TIDMPANR

RNS Number : 2623L

Pantheon Resources PLC

30 December 2022

30 December, 2022

Pantheon Resources Plc

Operational update

Pantheon Resources plc ("Pantheon" or the "Company" or the

"Group"), the AIM-quoted oil company with 100% working interest in

approximately 153,000 acres located adjacent to transportation and

pipeline infrastructure on State Land on the Alaska North Slope, is

pleased to provide the following operational update on the Alkaid

#2 well.

Operational update - Alkaid #2

As previously announced, the lateral section of the Alkaid #2

wellbore is partially blocked with approximately 1,000 feet of frac

sand which (i) has restricted tested flow rates due to the lack of

contribution from the blocked section, and (ii) has necessitated a

more conservative testing protocol in order to not exacerbate the

blockage, which has resulted in a slower 'cleanup phase'.

Encouragingly, despite the blockage, the well is flowing

naturally into Pantheon's recently commissioned permanent

production facilities located on the Dalton Highway at a rate of

over 500 barrels per day ("bpd") of hydrocarbon liquids which

includes oil, condensate and natural gas liquids ("NGL's"), as well

as significant natural gas, from an estimated 4,000 ft of lateral.

Importantly, it is estimated that the well is still less than 40%

of the way through cleanup phase, so potential exists for these

rates to further improve. Crude oil is processed on location and

oil sales are underway. To date over 7,000 barrels of 38-41 degree

API oil has been trucked and sold into the Trans Alaska Pipeline

System. This oil is lighter than existing North Slope oil

production and hence a welcome addition to the production

stream.

A proportion of the gas production is used to generate power

across all the facilities that are now electrically powered and

operational, reducing flaring and providing cost savings to

operations at this location.

Production

At this early clean up stage, Alkaid #2 is delivering

hydrocarbon liquid rates near expectations over the 4,000 ft

unblocked section, with gas rates well above original prognosis.

Sustained daily production over more than the last 30 days has

averaged over 500 barrels per day of hydrocarbon liquids, of which

circa 200 bpd of crude oil and over 300 bpd being condensate and

NGLs, all of which can be sold either by blending into the pipeline

or trucking to an Alaskan refinery. Gas rates are above 2.5 mmcfd

which is higher than originally anticipated, however this is not

believed to be from a gas cap but coming out of solution near the

well bore. This is not considered a long term problem as excess gas

could be reinjected into the reservoir for pressure maintenance.

This combined hydrocarbon deliverability to date confirms the

forecasted reservoir properties and highlights the potential

deliverability of the Alkaid reservoir. The Company is confident

there is upside above these rates as it is apparent that only a

portion of the completed wellbore is contributing to the production

stream; and it is estimated that the well has produced to date less

than 40% of the volume of frac fluid used in the stimulations.

Sand

As previously announced, the flow rate is restricted by the

accumulation of sand in the horizontal portion of the well bore

also slows down well cleanup. This is not uncommon in long

horizontal wells that have been treated with multi stage fracture

stimulations. With the correct equipment, removing the sand and

cleaning the well is a simple operation which is currently planned

for January. The sand blockage in the well bore was identified

early in the production test, however no winterized workover rig

was available which prohibited the removal of the tubing and a

proper clean out at that time. Instead, a coiled tubing unit

("CTU") was used to conduct a through-tubing cleanout, but was

unable to reach the full well depth and hence was partially

successful with more than 1,000 ft remaining blocked and untouched

by the CTU clean out. A rig is available in January to clean out

the entire well bore and is expected to open the entirety of the

lateral allowing the full potential of the well to be revealed and

at the same time accelerating the clean up phase.

In advance of the clean out the Company plans to shut in and

perform reservoir diagnostics, a normal oilfield practice, to

gather additional data.

Jay Cheatham, CEO, said: "The Alkaid #2 well is delivering a

total hydrocarbon liquid mixture exceeding 500 bpd from what we

believe is from only c.4,000 feet of lateral. The liquid mixture

includes high quality oil with associated condensates and NGL that

are saleable through TAPS. The total hydrocarbon production rates

confirm we have tapped into a significant hydrocarbon system. To

have this level of production at this stage in the "clean up" phase

of production testing remains positive. The current reservoir

performance is compromised by the sand blockage and we will not

have a true indication of reservoir performance until the entire

well bore is clean. We are deliberately using a conservative

approach in flow testing of not 'pulling on the reservoir' too

hard, allowing the natural healing of the fractures to minimise

future sand flow. Overall, we're very encouraged with the

preliminary results of the production test and the fact that we

have permanent facilities for treating and selling our oil as well

as utilizing our gas to power our operations on location. Despite

this encouragement however, we remind shareholders as we always do,

that a definitive assessment of the well cannot be made until flow

testing operations have concluded and we are still too early in the

process.

"We expect flow rates after the clean out to improve. The

location of Alkaid, immediately adjacent to the Dalton Highway,

again highlights the significant advantage we have to other

operators on the North Slope in expediting our oil developments.

These initial positive testing results have increased our

confidence in pursuing an Alkaid #3 well, subject to funding, which

would be a high impact appraisal well to test the Shelf Margin

Deltaic, the reservoir target immediately above the discovered oil

at Alkaid #1 and #2. A success at Alkaid #3 would be a commercially

impactful well with material resource implications and would also

leverage off the established production facilities for important

near term cashflow and it could be drilled outside of the

traditional winter drilling season."

Glossary

Bpd Barrells per day

Bopd Barrells of oil per day

Mmcfd Millions of cubic feet per day

Ft Feet

In accordance with the AIM Rules - Note for Mining and Oil &

Gas Companies - June 2009, the information contained in this

announcement has been reviewed and signed off by Robert Rosenthal,

a qualified Petroleum Geologist, who has over 40 years' relevant

experience within the sector.

The information contained within this Announcement is deemed by

Pantheon Resources PLC to constitute inside information as

stipulated under the Market Abuse Regulation (EU) No. 596/2014 as

it forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR").

Cautionary Statement: Certain statements and estimates contained

in this announcement carry an associated risk of accuracy as such

statements and estimates are based upon information available at

the time of making such statements. Actual results could differ

materially from expectations set out in such statements. Among

other factors, this could be as a result of changes in economic,

market, geological and political factors, the success of future

drilling and geological success, the risk of future drilling

changes in the regulatory environment and other government actions,

fluctuations in the price of oil and exchange rates, and business

and operational risk management.

-Ends-

Further information:

Pantheon Resources plc

Jay Cheatham, CEO +44 20 7484 5361

Justin Hondris, Director, Finance and Corporate

Development

Canaccord Genuity L imited (Nominated Adviser

and broker)

Henry Fitzgerald-O'Connor, James Asensio, Gordon

Hamilton +44 20 7523 8000

BlytheRay

Tim Blythe, Megan Ray, Matthew Bowld +44 20 7138 3204

Notes to Editors

Pantheon Resources plc is an AIM listed Oil & Gas company

focused on several large projects located on the North Slope of

Alaska ("ANS"), onshore USA where it has a 100% working interest in

153,000 highly prospective acres with potential for multi billion

barrels of oil recoverable. A major differentiator to other ANS

projects is its close proximity to transport and pipeline

infrastructure which offers a significant competitive advantage to

Pantheon, allowing for materially lower capital costs and much

quicker development times. The Group's stated objective is to

create material value for its stakeholders through oil exploration,

appraisal and development activities in high impact, highly

prospective conventional assets, in the USA; a highly established

region for energy production with infrastructure, skilled personnel

and low sovereign risk. All operations are onshore USA, with

drilling costs materially below that of offshore wells.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGGBDDRXXDGDG

(END) Dow Jones Newswires

December 30, 2022 02:00 ET (07:00 GMT)

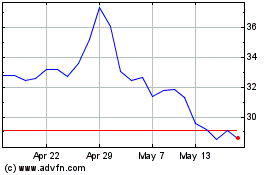

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From Apr 2023 to Apr 2024