GE to Sell Up to 20% Stake in Baker Hughes

November 13 2018 - 8:28AM

Dow Jones News

By Thomas Gryta

General Electric Co. said it plans to sell up to 20% of its

majority holding in oil services company Baker Hughes, providing

around $4 billion in cash for the struggling conglomerate.

GE will sell up to 101 million shares in a secondary offering to

the market and Baker Hughes has agreed to repurchase about 65

million shares from its controlling shareholder.

Based on Monday's closing price of $23.64, the sales would raise

roughly $4 billion for GE.

GE had been prevented from selling its stake in Baker Hughes

until July 2019 as part of the agreement that formed the company,

when GE combined its oil and gas business with Baker Hughes. GE

said it plans to maintain a stake above 50% in Baker Hughes after

the transaction.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

November 13, 2018 08:13 ET (13:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

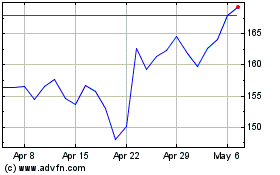

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

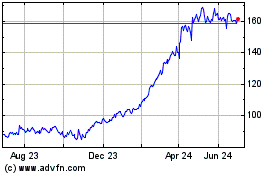

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024