TIDMSMDS

RNS Number : 1840R

Smith (DS) PLC

25 June 2015

25 June 2015

DS Smith Plc - 2014/15 FULL YEAR RESULTS

Continued momentum in performance, scale and quality of the

business

12 months to 30 Change Change

April 2015 (reported) (constant currency)

------------------- --------- ----------- --------------------

Revenue GBP3,820m (5)% +1%

Adjusted operating

profit(1) GBP335m +9% +17%

Profit before tax GBP200m +20% +30%

EPS(1) 24.5p +14% +24%

Dividend per share 11.4p +14% +14%

Return on sales(4) 8.8% +120bps +130bps

ROACE(5) 14.6% +160bps +160bps

------------------- --------- ----------- --------------------

Highlights

-- Strong growth in profits, returns and dividends, despite FX headwinds

-- Organic corrugated box volume growth of +3.1%

o Acceleration in H2

o Market share gains

-- Strengthened the quality of the business portfolio and

continued value creation from acquisitions

o Four acquisitions announced in the year, including Andopack in

Spain and Duropack in south eastern Europe

o Announcing today the proposed acquisition of Grupo Lantero's

corrugated business for EUR190 million, substantially expanding our

position in Iberia

-- Continued delivery against all our medium-term targets

o Significant improvement in return on sales and ROACE

o Strong cashflow and working capital performance

o Net debt reduced to GBP651 million, 1.49x EBITDA

Miles Roberts, Group Chief Executive, commented:

"This has been another good year for DS Smith. In a fast

changing retail and consumer environment, packaging is more

relevant than ever. The progress in the business with customers is

evidenced by accelerating volume growth, together with increased

margins and returns, from our unique and enhanced offering.

We also have momentum behind developing our business portfolio

to improve the quality of our business, and we are pleased to

announce the proposed acquisition of Grupo Lantero's corrugated

business today. We have been delighted with the positive customer

reaction to our recent acquisitions. The progress we continue to

make with global customers, together with the opportunities we see

for growth as we expand our international reach and offering, gives

us confidence to increase our medium-term margin target by 100

basis points, and, notwithstanding the continued challenging market

environment, we remain excited about the prospects for the

business."

Sustainable delivery in line with medium term targets

Medium-term targets Delivery in 2014/15

------------------------------- -------------------

Organic volume growth(2) at

least GDP(3) +1% 3.1%

Return on sales(4) 7% - 9% 8.8%, +130 bps

ROACE(5) 12% - 15% 14.6%, +160 bps

Net Debt / EBITDA(6) <=2.0x 1.49x

Operating cash flow/ operating

profit(7) >= 120% 127%

------------------------------- -------------------

See notes to the financial tables, below

Enquiries

DS Smith Plc +44 (0)20 7756 1800

Hugo Fisher, Group Communications Director

Rachel Stevens, Investor Relations Manager

Bell Pottinger

John Sunnucks +44 (0)20 3772 2549

Ben Woodford +44 (0)20 3772 2566

Presentation and dial-in details

A presentation to investors and analysts will be held at 09:30

today at Allen & Overy, One Bishops Square, London E1 6AD.

Dial-in access for the presentation is available per the details

below. The slides accompanying the presentation will be available

on our website shortly before 09:30. Dial-in participants will have

the opportunity to participate in the Q&A.

+44 (0)20 3003 2666 (standard access) or 0808 109 0700 (UK toll

free) Password:

DS Smith.

A replay of the event is available for seven days, on +44 (0) 20

8196 1998, PIN 2915151#. An audio file and transcript will also be

available on

www.dssmith.com/investors/results-and-presentations.

Notes to the financial tables

(1) Before exceptional items and amortisation

(2) Corrugated box volumes, adjusted for the number of working days

(3) GDP growth (year-on-year) for the countries in which DS

Smith operates, weighted by our sales by country, for the period

April 2014 - March 2015= 1.3%. Source: Eurostat (13/5/15)

(4) Earnings from continuing operations before interest, tax,

amortisation and exceptional items as a percentage of revenue.

Comparative on a constant currency basis

(5) Earnings from continuing operations before interest, tax,

amortisation and exceptional items as a percentage of the average

monthly capital employed over the previous 12 month period. Average

capital employed includes property, plant and equipment, intangible

assets (including goodwill), working capital, provisions, capital

debtors/creditors and assets/liabilities held for sale

(6) EBITDA being earnings from continuing operations before

interest, tax, exceptional items, depreciation and amortisation.

Comparative on a constant currency basis

(7) Free cash flow before tax, net interest, growth capital

expenditure, pension payments and exceptional cash flows as a

percentage of earnings before interest, tax, amortisation and

exceptional items

Cautionary statement: This announcement contains certain

forward-looking statements with respect to the operations,

performance and financial condition of the Group. By their nature,

these statements involve uncertainty since future events and

circumstances can cause results and developments to differ

materially from those anticipated. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this announcement and DS Smith Plc undertakes no

obligation to update these forward-looking statements. Nothing in

this statement should be construed as a profit forecast.

Overview

In the financial year 2014/15, DS Smith has again delivered

strong underlying growth in volumes, margins, profits, returns and

dividends, with all metrics well in line with our medium-term

financial targets. At the same time as gaining market share through

organic growth, we have delivered a series of acquisitions and

disposals this year which help to focus the business on recycled

packaging, and expand our geographic footprint and customer

offering. We have also delivered against our non-financial key

performance indicators, with further improvements in health and

safety and in our environmental impact, reflecting our strategy of

having a sustainable business model.

Corrugated box volumes have increased by 3.1 per cent

year-on-year, on a like-for-like basis, with an acceleration in H2.

All regions demonstrated positive progress, with particularly good

growth in Central Europe and Italy. This is materially ahead of

both our target of volume growth of GDP +1 per cent and the overall

corrugated market in Europe, demonstrating how customers are

continuing to move to DS Smith, reflecting our strength in

innovation and design and the ability to deliver a pan-European

solution for their packaging requirements.

In a market where the needs of consumers, retailers and our

customers are constantly changing, we continue to focus on

developing innovative solutions for our customers and the roll-out

of our performance packaging programme. This utilises our unique

proprietary technology, in order to provide high quality packaging

for our customers on a consistent basis in the most cost-effective

way.

For the full year period, revenues increased by 1 per cent on a

constant currency basis, despite a slight reduction from the net

impact of acquisitions and disposals. Reported revenues reduced by

5 per cent due to foreign exchange (FX) translation of non-sterling

revenues. Adjusted operating profit increased by 17 per cent on a

constant currency basis to GBP335 million (9 per cent on a reported

basis), driven by the contribution from the volume growth, our

focus on higher value-added product and services to customers,

together with the benefit of synergies from the SCA Packaging

acquisition, where we have delivered the expected, final tranche of

EUR40 million of synergies in the period.

We have continued our strategy to licence certain of our

technologies in a number of geographies worldwide. During the

period, we entered into an agreement with Georgia-Pacific

Corrugated LLC (GP), a major packaging company in North America,

whereby GP licenses our technology for real-time monitoring and

measurement of the quality and performance of packaging.

We have an ongoing programme of opening our Impact and Packright

design centres, where we bring together our innovation and design

expertise to develop the best packaging solutions. The strength of

our business model lies in our scale, as the design centres share

expertise and a database of designs, which means customers receive

the best solutions, while the cost of development is shared. To

date we have rolled out 17 new or refurbished centres, which

combined with existing design centres means we have 30 such centres

across Europe. We expect to extend this to over 40 by the end of

the 2015/16 financial year.

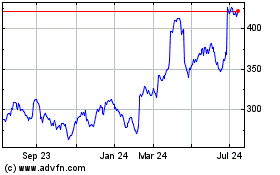

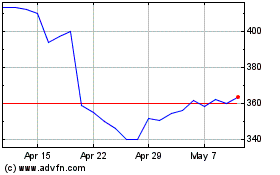

Earnings per share increased by 24 per cent on a constant

currency basis to 24.5 pence (14 per cent on a reported basis)

(2013/14: 21.4 pence). This result follows four prior years of

consistent growth, with the 5-year compound annual growth rate for

reported EPS being 34 per cent.

The Board considers the dividend to be an important component of

shareholder returns and, as such, has a policy to deliver a

progressive dividend, where dividend cover is between 2.0 and 2.5

times, through the cycle. For the year 2014/15, the Board

recommends a final dividend of 7.7 pence, which together with the

interim dividend of 3.7 pence gives a total dividend for the year

of 11.4 pence per share (2013/14: 10.0 pence per share). This

represents an increase of 14 per cent on the prior year and cover

of 2.1 times in relation to earnings per share (before amortisation

and exceptional items).

Improving the quality of the business by investment and

reshaping the asset portfolio

DS Smith is ambitious to improve the quality and scale of our

business. Scale is important as it allows us to invest in

innovation and design, with the benefit shared throughout the

business and across our customers. This results in a business that

is able to lead the market in quality and innovation while

remaining competitive on price and providing a full geographic

reach, which together underpin our improvement in driving margins

and returns. Allied to this is a focus on increasing the

value-added products and services to our customers.

We have made significant further steps this year to expand our

scale and improve the quality of the business through organic

investment, acquisitions, and disposals.

We increased our interest in Italmaceri, a recycling business in

Italy, from 50 to 100 per cent in July 2014, and bought a plastics

manufacturing site in Croatia in September 2014.

In November 2014 we acquired Andopack, a corrugated packaging

business in Spain. We have been delighted with the customer

reaction and the performance of the business, with volume growth

significantly ahead of the Group average.

Since the year end we have completed our acquisition of

Duropack, a corrugated packaging business with a market leading

position in south eastern Europe. The reaction from customers and

employees has been very positive and we look forward to integrating

the business into the Group.

During the year we have also acquired a small packaging

consultancy business, serving global customers with operations in

Europe, US and Asia. This expands our global reach and increases

our capabilities in the analysis of packaging and its interaction

with supply chains. We are adding additional capability in the US

to offer greater packaging design consultancy and procurement

services, on the back of existing customer contracts and strong

demand for our services beyond Europe. We are very pleased with the

positive reaction from our global customers to this new

initiative.

We have made a number of disposals of businesses that were not

core to the Group's strategy, including a Foams business in

Scandinavia, in September 2014, and StePac, a specialist modified

atmosphere packaging business, in May 2015, after the year end. We

have also disposed of a paper mill at Nantes, France, in line with

our strategy to reduce non-integrated paper manufacturing.

We have continued to invest in our assets ahead of depreciation,

with net capex of GBP149 million (2013/14: GBP156 million).

Approximately three quarters of this expenditure has been in the

corrugated packaging business, with growth expenditure focused on

the regions where there is the greatest opportunity. For example,

in the year, approximately a third of the growth capex in the

packaging business was spent in Central Europe, with investment in

our sites in Poland, Hungary, Czech Republic and Romania.

Operating review

Unless otherwise stated, any commentary and comparable analysis

in the operating review is based on constant currency

performance.

UK

Year ended Year ended Change

30 April 30 April

2015 2014

Revenue GBP905m GBP929m (3%)

Operating profit* GBP81m GBP64m 27%

Return on sales* 9.0% 6.9% +210bps

*Adjusted, before amortisation and exceptional items

The UK has seen modest volume growth in a competitive market

environment and challenging retail landscape. Revenues have fallen

by 3 per cent, in part reflecting reduced external sales from

recycling.

The UK business has been leading the development of our

performance packaging processes, requiring close collaboration

between our paper and our packaging operations, with this rolled

out throughout the UK. Profitability has improved by GBP17 million

through a combination of improvements in both the packaging and the

paper operations, resulting in a significant uplift of 210 basis

points to our margin. In packaging, we have focused on higher

value-added contracts, driving the performance packaging

initiatives, and the delivery of cost initiatives. In our paper

operations, we saw an improved performance from the Kemsley mill in

Kent in the first half of the year, where applying best practice

from our European mills has resulted in an improvement in

efficiency and profitability of this site. In the second half of

the year there was some adverse impact to the business from the

increased strength of sterling on trading from the UK to

continental Europe.

Western Europe

Year ended Year ended Change- Change-

30 April 30 April reported constant

2015 2014 currency

Revenue GBP941m GBP1,017m (7%) 0%

Operating profit* GBP65m GBP67m (3%) 7%

Return on sales* 6.9% 6.6% +30bps +40 bps

*Adjusted, before amortisation and exceptional items

Like-for-like volumes in the region have been around the market

average, with France outperforming that average, offset by tougher

conditions in the Benelux region. We have been particularly pleased

with the initial performance from the Andopack site, which has

significantly outperformed the market. On a constant currency basis

revenue was broadly flat, with the benefit from the acquisition of

Andopack part way through the year offset by declines in other

parts of the business.

Adjusted operating profit on a constant currency basis increased

by 7 per cent, reflecting a focus on higher value-added business,

operating leverage and synergies. Return on sales has improved by

40 basis points.

DACH and Northern Europe

Year ended Year ended Change-reported Change

30 April 30 April - constant

2015 2014 currency

Revenue GBP922m GBP1,029m (10%) (2)%

Operating profit* GBP96m GBP96m 0% 10%

Return on sales* 10.4% 9.3% +110bps +120bps

*Adjusted, before amortisation and exceptional items

Volumes in this region have grown well, in particular in DACH,

where we have been gaining market share. Constant currency revenues

declined by 2 per cent, as a result of the disposal of the

Scandinavian foams business near the start of the year. The

underlying business delivered stable revenues, with the revenues

from pan-European customers increasing substantially.

Constant currency operating profit increased by 10 per cent,

despite a modest reduction from the disposed business, driven by

operating leverage benefits and synergy delivery. Return on sales

improved 120 basis points to 10.4 per cent, the highest margin of

all regions.

Central Europe and Italy

Year ended Year ended Change Change

30 April 30 April - reported - constant

2015 2014 currency

Revenue GBP750m GBP739m 1% 11%

Operating profit* GBP65m GBP53m 23% 33%

Return on sales* 8.7% 7.2% +150bps +150bps

* Adjusted, before amortisation and exceptional items

Volumes in this region have been excellent, with both the

business in Italy and in Central Europe substantially outperforming

the market. Constant currency revenue growth of 11 per cent

reflects the volume performance, delivered through above average

market growth and significant market share development, plus a

modest contribution from the acquired recycling business in

Italy.

Adjusted operating profit grew by 33 per cent, with

approximately half of the revenue growth in the region from

pan-European customers with the remainder from the local markets.

The region has seen significant investment in its plants over the

period and we are continuing to invest in this exciting region.

Plastics

Year ended Year ended Change Change

30 April 30 April - reported - constant

2015 2014 currency

Revenue GBP302m GBP321m (6%) (2%)

Operating profit* GBP28m GBP27m 4% 8%

Return on sales* 9.3% 8.4% +90bps +90bps

* Adjusted, before amortisation and exceptional items

Constant currency revenue declined slightly, reflecting growth

in the underlying business, offset by the disposal of two small

non-core businesses. Adjusted operating profit grew by 8 per cent

on a constant currency basis with a 90 basis point increase in

margin, reflecting organic profit development as the investments

made in the business in 2013/14 were put into service. In the

flexible packaging segment of the business, continued double digit

growth of the beverage dispensing tap business in the USA was

partially offset by the gradual start-up of new facilities in

Europe. Demand for flexible packaging continues to grow through new

product offerings and new markets served, in addition to a better

service offering in Europe.

The rigid transit packaging segment, based in Europe, had a very

strong year. Revenue increased by 8 per cent over the prior year on

increased demand for most product lines and adjusted operating

profit increased by 26 per cent as plant improvements and a

favourable raw materials market increased the impact of the

additional sales and more than offset the negative FX effects.

Delivering on our medium-term targets and key performance

indicators

We have made progress against our key performance indicators

over the full-year with substantial improvement in our metrics. As

set out above, corrugated box volumes grew by 3.1 per cent. This

exceeded our target of GDP+1 per cent, with year-on-year GDP

growth, weighted by our sales in the markets in which we operate,

estimated at 1.3 per cent (Source: Eurostat) resulting in a target

of 2.3 per cent. We have delivered this growth across all our

regions with a particularly strong contribution from Central Europe

and Italy, which has benefited from our investment in the region as

well as good growth in the markets. This performance reinforces our

confidence in our investment in the Duropack business, which

expands our geographic reach in the region, with the new business

expected to increase our corrugated volumes in the region by circa

one third. As a consequence of our strong volume growth, DS Smith

has gained market share across Europe, where the overall corrugated

packaging market has shown volume growth of 1.5 per cent (Source:

FEFCO, May 2014 - April 2015).

Adjusted return on sales has increased by 130 basis points on a

constant currency basis to 8.8 per cent, at the upper end of our

target range of 7 to 9 per cent, reflecting the improvement in

profitability from our focus on higher value-added products and

services, operational gearing and the final year of cost synergies

from the acquisition of SCA Packaging, that have been achieved over

the year as anticipated.

Return on average capital employed has improved by 160 basis

points to 14.6 per cent (2013/14: 13.0 per cent), toward the upper

end of our medium-term target range of 12 to 15 per cent and

significantly above our cost of capital. The improvement is driven

by our improved profitability and our continual focus on tight

capital allocation and management within the business, including

working capital, which has shown further improvement this year.

Return on average capital employed is our primary financial measure

of success, and is measured and calculated on a monthly basis. All

senior management have part of their remuneration package linked to

this measure.

Net debt has decreased to GBP651 million (2013/14: GBP827

million) while net debt / EBITDA (calculated in accordance with our

banking covenant requirements) was 1.49 times (2013/14: 1.96

times), in line with our medium-term financial KPI of a ratio of

2.0 times or below and reflecting ongoing tight cash management and

control throughout the business.

During the year the Group generated free cash flow of GBP307

million (2013/14: GBP140 million). Cash conversion was 127 per

cent, in line with our target.

DS Smith is committed to providing all employees with a safe and

productive working environment. We are pleased to report a further

substantial improvement in our safety record, with our accident

frequency rate reduced a further 13 per cent from 4.79 to 4.16,

reflecting our ongoing commitment to best practice in health and

safety. Our target is for zero accidents, which we are pleased to

report that 182 sites achieved this year, up from 138 in 2013/14.

We continue to strive to achieve zero accidents for the Group as a

whole.

The Group has a target for customer service of 97 per cent

on-time, in-full deliveries. In the year we achieved 92 per cent,

broadly similar to the level achieved in the prior year. Standards

of service, quality and innovation are key to our differentiation

in the market. We are investing significantly in these areas, from

design centres throughout Europe, to the roll-out of our

performance packaging methodology, in order to continue to lead the

industry in this field.

DS Smith is part of the sustainable economy, with our principal

product of corrugated packaging fully recyclable, and substantially

constructed from recycled material, as are many of our plastic

packaging products. Our Recycling business works with customers

across Europe to improve their recycling operations and overall

environmental performance. We have invested in improved

environmental tracking systems with far more detail now available,

as set out in greater detail in our Sustainability Report 2015.

CO(2) equivalent emissions, relative to production, have reduced by

2 per cent, and we are on target to achieve our 2010 commitment to

a 20 per cent reduction by 2020.

Updated medium term targets and financial key performance

indicators

We believe that scale brings benefits for customers and for our

shareholders. Five years ago, for the year ended 30 April 2010, DS

Smith reported a return on sales of 4.5 per cent. In December 2010

the Board set a medium term target of 6 - 8 per cent, and raised

that to 7 - 9 per cent following the disposal of Spicers in 2011.

Having achieved a full-year return on sales of 8.8 per cent this

year, near the top of that range, the Board consider it appropriate

to raise this sustainable medium-term target by an additional 100

basis points.

In relation to cash conversion, the target level of 120 per cent

was also set in 2010 when, inter alia, working capital was a

substantially higher proportion of revenue than its current level

of 2.7 per cent. The Board therefore believes that the appropriate

cash conversion ratio for the business going forward, having

achieved the target of 120 per cent or above for the prior five

years, is 100 per cent or above. This reflects the structural

working capital reductions achieved and the maturity of the current

business.

Outlook

The current year has started well, with momentum in volumes

continuing. We also have momentum behind developing our business

portfolio to improve the quality of our business. We have been

delighted with the positive customer reaction to our recent

acquisitions. The progress we continue to make with global

customers, together with the opportunities we see for growth as we

expand our international reach and offering, gives us confidence to

increase our medium-term margin target by 100 basis points, and,

notwithstanding the continued challenging market environment, we

remain excited about the prospects for the business.

Financial review

All numbers within this review are based on continuing

operations before amortisation and exceptional items, with any

comment and comparable analysis based on constant currency, unless

otherwise stated.

Group revenue of GBP3,820 million was 5 per cent lower than the

prior year (2013/14: GBP4,035 million) with exchange effects,

particularly the weakening of the euro throughout the year, having

a significant impact (GBP236 million). On a like-for-like constant

currency basis, after adjusting for acquisitions and disposals,

underlying revenue grew by GBP29 million, up 1 per cent.

The growth in revenue was underpinned by corrugated box volume

growth across Europe of 3.1 per cent, partially offset by the

effects of lower paper prices, particularly in the first half of

the year. Plastics revenue declined by 2 per cent as the

restructuring of the Flexibles business was implemented and a

platform for future growth was established.

Adjusted operating profit rose by 9 per cent to GBP335 million

(2013/14: GBP307 million), 17 per cent on a constant currency

basis, with exchange effects estimated to have an impact of about

GBP21 million. Whilst the business has benefitted from the balance

of the SCA Packaging synergies of EUR40 million, or GBP31 million,

bringing the total delivered to EUR120 million, as previously

announced, it has also been impacted by deflation in a few markets.

Input cost benefits were balanced by sales price reductions, with

organic growth in corrugated box volumes contributing the majority

of the further improvement in profit.

Amortisation for the year was GBP46 million (2013/14: GBP51

million). Depreciation of GBP117 million is slightly lower than the

prior year (2013/14: GBP123 million) due to the impact of foreign

exchange. New investments in machinery have increased depreciation

and maintenance costs by around GBP13 million; these have been

partially offset by a reduction from the finalisation of the SCA

Packaging fair value work which culminated in a comprehensive

review of asset lives on a consistent basis, which had a c. GBP7

million impact.

The Group's measures of return on sales and return on average

capital employed have seen improvements in the current year and

both are towards the top end of their target ranges. Return on

sales is 8.8 per cent (target range of 7-9 per cent), whilst return

on average capital employed is 14.6 per cent (target range of 12-15

per cent). As noted earlier, return on average capital employed is

significantly above the Group cost of capital. The Board has

reviewed the medium-term targets and has decided to raise the

return on sales target by 100 basis point whilst retaining the

return on average capital employed range as it is, to reflect the

short-term impact which results from the acquisition of new

businesses.

Exceptional items

Exceptional items before tax and share of results of associates

were GBP44 million (2013/14: GBP38 million).

Exceptional items comprise of restructuring initiatives

totalling GBP47 million, which have been concentrated in UK and

German Packaging businesses, and on the infrastructure necessary to

support the Group's growth and development. These costs have been

partially offset by utilisation of provisions made on the SCA

Packaging acquisition.

Acquisition and disposal activity has generated a further GBP4

million of exceptional costs. This charge also includes costs

incurred in respect of the post-balance sheet date acquisition of

Duropack.

Gains on the disposal of the Scandinavian Foam business and the

step-up acquisition of the Italian recycling business amounted to

GBP6 million, and were offset by the loss on disposal of the Nantes

mill of GBP9 million and other costs of GBP2 million.

Unamortised finance costs amounting to GBP4 million relating to

the refinancing of the SCA Packaging acquisition finance.

Exchange losses on the Ukrainian associate of GBP7 million, as

the Hryvian weakened against the US dollar (the currency in which

the associate's debt is denominated), have been recognised as

exceptional.

In 2015/16, exceptional costs of GBP40 million are expected to

be incurred, principally relating to the acquisition and

integration of Duropack and other one-off restructuring projects in

our packaging business.

Interest, tax and earnings per share

Net interest expense before exceptionals has reduced from GBP41

million in 2013/14 to GBP32 million in 2014/15, due both to the

refinancing and to the lower levels of debt as further working

capital initiatives have delivered results. The employment benefit

net finance expense was GBP6 million (2013/14: GBP7 million).

Profit before tax (excluding amortisation, exceptional items and

share of profit of associates) was GBP297 million (2013/14: GBP259

million), an increase of 15 per cent on a reported basis.

The share of the results of equity accounted investments

includes the previously described exceptional exchange loss of GBP7

million on US dollar denominated debt in the Ukrainian

associate.

The Group's effective tax rate, excluding amortisation,

exceptional items and associates was 23 per cent, consistent with

the prior year. The exceptional tax credit was GBP10 million.

Reported profit after tax after amortisation and exceptional

items from continuing operations was GBP156 million (2013/14:

GBP144 million).

Adjusted earnings per share were 24.5 pence (2013/14: 21.4

pence), an increase of 14 per cent. Total earnings per share were

16.6 pence (2013/14: 15.0 pence).

Dividend

The proposed final dividend is 7.7 pence (2013/14: 6.8 pence),

giving a total dividend for the year of 11.4 pence (2013/14: 10.0

pence). Dividend cover before amortisation and exceptional items

was 2.1 times in 2014/15 (2013/14: 2.1 times). The final dividend

will be paid on 2 November 2015 to shareholders on the register at

the close of business on 2 October 2015.

Acquisitions and disposals

The Group's strategic aim is to grow its consumer packaging

businesses to meet the requirements of its major customers. The

focus on the overall "short" paper position remains, with ongoing

investment in paper mills which produce high quality lightweight

papers and further reduction in exposure to those that do not.

Acquisition and disposal activity has intensified in the year, with

three acquisitions and two disposals. Since the year end a further

acquisition and disposal have been completed.

On 10 July 2014 the 50 per cent of Italmaceri not previously

owned was acquired. The Italmaceri recycling business operates in

northern Italy with annual volumes of approximately 500k tonnes. On

9 September 2014 Kaplast, an injection-moulding business in

Croatia, was acquired, to expand the returnable transit packaging

element of the Plastics business. On 6 November 2014, the

acquisition of Andopack, a corrugated manufacturing business in

Spain, was completed for GBP39 million (including acquired debt of

GBP28 million). The business operates from a single well-invested

site with considerable scope to grow the business by serving the

Group's pan-European customers based in this large market.

On 2 September 2014 the Scandinavian Foams business, which the

Group had acquired as part of the SCA Packaging acquisition, was

disposed of for GBP22 million, realising a gain of GBP3

million.

Following the binding offer received on 20 November 2014, the

small paper mill in Nantes, France with annual capacity of c. 60k

tonnes of testliner was disposed of, with a loss on disposal of

GBP9 million. This disposal was in-line with our strategy to

increase our "short" paper position.

Subsequent to the year end, on 31 May 2015, the acquisition of

Duropack, a recycled corrugated packaging business with

market-leading positions across south eastern Europe, was completed

for EUR305 million, including debt acquired of EUR100 million,

subject to post-closing working capital adjustments.

On 18 May 2015, the Group completed the sale of StePac, a

specialist modified atmosphere packaging business based in Israel,

for $31 million, subject to post-closing working capital

adjustments.

Cash flow

Net debt ended the year significantly lower than the prior year

at GBP651 million (GBP827 million). Working capital management

continues to be a major focus for the business. The current year

inflow of GBP101 million reflects a continuation of tight working

capital management, particularly of trade receivables and trade

payables. A number of inventory reduction initiatives have

commenced, the results of which should flow through over the next

12 months. The structuring of the Group's debt to be aligned with

the currency of operations benefited net debt by GBP68 million

driven mainly by the weaker euro. The business has continued to

invest in capital expenditure with net costs (after disposal

proceeds of GBP18 million) of GBP149 million (2013/14: GBP156

million). The Group strikes a balance between expenditure on asset

renewal/replacement and investment in growth and efficiency, with

the latter amounting to about 52 per cent of the total expenditure.

Disposals included GBP6 million of surplus property assets

(2013/14: GBP3 million) realising profits of GBP6 million (2013/14:

GBP5 million).

Net interest payments of GBP34 million were GBP9 million lower

than the prior year and were broadly in line with the net finance

expense. Tax paid of GBP28 million was significantly lower than the

prior year (2013/14: GBP55 million) primarily due to refunds

secured in a number of regions and a greater focus on the timing of

payments.

Cash costs of exceptional items amounted to GBP49 million

representing the cash investment in restructuring and

infrastructure. Disposals of businesses realised GBP18 million,

whilst acquisitions of GBP28 million comprised Andopack, Italmaceri

and the Kaplast businesses.

The dividend pay-out was GBP94 million, reflecting the payment

in 2014/15 of the interim and final dividend for 2013/14.

Total Group cash inflow for the year was GBP154 million,

compared to an outflow of GBP27 million in the prior year. Net debt

acquired was GBP30 million. Exchange and other movements reduced

net debt by GBP52 million.

Statement of financial position

Shareholders' funds of GBP1,018 million at 30 April 2015 have

reduced from GBP1,131 million at 30 April 2014, principally due to

exchange losses, actuarial losses and dividends, partially offset

by retained profit for the year. Profit attributable to

shareholders was GBP156 million (2013/14: GBP141 million) and

dividends of GBP94 million (2013/14: GBP74 million) were paid

during the year. In addition, actuarial losses of GBP65 million

from the Group's employee benefit schemes were charged to reserves.

Other items recognised directly in reserves include currency

translation losses of GBP105 million, favourable movements on cash

flow hedges of GBP5 million and the related tax charge of GBP12

million.

At 30 April 2015, the Group's net debt was GBP651 million (30

April 2014: GBP827 million). The Group improved its net debt to

earnings before interest, tax, depreciation and amortisation

(EBITDA) ratio from 1.96 times at 30 April 2014 to 1.49 times at 30

April 2015 and complied with all the covenants in its financing

agreements. The Group's financial covenants for the syndicated

committed bank facilities specify an EBITDA to net interest payable

ratio of not less than 4.5 times, a maximum ratio of net debt to

EBITDA of 3.25 times and net assets to exceed GBP360 million.

The covenant calculations exclude from the income statement

exceptional items and any interest arising from the defined benefit

pension schemes. The calculation of net assets excludes the net

asset or liability arising from the defined benefit pension

schemes. At 30 April 2015, the Group had substantial headroom under

its covenants; the most sensitive covenant is net debt to EBITDA

and this had an EBITDA headroom of GBP243 million.

Energy costs

Energy continued to be a significant cost for the Group in

2014/15. The Group's total costs for gas, electricity and diesel

decreased from GBP241 million in 2013/14 to GBP187 million in

2014/15 a 22 per cent decrease, with the benefits of capital

invested in CHP facilities, currency translation, lower prices and

energy efficiency initiatives all contributing. The Group continues

to manage the risks associated with its purchases of energy through

its Energy Procurement Group. By hedging energy costs with

suppliers and financial institutions we aim to reduce the

volatility of energy costs and to provide the Group with a degree

of certainty over future energy costs. Given the significant

reduction in spot natural gas prices, particularly last summer, the

hedging strategy removed opportunities to benefit from the lowest

possible prices.

Capital structure and treasury management

The Group funds its operations from the following sources of

capital: operating cash flow, borrowings, finance and operating

leases, shareholders' equity and, where appropriate, disposals of

non-core businesses. The Group's objective is to achieve a capital

structure that results in an appropriate cost of capital whilst

providing flexibility in short and medium-term funding so as to

accommodate material investments or acquisitions. The Group also

aims to maintain a strong balance sheet and to provide continuity

of financing by having a range of maturities and borrowings from a

variety of sources, supported by its investment grade credit

rating.

The Group's overall treasury objectives are to ensure that

sufficient funds are available for the Group to carry out its

strategy and to manage certain financial risks to which the Group

is exposed.

The Group regularly reviews the level of cash and debt

facilities required to fund its activities. At 30 April 2015, the

Group's committed borrowing facilities totalled c. GBP1.4 billion

of which GBP649 million were undrawn. Total gross borrowings at 30

April 2015 were GBP783 million. At 30 April 2015, the Group's

committed borrowing facilities had a weighted-average maturity of

4.6 years (30 April 2014: 3.3 years).

During the year the Group refinanced its committed bank

borrowing facilities. The syndicated term loan facility, under

which EUR380 million was outstanding at 30 April 2014, was repaid

on 23 May 2014, and replaced with a EUR300 million syndicated bank

term loan facility maturing in May 2017. In addition, on the same

date, the GBP610 million syndicated revolving credit facility was

repaid and replaced with a GBP800 million syndicated bank revolving

credit facility maturing in 2019, but with options to extend this

facility to 2021. Since the year end the maturity of this facility

has been extended to May 2020. The year-on-year interest saving,

assuming the previous facilities were fully drawn at all times is

GBP5 million.

The Group also obtained an investment grade credit rating from

Standard and Poor's (BBB-Stable) which reflects the strong credit

metrics of the Group and the financial discipline of management.

This credit rating allows the Group to issue investment grade bonds

in the public debt markets.

Foreign exchange translation

Approximately 63 per cent of the Group's EBITA in 2014/15 was

earned in euros, 17 per cent in Sterling, 6 per cent in US dollar

and the remainder in other European currencies. In addition to the

headwind to operating profit in 2014/15 of GBP21 million, the

results for the year 2015/16 will be influenced by foreign exchange

translation, where the euro is currently weaker than the average

rate over 2014/15 of 1.29. In relation to the euro, an increase of

1c decreases EBITA by approximately GBP1.6 million and profit

before tax by approximately GBP1.0 million.

Consolidated Income Statement

Year ended 30 April 2015

Before Exceptional After Before Exceptional After

exceptional items exceptional exceptional items exceptional

(note (note

items 3) items items 3) items

2015 2015 2015 2014 2014 2014

Continuing operations Note GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Revenue 2 3,820 - 3,820 4,035 - 4,035

Operating costs (3,485) (31) (3,516) (3,728) (35) (3,763)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Operating profit before

amortisation,

acquisitions and

disposals and SCA

Packaging related

costs 335 (31) 304 307 (35) 272

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Amortisation of intangible

assets

and acquisitions

and disposals (46) (9) (55) (51) - (51)

SCA Packaging related

exceptional costs - - - - (3) (3)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Operating profit 289 (40) 249 256 (38) 218

Finance income 5 3 - 3 3 - 3

Finance costs 5 (35) (4) (39) (44) - (44)

Employment benefit

net finance expense 4 (6) - (6) (7) - (7)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Net financing costs (38) (4) (42) (48) - (48)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Profit after financing

costs 251 (44) 207 208 (38) 170

Share of profit/(loss)

of equity accounted

investments, net

of tax - (7) (7) - (3) (3)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Profit before income

tax 251 (51) 200 208 (41) 167

Income tax (expense)/credit 6 (54) 10 (44) (45) 22 (23)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Profit for the year

from continuing operations 197 (41) 156 163 (19) 144

Discontinued operations

Loss for the year

from discontinued

operations - - - (3) - (3)

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Profit for the year 197 (41) 156 160 (19) 141

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Profit for the year

attributable to:

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Owners of the parent 197 (41) 156 159 (19) 140

Non-controlling interests - - - 1 - 1

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Earnings per share

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

Adjusted from continuing

operations (1)

Basic 7 24.5p 21.4p

Diluted 7 24.3p 21.1p

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

From continuing operations

Basic 7 16.6p 15.3p

Diluted 7 16.4p 15.2p

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

From continuing and

discontinued operations

Basic 16.6p 15.0p

Diluted 16.4p 14.9p

---------------------------- ---- ------------- ----------- ------------ ------------- ----------- ------------

1 Adjusted for amortisation and exceptional items.

Notes

(a) Subject to approval of shareholders at the Annual General

Meeting to be held on 8 September 2015, the final dividend of 7.7p

will be paid on 2 November 2015 to ordinary shareholders on the

register on 2 October 2015.

(b) The financial information presented in this preliminary

announcement is extracted from, and is consistent with, the Group's

audited financial statements for the year ended 30 April 2015. The

financial information set out above does not constitute the

Company's statutory financial statements for the years ended 30

April 2015 or 30 April 2014 but is derived from those financial

statements. Statutory accounts for the year ended 30 April 2014

have been delivered to the Registrar of Companies. Statutory

accounts for the year ended 30 April 2015 will be delivered

following the Company's Annual General Meeting. The auditors'

report on these accounts was not qualified or modified and did not

contain any statement under Sections 498(2) or (3) of the Companies

Act 2006.

(c) The Group's audited financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the EU. The preliminary announcement has been

agreed with the Company's Auditor for release.

(d) Items are presented as exceptional in the accounts where

they are significant items of financial performance that the

Directors consider should be separately disclosed, to assist in the

understanding of the trading and financial results achieved by the

Group (note 3).

Consolidated Statement of Comprehensive Income

Year ended 30 April 2015

2015 2014

GBPm GBPm

------------------------------------------------------ ----- -----

Profit for the year 156 141

Items which will not be reclassified subsequently

to profit or loss

Actuarial (losses)/gains on employee benefits (65) 57

Income tax on items which will not be reclassified

subsequently to profit or loss 10 (18)

Items which may be reclassified subsequently

to profit or loss

Foreign currency translation differences (105) (55)

Movements in cash flow hedges 5 (16)

Income tax on items which may be reclassified

subsequently to profit or loss (22) (4)

------------------------------------------------------- ----- -----

Other comprehensive expense for the year,

net of tax (177) (36)

------------------------------------------------------- ----- -----

Total comprehensive (expense)/income for

the year (21) 105

------------------------------------------------------- ----- -----

Total comprehensive (expense)/income attributable

to:

------------------------------------------------------ ----- -----

Owners of the parent (21) 104

Non-controlling interests - 1

------------------------------------------------------- ----- -----

Consolidated Statement of Financial Position

At 30 April 2015

2015 2014

Note GBPm GBPm

--------------------------------------- ---- ------- -------

Assets

Non-current assets

Intangible assets 855 961

Property, plant and equipment 1,342 1,372

Equity accounted investments 17 24

Other investments 3 8

Deferred tax assets 58 84

Other receivables 5 3

Derivative financial instruments 24 4

--------------------------------------- ---- ------- -------

Total non-current assets 2,304 2,456

--------------------------------------- ---- ------- -------

Current assets

Inventories 256 272

Other investments 1 1

Income tax receivable 38 11

Trade and other receivables 548 650

Cash and cash equivalents 95 98

Derivative financial instruments 13 2

Assets held for sale 46 45

--------------------------------------- ---- ------- -------

Total current assets 997 1,079

--------------------------------------- ---- ------- -------

Total assets 3,301 3,535

--------------------------------------- ---- ------- -------

Liabilities

Non-current liabilities

Interest-bearing loans and borrowings (781) (786)

Employee benefits 4 (200) (151)

Other payables (5) (4)

Provisions (7) (23)

Deferred tax liabilities (121) (163)

Derivative financial instruments (13) (40)

--------------------------------------- ---- ------- -------

Total non-current liabilities (1,127) (1,167)

--------------------------------------- ---- ------- -------

Current liabilities

Bank overdrafts (13) (34)

Interest-bearing loans and borrowings (2) (96)

Trade and other payables (927) (930)

Income tax liabilities (147) (90)

Provisions (34) (49)

Derivative financial instruments (18) (20)

Liabilities held for sale (15) (18)

--------------------------------------- ---- ------- -------

Total current liabilities (1,156) (1,237)

--------------------------------------- ---- ------- -------

Total liabilities (2,283) (2,404)

--------------------------------------- ---- ------- -------

Net assets 1,018 1,131

--------------------------------------- ---- ------- -------

Equity

Issued capital 94 94

Share premium 715 715

Reserves 210 323

--------------------------------------- ---- ------- -------

Total equity attributable to owners of

the parent 1,019 1,132

Non-controlling interests (1) (1)

--------------------------------------- ---- ------- -------

Total equity 1,018 1,131

--------------------------------------- ---- ------- -------

Consolidated Statement of Changes in Equity

Year ended 30 April 2015

Total

reserves

attributable

to

owners

Share Share Hedging Translation Own Retained of the Non-controlling Total

capital premium reserve reserve shares earnings parent interests equity

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

At 1 May 2013 93 710 (17) 65 (2) 238 1,087 (2) 1,085

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Profit for the

year - - - - - 140 140 1 141

Actuarial

gains

on employee

benefits - - - - - 57 57 - 57

Foreign

currency

translation

differences - - - (55) - - (55) - (55)

Cash flow

hedges

fair value

changes - - (16) - - - (16) - (16)

Income tax on

other

comprehensive

income - - 2 (6) - (18) (22) - (22)

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Total comprehensive

income/(expense) - - (14) (61) - 179 104 1 105

-------------------- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Issue of share

capital 1 5 - - - - 6 - 6

Employee share

trust - - - - 2 (2) - - -

Share-based

payment

expense (net

of tax) - - - - - 9 9 - 9

Dividends paid 8 - - - - - (74) (74) - (74)

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Other changes in

equity in the year 1 5 - - 2 (67) (59) - (59)

-------------------- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

At 30 April

2014 94 715 (31) 4 - 350 1,132 (1) 1,131

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Profit for the

year - - - - - 156 156 - 156

Actuarial

losses

on employee

benefits - - - - - (65) (65) - (65)

Foreign

currency

translation

differences - - - (105) - - (105) - (105)

Cash flow

hedges

fair value

changes - - 5 - - - 5 - 5

Income tax on

other

comprehensive

income - - (1) (21) - 10 (12) - (12)

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Total comprehensive

(expense)/income - - 4 (126) - 101 (21) - (21)

-------------------- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Share-based

payment

expense (net

of tax) - - - - - 2 2 - 2

Dividends paid 8 - - - - - (94) (94) - (94)

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Other changes in

equity in the year - - - - - (92) (92) - (92)

-------------------- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

At 30 April

2015 94 715 (27) (122) - 359 1,019 (1) 1,018

-------------- ---- ------- ------- ------- ----------- ------ -------- ------------ --------------- -------

Consolidated Statement of Cash Flows

Year ended 30 April 2015

2015 2014

Continuing operations Note GBPm GBPm

------------------------------------------------- ---- ----- -----

Operating activities

Cash generated from operations 9 463 309

Interest received 3 3

Interest paid (37) (46)

Tax paid (28) (55)

------------------------------------------------- ---- ----- -----

Cash flows from operating activities 401 211

------------------------------------------------- ---- ----- -----

Investing activities

Acquisition of subsidiary businesses, net

of cash and cash equivalents 12 (28) (27)

Divestment of subsidiary and equity accounted

businesses, net of cash and cash equivalents 12 18 12

Capital expenditure (167) (174)

Proceeds from sale of property, plant and

equipment and intangible assets 18 18

Decrease in restricted cash 3 16

Loan to associate (2) -

------------------------------------------------- ---- ----- -----

Cash flows used in investing activities (158) (155)

------------------------------------------------- ---- ----- -----

Financing activities

Proceeds from issue of share capital - 6

Decrease in borrowings (352) -

Increase in borrowings 233 8

Repayment of finance lease obligations - (2)

Dividends paid to Group shareholders 8 (94) (74)

------------------------------------------------- ---- ----- -----

Cash flows used in financing activities (213) (62)

------------------------------------------------- ---- ----- -----

Increase/(decrease) in cash and cash equivalents

from continuing operations 30 (6)

Discontinued operations:

Cash used in discontinued operations - (4)

------------------------------------------------- ---- ----- -----

Increase/(decrease) in cash and cash equivalents 30 (10)

Net cash and cash equivalents at 1 May 64 78

Reclassification to held for sale (6) -

Exchange losses on cash and cash equivalents (6) (4)

------------------------------------------------- ---- ----- -----

Net cash and cash equivalents at 30 April 82 64

------------------------------------------------- ---- ----- -----

Notes to the financial statements

1. Basis of preparation

The consolidated financial statements have been prepared and

approved by the Directors in accordance with International

Financial Reporting Standards as adopted by the EU ('adopted

IFRSs'), and have also applied IFRSs as issued by the International

Accounting Standards Board (IASB).

The consolidated financial statements are prepared on the

historical cost basis with the exception of assets and liabilities

of certain financial instruments, employee benefit plans and

share-based payments that are stated at their fair value.

The consolidated financial statements have been prepared on a

going concern basis.

The preparation of consolidated financial statements requires

management to make judgements, estimates and assumptions that

affect whether and how policies are applied and the reported

amounts of assets and liabilities, income and expenses.

No changes have been made to the Group's accounting policies in

the year ended 30 April 2015.

The accounting policies, presentation methods and methods of

computation followed are the same as those detailed in the 2014

Annual Report and Accounts, which is available on the Group's

website (www.dssmith.com/investors/results-and-presentations).

Whilst the financial information included in the preliminary

announcement has been computed in accordance with IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS.

Notes to the financial statements continued

2. Segment reporting

Operating segments

DACH Central

and Europe Total

Western Northern and Continuing

UK Europe Europe Italy Plastics Operations

Year ended 30 April 2015 Note GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

External revenue 905 941 922 750 302 3,820

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

EBITDA 107 99 119 89 38 452

Depreciation (26) (34) (23) (24) (10) (117)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Operating profit (1) 81 65 96 65 28 335

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Unallocated items:

Amortisation (46)

Exceptional items 3 (40)

-----------

Total operating profit

(continuing operations) 249

-----------

Analysis of total assets

and total liabilities

Segment assets 709 728 829 612 174 3,052

----- ------- --------- ------- -------- -----------

Unallocated items:

Equity accounted investments

and other investments 21

Derivative financial instruments 37

Cash and cash equivalents 95

Tax 96

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Total assets 3,301

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Segment liabilities (250) (314) (166) (188) (61) (979)

----- ------- --------- ------- -------- -----------

Unallocated items:

Borrowings and accrued

interest (805)

Derivative financial instruments (31)

Tax (268)

Employee benefits (200)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Total liabilities (2,283)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Capital expenditure 42 35 39 41 10 167

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

1 Adjusted for amortisation and exceptional items.

DACH Central

and Europe Total

Western Northern and Continuing

UK Europe Europe Italy Plastics Operations

Year ended 30 April 2014 Note GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

External revenue 929 1,017 1,029 739 321 4,035

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

EBITDA 92 102 126 73 37 430

Depreciation (28) (35) (30) (20) (10) (123)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Operating profit (1) 64 67 96 53 27 307

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Unallocated items:

Amortisation (51)

Exceptional items 3 (38)

-----------

Total operating profit

(continuing operations) 218

-----------

Analysis of total assets

and total liabilities

Segment assets 708 790 981 641 183 3,303

----- ------- --------- ------- -------- -----------

Unallocated items:

Equity accounted investments

and other investments 33

Derivative financial instruments 6

Cash and cash equivalents 98

Tax 95

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Total assets 3,535

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Segment liabilities (230) (319) (192) (196) (76) (1,013)

----- ------- --------- ------- -------- -----------

Unallocated items:

Borrowings and accrued

interest (927)

Derivative financial instruments (60)

Tax (253)

Employee benefits (151)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Total liabilities (2,404)

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

Capital expenditure 40 41 47 35 11 174

------------------------------------ ---- ----- ------- --------- ------- -------- -----------

1 Adjusted for amortisation and exceptional items.

Notes to the financial statements continued

2. Segment reporting CONTINUED

Geographical areas

In presenting information by geographical area, external revenue

is based on the geographical location of customers.

External revenue

------------------

2015 2014

Continuing operations GBPm GBPm

---------------------- -------- --------

UK 865 933

France 623 688

Germany 578 613

Italy 429 433

Rest of the World 1,325 1,368

-------------------------- -------- --------

3,820 4,035

---------------------- -------- --------

3. Exceptional items

Items are presented as exceptional in the financial statements

where they are significant items of financial performance that the

Directors consider should be separately disclosed to assist in the

understanding of the trading and financial results of the Group.

Such items include business disposals, restructuring and

optimisation, acquisition related and integration costs, and

impairments.

2015 2014

Continuing operations GBPm GBPm

-------------------------------------------- ----- -----

SCA Packaging integration costs - (42)

SCA Packaging acquisition finalisation - 39

SCA Packaging related exceptional costs - (3)

Acquisition related costs (4) (4)

Other restructuring costs (31) (29)

Impairment of assets (4) (5)

Rebranding - (4)

(Loss)/gain on divestments (5) 4

Other 4 3

-------------------------------------------- ----- -----

Total pre-tax exceptional items (recognised

in operating profit) (40) (38)

Income tax credit on exceptional items 10 22

Share of exceptional loss of associate,

net of tax (7) (3)

Exceptional finance costs (4) -

-------------------------------------------- ----- -----

Total post-tax exceptional items (41) (19)

-------------------------------------------- ----- -----

2014/15

Acquisition costs of GBP4m relate to professional advisory,

legal and consultancy fees relating to the review of potential

deals, and deals completed during the year.

Of the GBP31m other restructuring costs, GBP10m relates to UK

site closures and reorganisations, GBP11m relates to restructuring

of businesses in the DACH and Northern Europe region and GBP3m

relates to restructuring of businesses in the Recycling

division.

Impairment of assets of GBP4m relate to the impairment of assets

in UK Packaging and France Packaging.

The loss on divestments of GBP5m comprises a GBP3m gain on the

disposal of the Foam business in Denmark and Sweden in September

2014, a gain of GBP2m on the step acquisition of the Italian

Recycling business from 50% to 100% in July 2014, offset by a loss

of GBP9m on the divestment of the Nantes paper mill in France in

January 2015 and other losses on divestment of GBP1m.

Other exceptional items of GBP4m principally relate to the

release of acquisition related provisions of GBP16m, partially

offset by the costs of continuing UK centralisation projects of

GBP9m.

The share of exceptional loss of associate relates to the

Group's share of post-tax foreign exchange losses recognised in the

Group's Ukrainian associate Rubezhansk as a result of the

significant decline in the value of the Ukrainian currency,

Hryvnia, during the local geopolitical crisis.

Exceptional finance costs of GBP4m relate to the write-off of

unamortised finance costs relating to the SCA Packaging acquisition

following the refinancing of borrowings in May 2014.

The above items give rise to a net income tax credit at the

local applicable tax rate with the exception of gains and losses on

some of the divestments which are not subject to tax under local

rules, impairments not deductible for tax purposes, and non-tax

deductible deal related advisory fees in relation to acquisitions

and disposals.

Notes to the financial statements continued

3. Exceptional items CONTINUED

2013/14

SCA Packaging integration costs relate to the completion of

integration projects which began in 2012/13.

The SCA Packaging completion process concluded in December 2013.

Together with the effects of the subsequent acquisition of the

power plant adjacent to the paper mill in Italy, and the release of

an onerous contract provision recognised in the statement of

financial position on acquisition of SCA Packaging, the Group has

recorded a gain of GBP39m.

Acquisition costs of GBP4m primarily relate to professional

advisory, legal and consultancy fees relating to the finalisation

of the completion accounts process of the acquisition of SCA

Packaging.

In November 2013, the Group announced a major rebranding,

bringing the businesses together under one unified corporate

identity. Of the GBP4m cost in the year, the majority related to

signage, internal and external communication and marketing

costs.

Of the GBP29m other restructuring costs, GBP12m relates to

restructuring and rationalisation in the Plastics businesses, GBP7m

relates to UK site closures and reorganisations, and GBP4m relates

to restructuring of businesses in the DACH region.

The income tax credit on exceptional items includes the reversal

of prior year provisions for exceptional tax and the tax effect of

exceptional items that are subject to tax.

4. Employee benefits

Movements in the net employee benefit deficit recognised in the

statement of financial position

2015 2014

GBPm GBPm

-------------------------------------------------- ----- -----

Employee benefit deficit 1 May (151) (214)

Expense recognised in operating profit (4) (7)

Employment benefit net finance expense (excluding

Pension Protection Fund levy) (4) (7)

Employer contributions 17 19

Other payments and contributions 6 -

Actuarial (losses)/gains (65) 57

Currency translation 10 1

Reclassification (9) -

-------------------------------------------------- ----- -----

Employee benefit deficit at 30 April (200) (151)

Deferred tax asset 48 40

-------------------------------------------------- ----- -----

Net employee benefit deficit at 30 April (152) (111)

-------------------------------------------------- ----- -----

The table above is the aggregate value of all Group employee

benefit schemes including both overseas and UK schemes. The Group's

principal funded, defined benefit pension scheme, the DS Smith

Group Pension scheme ('the Group scheme'), is in the UK and is now

closed to future accrual.

The Group also operates various local post-retirement

arrangements for overseas operations, pre-retirement benefits and

long-service awards and a small UK unfunded scheme.

5. Finance income and costs

2015 2014

Continuing operations GBPm GBPm

-------------------------------------- ----- -----

Interest income from financial assets (1) (1)

Other (2) (2)

-------------------------------------- ----- -----

Finance income (3) (3)

-------------------------------------- ----- -----

Interest on loans and overdrafts 37 41

Other 2 3

-------------------------------------- ----- -----

Finance costs 39 44

-------------------------------------- ----- -----

Notes to the financial statements continued

6. Income tax expense

2015 2014

Continuing operations GBPm GBPm

-------------------------------------------------- ----- -----

Current tax expense

Current year (73) (61)

Adjustment in respect of prior years 1 6

-------------------------------------------------- ----- -----

(72) (55)

-------------------------------------------------- ----- -----

Deferred tax expense

Origination and reversal of temporary differences 10 1

Reduction in UK tax rate - 2

Adjustment in respect of prior years 8 7

-------------------------------------------------- ----- -----

18 10

Total income tax expense before exceptional

items (54) (45)

Tax relating to exceptional items (note 3) 10 22

-------------------------------------------------- ----- -----

Total income tax expense in the income statement

from continuing operations (44) (23)

-------------------------------------------------- ----- -----

Discontinued operations

Current tax expense adjustment in respect of

prior years - (3)

-------------------------------------------------- ----- -----

Total income tax expense in the income statement

from discontinued operations - (3)

-------------------------------------------------- ----- -----

The reconciliation of the actual tax charge to that at the

domestic corporation tax rate is as follows:

2015 2014

GBPm GBPm

------------------------------------------------ ----- -----

Profit before income tax 200 167

Share of (profit)/loss of associates 7 3

------------------------------------------------ ----- -----

Profit before tax and share of (profit)/loss

of associates 207 170

------------------------------------------------ ----- -----

Income tax at the domestic corporation tax

rate of 20.92% (2013/14: 22.83%) (43) (39)

Effect of additional taxes and tax rates in

overseas jurisdictions (19) (14)

Additional items deductible for tax purposes 18 35

Non-deductible expenses (17) (25)

Non-taxable gains 3 -

Release of prior year provisions in relation

to acquired businesses 2 -

Change in unrecognised deferred tax assets

in relation to acquired businesses 6 -

Adjustment in respect of prior years 9 15

Effect of change in UK corporation tax rate (3) 2

------------------------------------------------ ----- -----

Income tax expense - total Group (44) (26)

------------------------------------------------ ----- -----

Income tax expense from continuing operations (44) (23)

Income tax expense from discontinued operations - (3)

------------------------------------------------ ----- -----

Notes to the financial statements continued

7. Earnings per share

Basic earnings per share from continuing operations

2015 2014

----------------------------------------------- ------- -------

Profit from continuing operations attributable

to ordinary shareholders GBP156m GBP143m

----------------------------------------------- ------- -------

Weighted average number of ordinary shares 941m 932m

----------------------------------------------- ------- -------

Basic earnings per share 16.6p 15.3p

----------------------------------------------- ------- -------

Diluted earnings per share from continuing operations

2015 2014

----------------------------------------------- ------- -------

Profit from continuing operations attributable

to ordinary shareholders GBP156m GBP143m

----------------------------------------------- ------- -------

Weighted average number of ordinary shares 941m 932m

Potentially dilutive shares issuable under

share-based payment arrangements 9m 8m

----------------------------------------------- ------- -------

Weighted average number of ordinary shares

(diluted) 950m 940m

----------------------------------------------- ------- -------

Diluted earnings per share 16.4p 15.2p

----------------------------------------------- ------- -------

Basic earnings per share from discontinued operations

2015 2014

------------------------------------------- ---- -------

Loss attributable to ordinary shareholders - (GBP3m)

------------------------------------------- ---- -------

Weighted average number of ordinary shares 941m 932m

------------------------------------------- ---- -------

Basic earnings per share - (0.3p)

------------------------------------------- ---- -------

Diluted earnings per share from discontinued operations

2015 2014

------------------------------------------- ---- -------

Loss attributable to ordinary shareholders - (GBP3m)

------------------------------------------- ---- -------

Weighted average number of ordinary shares 941m 932m

Potentially dilutive shares issuable under

share-based payment arrangements n/a n/a