The Trade Desk, Inc. (NASDAQ: TTD), a provider of a global

technology platform for buyers of advertising, today announced

financial results for its second quarter ended June 30, 2018.

“There is strong momentum to diversify the way advertisers spend

on digital. We continued to see marketers spend disproportionately

more with The Trade Desk as they look beyond the few search and

social sites that historically captured the most advertising

dollars. Our strategy of being the best platform for media buying

and not owning or arbitraging media is more valuable today than it

ever was,” said Jeff Green, founder and CEO of The Trade Desk. “We

broke our previous revenue record and surpassed our own

expectations during the second quarter. Record revenue of

$112.3 million was a 54% increase year over year which equaled the

54% year over year increase we had last year in the second quarter.

Net income was a record $19.3 million. Connected TV, audio, mobile

and video led our channel growth. Our momentum continued with

additional large customer wins and robust international growth.

During the quarter, we also launched the Next Wave, the biggest

product launch in our company’s history. The Next Wave includes

three game-changing components: Koa™, a powerful artificial

intelligence (AI) agent; The Trade Desk Planner, a data-driven

media planning tool; and Megagon™, our intuitive

new user experience.”

Second Quarter 2018 Financial Highlights:

The following table summarizes our consolidated financial

results for the periods ended June 30, 2018 and 2017 ($ in

millions, except per share amounts):

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| GAAP

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

112.3 |

|

|

$ |

72.8 |

|

|

$ |

198.0 |

|

|

$ |

126.2 |

|

| Increase in revenue

year over year |

|

|

54 |

% |

|

|

54 |

% |

|

|

57 |

% |

|

|

63 |

% |

| Net Income |

|

$ |

19.3 |

|

|

$ |

18.8 |

|

|

$ |

28.4 |

|

|

$ |

23.8 |

|

| Diluted EPS |

|

$ |

0.43 |

|

|

$ |

0.43 |

|

|

$ |

0.63 |

|

|

$ |

0.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

36.9 |

|

|

$ |

25.3 |

|

|

$ |

55.8 |

|

|

$ |

31.5 |

|

| Adjusted EBITDA

Margin |

|

|

33 |

% |

|

|

35 |

% |

|

|

28 |

% |

|

|

25 |

% |

| Non-GAAP Net

Income |

|

$ |

27.2 |

|

|

$ |

23.0 |

|

|

$ |

42.6 |

|

|

$ |

30.9 |

|

| Non-GAAP Diluted

EPS |

|

$ |

0.60 |

|

|

$ |

0.52 |

|

|

$ |

0.95 |

|

|

$ |

0.71 |

|

Second Quarter and Recent Business Highlights

Include:

- Continued Omni-channel Growth: Omni-channel

solutions remain a strategic focus for The Trade Desk as the

industry continues shifting toward transparency and programmatic

buying. Specific channel spend highlights include:

- Mobile (in-app, video and web) grew 89% from Q2 2017 to Q2

2018.

- Mobile increased to 45% of gross spend for the quarter, its

highest percentage ever, highlighting the growing importance of

this channel to advertisers.

- Connected TV more than doubled from Q1 2018 to Q2 2018.

- Audio grew 191% from Q2 2017 to Q2 2018.

- Mobile video grew 156% from Q2 2017 to Q2 2018.

- Mobile in-app grew 104% from Q2 2017 to Q2 2018.

- Strong Customer Retention: Customer retention

remained over 95% during the quarter, as it has for the previous 18

quarters.

- New Products and Features: On June 26, 2018,

The Trade Desk launched a range of new products that will help

advertisers use data-driven insights to plan, forecast, and buy

digital media more effectively than ever before. Collectively

referred to as the Next Wave, this release includes three

transformative products:

- Koa™ is powerful AI that improves

advertisers’ decisioning and accelerates campaign performance.

Koa™’s robust and transparent forecasting engine is built on The

Trade Desk’s valuable data set – including nearly nine million

queries every second – to help buyers extend audience reach and

spend more efficiently.

- The Trade Desk Planner is a data-driven

media planning tool that delivers audience insights and informs ad

strategies across channels and devices.

- Megagon™ is an intuitive new user

interface that proactively surfaces tailored insights and offers

Koa™ recommendations to help advertisers make real-time

optimization decisions. Megagon™ helps buyers save

time and advertising budget without sacrificing transparency and

control.The Trade Desk’s enhanced platform allows advertisers

to:

- Easily plan and immediately activate cross-channel campaigns

that identify high-value opportunities before spending a

single dollar in market.

- Have immediate visibility into the impact on scope and spend

for every optimization made or setting selected in the

platform.

- Make smarter, more effective optimizations with customized,

data-driven Koa™ recommendations.

Third Quarter and Revised Full Year 2018

Outlook:

Mr. Green added, “Programmatic is the fastest growing segment of

advertising and the Trade Desk is going faster than anyone in

programmatic. We continue to see momentum as ad dollars shift to

our platform, and as such, we now expect revenue to be at least

$456 million for the full year. We continue to make aggressive, yet

prudent investments in our business in our key growth areas, such

as mobile, video, connected TV and expanding our global

infrastructure, and we now expect our adjusted EBITDA for 2018 to

be $140 million.”

The Trade Desk is providing its financial targets for the third

quarter of 2018 and revised targets for its fiscal year 2018. The

Company’s financial targets are as follows:

Third Quarter 2018:

- Revenue of $116 million

- Adjusted EBITDA of $33 million

Full Year 2018

- Revenue at least $456 million, revised from $433 million

- Adjusted EBITDA of $140 million, revised from $133 million

Reconciliation of adjusted EBITDA guidance to net income, the

closest corresponding U.S. GAAP measure is not available without

unreasonable efforts on a forward-looking basis due to the

variability and complexity with respect to the charges excluded

from these non-GAAP measures; in particular, the measures and

effects of our stock-based compensation expense that are directly

impacted by unpredictable fluctuations in our share price. We

expect the variability of the above charges could have a

significant and potentially unpredictable, impact on our future

U.S. GAAP financial results.

Use of Non-GAAP Financial InformationIncluded

within this press release are the non-GAAP financial measures of

Adjusted EBITDA, Non-GAAP net income and Non-GAAP diluted EPS that

supplement the Condensed Consolidated Statements of Operations of

The Trade Desk, Inc. (the Company) prepared under generally

accepted accounting principles (GAAP). Adjusted EBITDA is earnings

before depreciation and amortization, stock-based compensation,

interest expense (income), net, secondary offering costs and

provision for (benefit from) income taxes. Non-GAAP net income

excludes charges and the related income tax effects for stock-based

compensation and secondary offering costs. Tax rates on the

tax-deductible portions of the stock-based compensation expense

approximating 30% and 40% have been used in the computation of

non-GAAP net income and non-GAAP diluted EPS for the 2018 and 2017

periods, respectively. Reconciliations of GAAP to non-GAAP amounts

for the periods presented herein are provided in schedules

accompanying this release and should be considered together with

the Condensed Consolidated Statements of Operations. These non-GAAP

measures are not meant as a substitute for GAAP, but are included

solely for informational and comparative purposes. The Company's

management believes that this information can assist investors in

evaluating the Company's operational trends, financial performance,

and cash generating capacity. Management believes these non-GAAP

measures allow investors to evaluate the Company’s financial

performance using some of the same measures as management. However,

the non-GAAP financial measures should not be regarded as a

replacement for or superior to corresponding, similarly captioned,

GAAP measures and may be different from non-GAAP financial measures

used by other companies.

Second Quarter Fiscal Year 2018 Results Webcast and

Conference Call Details

- When: August 9, 2018 at 2:00 P.M. Pacific Time

(5:00 P.M. Eastern Time).

- Webcast: A live webcast of the call can be

accessed from the Investor Relations section of The Trade Desk’s

website at http://investors.thetradedesk.com/. Following the

call, a replay will be available on the company’s website.

- Dial-in: To access the call via telephone in

North America, please dial 877-407-0782. For callers outside

the United States, please dial 1-201-689-8567. Participants

should reference the conference call ID “The Trade Desk Call” after

dialing in.

- Audio replay: An audio replay of the

call will be available beginning about two hours after the

call. To listen to the replay in the United States, please

dial 877-481-4010 (replay code: 35276). Outside the United

States, please dial 1-919-882-2331 (replay code: 35276). The audio

replay will be available via telephone until August 16, 2018.

About The Trade DeskThe Trade Desk™ is a

technology company that empowers buyers of advertising. Through its

self-service, cloud-based platform, ad buyers can create, manage,

and optimize more expressive data-driven digital advertising

campaigns across ad formats, including display, video, audio,

native and, social, on a multitude of devices, such as computers,

mobile devices, and connected TV. Integrations with major data,

inventory, and publisher partners ensure maximum reach and

decisioning capabilities, and enterprise APIs enable custom

development on top of the platform. Headquartered in Ventura, CA,

The Trade Desk has offices across North America, Europe, and Asia.

To learn more, visit thetradedesk.com or follow us

on Facebook, Twitter, and LinkedIn.

Forward-Looking StatementsThis document

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

relate to expectations concerning matters that (a) are not

historical facts, (b) predict or forecast future events or

results, or (c) embody assumptions that may prove to have been

inaccurate, including statements relating to the industry and

market trends, and the Company’s financial targets such as revenue

and Adjusted EBITDA. When words such as “believe,” “expect,”

“anticipate,” “will”, “outlook” or similar expressions are used,

the Company is making forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, it cannot give readers

any assurance that such expectations will prove correct. These

forward-looking statements involve risks, uncertainties and

assumptions, including those related to the Company’s limited

operating history, which makes it difficult to evaluate the

Company’s business and prospects, the market for programmatic

advertising developing slower or differently than the Company’s

expectations, the demands and expectations of clients and the

ability to attract and retain clients. The actual results may

differ materially from those anticipated in the forward-looking

statements as a result of numerous factors, many of which are

beyond the control of the Company. These are disclosed in the

Company’s reports filed from time to time with the Securities and

Exchange Commission, including its most recent Form 10-K and any

subsequent filings on Forms 10-Q or 8-K, available at www.sec.gov.

Readers are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company does not intend to update any

forward-looking statement contained in this press release to

reflect events or circumstances arising after the date hereof.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| THE TRADE DESK, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (Amounts in thousands, except per share

amounts) |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| Revenue |

|

$ |

112,333 |

|

|

$ |

72,804 |

|

|

$ |

198,001 |

|

|

$ |

126,156 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Platform

operations |

|

|

26,601 |

|

|

|

15,151 |

|

|

|

49,498 |

|

|

|

27,700 |

|

| Sales and

marketing |

|

|

20,690 |

|

|

|

14,166 |

|

|

|

36,720 |

|

|

|

26,642 |

|

|

Technology and development |

|

|

19,484 |

|

|

|

12,135 |

|

|

|

37,185 |

|

|

|

22,596 |

|

| General

and administrative |

|

|

19,396 |

|

|

|

11,658 |

|

|

|

38,506 |

|

|

|

27,588 |

|

| Total operating

expenses |

|

|

86,171 |

|

|

|

53,110 |

|

|

|

161,909 |

|

|

|

104,526 |

|

| Income from

operations |

|

|

26,162 |

|

|

|

19,694 |

|

|

|

36,092 |

|

|

|

21,630 |

|

| Total other expense,

net |

|

|

1,064 |

|

|

|

1,303 |

|

|

|

1,764 |

|

|

|

2,095 |

|

| Income before income

taxes |

|

|

25,098 |

|

|

|

18,391 |

|

|

|

34,328 |

|

|

|

19,535 |

|

| Provision for (benefit

from) income taxes |

|

|

5,755 |

|

|

|

(458 |

) |

|

|

5,915 |

|

|

|

(4,223 |

) |

| Net income |

|

$ |

19,343 |

|

|

$ |

18,849 |

|

|

$ |

28,413 |

|

|

$ |

23,758 |

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.46 |

|

|

$ |

0.47 |

|

|

$ |

0.68 |

|

|

$ |

0.60 |

|

|

Diluted |

|

$ |

0.43 |

|

|

$ |

0.43 |

|

|

$ |

0.63 |

|

|

$ |

0.54 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

42,174 |

|

|

|

40,046 |

|

|

|

41,903 |

|

|

|

39,609 |

|

|

Diluted |

|

|

45,242 |

|

|

|

43,944 |

|

|

|

44,895 |

|

|

|

43,752 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| STOCK-BASED COMPENSATION EXPENSE |

|

| (Amounts in thousands) |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| Platform

operations |

|

$ |

1,107 |

|

|

$ |

496 |

|

|

$ |

1,903 |

|

|

$ |

725 |

|

| Sales and

marketing |

|

|

2,759 |

|

|

|

1,238 |

|

|

|

4,724 |

|

|

|

1,777 |

|

| Technology and

development |

|

|

2,534 |

|

|

|

1,326 |

|

|

|

4,892 |

|

|

|

1,991 |

|

| General and

administrative |

|

|

2,858 |

|

|

|

1,131 |

|

|

|

5,022 |

|

|

|

2,020 |

|

| Total |

|

$ |

9,258 |

|

|

$ |

4,191 |

|

|

$ |

16,541 |

|

|

$ |

6,513 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| THE TRADE DESK, INC. |

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED BALANCE SHEETS |

|

| (Amounts in thousands) |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

|

As of |

|

|

|

|

June 30,2018 |

|

|

December 31,2017 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

141,681 |

|

|

$ |

155,950 |

|

| Accounts

receivable, net |

|

|

645,555 |

|

|

|

599,565 |

|

| Prepaid

expenses and other current assets |

|

|

13,170 |

|

|

|

10,298 |

|

| Total

current assets |

|

|

800,406 |

|

|

|

765,813 |

|

| Property and equipment,

net |

|

|

23,031 |

|

|

|

17,405 |

|

| Deferred income

taxes |

|

|

3,359 |

|

|

|

3,359 |

|

| Other assets,

non-current |

|

|

12,609 |

|

|

|

10,587 |

|

| Total assets |

|

$ |

839,405 |

|

|

$ |

797,164 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

503,208 |

|

|

$ |

490,377 |

|

| Accrued

expenses and other current liabilities |

|

|

28,376 |

|

|

|

28,155 |

|

| Total

current liabilities |

|

|

531,584 |

|

|

|

518,532 |

|

| Debt, net |

|

|

— |

|

|

|

27,000 |

|

| Other liabilities,

non-current |

|

|

6,847 |

|

|

|

6,049 |

|

| Total liabilities |

|

|

538,431 |

|

|

|

551,581 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

|

|

|

| Preferred stock |

|

|

— |

|

|

|

— |

|

| Common stock |

|

|

— |

|

|

|

— |

|

| Additional paid-in

capital |

|

|

236,581 |

|

|

|

209,603 |

|

| Retained earnings |

|

|

64,393 |

|

|

|

35,980 |

|

| Total stockholders'

equity |

|

|

300,974 |

|

|

|

245,583 |

|

| Total liabilities and

stockholders' equity |

|

$ |

839,405 |

|

|

$ |

797,164 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| THE TRADE DESK, INC. |

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| (Amounts in thousands) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

| OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

28,413 |

|

|

$ |

23,758 |

|

|

Adjustments to reconcile net income to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,830 |

|

|

|

3,189 |

|

|

Stock-based compensation |

|

|

16,541 |

|

|

|

6,513 |

|

| Bad debt

expense |

|

|

1,239 |

|

|

|

3,460 |

|

|

Other |

|

|

2,725 |

|

|

|

(968 |

) |

| Changes

in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

(50,348 |

) |

|

|

(6,853 |

) |

| Prepaid

expenses and other assets |

|

|

(2,702 |

) |

|

|

(11,643 |

) |

| Accounts

payable |

|

|

11,220 |

|

|

|

(28,527 |

) |

| Accrued

expenses and other liabilities |

|

|

491 |

|

|

|

(900 |

) |

| Net cash

provided by (used in) operating activities |

|

|

12,409 |

|

|

|

(11,971 |

) |

| INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Purchases

of property and equipment |

|

|

(6,585 |

) |

|

|

(6,707 |

) |

|

Capitalized software development costs |

|

|

(2,772 |

) |

|

|

(1,811 |

) |

| Net cash

used in investing activities |

|

|

(9,357 |

) |

|

|

(8,518 |

) |

| FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Repayment

on line of credit |

|

|

(27,000 |

) |

|

|

— |

|

| Payment

of debt financing costs |

|

|

— |

|

|

|

(120 |

) |

| Payment

of financing obligations |

|

|

— |

|

|

|

(321 |

) |

| Proceeds

from exercise of stock options |

|

|

3,209 |

|

|

|

1,124 |

|

| Proceeds

from employee stock purchase plan |

|

|

7,014 |

|

|

|

2,294 |

|

| Taxes

paid related to net settlement of restricted stock awards |

|

|

(544 |

) |

|

|

(29 |

) |

| Net cash

provided by (used in) financing activities |

|

|

(17,321 |

) |

|

|

2,948 |

|

| Decrease in cash and

cash equivalents |

|

|

(14,269 |

) |

|

|

(17,541 |

) |

| Cash and cash

equivalents—Beginning of period |

|

|

155,950 |

|

|

|

133,400 |

|

| Cash and cash

equivalents—End of period |

|

$ |

141,681 |

|

|

$ |

115,859 |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Metrics (Amounts in

thousands, except per share amounts)

The following tables show the Company’s GAAP financial metrics

reconciled to non-GAAP financial metrics included in this

release.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

19,343 |

|

|

$ |

18,849 |

|

|

$ |

28,413 |

|

|

$ |

23,758 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

2,579 |

|

|

|

1,696 |

|

|

|

4,830 |

|

|

|

3,189 |

|

|

Stock-based compensation expense |

|

|

9,258 |

|

|

|

4,191 |

|

|

|

16,541 |

|

|

|

6,513 |

|

| Interest

expense (income), net |

|

|

(32 |

) |

|

|

413 |

|

|

|

124 |

|

|

|

777 |

|

| Secondary

offering costs |

|

|

— |

|

|

|

583 |

|

|

|

— |

|

|

|

1,523 |

|

| Provision

for (benefit from) income taxes |

|

|

5,755 |

|

|

|

(458 |

) |

|

|

5,915 |

|

|

|

(4,223 |

) |

| Adjusted EBITDA |

|

$ |

36,903 |

|

|

$ |

25,274 |

|

|

$ |

55,823 |

|

|

$ |

31,537 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| GAAP net income |

|

$ |

19,343 |

|

|

$ |

18,849 |

|

|

$ |

28,413 |

|

|

$ |

23,758 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

9,258 |

|

|

|

4,191 |

|

|

|

16,541 |

|

|

|

6,513 |

|

| Secondary

offering costs |

|

|

— |

|

|

|

583 |

|

|

|

— |

|

|

|

1,523 |

|

|

Adjustment for income taxes |

|

|

(1,364 |

) |

|

|

(602 |

) |

|

|

(2,390 |

) |

|

|

(926 |

) |

| Non-GAAP net

income |

|

$ |

27,237 |

|

|

$ |

23,021 |

|

|

$ |

42,564 |

|

|

$ |

30,868 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted EPS |

|

$ |

0.43 |

|

|

$ |

0.43 |

|

|

$ |

0.63 |

|

|

$ |

0.54 |

|

| Non-GAAP diluted

EPS |

|

$ |

0.60 |

|

|

$ |

0.52 |

|

|

$ |

0.95 |

|

|

$ |

0.71 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding—diluted |

|

|

45,242 |

|

|

|

43,944 |

|

|

|

44,895 |

|

|

|

43,752 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Investors Chris Toth Vice President

Investor Relations, The Trade Desk ir@thetradedesk.com

310-334-9183

Media Austin Rotter Associate Vice President, 5WPR

arotter@5wpr.com 646-862-6866

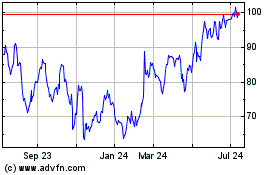

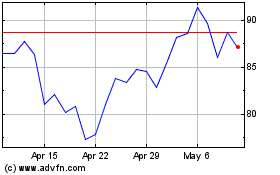

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Apr 2023 to Apr 2024