Bristol-Myers Squibb Revenue Fueled By Eliquis -- Earnings Review

February 05 2018 - 8:12AM

Dow Jones News

By Allison Prang

Bristol-Myers Squibb Co. (BMY) reported earnings for its fourth

quarter on Monday before the market opened. Here's what you need to

know:

LOSS: The company reported a loss of $2.33 billion, or $1.42 a

share, compared with the same period a year prior when it reported

a profit of $894 million, or 53 cents a share. The loss was due to

a $3.03 billion provision charge for income taxes as a result of

the new tax law.

ADJUSTED PROFIT: On an adjusted basis, the company made $1.12

billion, or 68 cents a share. Analysts polled by Thomson Reuters

were expecting adjusted earnings of 67 cents a share.

REVENUE: Revenue rose 3.9% to $5.45 billion. Sales of Eliquis, a

drug to help with blood clots, rose 44% to $1.36 billion, bringing

in the most of any of the company's other drugs. Sales of Opdivo, a

medicine for cancer treatment and the company's second-largest drug

by revenue during the quarter, were $1.36 billion, up 3.9% from the

comparable period the year before. Those gains were offset by

falling revenue in some of Bristol-Myers' other brands. Revenue

from the company's Hepatitis C franchise fell 74% to $59 million

and revenue from the company's Reyataz franchise, which treats HIV,

fell 31% to $143 million. Analysts were expecting revenue of $5.35

billion.

GROSS MARGIN: The company said its gross margin as a percentage

of revenue fell to 69.3% from from 73.6%.

COSTS: Research and development costs were $1.92 billion, up

37%. The company said the uptick was because of $377 million from

license and asset acquisition charges. The cost of products sold

was $1.67 billion, up 21%. Marketing, selling and administrative

expenses fell to $1.3 billion, down 11%.

GUIDANCE: The company said it expects adjusted earnings for the

year to be between $3.15 and $3.30 a share. That is in line with

analysts' expectations of $3.23. Bristol-Myers expects revenue for

2018 to rise in the low to mid-single digits. Adjusted research and

development expenses are expected to rise in the high single

digits, it said. Gross margin as a percentage of revenue is

expected to be about 70%.

Shares rose 4% premarket. In the past 12 months, they've rise

25%.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

February 05, 2018 07:57 ET (12:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

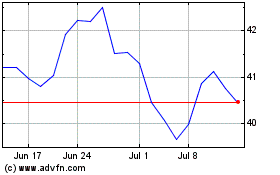

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

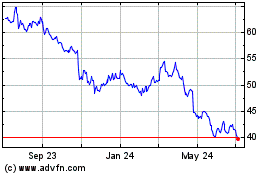

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024