Pound Weakens On Risk Aversion

September 05 2018 - 2:11AM

RTTF2

The pound slipped against its major counterparts in early

European deals on Wednesday, as increased trade tensions between

the U.S. and its key partners as well as the spreading selloff in

emerging market currencies dented investors' appetite for risk.

The U.S.-Canada talks will resume today, while fresh U.S.

tariffs on $200 billion worth of Chinese goods are expected to take

effect as early as Thursday.

Emerging market woes persisted as South Africa slipped into a

recession for the first time since 2009 and Turkey reported its

highest inflation rate in 15 years.

Survey data from IHS Markit showed that UK services sector

expanded at a faster pace in August on stronger new orders.

The IHS Markit/Chartered Institute of Procurement & Supply

services Purchasing Managers' Index rose to 54.3 from 53.5 in July.

The indicator has reached its second-highest level since February.

The expected score was 53.9.

The currency held steady against its major rivals in the Asian

session, with the exception of the franc.

The pound dropped to a weekly low of 0.9040 against the euro,

from a high of 0.9000 set at 3:15 am ET. If the pound falls

further, it may find support around the 0.92 level.

Final data from IHS Markit showed that the euro area private

sector expanded slightly more than initially estimated in

August.

The composite output index rose to 54.5 in August from July's

54.3. The score was marginally above the flash estimate of

54.4.

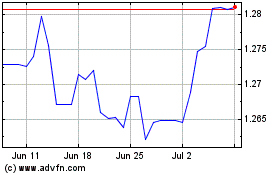

The U.K. currency weakened to near a 2-week low of 1.2804

against the greenback, after rising to 1.2870 at 10:15 pm ET. The

pound is likely to challenge support around the 1.27 level.

Having advanced to a 2-day high of 143.68 against the yen at

9:30 pm ET, the pound reversed direction and eased to 142.75. On

the downside, 140.00 is possibly seen as the next support level for

the pound.

Survey from Nikkei showed that the services sector in Japan

continued to expand in August, and at a faster rate, with a PMI

score of 51.5.

That's up from 51.3 in July, and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

The pound edged down to 1.2478 against the franc, from a high of

1.2529 hit at 9:30 pm ET. The pound is poised to find support

around the 1.22 level.

Looking ahead, U.S. and Canadian trade data for July are due in

the New York session.

At 10:00 am ET, the Bank of Canada announces its decision on

interest rate. Economists expect the benchmark rate to remain

unchanged at 1.50 percent.

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024