AXA First-Half Net Profit Falls

August 02 2018 - 1:44AM

Dow Jones News

By Pietro Lombardi

AXA SA (CS.FR) said Thursday that first-half net profit fell

after the company was hit by exceptional charges related to the

initial public offering of AXA Equitable Holdings Inc. (EQH), a

change in the fair value of financial assets and derivatives, and

impairment of intangible assets related to its Swiss Group Life

business.

The French insurer said net profit for the period fell 14%

compared with a year earlier to 2.80 billion euros ($3.27

billion).

Revenue was EUR53.60 billion, down from EUR54.28 billion a year

earlier. At constant exchange rate, revenue increased 3% on the

year, the company said.

AXA said that adjusted earnings rose around 4% to EUR3.63

billion.

Annual premium equivalent, known as APE, was up 8%, AXA said.

APE is a measure of new business growth.

"AXA delivered a very strong operating performance in the first

half of 2018, with a 6% increase in underlying earnings per share,

towards the top end of our Ambition 2020 target range," Chief

Executive Thomas Buberl said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

August 02, 2018 01:29 ET (05:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

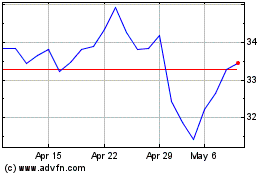

Axa (EU:CS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Axa (EU:CS)

Historical Stock Chart

From Sep 2023 to Sep 2024