TIDMNWF

RNS Number : 5188V

NWF Group PLC

31 January 2017

NWF Group plc

NWF Group plc: Half Year results for the period ended 30

November 2016

NWF Group plc ("NWF" or "the Group"), the specialist

agricultural and distribution business delivering feed, food and

fuel across the UK, today announces its half year results for the

period ended 30 November 2016.

Financial highlights 2016 2015 %

-------------------------- ------------ ------------ --------

Revenue GBP255.9m GBP224.6m +13.9%

Headline operating

profit* GBP2.2m GBP2.8m (21.4%)

Headline profit

before taxation* GBP2.0m GBP2.6m (23.1%)

Fully diluted headline

EPS* 3.3p 4.3p (23.3%)

Fully diluted EPS 2.1p 2.9p (27.6%)

Interim dividend

per share 1.0p 1.0p -

Net debt GBP19.1m GBP10.4m +83.7%

Net debt to EBITDA 1.6x 0.8x

-------------------------- ------------ ------------ --------

* Headline operating profit excludes exceptional items. Headline

profit before taxation excludes exceptional items and the net

finance cost in respect of the Group's defined benefit pension

scheme and the taxation effect thereon where relevant. Statutory

profit before taxation was GBP1.3 million (2015: GBP1.8

million).

Operational highlights:

-- Revenue growth in all three divisions - reflecting

acquisition contributions, higher activity levels and increased

commodity prices in Feeds and Fuels

-- Profitability impacted by weak first quarter performance due

to a warm summer and rapid commodity price increases

-- Development and expansion of the feed mill infrastructure being delivered successfully

-- Board's full year expectations for performance and net debt levels maintained

Divisional highlights:

-- Feeds - headline operating loss of GBP0.3 million (H1 2015:

profit of GBP0.3 million). The business increased volumes in the

period, benefitting from acquisitions, against a tough market

backdrop. However, profitability was adversely impacted by lower

market demand for feed in the first quarter and the rapid increase

in commodity prices as a result of global dynamics and currency

movements. Our investment in mill capacity, both in the North and

Cheshire, continues on track and will benefit the division going

forward.

-- Food - headline operating profit of GBP1.6 million (H1 2015:

GBP1.4 million). A strong result achieved through delivering

additional volume demand efficiently and managing the utilisation

of external storage facilities effectively. Service levels were

maintained at 99.7%.

-- Fuels - headline operating profit of GBP0.9 million (H1 2015:

GBP1.1 million). Delivered strong volume growth from organic and

acquisition development to offset the lower levels of market demand

for heating oil over warm summer/autumn months.

Richard Whiting, Chief Executive, NWF Group plc, commented:

"NWF has delivered growth across all three divisions in the

first half of the year despite difficult market conditions. The

Group's investment in the expansion and development of new mill

capacity in the North and Cheshire has proceeded as planned and net

debt is in line with expectations. Current trading is in line with

the Board's full year expectations."

For further information please visit www.nwf.co.uk or

contact:

Richard Whiting, Reg Hoare /Andrew Leach Justin Jones /

Chief Executive / Mike Bell

Kelsey Traynor Peel Hunt LLP

NWF Group plc MHP Communications (Nominated Adviser)

Tel: 01829 260 Tel: 020 3128 8100 Tel: 020 7418 8900

260

CHAIRMAN'S STATEMENT

NWF has continued to develop its business both organically and

as a result of planned development expenditure on new feed capacity

in both the Northern and Cheshire mills. The first quarter (as

reported at the time of the AGM in September 2016) presented some

challenging conditions with the ruminant feed market being impacted

by low milk prices and the fuel market by a lack of demand for

heating oil as a result of the warm summer/autumn period. Feeds has

increased volumes against a lower level of market demand, Food has

increased activity levels on the back of increased demand from our

customers and Fuels' volumes have increased significantly to both

offset the lack of demand for heating oil and fully utilise the

tanker fleet.

Net debt at the period end was GBP19.1 million (H1 2015: GBP10.4

million), as a result of the acquisition of Jim Peet Agriculture

and planned development expenditure on mill expansions, with net

debt to EBITDA at 1.6x (H1 2015: 0.8x). The Group's banking

facilities of GBP65.0 million are committed to October 2019 and NWF

continues to operate with substantial headroom.

Results

Revenue for the half year ended 30 November 2016 was 13.9%

higher at GBP255.9 million (H1 2015: GBP224.6 million) as a result

of acquisitions, higher levels of activity in all three divisions

and increased commodity prices in Feeds and Fuels. Headline

operating profit was lower at GBP2.2 million (H1 2015: GBP2.8

million), due to weak trading conditions in the first quarter and

the adverse impact of rapidly rising commodity prices in the Feeds

division. Headline profit before taxation(1) was GBP2.0 million (H1

2015: GBP2.6 million). An exceptional item of GBP0.4 million

relates to the costs of restructuring the Feeds business as the new

mill investment is made.

Headline basic earnings per share(1) was 3.3p (H1 2015: 4.3p)

and headline diluted earnings per share(1) was 3.3p (H1 2015:

4.3p).

Operating cash inflow for the period, before movements in

working capital, amounted to GBP3.3 million (H1 2015: GBP3.7

million). Whilst the focus on working capital management has

continued, there was an increase in working capital at the end of

November 2016 due to the increased activity levels. This resulted

in net cash absorbed by operations of GBP2.3 million (H1 2015: net

cash generated of GBP3.2 million).

Net capital expenditure in the period was GBP6.1 million (H1

2015: GBP2.2 million), representing GBP3.6 million of development

spend and a normal level of replacement capital (GBP2.5

million).

Net assets at 30 November 2016 reduced to GBP34.5 million (30

November 2015: GBP36.6 million) largely due to the increase in the

accounting valuation of the pension deficit. The IAS 19R valuation

has increased from GBP19.2 million to GBP21.9 million primarily as

a result of a reduction in the discount rate from 3.90% to 3.05%. A

triennial valuation is being undertaken as at 31 December 2016.

1 Excluding GBP0.3 million (H1 2015: GBP0.4 million) net finance

cost in respect of the defined benefit pension scheme, and

exceptional restructuring costs of GBP0.4 million (H1 2015: GBP0.4

million) and, where applicable, the tax effect thereon.

Dividend

The Board has approved an interim dividend per share of 1.0p (H1

2015: 1.0p). This will be paid on 2 May 2017 to shareholders on the

register on 24 March 2017. The shares will trade ex-dividend on 23

March 2017.

Operations

Feeds

Revenue increased by 4.8% to GBP65.1 million (H1 2015: GBP62.1

million) as a result of increased volumes and commodity prices.

Headline operating loss was GBP0.3 million, compared to a GBP0.3

million profit for the same period last year.

Volumes were up 1.5% to 268,000 tonnes (H1 2015: 264,000 tonnes)

in spite of market demand being depressed as a result of a lower

milk price, particularly in the first quarter. The lower milk

prices have continued to impact feed prices and this has been

exacerbated by a significant increase in commodity costs. Across a

basket of products, commodity costs increased by over 20% from

March to November 2016 as a result of both underlying commodity

prices and adverse movements in exchange rates. Average milk prices

at the end of November were 25.5p (November 2015: 24.6p), but were

as low as 20.5p in June 2016. The acquisitions made in the last

eighteen months have continued to perform in line with

expectations.

Food

Revenue increased by 4.1% to GBP20.1 million (H1 2015: GBP19.3

million). Headline operating profit was GBP1.6 million (H1 2015:

GBP1.4 million).

The business benefited from increased activity levels both in

storage and distribution. Activity at Wardle and in external

warehouse locations has been managed efficiently to meet this

increased level of demand and importantly a service level of 99.7%

was maintained in the period. Average storage levels in the period

were 103,000 pallet spaces (H1 2015: 99,000), and transport

activity over 10% up on prior year. Post period end we have entered

into a two-year agreement with Princes Limited to store a reduced

number of pallets at Wardle as they utilise existing warehouse

capacity within their network.

Fuels

Revenue increased by 19.2% to GBP170.7 million (H1 2015:

GBP143.2 million) as a result of increased activity levels and the

benefit of Staffordshire Fuels, which was acquired in November

2015. Headline operating profit was GBP0.9 million (H1 2015: GBP1.1

million).

Volumes increased by 17.4% to 250 million litres (H1 2015: 213

million litres) with the most significant growth in commercial

customers for road diesel and gas oil, which attract a lower gross

margin than heating oil. This area continues to develop

successfully and helped to partially offset the lower market demand

for heating oil in the warm summer months. The new start up depots

at Home Counties and Martlet are performing well, as is

Staffordshire Fuels. Brent Crude was more stable than during the

previous year at an average of $48.20 per barrel (H1 2015: $52.19

per barrel) and ended the reported period at $50.47 per barrel.

Board

As announced on 4 January 2017, Chris Belsham has been appointed

as Group Finance Director and will join the Group in June 2017. In

addition, after 10 years' service as Chairman, I have informed the

Board of my decision to step down at this year's AGM to be held in

September 2017. I am pleased to confirm that Philip Acton,

currently non-executive Director of NWF and Chairman of the

Remuneration Committee, has accepted the position of Chairman which

he will commence upon the conclusion of the AGM.

Outlook and future prospects

We have performed as planned since the period end. In Feeds, our

customers have seen some further positive increases in milk prices

and the new milling capacity comes on line to optimise our

infrastructure, deliver efficiency benefits and meet increased

demand. In the Food division, demand has remained robust and we

maintained our high service levels over the crucial Christmas

period. The division is now focused on new business development to

offset the reduced demand from Princes Limited. In Fuels, oil

prices have now moved to over $50 per barrel and the business is

trading well in the normal winter conditions experienced to

date.

Having invested significantly in new feed mill and fuel capacity

and successfully integrated recent acquisitions in both areas, we

continue to focus on growth initiatives, both organic and through

further targeted acquisitions.

Overall the Group continues to trade in line with the Board's

expectations and I look forward to updating shareholders later this

year.

Mark Hudson

Chairman

31 January 2017

Condensed consolidated income statement

for the half year ended 30 November 2016 (unaudited)

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

Note GBPm GBPm GBPm

----------------------------------- ---- ------------ ------------ -------

Revenue 3 255.9 224.6 465.9

Operating expenses (254.1) (222.2) (458.8)

----------------------------------- ---- ------------ ------------ -------

Headline operating profit(1) 2.2 2.8 8.7

Exceptional items 4 (0.4) (0.4) (1.6)

----------------------------------- ---- ------------ ------------ -------

Operating profit 3 1.8 2.4 7.1

Finance costs 5 (0.5) (0.6) (1.1)

----------------------------------- ---- ------------ ------------ -------

Headline profit before taxation(1) 2.0 2.6 8.3

Net finance cost in respect

of the defined benefit pension

scheme (0.3) (0.4) (0.7)

Exceptional items 4 (0.4) (0.4) (1.6)

----------------------------------- ---- ------------ ------------ -------

Profit before taxation 1.3 1.8 6.0

Income tax expense(2) 6 (0.3) (0.4) (1.2)

----------------------------------- ---- ------------ ------------ -------

Profit for the period attributable

to equity shareholders 1.0 1.4 4.8

----------------------------------- ---- ------------ ------------ -------

Earnings per share (pence)

Basic 7 2.1 2.9 9.8

Diluted 7 2.1 2.9 9.7

---- ------------ ------------ -------

Headline earnings per share

(pence)(1)

Basic 7 3.3 4.3 13.6

Diluted 7 3.3 4.3 13.5

----------------------------------- ---- ------------ ------------ -------

1 Headline operating profit is statutory operating profit of

GBP1.8 million (H1 2015: GBP2.4 million) before exceptional items

of GBP0.4 million (GBP0.4 million). Headline profit before taxation

is statutory profit before taxation of GBP1.3 million (H1 2015:

GBP1.8 million) after adding back the net finance cost in respect

of the Group's defined benefit pension scheme of GBP0.3 million (H1

2015: GBP0.4 million) and the exceptional items and the taxation

effect thereon where relevant.

2 Taxation on exceptional items in the current period has

reduced the charge by GBP0.1 million (H1 2015: GBP0.1 million).

Condensed consolidated statement of comprehensive income

for the half year ended 30 November 2016 (unaudited)

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2015

GBPm GBPm GBPm

-------------------------------------- ------------ ------------ -------

Profit for the period attributable

to equity shareholders 1.0 1.4 4.8

Items that will never be reclassified

to profit or loss:

Re-measurement (loss)/gain on the

defined benefit pension scheme (3.7) 0.9 0.2

Tax on items that will never be

reclassified to profit or loss 0.6 (0.2) (0.3)

-------------------------------------- ------------ ------------ -------

Total comprehensive (expense)/income

for the period (2.1) 2.1 4.7

-------------------------------------- ------------ ------------ -------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated balance sheet

as at 30 November 2016 (unaudited)

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

---------------------------------- ----------- ----------- ------

Non-current assets

Property, plant and equipment 45.2 39.4 41.1

Intangible assets 23.1 22.2 23.3

Deferred income tax assets 3.7 3.5 3.4

---------------------------------- ----------- ----------- ------

72.0 65.1 67.8

---------------------------------- ----------- ----------- ------

Current assets

Inventories 4.7 5.0 3.4

Trade and other receivables 61.8 52.6 52.8

Cash and cash equivalents 0.5 - 1.8

Derivative financial instruments

(note 8) 0.2 0.2 0.2

---------------------------------- ----------- ----------- ------

67.2 57.8 58.2

---------------------------------- ----------- ----------- ------

Total assets 139.2 122.9 126.0

---------------------------------- ----------- ----------- ------

Current liabilities

Trade and other payables (57.4) (50.1) (52.7)

Current income tax liabilities (0.4) (1.2) (0.9)

Borrowings (note 8) (0.1) (0.1) (0.1)

Derivative financial instruments

(note 8) - (0.2) -

---------------------------------- ----------- ----------- ------

(57.9) (51.6) (53.7)

---------------------------------- ----------- ----------- ------

Non-current liabilities

Borrowings (note 8) (19.5) (10.3) (11.6)

Contingent deferred consideration (1.4) (1.4) (1.4)

Deferred income tax liabilities (3.6) (3.8) (3.8)

Retirement benefit obligations (21.9) (19.2) (18.3)

Provisions (0.4) - (0.5)

---------------------------------- ----------- ----------- ------

(46.8) (34.7) (35.6)

---------------------------------- ----------- ----------- ------

Total liabilities (104.7) (86.3) (89.3)

---------------------------------- ----------- ----------- ------

Net assets 34.5 36.6 36.7

---------------------------------- ----------- ----------- ------

Equity

Share capital (note 9) 12.1 12.0 12.0

Share premium 0.9 0.9 0.9

Retained earnings 21.5 23.7 23.8

---------------------------------- ----------- ----------- ------

Total equity 34.5 36.6 36.7

---------------------------------- ----------- ----------- ------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated statement of changes in equity

for the half year ended 30 November 2016 (unaudited)

Share Share Retained Total

capital premium earnings equity

GBPm GBPm GBPm GBPm

------------------------------------ -------- -------- --------- -------

Balance at 1 June 2015 12.0 0.9 21.9 34.8

------------------------------------ -------- -------- --------- -------

Profit for the period - - 1.4 1.4

Items that will never be

reclassified to profit

or loss:

Re-measurement gain on

the defined benefit pension

scheme - - 0.9 0.9

Tax on items that will

never be reclassified to

profit or loss - - (0.2) (0.2)

------------------------------------ -------- -------- --------- -------

Total comprehensive expense

for the period - - 2.1 2.1

------------------------------------ -------- -------- --------- -------

Transactions with owners:

Value of employee services - - (0.3) (0.3)

- - (0.3) (0.3)

------------------------------------ -------- -------- --------- -------

Balance at 30 November

2015 12.0 0.9 23.7 36.6

------------------------------------ -------- -------- --------- -------

Profit for the period - - 3.4 3.4

Items that will never be

reclassified to profit

or loss:

Re-measurement loss on

the defined benefit pension

scheme - - (0.7) (0.7)

Tax on items that will

never be reclassified to

profit or loss - - (0.1) (0.1)

------------------------------------ -------- -------- --------- -------

Total comprehensive income

for the period - - 2.6 2.6

------------------------------------ -------- -------- --------- -------

Transactions with owners:

Dividend paid - - (2.6) (2.6)

Issue of shares - - - -

Credit to equity for equity-settled

share-based payments - - 0.1 0.1

------------------------------------ -------- -------- --------- -------

- - (2.5) (2.5)

------------------------------------ -------- -------- --------- -------

Balance at 31 May 2016 12.0 0.9 23.8 36.7

------------------------------------ -------- -------- --------- -------

Profit for the period - - 1.0 1.0

Items that will never be

reclassified to profit

or loss:

Re-measurement loss on

the defined benefit pension

scheme - - (3.7) (3.7)

Tax on items that will

never be reclassified to

profit or loss - - 0.6 0.6

------------------------------------ -------- -------- --------- -------

Total comprehensive income

for the period - - (2.1) (2.1)

------------------------------------ -------- -------- --------- -------

Transactions with owners:

Issue of shares 0.1 - (0.1) -

Value of employee services - - (0.1) (0.1)

------------------------------------ -------- -------- --------- -------

0.1 - (0.2) (0.1)

------------------------------------ -------- -------- --------- -------

Balance at 30 November

2016 12.1 0.9 21.5 34.5

------------------------------------ -------- -------- --------- -------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated cash flow statement

for the half year ended 30 November 2016 (unaudited)

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

--------------------------------------- ------------ ------------ -------

Cash flows from operating activities

Operating profit 1.8 2.4 7.1

Adjustments for:

Depreciation and amortisation 2.1 2.0 3.9

Cash contributions to pension

scheme (0.7) (0.9) (1.8)

Other 0.1 0.2 (0.1)

--------------------------------------- ------------ ------------ -------

Operating cash flows before movements

in working capital 3.3 3.7 9.1

Movements in working capital:

(Increase)/decrease in inventories (1.3) (1.2) 0.9

(Increase)/decrease in receivables (9.0) 5.4 7.7

Increase/(decrease) in payables 4.7 (4.7) (3.4)

--------------------------------------- ------------ ------------ -------

Net cash (absorbed by)/generated

from operations (2.3) 3.2 14.3

Interest paid (0.2) (0.2) (0.4)

Income tax paid (0.6) (0.6) (2.0)

--------------------------------------- ------------ ------------ -------

Net cash (absorbed by)/generated

from operating activities (3.1) 2.4 11.9

--------------------------------------- ------------ ------------ -------

Cash flows from investing activities

Purchase of intangible assets (0.2) (0.2) (0.3)

Purchase of property, plant and

equipment (6.0) (2.0) (3.2)

Proceeds on sale of property,

plant and equipment 0.1 - 0.1

Acquisition of subsidiaries (net

of cash acquired) - (4.5) (7.5)

--------------------------------------- ------------ ------------ -------

Net cash absorbed by investing

activities (6.1) (6.7) (10.9)

--------------------------------------- ------------ ------------ -------

Cash flows from financing activities

Increase in bank borrowings 8.0 4.3 5.5

Repayment of bank borrowings in

respect of acquisitions - - (2.0)

Capital element of finance lease

and hire purchase payments (0.1) - (0.1)

Dividends paid - - (2.6)

--------------------------------------- ------------ ------------ -------

Net cash generated from financing

activities 7.9 4.3 0.8

--------------------------------------- ------------ ------------ -------

Net movement in cash and cash

equivalents (1.3) - 1.8

Cash and cash equivalents at beginning

of period 1.8 - -

--------------------------------------- ------------ ------------ -------

Cash and cash equivalents at end

of period 0.5 - 1.8

--------------------------------------- ------------ ------------ -------

The notes form an integral part of this condensed consolidated

half year report.

Notes to the condensed consolidated half year report

for the half year ended 30 November 2016 (unaudited)

1. General information

NWF Group plc ('the Company') is a public limited company

incorporated and domiciled in the UK under the Companies Act 2006.

The address of its registered office is NWF Group plc, Wardle,

Nantwich, Cheshire CW5 6BP.

The Company has its primary listing on AIM, part of the London

Stock Exchange.

These condensed consolidated interim financial statements

('interim financial statements') were approved for issue on 31

January 2017.

These interim financial statements do not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. The interim financial statements for the half year ended 30

November 2016 and 30 November 2015 are neither audited nor reviewed

by the Company's auditors. Statutory accounts for the year ended 31

May 2016 were approved by the Board of Directors on 3 August 2016

and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

2. Basis of preparation and accounting policies

Except as described below, these interim financial statements

have been prepared in accordance with the principal accounting

policies used in the Company's consolidated financial statements

for the year ended 31 May 2016. These interim financial statements

should be read in conjunction with those consolidated financial

statements, which have been prepared in accordance with IFRS as

endorsed by the European Union.

These interim financial statements do not fully comply with IAS

34 'Interim Financial Reporting', as is currently permissible under

the rules of AIM.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The triennial actuarial valuation of the Group's defined benefit

pension scheme was completed in the half year ended 30 November

2014, with a deficit of GBP14.1 million at the valuation date of 31

December 2013. In these interim financial statements, this

liability has been updated in order to derive the IAS 19R valuation

as of 30 November 2016. The triennial valuation resulted in Group

contributions of GBP1.8 million per annum, including recovery plan

payments of GBP1.2 million per annum for 12 years from 1 January

2014.

The Directors consider that headline operating profit, headline

profit before taxation and headline earnings per share measures

referred to in these interim financial statements, provide useful

information for shareholders on underlying trends and performance.

Headline profit before taxation is reported profit before taxation,

after adding back the net finance cost in respect of the Group's

defined benefit pension scheme, and the exceptional items and the

taxation effect thereon where relevant. The calculations of basic

and diluted headline earnings per share are shown in note 7 of

these interim financial statements.

Certain statements in these interim financial statements are

forward looking. The terms 'expect', 'anticipate', 'should be',

'will be' and similar expressions identify forward looking

statements. Although the Board of Directors believes that the

expectations reflected in these forward looking statements are

reasonable, such statements are subject to a number of risks and

uncertainties and actual results and events could differ materially

from those expressed or implied by these forward looking

statements.

A number of amendments to IFRSs became effective for the

financial period beginning on 1 June 2016 however the Group did not

have to change its accounting policies or make material

retrospective adjustments as a result of adopting these new

standards.

3. Segment information

The chief operating decision-maker has been identified as the

Board of Directors ('the Board'). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports, are Feeds, Food and Fuels.

The Board considers the business from a product/services

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the

UK.

The nature of the products/services provided by the operating

segments are summarised below:

Feeds - manufacture and sale of animal feeds and other agricultural products

Food - warehousing and distribution of clients' ambient grocery

and other products to supermarket and other retail distribution

centres

Fuels - sale and distribution of domestic heating, industrial and road fuels

Segment information about the above businesses is presented

below.

The Board assesses the performance of the operating segments

based on a measure of headline operating profit. Finance income and

costs are not included in the segment result which is assessed by

the Board. Other information provided to the Board is measured in a

manner consistent with that in the financial statements.

Inter-segment transactions are entered into under the normal

commercial terms and conditions that would also be available to

unrelated third parties.

Segment assets exclude deferred income tax assets and cash and

cash equivalents. Segment liabilities exclude taxation, contingent

deferred consideration, borrowings and retirement benefit

obligations. Excluded items are part of the reconciliation to

consolidated total assets and liabilities.

Half year ended 30 November Feeds Food Fuels Group

2016 GBPm GBPm GBPm GBPm

------------------------------ ----- ----- ----- -----

Revenue

Total revenue 67.5 20.4 173.3 261.2

Inter-segment revenue (2.4) (0.3) (2.6) (5.3)

------------------------------ ----- ----- ----- -----

Revenue 65.1 20.1 170.7 255.9

------------------------------ ----- ----- ----- -----

Result

Headline operating profit (0.3) 1.6 0.9 2.2

------------------------------ ----- ----- -----

Segment exceptional items

(note 4) (0.4) - - (0.4)

-----

Operating profit as reported 1.8

Finance costs (note 5) (0.5)

-----

Profit before taxation 1.3

Income tax expense (note

6) (0.3)

------------------------------ ----- ----- ----- -----

Profit for the period 1.0

------------------------------ ----- ----- ----- -----

Other information

Depreciation and amortisation 0.6 0.8 0.7 2.1

------------------------------ ----- ----- ----- -----

Feeds Food Fuels Group

As at 30 November 2016 GBPm GBPm GBPm GBPm

---------------------------------- ------ ----- ------ -------

Balance sheet

Assets

Segment assets 52.0 32.1 50.9 135.0

---------------------------------- ------ ----- ------

Deferred income tax assets 3.7

Cash and cash equivalents 0.5

---------------------------------- ------ ----- ------ -------

Consolidated total assets 139.2

---------------------------------- ------ ----- ------ -------

Liabilities

Segment liabilities (13.3) (4.1) (40.4) (57.8)

---------------------------------- ------ ----- ------

Current income tax liabilities (0.4)

Deferred income tax liabilities (3.6)

Borrowings (19.6)

Contingent deferred consideration (1.4)

Retirement benefit obligations (21.9)

---------------------------------- ------ ----- ------ -------

Consolidated total liabilities (104.7)

---------------------------------- ------ ----- ------ -------

Half year ended 30 November Feeds Food Fuels Group

2015 GBPm GBPm GBPm GBPm

------------------------------ ----- ----- ----- -----

Revenue

Total revenue 64.3 19.6 145.5 229.4

Inter-segment revenue (2.2) (0.3) (2.3) (4.8)

------------------------------ ----- ----- ----- -----

Revenue 62.1 19.3 143.2 224.6

------------------------------ ----- ----- ----- -----

Result

Headline operating profit 0.3 1.4 1.1 2.8

------------------------------ ----- ----- -----

Segment exceptional items

(note 4) (0.2) (0.1) (0.1) (0.4)

-----

Operating profit as reported 2.4

Finance costs (note 5) (0.6)

-----

Profit before taxation 1.8

Income tax expense (note

6) (0.4)

------------------------------ ----- ----- ----- -----

Profit for the period 1.4

------------------------------ ----- ----- ----- -----

Other information

Depreciation and amortisation 0.6 0.8 0.6 2.0

------------------------------ ----- ----- ----- -----

Feeds Food Fuels Group

As at 30 November 2015 GBPm GBPm GBPm GBPm

---------------------------------- ----- ----- ------ ------

Balance sheet

Assets

Segment assets 41.9 32.2 45.3 119.4

---------------------------------- ----- ----- ------

Deferred income tax assets 3.5

Cash and cash equivalents -

---------------------------------- ----- ----- ------ ------

Consolidated total assets 122.9

---------------------------------- ----- ----- ------ ------

Liabilities

Segment liabilities (9.5) (4.2) (36.6) (50.3)

---------------------------------- ----- ----- ------

Current income tax liabilities (1.2)

Deferred income tax liabilities (3.8)

Borrowings (10.4)

Contingent deferred consideration (1.4)

Retirement benefit obligations (19.2)

---------------------------------- ----- ----- ------ ------

Consolidated total liabilities (86.3)

---------------------------------- ----- ----- ------ ------

Feeds Food Fuels Group

Year ended 31 May 2016 GBPm GBPm GBPm GBPm

------------------------------ ----- ----- ----- ------

Revenue

Total revenue 142.5 38.1 297.8 478.4

Inter-segment revenue (6.7) (0.5) (5.3) (12.5)

------------------------------ ----- ----- ----- ------

Revenue 135.8 37.6 292.5 465.9

------------------------------ ----- ----- ----- ------

Result

Headline operating profit 2.1 2.7 3.9 8.7

------------------------------ ----- ----- -----

Segment exceptional items

(note 4) (2.6) (0.1) (0.2) (2.9)

Group exceptional items 1.3

------

Operating profit as reported 7.1

Finance costs (note 5) (1.1)

------

Profit before taxation 6.0

Income tax expense (note

6) (1.2)

------------------------------ ----- ----- ----- ------

Profit for the year 4.8

------------------------------ ----- ----- ----- ------

Other information

Depreciation and amortisation 1.0 1.5 1.4 3.9

------------------------------ ----- ----- ----- ------

Feeds Food Fuels Group

As at 31 May 2016 GBPm GBPm GBPm GBPm

---------------------------------- ------ ----- ------ ------

Balance sheet

Assets

Segment assets 45.1 31.0 44.7 120.8

---------------------------------- ------ ----- ------

Deferred income tax assets 3.4

Cash and cash equivalents 1.8

---------------------------------- ------ ----- ------ ------

Consolidated total assets 126.0

---------------------------------- ------ ----- ------ ------

Liabilities

Segment liabilities (14.6) (3.9) (34.7) (53.2)

---------------------------------- ------ ----- ------

Current income tax liabilities (0.9)

Deferred income tax liabilities (3.8)

Borrowings (11.7)

Contingent deferred consideration (1.4)

Retirement benefit obligations (18.3)

---------------------------------- ------ ----- ------ ------

Consolidated total liabilities (89.3)

---------------------------------- ------ ----- ------ ------

4. Profit before taxation - exceptional items

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

----------------------------------- ------------ ------------ -------

Restructuring costs (0.4) (0.2) (2.6)

Acquisition-related costs - (0.2) (0.3)

Net gain on pension scheme closure - - 1.3

----------------------------------- ------------ ------------ -------

Net exceptional cost (0.4) (0.4) (1.6)

----------------------------------- ------------ ------------ -------

During the period, the Group incurred exceptional costs of

GBP0.4 million relating to the new mill investment and

restructuring of the Feeds business.

5. Finance costs

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

-------------------------------------- ------------ ------------ -------

Interest on bank loans and overdrafts 0.2 0.2 0.4

-------------------------------------- ------------ ------------ -------

Total interest expense 0.2 0.2 0.4

Net finance cost in respect

of the defined benefit pension

scheme 0.3 0.4 0.7

-------------------------------------- ------------ ------------ -------

Total finance costs 0.5 0.6 1.1

-------------------------------------- ------------ ------------ -------

6. Income tax expense

The income tax expense for the half year ended 30 November 2016

is based upon management's best estimate of the weighted average

annual tax rate expected for the full financial year ending 31 May

2017 of 20.9% (H1 2015: 20.7%).

7. Earnings per share

The calculation of basic and diluted earnings per share is based

on the following data:

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

------------------------------------------ ------------ ------------ -------

Earnings

Earnings for the purposes of basic

and diluted earnings per share

being profit for the period attributable

to equity shareholders 1.0 1.4 4.8

------------------------------------------ ------------ ------------ -------

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

000s 000s 000s

-------------------------------------- ------------ ------------ -------

Number of shares

Weighted average number of shares

for the purposes of basic earnings

per share 48,599 48,410 48,469

Weighted average dilutive effect

of conditional share awards (note

9) 45 119 420

-------------------------------------- ------------ ------------ -------

Weighted average number of shares

for the purposes of diluted earnings

per share 48,644 48,529 48,889

-------------------------------------- ------------ ------------ -------

The calculation of basic and diluted headline earnings per share

is based on the following data:

Half Half

year year Year

ended ended ended

30 November 30 November 31 May

2016 2015 2016

GBPm GBPm GBPm

------------------------------------ ------------ ------------ -------

Profit for the period attributable

to equity shareholders 1.0 1.4 4.8

Add back:

Net finance cost in respect of

the defined benefit pension scheme 0.3 0.4 0.7

Exceptional items 0.4 0.4 1.6

Tax effect of the above (0.1) (0.1) (0.5)

------------------------------------ ------------ ------------ -------

Headline earnings 1.6 2.1 6.6

------------------------------------ ------------ ------------ -------

8. Financial instruments

The Group's financial instruments comprise cash, bank

overdrafts, invoice discounting advances, obligations under hire

purchase agreements, derivatives and various items such as

receivables and payables, which arise from its operations. There is

no significant foreign exchange risk in respect of these

instruments.

The carrying amounts of all of the Group's financial instruments

are measured at amortised cost in the financial statements, with

the exception of derivative financial instruments being forward

supply contracts. Derivative financial instruments are measured at

fair value subsequent to initial recognition.

The Group classifies fair value measurement using a fair value

hierarchy that reflects the significance of inputs used in making

measurements of fair value. The fair value hierarchy has the

following levels:

-- Level 1 fair value measurements are those derived from

unadjusted quoted prices in active markets for identical assets or

liabilities;

-- Level 2 fair value measurements are those derived from

inputs, other than quoted prices included within Level 1 above,

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

-- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable

inputs).

All of the Group's derivative financial instruments were

classified as Level 2 in the current and prior periods. There were

no transfers between levels in both the current and prior

periods.

The book and fair values of financial assets at 30 November

2016, other than non-interest bearing short-term trade and other

receivables, are as follows:

30 November 30 November 31 May

2016 2015 2016

Total book and fair value GBPm GBPm GBPm

-------------------------------------- ----------- ----------- ------

Financial assets carried at fair

value: derivatives 0.2 0.2 0.2

Financial assets carried at amortised

cost: cash and cash equivalents 0.5 - 1.8

-------------------------------------- ----------- ----------- ------

Financial assets 0.7 0.2 2.0

-------------------------------------- ----------- ----------- ------

The book and fair values of financial liabilities at 30 November

2016, other than non-interest bearing short-term trade and other

payables, are as follows:

30 November 30 November 31 May

2016 2015 2016

Total book and fair value GBPm GBPm GBPm

-------------------------------------- ----------- ----------- ------

Financial liabilities carried

at fair value: derivatives - 0.2 -

Financial liabilities carried

at amortised cost:

- Hire purchase obligations repayable

within one year 0.1 0.1 0.1

- Floating rate invoice discounting

advances 9.4 3.2 1.4

- Revolving credit facility 10.0 7.0 10.0

- Hire purchase obligations repayable

after more than one year 0.1 0.1 0.2

-------------------------------------- ----------- ----------- ------

19.5 10.3 11.6

Financial liabilities 19.6 10.6 11.7

-------------------------------------- ----------- ----------- ------

9. Share capital

Number

of shares Total

(000s) GBPm

----------------------------------------- ---------- -----

Allotted and fully paid: ordinary shares

of 25p each

Balance at 31 May 2015 48,350 12.0

Issue of shares (see below) 178 -

----------------------------------------- ---------- -----

Balance at 30 November 2015 48,528 12.0

Issue of shares - -

----------------------------------------- ---------- -----

Balance at 31 May 2016 48,528 12.0

Issue of shares (see below) 116 0.1

----------------------------------------- ---------- -----

Balance at 30 November 2016 48,644 12.1

----------------------------------------- ---------- -----

During the half year ended 30 November 2016, 116,139 (H1 2015:

178,103) shares with an aggregate nominal value of GBP29,035 (H1

2015: GBP44,525) were issued under the Company's conditional

Performance Share Plan.

The maximum total number of ordinary shares that may vest in the

future in respect of conditional Performance Share Plan awards

outstanding at 30 November 2016 amounted to 866,884 (H1 2015:

1,164,392) shares. These shares will only be issued subject to

satisfying certain performance criteria.

12. Half Year Report

Copies of this Half Year Report are due to be sent to

shareholders on 7 February 2017. Further copies may be obtained

from the Company Secretary at NWF Group plc, Wardle, Nantwich,

Cheshire CW5 6BP, or from the Company's website at

www.nwf.co.uk.

13. 2017 financial calendar

Interim dividend paid 2 May 2017

Financial year end 31 May 2017

Full year results announcement Early August 2017

Publication of Annual Report and Accounts Late August 2017

Annual General Meeting 28 September 2017

Final dividend paid Early December 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAPFEDEEXEFF

(END) Dow Jones Newswires

January 31, 2017 02:00 ET (07:00 GMT)

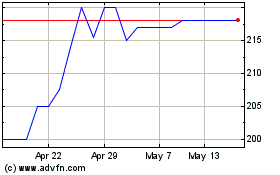

Nwf (LSE:NWF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nwf (LSE:NWF)

Historical Stock Chart

From Apr 2023 to Apr 2024