Canadian Dollar Declines As Oil Prices Slide Amid Trade Fears

June 19 2018 - 6:32AM

RTTF2

The Canadian dollar dropped against its major counterparts in

early New York deals on Tuesday amid falling oil prices, as fears

over a global trade war intensified after U.S. President Donald

Trump threatened to impose additional tariffs on Chinese goods

worth $200 billion and Beijing vowed to "immediately"

retaliate.

Crude for August delivery fell $1.05 to $64.64 per barrel.

On Monday, Trump said that the U.S. will impose tariffs on an

additional $200 billion worth of Chinese goods, should China

proceeds with its pledge to hit back against the U.S. tariffs

imposed last week.

"Further action must be taken to encourage China to change its

unfair practices, open its market to United States goods, and

accept a more balanced trade relationship with the United States,"

Trump said.

China's Commerce Ministry accused the White House of

blackmailing by threatening to impose additional tariffs and warned

that it would strike back with comprehensive measures if Washington

push forward with the plan.

Oil has also suffered from speculation that OPEC will ramp up

production after this week's meeting in Vienna. Russian output is

also expected to increase after a prolonged supply quota.

The loonie drifted lower to 82.62 against the yen, its weakest

since April 4. The loonie is poised to challenge support around the

80.00 level.

The loonie slipped to a 1-year low of 1.3292 against the

greenback and held steady thereafter. The loonie is seen finding

support around the 1.35 region.

Data from the Commerce Department showed a much bigger than

expected jump in new residential construction in the U.S. in

May.

The report said housing starts spiked by 5.0 percent to an

annual rate of 1.350 million in May after tumbling by 3.1 percent

to a revised rate of 1.286 million in April.

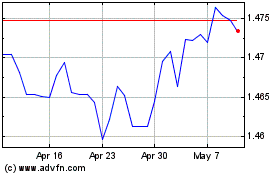

The loonie reversed from an early high of 1.5268 against the

euro, easing back to 1.5362. This may be compared to a 1-1/2-month

low of 1.5383 set at 11:15 pm ET. On the downside, 1.55 is possibly

seen as the next support level for the loonie.

Report from German Ifo Institute showed that Germany's economy

is forecast to expand at slower pace this year and next as global

economic risks increased significantly.

In the Summer Forecast, the think tank projected the economy to

expand 1.8 percent each this year and next. Earlier, the Ifo had

forecast 2.6 percent growth for 2018 and 2.1 percent in 2019.

Reversing from an early near a 3-week high of 0.9739 against the

aussie, the loonie fell back to 0.9785. If the loonie falls

further, 0.99 is possibly seen as its next support level.

Weekly survey compiled by the ANZ bank and Roy Morgan Research

showed that Australia's consumer confidence weakened during the

week ended June 17.

The consumer confidence index dropped to 122.1 from 123.0 in the

preceding week. However, the index remained comfortably above its

long term average.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024