Peter Hambro Mining

10/20/2005

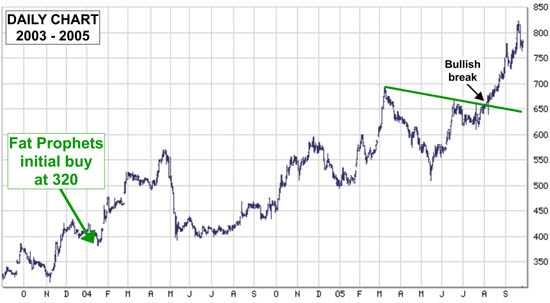

Last month Russian gold producer, Peter Hambro Mining (POG), released a stellar operating result for the six months to 30 June. First half profits increased a healthy 83 percent to US$5.9 million on the back of rising production and buoyant gold markets. With further production gains likely, and an absence of long-term hedging, Peter Hambro continues to offer significant leverage to a robust gold market. Last month Russian gold producer, Peter Hambro Mining (POG), released a stellar operating result for the six months to 30 June. First half profits increased a healthy 83 percent to US$5.9 million on the back of rising production and buoyant gold markets. With further production gains likely, and an absence of long-term hedging, Peter Hambro continues to offer significant leverage to a robust gold market.

Turnover increased 50 percent to US$42.3 million on the back of a 37 percent increase in attributable gold production to 102,178 ounces, and a 7 percent increase in the average realised gold price to US$422 per ounce. Operating profits rose by US$2.7 million to US$8.0 million.

Peter Hambro's primary mine, Pokrovskiy increased production 41 percent to 84,600 ounces. Higher quality ore and increased capacity at the mine's gold extraction plant both contributed to the outstanding performance. An additional upgrade of the plant and current maintenance work will add further processing capacity, and possibly increase reserve estimates as non-commercial ore becomes economical.

The Omchak joint venture (JV) also made solid gains in the first half of the year as attributable production rose 36 percent to 17,015 ounces. We are encouraged that Peter Hambro's share of the venture has increased in light of recent developments. The JV has acquired the exploration and mining license for the Verkhne-Alliinskiy gold property. The prospect is estimated to contain 593,000 ounces of gold resources plus significant silver reserves.

Progress in developing the promising Pioneer deposit was also made during the period. Following an independent audit of reserves and resources, total estimates were increased 14 percent to 2.2 million ounces. As a result, work has begun on the construction of the basic infrastructure needed to support a large scale mining and processing operation at Pioneer.

Implementation of a longer-term strategy to develop several sites in the North East of the Amur region continued apace. Encouraging results have been achieved at Voroshilovskiy while YamalZoloto has, in addition to gold resources, significant iron ore deposits.

We believe the fundamentals at Peter Hambro are as simple as they are compelling. Full year gold production is still on target to rise 30 percent to 271,000 ounces. A well funded exploration and development programme is expected to drive production and reserves even higher. In addition, due to the anti-hedging strategy in place, we believe the miner offers excellent leverage to rising gold prices.

|