Corio Profit Up On Acquisition, Sees 2011 Profit Slightly Up

February 17 2011 - 12:47PM

Dow Jones News

Dutch real-estate company Corio NV (CORA.AE) Thursday reported

an increase in fourth-quarter profit as a large acquisition helped

to boost rental income, and said it expects a slight improvement in

its direct result.

The Utrecht-based company, one of Europe's biggest listed

investors in shopping malls, said its fourth-quarter direct

result--rental income minus taxes and operating and administrative

expenses--rose to EUR63.4 million from EUR56.3 million in the same

period a year earlier.

Investors watch this figure closely, as it is used to calculate

dividend payments.

Corio said it intends to pay a dividend of EUR2.69 a share,

EUR0.04 more than in the year prior.

Profit was helped by last year's acquisition of a EUR1.3 billion

real-estate portfolio that included four shopping centers in

Germany, Spain and Portugal.

Corio competes with Franco-Dutch rival Unibail-Rodamco SA

(UL.FR) and Netherlands-based Wereldhave NV (WHA.AE). Its biggest

tenants include food and fashion retailers such as Royal Ahold NV

(AH.AE), Hennes & Mauritz AB (HM-B.SK) and Inditex SA

(ITX.MC).

Corio published its results after the local market closed.

Thursday, it ended trading up 0.1% at EUR49.03 in an Amsterdam

market up 0.4%.

An ING analyst said in a first reaction Corio's results were in

line with expectations.

-By Archibald Preuschat, Dow Jones Newswires; +31 20 5715 218;

archibald.preuschat@dowjones.com

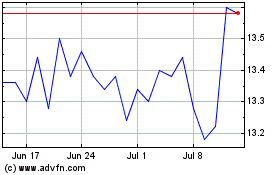

Wereldhave NV (EU:WHA)

Historical Stock Chart

From Mar 2024 to Apr 2024

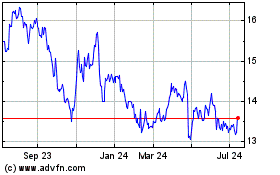

Wereldhave NV (EU:WHA)

Historical Stock Chart

From Apr 2023 to Apr 2024