XP Power Ltd Trading Statement

April 13 2018 - 2:00AM

UK Regulatory

TIDMXPP

13 April 2018

XP Power Limited

("XP Power" or the "Company")

Trading Update

XP Power, one of the world's leading developers and manufacturers of critical

power control solutions for the electronics industry, is today issuing a

trading update for the first quarter ended 31 March 2018.

Trading

The Company has made a good start to the new financial year as the strong order

intake reported in 2017 continued into 2018. Order intake in the first quarter

of 2018 was GBP51.2 million (2017: GBP47.0 million), 9% ahead of Q1 2017 on a

reported basis or 19% ahead in constant currency. On a "like for like" basis,

removing currency effects and the impact of the Comdel acquisition, orders

increased by 12%.

Group revenue for the three months to 31 March 2018 was GBP46.6 million (2017: GBP

39.6 million), 18% ahead of Q1 2017 on a reported basis, or 28% ahead in

constant currency. On a "like for like" basis revenue increased by 17%. The

Book to Bill ratio, which tracks the relationship between orders received and

completed sales and is an indicator of future revenue growth, was 1.10 for the

first quarter.

Financial Position

Net debt was GBP6.8 million at 31 March 2018 compared with GBP9.0 million at 31

December 2017.

Dividend

The Board has declared a dividend for the first quarter of 16 pence per share,

a 7% increase over the prior year, which will be paid on 11 July 2018 to

shareholders on the register at 15 June 2018 (2017: 15 pence per share).

Outlook

The momentum seen in 2017 has continued into the first quarter of 2018 and we

are encouraged by the continued strong order intake experienced across the

business and the book to bill level gives us confidence for the future. The

Board's expectations for the Company's full year performance remain unchanged.

Enquiries:

XP Power

Duncan Penny, Chief Executive Officer +44 (0)118 976 5086

Gavin Griggs, Chief Financial Officer +44 (0)118 976 5154

Citigate Dewe Rogerson +44 (0)20 7638 9571

Kevin Smith/Jos Bieneman

Note to editors

XP designs and manufactures power controllers, the essential sub assembly in

every piece of electrical equipment that converts the power from the

electricity grid into the right form for the equipment to function. XP

typically designs in power control solutions into the end products of major

blue chip OEMs, with a focus on the industrial (circa 39% of sales), healthcare

(circa 31% sales) and technology (circa 30% of sales) sectors. Once designed

into a program, XP has a revenue annuity over the life cycle of the customer's

product which is typically 5 to 7 years depending on the industry sector. XP

has invested in research and development and its own manufacturing facilities

in China, North America and Vietnam, to develop a range of up to date products

based on its own intellectual property that provide its customers with

significantly improved functionality and efficiency. Headquartered in Singapore

and listed on the Main Market of the London Stock Exchange since 2000, XP

serves a global blue chip customer base from 27 locations in Asia, Europe and

North America.

END

(END) Dow Jones Newswires

April 13, 2018 02:00 ET (06:00 GMT)

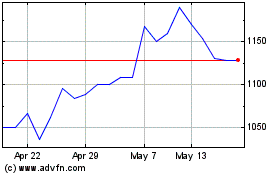

Xp Power (LSE:XPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

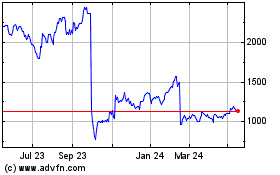

Xp Power (LSE:XPP)

Historical Stock Chart

From Apr 2023 to Apr 2024