TIDMWWH

LONDON STOCK EXCHANGE ANNOUNCEMENT

Worldwide Healthcare Trust PLC (the "Company")

Audited Results for the Year Ended 31 March 2022

The Company's annual report will be posted to shareholders on 6 June 2022.

Members of the public may obtain copies from Frostrow Capital LLP, 25

Southampton Buildings, London WC2A 1AL or from the Company's website at

www.worldwidewh.com where up to date information on the Company, including

daily NAV, share prices and fact sheets, can also be found.

The Company's annual report for the year ended 31 March 2022 has been submitted

to the UK Listing Authority, and will shortly be available for inspection on

the National Storage Mechanism (NSM):

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

(Documents will usually be available for inspection within two business days of

this notice being given)

Mark Pope, Frostrow Capital LLP, Company Secretary - 0203 008 4913

COMPANY PERFORMANCE

HISTORIC PERFORMANCE FOR THE YEARSED 31 MARCH

2017 2018 2019 2020 2021 2022

Net asset value per share (total 28.9% 2.8% 13.7% 6.5% 30.0% (5.8%)

return)*?

Benchmark (total return)*? 24.5% (2.5%) 21.1% 5.7% 16.0% 20.4%

Net asset value per share 2,367.2p 2,411.1p 2,722.9p 2,868.9p 3,703.0p 3,465.2p

Share price 2,304.0p 2,405.0p 2,730.0p 2,920.0p 3,695.0p 3,275.0p

(Discount)/Premium of share price (2.7%) (0.3%) 0.3% 1.8% (0.2%) (5.5%)

to net asset value per share?

Dividends per share 22.5p 17.5p 26.5p 25.0p 22.0p 26.5p]

Leverage? 16.9% 16.4% 4.9% 12.0% 7.6% 10.9%

Ongoing charges? 0.9% 0.9% 0.9% 0.9% 0.9% 0.9%

Ongoing charges (including 1.0% 1.2% 1.1% 0.9% 0.9% 1.4%

performance fees paid or

crystallised during the year)?

* Source: Morningstar

? Alternative Performance Measure (see Glossary).

CHAIRMAN'S STATEMENT

SIR MARTIN SMITH

INVESTMENT PERFORMANCE

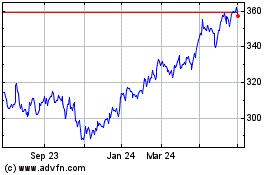

Following last year's strong returns, both on an absolute and on a relative

basis, the year under review has proved to be a challenging one for the

Company. The Company's net asset value per share total return was -5.8% (2021:

+30.0%) and the share price total return was -10.8% (2021: +27.4%), both

significantly underperforming the Company's Benchmark, the MSCI World Health

Care Index measured on a net total return, sterling adjusted basis, which rose

by 20.4% during the year (2021: rose by 16.0%). The disparity between the

performance of the Company's net asset value per share and its share price is

reflected in the widening of the Company's share price discount to its net

asset value per share from 0.2% at the start of the Company's financial year to

5.5% at 31 March 2022.

The majority of the Company's assets are denominated in U.S. dollars, and it

should be noted that the Company's net asset value performance was helped by

the weakness of sterling over the year, particularly against the dollar, where

it depreciated by 4.6%.

The negative absolute return over the year to 31 March 2022 reflected a mildly

positive first half, where the net asset value per share total return was +0.4%

(2021:+23.1%) compared to a rise in the Benchmark of 13.0% (2021: a rise of

15.3%) and a weaker second half where the net asset value total return was

-6.2% (2021-5.6%) compared to a rise in the Benchmark of 7.4% (2021: 0.7%).

During the year the Company's Portfolio Manager continued to pursue a strategy

of being underweight in large pharmaceutical companies and overweight in both

emerging markets and emerging biotechnology companies; an approach which had

served the Company well during the previous year but was the principal reason

for the Company's relative underperformance during the year under review.

While the healthcare sector as a whole performed well during the year, macro

considerations rather than company fundamentals were deemed to be most

important by investors. In addition, the "growth-to-value" rotation which has

tended to favour well-established companies despite their less-exciting growth

prospects also showed that investors have been less willing to take on

investment risk more generally. This risk aversion has hurt those sectors where

we have been strategically overweight, including emerging biotechnology, China

healthcare, and innovative tools.

Risk aversion has also resulted in further pressure on performance as the value

of the smaller capitalisation stocks we own has lagged while large

capitalisation pharmaceutical stocks have outperformed the rest of the

healthcare sector, particularly during the last quarter of the financial year.

It should be emphasised, however, that this extraordinary fall in the valuation

of the biotechnology and other sectors reflects a change in investor sentiment

rather than any significant deterioration in the performance of the underlying

companies. It is for this reason that we remain confident that these stocks

will recover in due course.

Our Portfolio Manager continues to adopt both a pragmatic and tactical approach

with regard to the use of leverage. Leverage levels varied over the course of

the year, with the net effect of a detraction of 1.0% from performance.

The long-term performance of the Company, however, continues to be strong, and

it should be noted that from the Company's inception in 1995 to 31 March 2022,

the total return of the Company's net asset value per share has been +3,866.7%,

equivalent to a compound annual return of +14.7%. This compares to a cumulative

blended Benchmark return of +2,133.6%, equivalent to a compound annual return

of +12.2% over the same period.

Further information on the healthcare sector, the Company's investments and

performance during the year can be found in the Portfolio Manager's Review.

CAPITAL

The Company's share price traded close to the net asset value per share for

much of the year under review. In accordance with the Company's share price

premium management policy 1,227,500 new shares were issued during the year at

an average premium of 0.8% to the Company's cum income net asset value per

share. This issuance gave rise to the receipt of £45.5m of new funds to the

Company, which have been invested in line with the investment policy. The

Company's ongoing share issuance programme triggered the requirement for the

Company to publish a prospectus in July 2021 which provided authority for the

issuance of 20 million new shares.

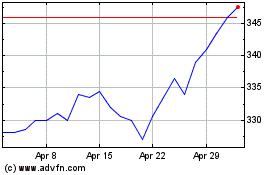

However, toward the end of the calendar year, the Company's share price fell to

a discount to the net asset value per share and 80,509 shares were repurchased

during the Company's financial year for treasury, in accordance with the

Company's share price discount management policy, at a discount of 8.4% to the

Company's cum income net asset value per share, at cost of £2.5m.

At the year-end there were 65,457,246 shares in issue (excluding the 80,509

shares held in treasury (2021: 64,310,255 with no shares held in treasury)).

Since the year-end, to 25 May 2022, the latest practicable date prior to the

publication of this report, a further 223,842 shares were repurchased for

treasury at a discount of 7.0% to the Company's cum income net asset value per

share, at cost of £7.3m. At the time of writing the share price discount stands

at 4.6%.

REVENUE AND DIVID

Shareholders will be aware that it remains the Company's policy to pursue

capital growth for shareholders and to pay dividends at least to the extent

required to maintain investment trust status. Therefore, the level of dividends

declared can go down as well as up. An increased interim dividend of 7.0p per

share for the year ended 31 March 2022, was paid on 11 January 2022 to

shareholders on the register on 19 November 2021 (2021: 6.5p per share). Due in

large part to an increase in exposure to higher yielding stocks in the

portfolio and also to the weakness of sterling, the Company's revenue return

per share for the year as a whole increased to 26.8 pence (2021: 24.1 pence).

Accordingly, the Board is proposing an increased final dividend of 19.5 p per

share (2021:15.5p per share) which, together with the interim dividend already

paid, makes a total dividend for the year of 26.5p (2021: 22.0p per share).

Based on the closing mid-market share price of 3040.0p on 25 May 2022, the

total dividend payment for the year represents a current yield of 0.9%.

The final dividend will be payable, subject to shareholder approval, on 15 July

2022 to shareholders on the register of members on 10 June 2022. The associated

ex-dividend date will be 9 June 2022.

The Company's dividend policy will be proposed for approval at the forthcoming

Annual General Meeting.

THE BOARD

The process of Board refreshment continues and, as indicated in my last

year-end statement, following David Holbrook's retirement last year, I shall be

stepping down from the Board on 6 July 2022, the date of this year's Annual

General Meeting. It has been agreed that in the interests of maintaining an

orderly succession process, Doug McCutcheon will extend his term and assume the

Chairmanship following my retirement. I wish him every success for the future.

Bina Rawal will take over as Chair of the Management Engagement & Remuneration

Committee at the same time.

I have served on the Board for 14 years, 13 of which as Chairman, and have been

fortunate to be supported by a group of very loyal, professional and hard

working colleagues during that time. I would also like to pay tribute to the

unswerving dedication of both our Portfolio Manager, OrbiMed and our AIFM,

Company Secretary and Administrator, Frostrow Capital. Although recent results

have been disappointing, I believe that it will be only a matter of time before

the skills and experience of our Portfolio Manager will enable the Company to

resume its excellent long-term record.

The process of recruiting a new Director is ongoing. Shareholders will be kept

informed of developments as they occur. As new members are recruited, the Board

will remain mindful of its commitment to a policy of diversity.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) MATTERS

ESG matters are an important priority for the Board and Bina Rawal and I have

been working closely with our Portfolio Manager to identify an appropriate set

of policies to address them.

Our Portfolio Manager continues to develop tools for assessing the

sustainability of the Company's portfolio including measuring the net impacts

that individual portfolio companies have on both the environment and society,

as much as is possible with the availability and consistency of the reporting

of non--financial data pertaining to both ESG matters and also to climate

change. OrbiMed is committed to taking a leading role in the development of

meaningful ESG engagement practices in the healthcare sector. As part of this

they facilitate dialogue and an exchange of leading practices among investors,

companies and other relevant experts on ESG in the large capitalisation

pharmaceutical sector. They also engage with a broad range of companies on a

regular basis where areas of improvement can be identified. Further information

on both ESG matters and climate change can be found in the Portfolio Manager's

ESG report.

PERFORMANCE FEE

I mentioned last year that as a result of the continued cumulative

outperformance in the year, there was a provision in our year-end accounts of £

31.7 million for future performance fee payments. However, only if

outperformance was maintained to the relevant quarterly calculation dates would

this provision become payable. During the year under review, a performance fee

of £12.9 million crystallised and became payable on 30 June 2021. However, due

to underperformance against the Benchmark during the year, the remainder of the

performance fee accrual as at 31 March 2021 was reversed. No performance fees

were accrued or payable at the Company's year-end as at 31 March 2022.

OUTLOOK

Global markets are currently experiencing unusually high levels of uncertainty.

In addition to the appalling human cost, Russia's invasion of Ukraine has

created near-term risks for markets as high energy prices, rising food prices

and disrupted supply chains threaten a substantial increase in global

inflation. It has also cast a shadow over the longer-term outlook with the

prospect of continued raised levels of geopolitical risk and an increase in

investor risk aversion, both of which may affect markets and economic

confidence for some time.

This comes in addition to existing market and economic concerns that troubled

investors before the invasion, including the onset of U.S. Federal Reserve

tightening, the impact of COVID-19 lockdowns on supply chains and inflation and

also the outlook for China where there are problems in the real estate sector,

as well as around its zero-tolerance COVID-19 policy and heavy-handed

regulation of technology firms.

Against this challenging background, however, our Portfolio Manager OrbiMed

remains positive on the outlook for healthcare with certain of the perceived

risks associated with the sector such as an inefficient drug approval process

in the U.S. and also the spectre of drug price reform having receded.

Fundamentals, however, remain strong, particularly given the amount of

innovation that is fuelling the industry's growth. They further believe that

the sector's defensive growth characteristics should continue to prove

attractive in times of global uncertainty.

Your Board continues to believe that long-term investors in this sector will be

rewarded.

ANNUAL GENERAL MEETING

After COVID restrictions prevented holding meetings in person, the Board is

pleased to welcome all shareholders back to the Company's Annual General

Meeting which offers an opportunity to meet the Directors and also to hear the

views of our Portfolio Manager. The meeting will be held at etc. venues 1-3

Bonhill Street, London EC2A 4BX on Wednesday, 6 July 2022 at 12.30pm. Of

course, should circumstances change and restrictions be reintroduced, we will

keep shareholders informed of the final arrangements for the meeting via the

Company's website at www.worldwidewh.com.

For those investors who are not able to attend the meeting in person, a video

recording of the Portfolio Manager's presentation will be uploaded to the

website after the meeting. Shareholders can submit questions in advance by

sending them to wwh@frostrow.com.

I encourage all shareholders to exercise their right to vote at the Annual

General Meeting and to register your votes online in advance of the meeting.

Registering your vote in advance will not restrict you from attending and

voting at the meeting in person should you wish to do so, subject of course to

any government guidance to the contrary. The votes on the resolutions to be

proposed at the Annual General Meeting will be conducted on a poll. The results

of the proxy votes will be published immediately following the conclusion of

the AGM by way of a stock exchange announcement and will also be able to be

viewed on the Company's website at www.worldwidewh.com.

Sir Martin Smith

Chairman

26 May 2022

INVESTMENT OBJECTIVE AND POLICY

INVESTMENT OBJECTIVE

The Company invests in the global healthcare sector with the objective of

achieving a high level of capital growth.

In order to achieve its investment objective, the Company invests worldwide in

a diversified portfolio of shares in pharmaceutical and biotechnology companies

and related securities in the healthcare sector. It uses gearing, and

derivative transactions to enhance returns and mitigate risk. Performance is

measured against the MSCI World Health Care Index on a net total return,

sterling adjusted basis ("Benchmark").

INVESTMENT STRATEGY

The implementation of the Company's Investment Objective has been delegated to

OrbiMed by Frostrow (as AIFM) under the Board's and Frostrow's supervision and

guidance.

Details of OrbiMed's investment strategy and approach are set out in the

Portfolio Manager's Review.

While the Board's strategy is to allow flexibility in managing the investments,

in order to manage investment risk it has imposed various investment, gearing

and derivative guidelines and limits, within which Frostrow and OrbiMed are

required to manage the investments, as set out below.

Any material changes to the Investment Objective, Policy and Benchmark or the

investment, gearing and derivative guidelines and limits require approval from

shareholders.

INVESTMENT POLICY

INVESTMENT LIMITS AND GUIDELINES

* The Company will not invest more than 15% of the portfolio in any one

individual stock at the time of acquisition;

* At least 50% of the portfolio will normally be invested in larger companies

(i.e. with a market capitalisation of at least U.S.$10bn);

* At least 20% of the portfolio will normally be invested in smaller

companies (i.e. with a market capitalisation of less than U.S.$10bn);

* Investment in unquoted securities will not exceed 10% of the portfolio at

the time of acquisition;

* A maximum of 5% of the portfolio, at the time of acquisition, may be

invested in each of debt instruments, convertibles and royalty bonds issued

by pharmaceutical and biotechnology companies;

* A maximum of 30% of the portfolio, at the time of acquisition, may be

invested in companies in each of the following sectors:

* healthcare equipment and supplies

* healthcare providers and services;

* The Company will not invest more than 10% of its gross assets in other

closed ended investment companies (including investment trusts) listed on

the London Stock Exchange, except where the investment companies themselves

have stated investment policies to invest no more than 15% of their gross

assets in other closed ended investment companies (including investment

trusts) listed on the London Stock Exchange, where such investments shall

be limited to 15% of the Company's gross assets at the time of acquisition.

DERIVATIVE STRATEGY AND LIMITS

In line with the Investment Objective, derivatives are employed, when

appropriate, in an effort to enhance returns and to improve the risk-return

profile of the Company's portfolio. Only Equity Swaps were employed within the

portfolio during the year.

The Board has set the following limits within which derivative exposures are

managed:

* Derivative transactions (excluding equity swaps) can be used to mitigate

risk and/or enhance capital returns and will be restricted to a net

exposure of 5% of the portfolio; and

* Equity Swaps may be used in order to meet the Company's investment

objective of achieving a high level of capital growth, and counterparty

exposure through these is restricted to 12% of the gross assets of the

Company at the time of acquisition.

The Company does not currently hedge against foreign currency exposure.

GEARING LIMIT

The Board has set a maximum gearing level, through borrowing, of 20% of the net

assets.

LEVERAGE LIMITS

Under the AIFMD the Company is required to set maximum leverage limits.

Leverage under the AIFMD is defined as any method by which the total exposure

of an AIF is increased.

The Company has two current sources of leverage: the overdraft facility, which

is subject to the gearing limit; and, derivatives, which are subject to the

separate derivative limits. The Board and Frostrow have set a maximum leverage

limit of 140% on both the commitment and gross basis.

Further details on the gearing and leverage calculations, and how total

exposure through derivatives is calculated, are included in the Glossary.

Further details on how derivatives are employed can be found in note 16.

PORTFOLIO

INVESTMENTS HELD AS AT 31 MARCH 2022

Market % of

value

Investments Country £'000 investments

AstraZeneca UK 135,292 5.7

Pfizer USA 117,923 4.9

Roche Holding Switzerland 113,899 4.8

Bristol-Myers Squibb USA 112,460 4.7

Horizon Therapeutics USA 105,462 4.4

AbbVie USA 101,256 4.3

Boston Scientific USA 100,010 4.2

Intuitive Surgical USA 91,924 3.9

Humana USA 88,067 3.7

UnitedHealth Group USA 86,845 3.7

Top 10 investments 1,053,138 44.3

Stryker USA 77,630 3.3

Edwards Lifesciences USA 71,813 3.0

BioMarin Pharmaceutical USA 61,893 2.6

Mirati Therapeutics USA 58,981 2.5

Vertex Pharmaceuticals USA 58,174 2.5

Shanghai Bio-Heart Biological Technology China 46,558 2.0

DexCom USA 42,742 1.8

Neurocrine Biosciences USA 39,067 1.6

Thermo Fisher Scientific USA 38,886 1.6

Guardant Health USA 37,457 1.6

Top 20 investments 1,586,339 66.8

Caris Life Science (unquoted) USA 36,986 1.6

Daiichi Sankyo Japan 36,600 1.5

Seagen USA 34,969 1.5

Tenet Healthcare USA 34,847 1.5

Natera USA 31,523 1.3

SI-BONE USA 31,479 1.3

Global Blood Therapeutics USA 29,984 1.3

Argenx Netherlands 27,097 1.1

Evolent Health USA 25,873 1.1

Shionogi Japan 25,202 1.1

Top 30 investments 1,900,899 80.1

API Holdings (unquoted) India 22,251 0.9

Joinn Laboratories China China 21,669 0.9

NanoString Technologies USA 21,594 0.9

Chugai Pharmaceutical Japan 21,422 0.9

Arrail Group China 18,581 0.8

Crossover Health (unquoted) USA 17,499 0.7

EDDA (unquoted) USA 16,128 0.7

Visen Pharmaceutical (unquoted) China 15,731 0.7

MeiraGTx USA 15,603 0.7

Iovance Biotherapeutics USA 14,869 0.6

Top 40 investments 2,086,246 87.9

Shanghai Fosun Pharmaceutical China 14,838 0.6

Beijing Yuanxin Technology (unquoted) China 14,705 0.6

Arcutis Biotherapeutics USA 13,224 0.5

Ruipeng Pet Group (unquoted) China 13,101 0.5

Dingdang Health Technology (unquoted) China 12,491 0.5

RiMAG (unquoted) China 12,208 0.5

Theravance Biopharma USA 11,394 0.5

Shanghai Kindly Medical Instruments China 11,301 0.5

uniQure Netherlands 11,289 0.5

CSPC Pharmaceutical China 11,001 0.5

Top 50 investments 2,211,798 93.1

Erasca USA 10,868 0.5

Alphamab Oncology China 10,794 0.5

RxSight USA 9,950 0.4

Danaher USA 9,600 0.4

Celldex Therapeutics USA 9,206 0.4

Apollo Hospitals Enterprise India 8,552 0.4

Shanghai Junshi Biosciences Hong Kong 8,133 0.4

New Horizon Health China 7,815 0.3

Ikena Oncology USA 7,522 0.3

Turning Point Therapeutics USA 7,373 0.3

Top 60 investments 2,301,611 97.0

Galapagos Belgium 7,217 0.3

Clover Biopharmaceuticals China 6,420 0.3

Shenzhen Hepalink Pharmaceutical China 6,400 0.3

Simcere Pharmaceutical China 6,092 0.3

MabPlex International (unquoted) China 5,874 0.2

China Medical System China 5,662 0.2

Harpoon Therapeutics USA 5,524 0.2

United Laboratories International Holdings Hong Kong 5,336 0.2

Burning Rock Biotech China 5,290 0.2

Yidu Tech China 5,081 0.2

Top 70 investments 2,360,507 99.4

NanoString Technologies 2.63% 01/03/2025 (unquoted) USA 5,024 0.2

Vor BioPharma USA 3,779 0.2

Abbisko China 3,735 0.2

Achilles Therapeutics USA 3,108 0.1

Passage Bio USA 2,376 0.1

MicroTech Medical Hangzhou China 844 0.0

Peloton Interactive (DCC*-unquoted) USA 475 0.0

Total equities and fixed interest investments 2,379,848 100.2

OTC Equity Swaps - Financed^

Healthcare M&A Target Swap USA 99,898 4.2

Apollo Hospitals India 35,120 1.5

Less: Gross exposure on financed swaps (140,147) (5.9)

Total OTC Swaps (5,129) (0.2)

Total investments including OTC Swaps 2,374,719 100.0

* DCC = deferred contingent consideration.

^ See Glossary and note 16 for further details in relation to the OTC

Swaps.

SUMMARY

Market % of

value

Investments £'000 investments

Quoted equities 2,207,375 93.0

Unquoted equities 167,449 7.0

Unquoted debt securities 5,024 0.2

Equity swaps (5,129) (0.2)

Total of all investments 2,374,719 100.0

PORTFOLIO MANAGER'S REVIEW

MARKETS

2021 was another unprecedented year for the global equity markets. After the

COVID-induced volatility that characterised 2020, markets climbed higher in

2021 despite various headwinds including inflationary fears and supply chain

disruptions. The market reached new highs by the calendar year-end, only to

sell-off in the face of rising interest rates and Russia's invasion of Ukraine

in early 2022. Of course, COVID-19 continued to cast a shadow over the year

under review, with Delta and Omicron variants inducing new waves of infections

across the globe.

Nevertheless, global equity markets produced solid double-digits returns in the

financial year. The MSCI World Index total return was +16.2% (in sterling

terms). The total return for the S&P 500 was +15.6% (in U.S. dollar terms),

notching 70 all-time highs throughout 2021 (source: Forbes). Meanwhile, the

FTSE All-Share Index total return was +13.0% (in sterling terms).

For the most part, healthcare stocks traded in-line with broader indices

throughout the financial year. However, with geopolitical tensions increasing

as the financial year drew to a close alongside a rising interest rate

environment, healthcare benefitted as investors became decisively more

defensive in the last five weeks of the period. As such, the MSCI World

Healthcare Index net total return over the year was +20.4% (in sterling terms),

with over half of that move accruing in the last 27 trading days of the

financial year.

PERFORMANCE

After one of the best performance years in the Company's history in the year

ended 31 March 2021, generating excess returns over the benchmark in the

current financial year proved to be very difficult. Whilst healthcare stocks

mostly traded higher, trading dynamics for the Company were broadly fuelled by

macro factors, with industry and company fundamentals firmly taking a backseat

and going largely unrecognised by investors. As a result, sub-sector moves

within healthcare were very disparate given the "growth-to-value" rotation and

the risk-off environment that characterised the reported year.

This trading environment heavily favoured large capitalisation companies over

small capitalisation stocks, thus, overall positioning within healthcare

equities was far more critical than stock selection. This was particularly true

for the Company's portfolio, with our key long-term strategic overweight

positions in emerging biotechnology, China healthcare, and innovative tools -

typically all small capitalisation stocks - materially underperforming. This

included in historic drawdowns and record setting underperformance in emerging

biotechnology stocks which severely impacted returns, despite an otherwise

healthy fundamental sector. This was exacerbated by our long-term underweight

positioning in pharmaceuticals - typically all large capitalisation stocks - a

sector that outperformed the rest of healthcare, particularly during the last

quarter of the financial year.

Overall, our performance was heavily impacted by this relative positioning as

the preponderance of fundamentals across healthcare failed to influence trading

dynamics; a true mismatch to our investment philosophy. Rather, this

extraordinary market perturbation created not only extreme volatility but also

an historic compression of valuations within certain components of healthcare,

a situation that would expectedly be damaging to our relative portfolio

positioning. As a result, relative and absolute performance suffered with a net

asset value total return of -5.8%, and a share price total return of -10.8%,

compared to the benchmark index total return of +20.4%.

Despite the volatility in the reported period, we are pleased to note that

since the Company's inception in 1995, the total return of the Company's net

asset value per share is +3,866.7%, equivalent to a compound annual return of

+14.7%. This compares to the blended benchmark rise of +2,133.6%, equivalent to

a compound annual return of +12.2%.

This 27-year track record demonstrates several important points. First, it puts

into context the recent drawdown. Previous periods of underperformance by the

Company have all been quickly followed by a significant bounce back and

material outperformance. Second, the chart above shows outperformance for

healthcare (the benchmark) versus the broader markets (in this case, the FTSE

All-Share Index), particularly over the past seven years which coincides with

the real explosion of innovation within the industry. Finally, it shows what an

active manager or specialist investor can do in healthcare, especially in the

face of a highly idiosyncratic, global sector that possesses many barriers to

understanding the scientific, clinical, regulatory, technological, and

political environment that envelops all of healthcare.

Finally, we would note that the fundamentals of healthcare remain strong,

especially in biotechnology, which we regard as the cradle of innovation for

clinical discovery.

The macro trading dynamics that impacted these stocks in the reported period do

not represent, in any way, a deterioration of the elements that underpin the

sector. Rather, it is simply a product of extreme market conditions that we

have never experienced previously, culminating in a profound collapse in

valuations, a situation that should reverse in due time. With fundamentals

intact, we remain positioned for a material rebound in biotechnology stocks.

CONTRIBUTION BY SUB-SECTOR

Looking at performance by sub-sector provides an understanding of overall

performance during the year. First, four areas which contributed a significant

absolute positive contribution were Pharmaceuticals (benefitting from a macro

defensive rotation), Medical Devices/ Technology (a result of stock picking),

Healthcare Services (reflecting our sector positioning), and India.

Healthcare (again, as a result of stock picking). Second, four sub-sectors that

contributed a notable relative positive contribution over the benchmark were

Specialty Pharmaceuticals, Medical Devices/Technology, India Healthcare (all

reflecting the results of stock-picking) and Japan Pharmaceuticals (reflecting

our sector positioning).

However, detractors from performance overwhelmed the positive contributions.

The following three sub-sectors were notable in terms of both relative and

absolute negative contribution - emerging biotechnology (reflecting macro

sector rotation), China healthcare (a result of fundamental investor concerns),

and small/mid-capitalisation life science tools/diagnostics (reflecting our

overweight sector positioning). Each of these sub-sectors experienced

significant drawdowns during the year creating a headwind to the Company's

performance that became insurmountable during the reported 12-month period.

The largest detractor by sub-sector was emerging biotechnology stocks, which

generated over 11% of negative contribution (both in absolute and relative

terms). A "perfect storm" of macro factors led to this disappointing

performance. The financial year began with a rotation by investors from growth

to value stocks, as generalist investors repositioned portfolios to gain

exposure to economically sensitive sectors that would benefit most from a

post-COVID reopening of the economy. Biotechnology underperformed during this

period, as did many other growth sectors to which investors had allocated

capital during the COVID pandemic. Many of the shorter-term investors who did

not regularly invest in the biotechnology sector, but who were temporarily

attracted to the industry's defensive nature and COVID-related research,

appeared to exit the sector.

In the second half of the financial year, increasing concerns about the U.S.

Federal Reserve's plans to raise interest rates to combat inflation led to

continued weakness in technology stocks, especially those earlier-stage

enterprises which are not expected to realise earnings for many years. This

trend was especially damaging to small capitalisation biotechnology performance

and those stocks sold off even further. Overall, these macroeconomic and

related factors created the longest and largest drawdown in biotechnology

history, with the gap between the S&P Biotechnology ETF (XBI) compared to the S

&P 500 Index reaching over 65% during the financial year.

Adding pressure to the Company's performance was a significant drawdown in the

Chinese markets, including Hong Kong, in the second half of the financial year.

The sell-off was precipitated by regulatory tightening by the Chinese

government across a variety of sectors, including the internet (and related

technology industries) and the for-profit education industry. Even though there

were no new significant regulations targeting Chinese healthcare companies,

investor fears were materially heightened that healthcare may be the

government's next target. This broad market downturn in China that began in

June 2021 adversely and indiscriminately impacted many of our China healthcare

positions. Unfortunately, these macro pressures persisted through to the end of

the financial year, generating nearly 4% of negative absolute and relative

contribution in the reported period. Importantly, we continue to believe

fundamental innovation in the China healthcare sector remains strong.

The life science tools sector was also challenging for the Company in the year

under review. Mirroring the broader market, large capitalisation diversified

companies significantly outperformed those with a small and mid-capitalisation

innovative growth profile, and our positioning in this regard was suboptimal,

resulting in over 5% of negative contribution relative to the benchmark.

Additionally, there were fundamental factors that drove this large

capitalisation outperformance - chief among which was the continued durability

of COVID-related revenues as well as a normalisation of non-COVID "base

business" performance which led to positive earnings revisions throughout the

2021 calendar year. Our view that the durability of COVID related earnings

would come into question amid record high valuations was clearly too early.

Whilst we did have modest exposure to Thermo Fisher Scientific and Danaher

Corporation, two companies which benefited from these dynamics and offer

best-in-class execution, we had lower exposure than our benchmark which damaged

our relative performance.

Separately, our preferred small and mid-capitalisation companies in the

innovative tools space weighed on our performance. Whilst we have a positive

structural outlook on liquid biopsy and the continued proliferation of

clinically successful oncology diagnostics, the sector fell out of favour

against the backdrop of demanding valuations and fundamental results that were

strong but were insufficient to drive shares higher against lofty near-term

expectations.

Finally, a word on the performance of large capitalisation pharmaceutical

stocks in the financial year. As articulated already in this report,

pharmaceutical stocks traded mostly in-line with the benchmark throughout the

period.

However, as we approached the turn of the calendar year, this performance began

to diverge materially as inflation, interest rates, and geopolitical risks all

rose and investors turned defensive. As a result, large capitalisation

pharmaceutical stocks moved much higher heading into the financial year end,

many of which ended on 52-week highs on 31 March 2022. This created the single

largest source of absolute contribution for the Company at over 7%. However, as

is our historical norm, we were materially underweight in the pharmaceutical

sector in the period, thus creating over 5.0% of negative relative contribution

to the benchmark due to our positioning.

KEY CONTRIBUTORS TO PERFORMANCE

There were a number of factors that underlay the key positive contributors to

absolute performance. These included the beneficiaries of the macro factors

described above, such as the outperformance of large capitalisation stocks,

alongside a mix of positive fundamentals that also influenced share price

moves. OrbiMed prides itself on its expertise within clinical medicine and how

that capability helps shape good stock picking within the healthcare sector.

A prototypical example of this combination of macro tailwinds and good stock

picking was AbbVie. Over the past two years, the company has been in the midst

of a transformation. Facing the largest patent expiration in industry history

-Humira, with peak global sales of U.S.$20 billion - the company has

re-invented its immunology franchise with newer, better, and safer drugs in

Skyrizi (injectable risankizumab) and Rinvoq (oral upadacitinib), two drugs

approved to treat a variety of immunological disorders.

Investor optimism hit a nadir in September 2021 when the U.S. Food and Drug

Administration (FDA) communicated their general concern over the safety of all

oral JAK inhibitors (Janus Kinase inhibitors, the class of medicines included

Rinvoq), certainly delaying and perhaps denying future additional approvals for

Rinvoq, largely considered the "best-in-class" JAK inhibitor in the world. With

the stock on the low after falling further on the news, we added meaningfully

to our position. That risk paid off two-fold. First, despite a modest delay,

the FDA did ultimately approve Rinvoq for Psoriatic Arthritis, Ulcerative

Colitis, and Atopic Dermatitis (in addition to the already approved Rheumatoid

Arthritis), pushing the stock higher. Second, the stock certainly caught the

macro trend towards the start of 2022 when large capitalisation pharmaceutical

stocks moved higher in the face of rising interest rates, record inflation, and

war in Europe.

Another pharmaceutical company that has re-invented itself is AstraZeneca.

After nearly a decade of declining revenues and earnings, the company has

turned itself around under the guidance of CEO Pascal Soriot, creating one the

largest and fastest growing global, multinational pharmaceutical companies in

the world. With leadership in oncology, cardiovascular, respiratory, and more

recently, rare diseases, the company is poised for sustainable, long-term

growth. However, these successes have not been without some angst, as a messy

but well-intended effort to develop a COVID vaccine created some share price

volatility as did the close of the acquisition of Alexion Pharmaceuticals,

which sparked investor fears that the company's stand-alone financials were

going to disappoint.

However, after a robust fourth quarter report, better than expected guidance

for 2022, and a strong launch for the company's COVID-19 prophylaxis injection,

Evusheld (tixagevimab co-packaged with cilgavima), AstraZeneca's share price

closed at an all-time high at the end of the Company's financial year.

UnitedHealth Group is the largest health insurer in the United States as well

as one of the largest healthcare services providers through its subsidiary,

Optum. This stock represents another example of a mix of positive fundamentals

and a macroeconomic environment that took the share price to new highs in 2022.

Heading into its third quarter 2021 earnings, investors faced significant fears

of whether increasing medical costs and lingering COVID-related costs (testing,

treatment, vaccines) would impede the insurers' ability to grow earnings.

Additionally, regulatory noise became louder with prospects of Medicare

Advantage, an insurer-run government programme, would face reimbursement cuts

or other challenges to pay for other priorities in a large U.S. federal

spending bill.

However, the company produced strong third and fourth quarter results, along

with better-than-expected earnings guidance for 2022. Meanwhile, political

negotiations over a large spending bill broke down in the U.S., removing

another critical source of risk. Finally, the shifting macroeconomic landscape,

including higher interest rates, rising inflation, and a shift out of growth

stocks into value stocks, all benefited UnitedHealth, which has since become a

"safe haven" in healthcare.

Shanghai Bio-heart Biological Technology is a cardiovascular medical device

startup in China. The company sells two product lines: Renal Denervation (RDN)

and Bioresorbable Vascular Scaffold System (BVS). Together, these technologies

address the unmet medical needs of Chinese patients for the treatment of

coronary and peripheral artery diseases and uncontrolled hypertension.

Bio-heart's line of RDN products is a "best-in-class" product in China, with a

unique catheter design which is the only one that can be inserted by both

radial artery and femoral artery (unlike the competition). The company's RDN

business is also backed by Terumo, the Japan-based global leader in medical

technology, in a technology-validating deal. The investment into Bio-heart was

an unquoted investment. The company listed on the Hong Kong Exchange in

December 2021 and the share price more than doubled during the remainder of the

Company's financial year.

Before the turn of the decade, Bristol-Myers Squibb became one of the most, if

not the most, dominant cancer companies in the world. With pioneering work in

revolutionary field of immuno-oncology in the mid-2010s and the U.S.$74 billion

acquisition of Celgene in 2019, the company possessed leadership in both the

solid tumour and liquid tumour fields of oncology. However, the company has

also become misunderstood. Investor anxiety over the company's growth strategy

and increased concerns over imminent patent expirations for key products saw

the company's valuation collapse to an all-time low, with the shares trading

with a price-to-earnings ratio of 7.0x during the reported period.

However, an analyst meeting hosted by company management in November 2021 in

New York City proved to be a seminal moment in the company's recent history.

Using that platform, the company provided a deep dive on their pipeline,

discussed growth opportunities, and provided long term growth targets. That

event, combined with the defensive rotation into pharmaceuticals at the

Company's financial year-end, was a boon to investor interest and the stock

re-rated over 30% (in local currency) over the last four months of the reported

period.

KEY DETRACTORS FROM PERFORMANCE

Mirati Therapeutics is an emerging biotechnology company focused on the

development of therapeutics for the treatment of cancer. The company's main

pipeline asset, adagrasib, is highly selective and potent oral small molecule

inhibitor of KRAS G12C (a mutation that underlies the formation of a number of

tumours) that is being developed for various cancers, including lung, colon,

and other solid tumours. Despite achieving many development milestones for

adagrasib in the year, including a successful new drug application with the

FDA, the share price was punished, perhaps unduly, for a variety of reasons,

including a stock offering and multiple management changes. Most recently, the

stock was under pressure again after the FDA accepted the filing for adagrasib

but granted a regular review rather than the expected priority review, pushing

the potential approval and launch in 2023.

MIRATI THERAPEUTICS: KRAS INHIBITION

In the diagnostics space, Natera is an industry leader with a host of

innovative offerings including non-invasive prenatal testing (NIPT) and other

genetic testing. While Natera's commercial execution was strong in the reported

period, the company did not benefit from COVID-testing tailwinds (unlike the

large-capitalisation diagnostic players) and share price declines were further

exacerbated by the growth-to-value rotation that characterised the year under

review. Additionally, the New York Times published an article in January 2022

denouncing the low accuracy of NIPT in identifying rare genetic diseases, and

in March 2022, a short seller published a report on Natera alleging illegal

billing practices relating to its NIPT business, both of which created

significant controversy. Whilst we disagreed with both of these reports, these

collective issues created a significant disconnect between the company's

fundamentals and most recent valuation.

NATERA: NIPT

Another innovative player in the diagnostics space is Guardant Health, an

oncology diagnostics company that has emerged as the pre-eminent liquid biopsy

provider. The company has many offerings in the cancer diagnostics sector

including therapy selection, disease assays, and response monitoring. The

company also plans to enter the non-invasive screening market in 2022.

Unfortunately, the share price experienced a material pullback through the

course of the year despite generally strong financial performance. Again,

macro-market conditions were largely to blame, but the stock was particularly

weak following rumours that it was considering a purchase of another oncology

diagnostics company, although the deal never materialised. Again, these

collective issues created a significant disconnect between the company's

fundamentals and its most recent valuation.

Deciphera Pharmaceuticals, is a clinical stage, emerging biotechnology company

that is developing small molecule drugs to treat various types of cancer. The

company's focus in recent years has been the continued development of Qinlock

(ripretinib), an orally administered inhibitor of specific mutated kinases

which otherwise contribute to the development of certain cancers. In 2020, the

FDA approved Qinlock for use as a fourth line therapy for gastrointestinal

stromal tumours (GIST). More recently, the company conducted a trial to explore

the use of Qinlock in earlier lines of therapy. However, in November 2021, that

trial failed to show significantly superior results versus the standard of care

in second line GIST, Sutent (sunitinib). The stock had traded down along with

the broader biotechnology drawdown into this update and subsequently gapped

even lower after the failed trial.

The "XBI" is an exchange-traded fund - SPDR S&P Biotech ETF - incorporated in

the U.S. that seeks to replicate the performance of the S&P Biotechnology

Index. The Index is equal-weighted, has approximately 150 constituents, and

tracks all biotechnology single stocks that are listed on the NYSE, American

Stock Exchange, and the NASDAQ National Market and Small Capitalisation

exchanges. The XBI offers an opportunity to gain tactical exposure to the

biotechnology subsector quickly and efficiently while not exposing the

portfolio to unnecessary idiosyncratic single stock risks. Given the

extraordinary drawdown in the biotechnology subsector since February 2021, the

removal of key sector overhangs, and anticipated mergers & acquisitions (M&A)

by large capitalisation pharmaceutical companies, we wanted to gain exposure to

a tactical rebound as we went through the year. Unfortunately, our purchase was

premature, and the XBI continued to sell off right into the financial year-end.

This holding was bought and sold during the year.

CONTRIBUTION FROM UNQUOTEDS

During the financial year, the Company made four new investments in unquoted

companies. Another four portfolio companies - including one of these new

investments - completed their Initial Public Offerings (IPOs) in the period. As

of 31 March 2022, investments in unquoted companies (excluding debt) accounted

for 7.0% of the Company's net assets versus 5.3% as of 31 March 2021.

The four new investments this year were all healthcare services companies in

emerging markets (one in India and three in China). In the U.S., a challenging

public offering market for small and mid-capitalisation therapeutics companies

made pre-IPO crossover investments unattractive in the year. Of the four

companies that completed an Initial Public Offering, three listed on the Hong

Kong Stock Exchange in the second half of the financial year and a

biotechnology company listed on the Nasdaq Stock Exchange in the U.S.

For the year ended 31 March 2022, the Company's unquoted holdings contributed

gains of £21.8m, (including both realised and unrealised gains) equivalent to a

return of 15% and those companies that went public contributed gains of £20.7m,

representing a return of 35%. While the gains in unquoteds were spread among

many companies, the gains for companies that listed were dominated by Shanghai

Bio-heart Biological Technology. Overall, the unquoted strategy (excluding

debt) contributed £42.5m equivalent to 1.8% of the Company's net asset value

return for the year.

GEARING STRATEGY

The Company employs gearing with a maximum level of 20% of the Company's net

assets. Historically, the typical gearing level employed by the Company is

low-to-high teens but can range from low single-digits to high teens.

Considering the level of market volatility during the past two financial years,

the use of gearing has evolved. First, the over level of gearing used - on

average - has declined from 9% (5 year average) to 6% (2 year average). Second,

month-over-month gearing levels have also varied more than historical norms as

we have attempted to utilise gearing in a more tactical fashion and in response

to various market conditions.

DERIVATIVES STRATEGY

The Company has the ability to use equity swaps and options, as set out in the

Company's Investment Objective and Policy. During the current financial year,

the Company employed single stock equity swaps to gain exposure to emerging

market Chinese and Indian stocks. In addition, the Company traded tactical

security baskets created to take advantage of depressed valuations in small and

mid-capitalisation companies that we felt were likely acquisition targets for

large capitalisation pharmaceutical companies. The equity swaps detracted 0.9%

from the Company's return during the year. An analysis of the Company's

investments in emerging markets is included in the Strategic Report.

Further details on the use of swaps can be found in Note 16 and in the

Glossary.

SECTOR DEVELOPMENTS & OUTLOOK

Overall, we remain positive on the outlook for the healthcare industry. Despite

the mixed trading dynamics during the financial year, many immediate overhangs

have lifted and the tailwinds remain strong, in particular the amount of

innovation that is fuelling the industry's growth, both in therapeutic and

non-therapeutic stocks.

On the regulatory front, there has been a growing concern from generalist

investors that things have slowed significantly at the FDA and that there is a

vacuum of leadership at the Agency. This view began to develop in 2020 with the

absence of a Commissioner (typically appointed when there is a change in U.S.

Presidents) and when agency resources where stretched given the COVID-19

pandemic. However, we have a very different view.

First, the FDA response to COVID-19 has been an unprecedented success with

multiple vaccines approved, multiple antibody treatments approved, and more

recently, two oral anti-viral therapies approved as well. We would also be

remiss not to mention the hundreds of diagnostic tests that have also been

approved by the agency. Second, we have not seen a material slowdown in new

drug approvals. In fact, the past five years have been the most productive in

the agency's history, including this past year. This included an Alzheimer's

drug that was approved in June 2021 - the first new treatment approved for

Alzheimer's disease in over 20 years (albeit with some controversy).

Finally, and perhaps most importantly, there was a growing concern that the FDA

was "rudderless" since the Agency has been without a commissioner over that

past two years (since President Biden took office). Whilst this belief was

mostly baseless, nevertheless, a new commissioner was just recently confirmed.

Dr. Robert Calif, a world-renowned cardiologist from Duke University, was the

previous Commissioner under President Obama, and most importantly, is viewed as

"industry friendly." Going forward, we think investor perception of the FDA is

going to improve immensely in 2022 and beyond.

Another dark cloud over the sector is the ongoing (and seemingly endless)

threat of prescription drug price reform in the U.S. This fear has been an

overhang on the Company since late 2020, when President Biden took the White

House and Democrats had total control of Congress, setting off a new

"wall-of-worry" for investors. However, with war breaking out in Eastern

Europe, the Biden Administration's attention has pivoted and is now completely

focused on other matters. Therefore, we believe that expectations for any drug

price reform have now appropriately faded, especially as we approach U.S.

midterm elections later in 2022.

Historically, the healthcare industry is one that sees a significant amount of

corporate activity, frequently in the form of M&A and this M&A activity has

been a notable source of positive performance for the Company. Of course, there

are always ebbs and flows that impact the pace of M&A at any one time, but the

last two quarterly reporting periods have been notable for the profound

messaging from the large capitalisation pharmaceutical executives about

business development, particularly about M&A being a "top priority", the need

to "do more", and looking to add "first-in-class and best-in-class" assets.

Overall, this may be a harbinger of things to come and could be a real rallying

point, especially in the biotechnology sector.

M&A: ACCELERATION EXPECTED

Given the historic volatility within the sector in the reported period, it is

imperative to note that this extreme sell-off was not emblematic of any notable

concerns about the fundamentals within the small and mid-capitalisation

universe of healthcare stocks. Yes, the number of investable companies

continues to increase. Yes, the complexity of the clinical science and new

technology continues to increase. Yes, the political and regulatory landscape

continue to evolve. Collectively, however, these factors can become a tailwind

for the sector as new products, drugs, and services come to market, driving top

line growth and margins, respectively. The by-product of the broad market

conditions has culminated in a profound collapse in valuations, a situation

that invariably reverses in due time, a particular attractive opportunity for

an active manager and specialist healthcare investor, and one on which we will

be in position to capitalise.

Ultimately, as with many modern industries, innovation is the key value driver

and healthcare is no different. We continue to believe that the current pace of

innovation is at an all-time high and will continue to develop novel solutions

to solve health and ageing problems that are facing all of humanity. There are

new advances for small molecules, gene and cell therapy, gene editing,

monoclonal antibodies, and of course vaccines and RNA therapeutics. Novel

diagnostics continue to progress and are shaping treatment choices, dictating

drugs of intervention, and follow-up care. Medical devices continue to evolve

across new robotic platforms, orthopedics, pain, and structural heart. Even

managed care is seeing a revolution in vertical integration that is unlocking

value. Innovation continues to be the number one growth driver for all of

healthcare and remains a key hallmark of the portfolio. As a result of this

view, we will continue to actively position the portfolio to benefit from this

incredible innovation, overweighting innovation through small and

mid-capitalisation stocks, which has been the key pillar of our long-term and

successful investment strategy.

Sven H. Borho and Trevor M. Polischuk

OrbiMed Capital LLC

Portfolio Manager

26 May 2022

CONTRIBUTION BY INVESTMENT

ABSOLUTE CONTRIBUTION BY INVESTMENT FOR THE YEARED 31 MARCH 2022

Principal contributors to and detractors from net asset value performance

Contribution

Contribution per share*

Top five contributors Country Sector £'000 £

Abbvie USA Pharmaceuticals 43,658 0.7

AstraZeneca UK Pharmaceuticals 39,516 0.6

UnitedHealth Group USA Healthcare Providers & 29,254 0.4

Services

Shanghai Bio-Heart Biological China Healthcare Equipment & 24,934 0.4

Technology Supplies

Bristol-Myers Squibb USA Pharmaceuticals 24,633 0.4

Top five detractors

SPDR S&P Biotech ETF ** USA Biotechnology (26,637) (0.4)

Deciphera Pharmaceuticals ** USA Biotechnology (32,923) (0.5)

Guardant Health USA Life Sciences Tools & (34,062) (0.5)

Services

Natera USA Life Sciences Tools & (35,122) (0.5)

Services

Mirati Therapeutics USA Biotechnology (45,742) (0.7)

* Calculation based on 65,307,132 shares being the weighted average number of

shares in issue during the year ended 31 March 2022.

* Not held at 31 March 2022.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE AND CLIMATE CHANGE

EXTRACT FROM ORBIMED'S RESPONSIBLE INVESTING POLICY

The Company's Portfolio Manager, OrbiMed, believes that there is a high

congruence between companies that seek to act responsibly and those that

succeed in building long-term shareholder value. OrbiMed seeks to integrate its

Responsible Investing Policy into its overall investment process for the

Company in order to maximise investment returns.

OrbiMed negatively screens potential investments and business sectors that may

objectively lead to negative impacts on public health or well-being. OrbiMed

makes investment decisions based on a variety of financial and non-financial

company factors, including environmental, social and governance (ESG)

information.

OrbiMed considers sector-specific guidance from the Sustainability Accounting

Standards Board (SASB) to determine material ESG factors. Depending on the

investment, all or a subset of the ESG factors that are financially material

and relevant are considered in OrbiMed's research. The evaluation of a

company's performance on ESG issues provides guidance for investment decisions

and constitutes part of the investment analysis. ESG factors, however, do not

form the sole, or primary, set of considerations for an investment decision.

ESG is a rapidly evolving field. ESG evaluation is not standardised and faces

limitations due to a lack of availability of accurate, timely and uniform data.

Presently, no known universally accepted standards for ESG incorporation in

investment decisions exist. Therefore, ESG evaluation carries a significant

degree of subjectivity.

ESG MONITORING

OrbiMed has integrated ESG scores for public equity holdings from third-party

service providers onto its platform via programming interface. ESG scores are

assigned by third-party service providers to each company based on the

company's disclosure and practice on material environmental, social and

governance factors. Recognising the need to supplement the scores with

OrbiMed's internal ESG research, OrbiMed has enabled enhancements in its

monitoring capability with a custom-built protocol for updating these scores.

OrbiMed is taking the initiative in leading meaningful ESG engagement in the

healthcare sector. As part of these efforts, OrbiMed facilitates dialogues and

an exchange of leading practices among investors, companies and other relevant

experts on ESG in the large capitalisation pharmaceutical sector.

CLIMATE CHANGE

As per the guidance from SASB, climate change in relation to the Company's own

operations is not a material ESG consideration for biotechnology and

pharmaceutical, medical equipment and supplies, and managed care sectors.

However, Energy management is noted as a material ESG concern for the

healthcare delivery sector. To that end, OrbiMed includes the scores on energy

management for the relevant sectors in its overall ESG monitoring.

OrbiMed engages with a number of companies, including one-on-one meetings with

management on ESG, analyst calls and other forums. For example, OrbiMed held a

meeting with Horizon Therapeutics on leading ESG practices and provided

feedback and recommendations on specific ESG topics such as talent management,

disclosure and governance benchmarks to the company. Through these engagements,

OrbiMed was made aware of the 'Energize' programme - a collaborative programme

launched by 10 pharmaceutical companies - including several OrbiMed portfolio

companies - to increase access to renewable electricity for global

pharmaceutical supply chains, and reduce greenhouse gas (GHG) emissions within

the healthcare supply chain.

OrbiMed generally follows the guidelines and recommendations of Glass Lewis &

Co LLC, a leading proxy voting services provider, including on climate change

matters.

Sven H. Borho and Trevor M. Polischuk

OrbiMed Capital LLC

Portfolio Manager

26 May 2022

BUSINESS REVIEW

The Strategic Report, contains a review of the Company's business model and

strategy, an analysis of its performance during the financial year and its

future developments and details of the principal risks and challenges it faces.

Its purpose is to inform shareholders in the Company and help them to assess

how the Directors have performed their duty to promote the success of the

Company. Further information on how the Directors have discharged their duty

under s172 of the Companies Act 2006 in promoting the success of the Company

for the benefit of the investors as a whole, and how they have taken wider

stakeholders' needs into account can be found in the Strategic Report. The

Strategic Report contains certain forward-looking statements. These statements

are made by the Directors in good faith based on the information available to

them up to the date of this report. Such statements should be treated with

caution due to the inherent uncertainties, including both economic and business

risk factors, underlying such forward-looking information.

BUSINESS MODEL

Worldwide Healthcare Trust PLC is an externally managed investment trust and

its shares are listed on the premium segment of the Official List and traded on

the main market of the London Stock Exchange.

As an externally managed investment trust, all of the Company's day-to-day

managements and administrative functions are outsourced to service providers.

As a result, the Company has no executive directors, employees or internal

operations. The Company employs Frostrow Capital LLP (Frostrow) as its

Alternative Investment Fund Manager (AIFM), OrbiMed Capital LLC (OrbiMed) as

its Portfolio Manager, J.P. Morgan Europe Limited as its Depositary and J.P.

Morgan Securities LLC as its Custodian and Prime Broker. Further details about

their appointments can be found in the Business Review. The Board has

determined an investment policy and related guidelines and limits, as described

below.

The Company is an investment company within the meaning of Section 833 of the

Companies Act 2006 and has been approved by HM Revenue & Customs as an

investment trust (for the purposes of Section 1158 of the Corporation Tax Act

2010). As a result the Company is not liable for taxation on capital gains. The

Directors have no reason to believe that approval will not continue to be

retained. The Company is not a close company for taxation purposes.

The Board is responsible for all aspects of the Company's affairs, including

the setting of parameters for and the monitoring of the investment strategy a s

well as the review of investment performance and policy. It also has

responsibility for all strategic issues, the dividend policy, the share

issuance and buy-back policy, gearing, share price and discount/premium

monitoring and corporate governance matters.

CONTINUATION OF THE COMPANY

A resolution was passed at the Annual General Meeting held in 2019 that the

Company continues as an investment trust for a further five year period. In

accordance with the Company's Articles of Association, shareholders will have

an opportunity to vote on the continuation of the Company at the Annual General

Meeting to be held in 2024 and every five years thereafter.

THE BOARD

The Board of the Company comprises Sir Martin Smith (Chairman), Sarah Bates,

Sven Borho, Doug McCutcheon, Dr Bina Rawal and Humphrey van der Klugt. All of

these Directors, served throughout the year. All are independent non-executive

Directors with the exception of Mr Borho who is not considered to be

independent by the Board.

All Directors, with the exception of Sir Martin Smith, are seeking re-election

by shareholders at this year's Annual General Meeting.

DIVID POLICY

It is the Company's policy to pay out dividends to shareholders at least to the

extent required to maintain investment trust status for each financial year.

Such dividends will typically be paid twice a year by means of an interim

dividend and a final dividend.

KEY PERFORMANCE INDICATORS ('KPI')

The Board assesses the Company's performance in meeting its objectives against

key performance indicators as follows. The Key Performance Indicators have not

changed from the previous year:

* Net asset value ('NAV') per share total return against the Benchmark;*

* Discount/premium of share price to NAV per share;* and

* Ongoing charges ratio.*

Information on the Company's performance is provided in the Chairman's

Statement and the Portfolio Manager's Review. Further information can be found

in the Glossary.

* Alternative Performance Measure (See Glossary)

NAV per share total return against the benchmark

The Directors regard the Company's NAV per share total return as being the

overall measure of value delivered to shareholders over the long term. This

reflects both net asset value growth of the Company and dividends paid to

shareholders.

The Board considers the most important comparator, against which to assess the

NAV per share total return performance, to be the MSCI World Health Care Index

measured on a net total return, sterling adjusted basis (the 'Benchmark').

OrbiMed has flexibility in managing the investments and are not limited by the

make up of the Benchmark. As a result, investment decisions are made that

differentiate the Company from the Benchmark and therefore the Company's

performance may also be different to that of the Benchmark.

A full description of performance during the year under review is contained in

the Portfolio Manager's Review.

Share price discount/premium to nav per share

The share price discount/premium to NAV per share is considered a key indicator

of performance as it impacts the share price total return of shareholders and

can provide an indication of how investors view the Company's performance and

its Investment Objective.

Ongoing charges ratio

The Board continues to be conscious of expenses and works hard to maintain a

balance between good quality service and costs.

PRINCIPAL SERVICE PROVIDERS

The principal service providers to the Company are the AIFM, Frostrow Capital

LLP (Frostrow), the Portfolio Manager, OrbiMed Capital LLC (OrbiMed), the

Custodian and Prime Broker J.P. Morgan Securities LLC, and the Depositary, J.P.

Morgan Europe Limited. Details of their key responsibilities follow and further

information on their contractual arrangements with the Company are included in

the Report of the Directors.

Alternative investment fund manager (AIFM)

Frostrow under the terms of its AIFM agreement with the Company provides, inter

alia, the following services:

* oversight of the portfolio management function delegated to OrbiMed Capital

LLC;

* investment portfolio administration and valuation;

* risk management services;

* marketing and shareholder services;

* share price discount and premium management;

* administrative and secretarial services;

* advice and guidance in respect of corporate governance requirements;

* maintenance of the Company's accounting records;

* maintenance of the Company's website;

* preparation and dispatch of annual and half year reports (as applicable)

and monthly fact sheets; and

* ensuring compliance with applicable legal and regulatory requirements.

During the year, under the terms of the AIFM Agreement, Frostrow received a fee

as follows:

On market capitalisation up to £150 million: 0.3%; in the range £150 million to

£500 million: 0.2%; in the range £500 million to £1 billion: 0.15%; in the

range £1 billion to £1.5 billion: 0.125%; over £1.5 billion: 0.075%. In

addition, Frostrow receives a fixed fee per annum of £57,500.

Portfolio manager

OrbiMed under the terms of its portfolio management agreement with the AIFM and

the Company provides, inter alia, the following services:

* the seeking out and evaluating of investment opportunities;

* recommending the manner by which monies should be invested, disinvested,

retained or realised;

* advising on how rights conferred by the investments should be exercised;

* analysing the performance of investments made; and

* advising the Company in relation to trends, market movements and other

matters which may affect the investment objective and policy of the

Company.

OrbiMed receives a base fee of 0.65% of NAV and a performance fee of 15% of

outperformance against the Benchmark.

Depositary, custodian and prime broker

J.P. Morgan Europe Limited acts as the Company's Depositary and J.P. Morgan

Securities LLC as its Custodian and Prime Broker.

J.P. Morgan Europe Limited, as Depositary, must take reasonable care to ensure

that the Company is managed in accordance with the Financial Conduct

Authority's Investment Funds Sourcebook, the AIFMD and the Company's Articles

of Association. The Depositary must in the context of this role act honestly,

fairly, professionally, independently and in the interests of the Company and

its shareholders.

The Depositary receives a variable fee based on the size of the Company.

J.P. Morgan Europe Limited has discharged certain of its liabilities as

Depositary to J.P. Morgan Securities LLC. Further details of this arrangement

are set out in the Report of the Directors. J.P. Morgan Securities LLC, as

Custodian and Prime Broker, provides the following services under its agreement

with the Company:

* safekeeping and custody of the Company's investments and cash;

* processing of transactions;

* provision of an overdraft facility. Assets up to 140% of the value of the

outstanding overdraft can be taken as collateral; and

* foreign exchange services.

AIFM AND PORTFOLIO MANAGER EVALUATION AND RE-APPOINTMENT

The performance of the AIFM and the Portfolio Manager is reviewed continuously

by the Board and the Management Engagement & Remuneration Committee (the

"Committee") with a formal evaluation being undertaken each year. As part of

this process, the Committee monitors the services provided by the AIFM and the

Portfolio Manager and receives regular reports and views from them. The

Committee also receives comprehensive performance measurement reports to enable

it to determine whether or not the performance objectives set by the Board have

been met. The Committee reviewed the appropriateness of the appointment of the

AIFM and the Portfolio Manager in February 2022 with a positive recommendation

being made to the Board.

The Board believes the continuing appointment of the AIFM and the Portfolio

Manager, is in the interests of shareholders as a whole. In coming to this

decision, it took into consideration, inter alia, the following:

* the quality of the service provided and the depth of experience of the

company management, company secretarial, administrative and marketing team

that the AIFM allocates to the management of the Company; and

* the quality of the service provided and the quality and depth of experience

allocated by the Portfolio Manager to the management of the portfolio and

the long-term performance of the portfolio in absolute terms and by

reference to the Benchmark.

RISK MANAGEMENT

The Board is responsible for the management of risks faced by the Company.

Through delegation to the Audit & Risk Committee, the Board has established

procedures to manage risk, to review the Company's internal control framework

and establish the level and nature of the principal risks the Company is

prepared to accept in order to achieve its long-term strategic objective. At

least twice a year the Audit Committee carries out a robust assessment of the

principal risks and uncertainties with the assistance of Frostrow (the

Company's AIFM) identifying the principal risks faced by the Company. These

principal risks and the ways they are managed or mitigated are detailed on the

following pages.

Principal risks and uncertainties Mitigation

Market risks

By the nature of its activities and To manage these risks the Board and the AIFM

Investment Objective, the Company's portfolio have appointed OrbiMed to manage the

is exposed to fluctuations in market prices investment portfolio within the remit of the

(from both individual security prices and investment objective and policy, and imposed

foreign exchange rates) and due to exposure various limits and guidelines. These limits

to the global healthcare sector, it is ensure that the portfolio is diversified,

expected to have higher volatility than the reducing the risks associated with individual

wider market. As such investors should be stocks, and that the maximum exposure

aware that by investing in the Company they (through derivatives and an overdraft

are exposing themselves to market risks and facility) is limited. The compliance with

those additional risks specific to the those limits and guidelines is monitored

sectors in which the Company invests, such as daily by Frostrow and OrbiMed and reported to

political interference in drug pricing. In the Board monthly.

addition, the Company uses leverage (both In addition, OrbiMed reports at each Board

through derivatives and gearing) the effect meeting on the performance of the Company's

of which is to amplify the gains or losses portfolio, which encompasses the rationale

the Company experiences. for stock selection decisions, the make-up of

the portfolio, potential new holdings and,

derivative activity and strategy (further

details on derivatives can be found in note

16).

The Company does not currently hedge its

currency exposure.