NextEnergy Solar Fund Limited Dividend Declaration (5426G)

November 06 2018 - 12:00PM

UK Regulatory

TIDMNESF

RNS Number : 5426G

NextEnergy Solar Fund Limited

06 November 2018

6 November 2018

NextEnergy Solar Fund Limited ("NESF")

Interim Dividend

NextEnergy Solar Fund Limited is pleased to announce an interim

dividend of 1.6625 pence per Ordinary Share for the quarter ending

30 September 2018. The interim dividend of 1.6625 pence will be

paid on 28 December 2018 to shareholders on the register as at the

close of business on 16 November 2018. The ex-dividend date is 15

November 2018.

The Company will also be offering shareholders a scrip dividend

alternative to this interim dividend as detailed in the Scrip

Circular dated 10 August 2018, a copy of which can be viewed and /

or downloaded from 'Circulars' in the Investor Relations part of

the NESF website (www.nextenergysolarfund.com). The Scrip Share

reference price will be announced on 22 November 2018, with

elections to be made by 5 December 2018.

For further information:

NextEnergy Capital Limited 020 3746 0700

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Robert Peel

Fidante Capital 020 7832 0900

John Armstrong-Denby

Shore Capital 020 7408 4090

Anita Ghanekar

Macquarie Capital (Europe) Limited 020 3037 2000

Nick Stamp

MHP Communications 020 3128 8100

Oliver Hughes

Ipes (Guernsey) Limited 01481 755 137

Nicholas Robilliard

Notes to Editors:

NESF is a specialist investment company that invests primarily

in operating solar power plants in the UK. It is able to invest up

to 15% of its Gross Asset Value in operating solar power plants in

OECD countries outside the UK. The Company's objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of GBP592m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities outstanding of c.GBP365m

in place (GBP149m from a syndicate including MIDIS, NAB and CBA;

MIDIS: GBP54m; ING GBP32m; UniCredit GBP32m; Santander GBP40m; and

Bayerische Landesbank GBP58m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division and over the course of its activities has provided

operating asset management, monitoring, technical due diligence and

other services to over 1,300 utility-scale solar power plants with

an installed capacity in excess of 1.9 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DIVBFBFTMBAMBRP

(END) Dow Jones Newswires

November 06, 2018 12:00 ET (17:00 GMT)

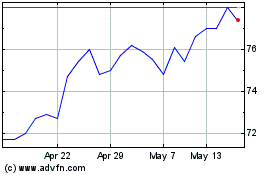

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2024 to May 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From May 2023 to May 2024