will move, but will likely

not see huge shifts in short periods of time (read Do You Need A

Floating Rate Bond ETF?).

Both funds have, unsurprisingly, performed quite well over the

past few weeks as slumping bond yields boost prices for these ETNs.

ITLY has jumped by about 12.4% in year-to-date terms while the

leveraged ITLT has added 33.5% over the same time period. While it

is true many products have surged to start the new year, the gains

in the bond space have been much harder to come by, making the

returns of these Italian bond ETNs even more impressive. In fact,

broad U.S. funds like AGG and BND have added less than 0.3% since

the start of the year while EU, a fund that tracks bonds from

across Europe, has gained just 4.5% in comparison, Clearly, Italian

bonds have been the place to be to start the year and could

continue to gain if sentiment remains high over the PIIGS nations

(see The Best Bond ETF You’ve Never Heard Of).

With that being said, investors should note that briefly in

early December of 2011 yields fell to right near their current

level. This represented a quick drop from near 7.25% rates but

yields soon came back to hit the 7% level after just a few weeks.

This situation could once again happen this time around, although

it should be noted that the decline in yields has already been

smoother this time than it was in December, suggesting more staying

power in this iteration. As a result, if investors are looking to

make a play on the Italian bond market, they must definitely weigh

their options. The country’s bonds could certainly continue to see

falling yields which would be more great news for products like

ITLY and ITLT. However, if Greece remains shaky and if investors

continue to fear more turmoil across the bloc, it wouldn’t be

unreasonable to see all of the gains that the ETNs have seen so far

this year evaporate in short order, suggesting that only investors

with high risk tolerance and the desire to trade frequently should

consider making a play on these uncertain products (also see EUFN:

The Best ETF For The Euro Crisis).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

US Aggregate (AMEX:AGG)

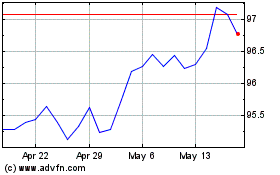

Historical Stock Chart

From Mar 2024 to Apr 2024

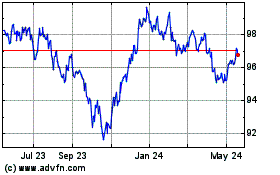

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Apr 2023 to Apr 2024