TIDMNBDD TIDMNBDX TIDMNBDG

RNS Number : 5119V

NB Distressed Debt Invest. Fd. Ltd

15 April 2021

NB DISTRESSED DEBT INVESTMENT FUND LIMITED

2020 ANNUAL Report

audited CONSOLIDATED Financial Statements

For the year ended 31 December 2020

COMPANY OVERVIEW | Features

Features

NB Distressed Debt Investment Fund Limited (the "Company")

The Company is a closed-ended investment company incorporated

and registered in Guernsey on 20 April 2010 with registration

number 51774 . The Company is governed under the provisions of the

Companies (Guernsey) Law, 2008 (as amended) (the "Law"), and the

Registered Collective Investment Scheme Rules 2018 issued by the

Guernsey Financial Services Commission ("GFSC"). It is a

non-cellular company limited by shares and has been declared by the

GFSC to be a registered closed-ended collective investment scheme.

The Company trades on the Specialist Fund Segment ("SFS") of the

London Stock Exchange ("LSE").

The Company is a member of the Association of Investment

Companies (the "AIC") and is classified within the Debt - Loans

& Bonds Category.

Alternative Investment Fund Manager ("AIFM") and Manager

Investment management services are provided to the Company by

Neuberger Berman Investment Advisers LLC (the "AIFM") and Neuberger

Berman Europe Limited (the "Manager"), collectively the "Investment

Manager". The AIFM is responsible for risk management and

discretionary management of the Company's Portfolio and the Manager

provides, amongst other things, certain administrative services to

the Company.

Share Capital

At 31 December 2020 the Company's share capital comprised the

following(1) :

Ordinary Share Class ("NBDD")

15,382,770 Ordinary Shares, none of which were held in

treasury.

Extended Life Share Class ("NBDX")

80,545,074 Extended Life Shares, none of which were held in

treasury.

New Global Share Class ("NBDG")

41,116,617 New Global Shares, none of which were held in

treasury.

(1) In addition the Company has two Class A Shares in issue.

Further information is provided in the Capital Structure section of

this report below

For the purposes of efficient portfolio management, the Company

has established a number of wholly-owned subsidiaries domiciled in

the US, the Cayman Islands and Luxembourg. All references to the

Company in this document refer to the Company together with its

wholly-owned subsidiaries.

Non-Mainstream Pooled Investments

The Company currently conducts its affairs so that the shares

issued by the Company can be recommended by Independent Financial

Advisers to ordinary retail investors in accordance with the

Financial Conduct Authority's ("FCA") rules in relation to

non-mainstream pooled investment ("NMPI") products and intends to

continue to do so for the foreseeable future.

The Company's shares are excluded from the FCA's restrictions

which apply to NMPI products.

Company Numbers

Ordinary Shares

LSE ISIN code: GG00BDFZ6F78

Bloomberg code: NBDD: LN

Extended Life Shares

LSE ISIN code: GG00BMY71631

Bloomberg code: NBDX:LN

New Global Shares

LSE ISIN code: GG00BMY71748

Bloomberg code: NBDG:LN

Legal Entity Identifier

YRFO7WKOU3V511VFX790

Website

www.nbddif.com

Capital Structure

The Company's share capital consists of three different share

classes, all of which are in the harvest period: the Ordinary Share

Class; the Extended Life Share Class; and the New Global Share

Class. These share classes each have different capital return

profiles and, in one instance a different geographical remit. In

addition, the Company has two Class A Shares in issue. While the

Company's share classes are all now in harvest, returning capital

to shareholders, the Company's corporate umbrella itself has an

indefinite life to allow for flexibility for the Company to add new

share classes if demand, market opportunities and shareholder

approval supported such a move, although the Company has no current

plans to create new share classes. Each share class is considered

in turn below.

Ordinary Share Class

NBDD was established at the Company's launch on 10 June 2010

with a remit to invest in the global distressed debt market with a

focus on North America. The investment period of NBDD expired on 10

June 2013.

Voting rights: Yes

Denomination: US Dollars

Hedging: Portfolio hedged to US Dollars

Authorised share capital: Unlimited

Par value: Nil

Extended Life Share Class

A vote was held at a class meeting of NBDD shareholders on 8

April 2013 where the majority of shareholders voted in favour of a

proposed extension.

Following this meeting and with the NBDD shareholders' approval

of the extension, on 9 April 2013 a new Class, NBDX, was created

and the NBDX Shares were issued to 72% of initial NBDD investors

who elected to convert their NBDD Shares to NBDX Shares. NBDX had a

remit to invest in the global distressed debt market with a focus

on North America. The investment period of NBDX expired on 31 March

2015.

Voting rights: Yes

Denomination: US Dollars

Hedging: Portfolio hedged to US Dollars

Authorised share capital: Unlimited

Par value: Nil

New Global Share Class

NBDG was created on 4 March 2014 and had a remit to invest in

the global distressed market with a focus on Europe and North

America. The investment period of NBDG expired on 31 March

2017.

Voting rights: Yes

Denomination: Pound Sterling

Hedging: Unhedged portfolio

Authorised share capital: Unlimited

Par value: Nil

Class A Shares

The Class A Shares are held by a trustee pursuant to a purpose

trust established under Guernsey law. Under the terms of the Trust

Deed the Trustee holds the Class A Shares for the purpose of

exercising the right to receive notice of general meetings of the

Company but the Trustee shall only have the right to attend and

vote at general meetings of the Company when there are no other

Shares of the Company in issue.

Voting rights: No

Denomination: US Dollars

Authorised share capital: 10,000 Class A Shares

Par value: US Dollar $1

Business Model

Principal Activities and Structure

The principal activity of the Company is to carry out business

as an investment company. The Directors do not envisage any changes

in this activity for the foreseeable future.

The chart below sets out the ownership, organisational and

investment structure of the Company.

INVESTMENT STRUCTURE OF THE COMPANY

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 1 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/5119V_1-2021-4-14.pdf

(1) Further information on the Company's capital structure can

be found above.

(2) Further information on the Company's investment management

arrangements can be found in the Strategic Report below.

Investment Objective

The Company's primary objective is to provide investors with

attractive risk-adjusted returns through long-biased, opportunistic

exposure to stressed, distressed and special situation

credit-related investments while seeking to limit downside risk by,

amongst other things, focusing on senior and senior secured debt

with both collateral and structural protection.

Investment Policy

The investment period of each share class has expired. During

the investment period, the Investment Manager sought, in accordance

with the Investment Policy, to identify mis-priced or otherwise

overlooked securities or assets that had the potential to produce

attractive absolute returns while seeking to limit downside risk

through collateral and structured protection where possible.

The Ordinary Shares, Extended Life Shares and New Global Shares

(collectively the "Portfolios") are biased toward stressed and

distressed debt securities secured by hard asset collateral in

accordance with the Investment Policy. When investing on behalf of

the Company, the Investment Manager focused on companies with

significant tangible assets which were judged likely to maintain

long-term value through a restructuring. The Investment Manager

avoided "asset-light" companies, as their values tend to depreciate

in distressed scenarios, and also aimed to concentrate on companies

with stressed balance sheets whose low implied enterprise value

multiples, often calculated using currently depressed cash flows,

offered a discount to comparable market valuations.

What is Distressed Debt?

Distressed debt generally refers to the financial obligations of

a company that is either already in default, under bankruptcy

protection, or in distress and heading toward default. Distressed

debt often trades at a significant discount to its par value and

may present investors with compelling opportunities to profit if

there is a recovery in the business. Typically, when a company

experiences financial distress or files for bankruptcy protection,

the original debt holders often sell their debt securities or

claims to a new set of investors at a discount. These investors

often try to influence the process by which the issuer restructures

its obligations or implements a plan to turn around its operations.

These investors may also inject new capital into a distressed

company in the form of debt or equity in order to prevent the

company from going into liquidation or to aid the company in

carrying out a restructuring plan. Investors in distressed debt

typically must not only assess the issuer's ability to improve its

operations but also whether the restructuring process is likely to

result in a meaningful recovery to the investors' class of

claims.

Distressed debt can be performing or non-performing. Performing

debt is defined as debt that maintains its contractual obligations

relating to interest and/or principal payments and can be debt that

has yet to default or even debt that is under bankruptcy

protection. Non-performing debt is defined as debt that does not

continue to meet its financial obligations.

There are several different strategies related to investing in

distressed debt. These strategies differ mainly in the types of

securities that investors purchase, the life of a fund and its

investment period, and a fund's expected returns. Four strategic

categories include: (i) senior/senior secured debt strategies; (ii)

control/private equity strategies; (iii) junior debt strategies;

and (iv) capital structure arbitrage strategies. During the

investment periods of the Portfolios, the Investment Manager

focused on implementing a senior/senior secured debt strategy in

which it invested primarily in secured debt with strong collateral

value and structural protection. The Investment Manager has also

invested in control positions and non-control positions with the

objective of acquiring a blocking position on behalf of the

Portfolios.

Investing in secured debt at the top of the capital structure

is, in the opinion of the Investment Manager, towards the more

conservative end of the distressed debt strategy risk spectrum due

to the support from the value of the underlying collateral.

Additionally, secured debt holders often have the ability to

foreclose on the assets securing their claim and to drive the

restructuring process. The typical holding period for investments

in this type of strategy is at least six months and can be more

than three years.

Typical Life Cycle of a Distressed Debt Investment

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 2 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/5119V_1-2021-4-14.pdf

Further information on the Company's investment process can be

found in the Company's most recent prospectuses which are available

on the Company's website at www.nbddif.com under the "Investor

Information" tab.

(1) Negotiations can take place within bankruptcy or creditors

can negotiate with the company to agree on a pre-packaged

bankruptcy whereby the plan of reorganisation is negotiated before

the company files for bankruptcy protection (this has become more

common).

Distributions to Shareholders

Income

In order to benefit from an exemption to the United Kingdom

("UK") offshore fund rules, all income from the Company's Portfolio

(after deduction of reasonable expenses) must be paid to investors.

To meet this requirement the Company will pay out by way of

dividend, in respect of each share class, all net income received

on investments of the Company attributable to such share class, as

appropriate.

It is not anticipated that income from the Portfolios will be

material and therefore any income distributions by way of dividend

will be on an ad-hoc basis. However, the Company monitors the need

to distribute such income annually (less allowable expenses under

the NMPI rules) in order to continue to be excluded from the FCA's

restrictions which apply to non-mainstream investment products. The

exact amount of such income distribution by way of dividend in

respect of any class of shares will be variable depending on the

amounts of income received by the Company attributable to such

share class and will only be paid in accordance with applicable law

at the relevant time, including the Companies (Guernsey) Law, 2008

(as amended) (the "Law") and, in particular, will be subject to the

Company passing the solvency test contained in the Law at the

relevant time. The amount of income distributions by way of

dividend paid in respect of one class of shares may be different

from that of another class.

Capital

Following the expiry of the Portfolios' investment periods, the

capital proceeds attributable to the corresponding share class as

determined by the Directors and in accordance with the articles of

incorporation (the "Articles"), will, at such times and in such

amounts as the Directors shall in their absolute discretion

determine, be distributed to shareholders of that class pro rata to

their respective holdings of the relevant shares.

Any capital return will only be made by the Company in

accordance with the Articles of the Company and applicable law at

the relevant time, including the Law (and, in particular, will be

subject to the Company passing the solvency test contained in the

Law at the relevant time).

Towards the end of the Portfolios' respective harvest periods, a

residual amount will be retained in accordance with regulatory

requirements until such time as the relevant share class may be

liquidated or its assets otherwise disposed of at the discretion of

the Board.

Gearing

The Company will not employ leverage or gearing for investment

purposes. The Company may, from time to time, use borrowings for

share buybacks and short-term liquidity purposes, including

bridging purposes, prior to the sale of investments. Save for such

bridging borrowings the Directors will restrict borrowing, with

respect to each share class, to an amount not exceeding 10 percent

of the NAV of the share class at the time of drawdown.

The Company does not currently have any borrowings. Derivatives

may be used for the purposes of efficient portfolio management and

to hedge risk within the Portfolios. In addition, from time to time

the Company may also invest in such derivatives for investment

purposes.

2020 PERFORMANCE REVIEW | Financial Highlights

Financial Highlights

Key Figures

Extended

Ordinary Life Share New Global

At 31 DECEMBER 2020 Share Class Class Share Class(1) Aggregated

-------------------------------- ------------- ------------ ---------------- -----------

Net Asset Value ("NAV")

($ millions) 13.0 63.5 31.9 108.4

================================ ============= ============ ================ ===========

NAV per Share ($) 0.8420 0.7889 0.7767 -

================================ ============= ============ ================ ===========

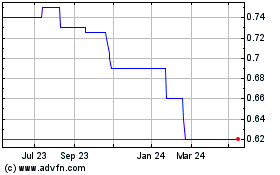

Share Price ($) 0.720 0.480 0.6356(1) -

================================ ============= ============ ================ ===========

NAV per Share (GBP) - - 0.5682 -

================================ ============= ============ ================ ===========

Share Price (GBP) - - 0.465 -

================================ ============= ============ ================ ===========

Premium /(Discount) to

NAV per Share (14.49%) (39.16%) (18.16%) -

================================ ============= ============ ================ ===========

Portfolio of Distressed

Investments ($ millions) 9.9 55.6 30.8 96.3

================================ ============= ============ ================ ===========

Cash and Cash Equivalents

($ millions) 3.6 9.1 0.9 13.6

================================ ============= ============ ================ ===========

Total Expense Ratio ("TER")(2) 2.89% 2.68% 2.76% -

================================ ============= ============ ================ ===========

Ongoing Charges (3) 2.42% 2.36% 2.39% -

================================ ============= ============ ================ ===========

Extended

Ordinary Life Share New Global

At 31 December 2019 Share Class Class Share Class(1) Aggregated

-------------------------------- ------------- ------------ ---------------- -----------

Net Asset Value ("NAV")

($ millions) 14.0 105.8 79.3 199.1

================================ ============= ============ ================ ===========

NAV per Share ($) 0.9086 0.9266 1.1047 -

================================ ============= ============ ================ ===========

Share Price ($) 0.845 0.735 0.9432(1) -

================================ ============= ============ ================ ===========

NAV per Share (GBP) - - 0.8339 -

================================ ============= ============ ================ ===========

Share Price (GBP) - - 0.712 -

================================ ============= ============ ================ ===========

Premium /(Discount) to

NAV per Share (7.00%) (20.68%) (14.62%) -

================================ ============= ============ ================ ===========

Portfolio of Distressed

Investments ($ millions) 13.2 102.8 76.8 192.8

================================ ============= ============ ================ ===========

Cash and Cash Equivalents

($ millions) 1.9 1.6 2.4 5.9

================================ ============= ============ ================ ===========

Total Expense Ratio ("TER")(2) 2.15% 2.21% 2.31% -

================================ ============= ============ ================ ===========

Ongoing Charges (3) 2.10% 2.11% 2.14% -

================================ ============= ============ ================ ===========

(1) Stated in US Dollars, the GBP price as at 31 December 2020

and 31 December 2019 converted to US Dollars using respective year

end exchange rate.

(2) The TERs represent the Company's management fees and all

other operating expenses, as required by US Generally Accepted

Accounting Principles ("US GAAP"), expressed as a percentage of

average net assets.

(3) In the year to 31 December 2020, the Company's Ongoing

Charges were 2.38%. This figure is based on an expense figure for

the year to 31 December 2020 of $3,198,067. This figure, which has

been prepared in accordance with AIC guidance represents the

Company's management fees and all other operating expenses,

excluding finance costs payable, expressed as a percentage of

average net assets. No performance fees were payable as at 31

December 2020. The Ongoing Charges by share class are disclosed

above.

Summary of Value in Excess of Original Capital Invested

Ordinary Extended Life New Global

Share Class Share Class Share Class

At 31 December 2020 ($) ($) (GBP)

------------------------------------- -------------- -------------- --------------

Original Capital Invested (124,500,202) (359,359,794) (110,785,785)

------------------------------------- -------------- -------------- --------------

Total Capital Distributions 129,627,394 259,844,033 42,460,798

------------------------------------- -------------- -------------- --------------

Total Income Distributions (1) 3,166,835 14,896,010 2,685,521

------------------------------------- -------------- -------------- --------------

Distributions as % of Original

Capital 107% 76% 41%

------------------------------------- -------------- -------------- --------------

Total Buybacks - 12,112,379 10,924,963

------------------------------------- ============== -------------- --------------

NAV 12,952,965 63,540,650 23,363,139

------------------------------------- -------------- -------------- --------------

Total of NAV Plus Capital and

Income Returned ("Value") 145,747,194 350,393,072 79,434,421

------------------------------------- -------------- -------------- --------------

Value in Excess of Original Capital

Invested 21,246,992 (8,966,722) (31,351,364)

------------------------------------- -------------- -------------- --------------

Value as % of Original Capital

Invested 117% 98% 72%

------------------------------------- -------------- -------------- --------------

Ordinary Extended Life New Global

Share Class Share Class Share Class

At 31 December 2019 ($) ($) (GBP)

------------------------------------- -------------- -------------- --------------

Original Capital Invested (124,500,202) (359,359,794) (110,785,785)

------------------------------------- -------------- -------------- --------------

Total Capital Distributions 129,627,394 236,873,855 24,473,845

------------------------------------- -------------- -------------- --------------

Total Income Distributions (1) 3,166,835 14,896,010 2,685,521

------------------------------------- -------------- -------------- --------------

Distributions as % of Original

Capital 107% 70% 25%

------------------------------------- -------------- -------------- --------------

Total Buybacks - 10,255,281 9,346,306

------------------------------------- -------------- -------------- --------------

NAV 13,976,415 105,771,674 59,862,782

------------------------------------- -------------- -------------- --------------

Total of NAV Plus Capital and

Income Returned ("Value") 146,770,644 367,796,820 96,368,454

------------------------------------- -------------- -------------- --------------

Value in Excess of Original Capital

Invested 22,270,442 8,437,026 (14,417,331)

------------------------------------- -------------- -------------- --------------

Value as % of Original Capital

Invested 118% 102% 87%

------------------------------------- -------------- -------------- --------------

(1) By way of dividend

A detailed breakdown of the Company's distributions is provided

on the Company's website at www.nbddif.com under "Investor

Information", "Capital Activity".

2020 PERFORMANCE REVIEW | Chairman's Statement

Chairman's Statement

Dear Shareholder,

The year ended 31 December 2020 was one of unprecedented global

economic and social disruption with a profound human impact.

Notwithstanding this unparalleled backdrop, I am pleased to report

that the Company has navigated these waters with no operational

impact, in large due to the operational resilience of our

Investment Manager and service providers.

We did, of course, suffer financial setbacks but were able to

deliver further capital distributions to the shareholders of the

NBDX and NBDG share classes consistent with the well-established

and orderly realisation of the portfolios. The process of

realisation has slowed as we have continued with this disciplined

approach. With each share class in its harvest period, we continue

to seek to balance the pace of exits and the value achieved for

shareholders as we return capital to our investors. As a reminder,

the Ordinary class shareholders will no longer receive capital

distributions until such time as all final assets attributable to

them have been realised to ensure compliance with UK

regulations.

Company Performance

As at 31 December 2020, the Company had returned a total of

$132.8m or 106.7% of NBDD investors' original capital of $124.5m,

$274.8m or 76.5% of NBDX investors' original capital of $359.4m and

GBP45.2m or 40.8% of NBDG investors' original capital of GBP110.8m.

Additionally, $1.9m was spent on buying back NBDX shares and

GBP1.6m was spent on buying back NBDG shares in a manner accretive

to net asset value ("NAV").

On 17 June 2020, we announced a further capital distribution of

$10.5m to our NBDX shareholders and GBP10.5m to our NBDG

shareholders which was paid on 10 July 2020.

Securing the balance between the pace of exits and the value for

shareholders is an active exercise. In many instances, assets will

need intense management to realise their full potential. In

response to the market improvements post the March lows the

Investment Manager realised all the remaining holdings of listed

equities so as to safeguard against any further market declines.

The Board continues to monitor all costs to ensure that they are

appropriate as we are conscious that shareholders may be concerned

about the impact of costs on a reducing portfolio during the

harvest period as evidenced by the increased Total Expense Ratios

reported herein. We would like to remind our investors that our

TERs continue to increase as the NAV decreases through capital

distributions as some expenses of the Company are fixed,

representing a higher portion of costs year on year.

On 16 November 2020 we announced in our quarterly Factsheet that

we would discontinue the buyback programme. The buyback programme

was intended to narrow the discount, during the investment period.

Going forward, we will make cash distributions to our Shareholders

from investment realisations and not through buybacks.

During the year, we appointed Jeffries International Limited as

sole corporate broker and financial adviser to the Company with

effect from 14 September 2020.

On 27 October 2020, we were pleased to announce that the

Investment Manager was waiving its entitlement to any Base Fee

calculated in respect of any cash and cash equivalents held by the

Company that is solely attributable to the account of the Ordinary

Shares, with such waiver having taken effect as at 1 October 2020.

This decision was made because the Ordinary Shares cannot make any

further distributions (given the 10% withholding limit) until a

final distribution is paid at the end of the Share Class's life and

also due to the delay in realising the remaining investments.

Further, we were delighted to announce on 18 March 2021, that the

Investment Manager had waived all fees across the Ordinary Share

Class, Extended Life Share Class and New Global Share Class with

immediate effect. The fee waiver recognises that it is taking

longer than expected to fully realise the Company's assets due to a

number of factors, including the COVID-19 pandemic, as we outlined

in our most recent quarterly update. A partial fee waiver on the

smallest share class, NBDD, was already in place as noted above,

but this has been replaced with a full fee waiver on all three

share classes to reduce costs for shareholders. The Investment

Manager remains committed to the Company and the orderly

realisation of remaining assets.

Annual General Meeting ("AGM") Results

As described in our interim accounts, the Board put its income

distribution policy to a shareholder vote by way of a separate

resolution at the 2020 AGM, which was approved. We will continue to

put our income distribution policy to a shareholder vote at each

annual general meeting. The income distribution policy is set out

in the Distributions to Shareholders section above. I would like to

remind shareholders that such distributions occur on an ad-hoc

basis and are not expected to be material, nor equal to all share

classes.

We view the AGM as a very important event and would urge all

shareholders to use their votes. I would hope that shareholders

will contact us ahead of the AGM to raise any concerns they may

have and would draw your attention to comments I make below on

aspects of governance.

Board Composition, Independence and Diversity

Cognisant of the time remaining for the realisation of all the

portfolios in the next couple of years and final distributions to

shareholders as soon as possible thereafter, the Board considers

that its size and composition remains optimal and in the best

interests of our shareholders. Messrs Legge and Vakil reviewed my

own position as Chairman and they believe it is prudent and in the

best interests of shareholders to continue to have the depth of

experience of a longer serving director on the Board and both

agreed that they consider me to remain independent. To that end, I

will remain as Chairman if re-elected at the next AGM. I am pleased

to report that the Board appointed Stephen Vakil as the Senior

Independent Director effective 1 January 2020.

While the Board believes it is currently in the best interests

of shareholders for the Company not to refresh the Board or

implement a formal succession plan, for the reasons given above,

the long-term outlook for the Company (as an umbrella structure) is

unknown. Any future capital raise would change this picture and be

preceded by a process of board refreshment. Naturally, we would

seek to appoint directors as needed to replace a key vacant

position should it arise.

We recognise that this approach does not strictly accord with

best practice but hope that shareholders will support it as a

pragmatic approach to the current situation.

While we currently have no female members on the Board, we

maintain our strong belief in the value of diversity in the

boardroom and recognise its importance. As I have already noted, we

will continue to assess the Board's composition, considering the

needs of the Company and the benefits to shareholders. We welcome

shareholder engagement and discussion on board composition and

diversity, as with all aspects of our governance.

Brexit

As previously reported in our interim report, Brexit has not

impacted our operations or Portfolios in any material manner, and

there is no significant impact from the trade deal agreed between

the UK and EU. Shareholders are reminded that the NBDD and NBDX

Portfolios are US Dollar denominated and any non-US exposure is

hedged back to the US Dollars and that NBDG, on the other hand, is

a Pound Sterling denominated, but unhedged, share class with a

broader geographic remit than the other two share classes.

COVID-19

The world has experienced unprecedented times as a result of the

COVID-19 pandemic and the values of many of our assets have been

negatively affected. I am pleased to be able to report that our key

service providers have continued to provide services to the Company

throughout the pandemic and thank them for their efforts in

maintaining our operational resilience .

The various valuation methodologies we use to value your

portfolio's holdings have been reviewed and we consider that they

remain appropriate for determining values at any given point in

time.

As global virus outbreaks continue to occur, the COVID-19 virus

remains the primary issue for investors. The outbreaks and calls

for additional lockdowns diminish near term virus containment

hopes, while also restricting behaviour and curtailing more robust

economic activity. Nevertheless, the development and implementation

of vaccines has provided reason for optimism. Given these

circumstances, the longer-term financial impact on our assets

remains difficult to predict. Despite the uncertainty, the

Investment Manager remains committed to realising the investments

in an orderly manner. However, the timing of the orderly

realisation of some assets is less certain and the quantum of the

proceeds therefrom is difficult to predict.

Our objectives remain the same; to maximise the benefit to

investors during this harvest period and to continue to provide

updated information regarding asset values.

Outlook

The Ordinary class of shares will be the first to commence the

final wind up process, followed by the Extended share class and

then the New Global share class. As is normally the case with

investment companies, as opposed to those with commercial

undertakings, this does not currently have any material impact on

the Company's ability to continue as a going concern or remain

viable. However, the whole process must be managed in a way that

ensures compliance with UK regulations.

The Extended and Global classes will continue to distribute

until their net assets are reduced to approximately $35m and GBP9m

respectively. In certain cases, the cash associated with these

share classes will need to remain in underlying corporate vehicles

while tax and other matters relating to those vehicles are

concluded. We will keep investors appraised of developments in

respect of the remaining assets.

We had previously indicated that we expected the final

distribution of the Ordinary share class to be made during 2020,

but the delay to the realisation of the final assets owing to the

ongoing global pandemic has delayed this expectation to 2021. The

wind up of the other two classes will take a little longer but we

hope to complete the realisation process in the next couple of

years. As noted earlier, upheaval in financial markets and global

economic uncertainty may impact these timings and we will keep

shareholders updated via the quarterly fact sheets.

On behalf of the Board, I would like to thank our longstanding

shareholders for your support of our Company. We look forward to

updating you further on investment realisations throughout the

remainder of the year.

John Hallam

Chairman

14 April 2021

2020 PERFORMANCE REVIEW | Investment Manager's Report

Investment Manager's Report

Ordinary Share Class

Summary

The NAV per share decreased by 7.3% for the year ended 2020. We

continued to see significant volatility in the markets due to the

spread of COVID-19 and its impact on global growth expectations.

The long-term effects of COVID-19 on the global economy remain

unknown. With the sale of the public equities in the first half of

the year, the remaining investments await realisation events. The

Investment Manager is committed to realising the investments in a

timely manner and winding down the share class as soon as

practicable, but there is one asset we are working through which

will determine the final distribution date. The Investment Manager

is evaluating options to wind down the share class.

Portfolio Update

NBDD ended the year with a NAV per share of $0.8420 compared to

$0.9086 at end of 2019. The NAV decrease was principally driven by

lower prices in the investments in light of the COVID-19 crisis and

realised losses in exits of public equities. At 31 December 2020,

60% of NBDD's NAV was invested in distressed assets, and $5M in US

Government securities which represented a further 40% of NAV, with

minimal cash net of payables (see table below). Cash balances will

continue to increase as assets are realised, subject to variations

in collateral cash, but as noted previously cannot be distributed

until the final liquidation of the share class. The portfolio

consisted of 6 issuers across 5 sectors. The largest sector

concentrations were in containers & packaging, surface

transportation and financial intermediaries.

Cash Analysis

====================== ========

Balance Sheet - Cash $3.6m

====================== ========

Collateral cash ($3.1m)

====================== ========

Other payables ($0.0m)

====================== ========

Total available cash $0.5m

====================== ========

Notable events below describe activity in the investments during

2020:

-- During the year, Exide Technologies filed for Chapter 11

bankruptcy due to the global shutdown and COVID-19. The company

sold its US operations and lenders credit are bidding for the

European business. The valuation impact was a $1.1m unrealised

loss. The magnitude of the unrealised loss is due to the decline in

business operations as well as the decision to not reorganise and

sell off the business units.

-- NBDD completed the exit of all public equities in early 2020

in view of the market uncertainties at that time.

-- The Financial Intermediary investment received approval to

make first distribution on surplus notes in July 2020 and received

approval in the fourth quarter to make another distribution in

early 2021 as a result of which the Company will receive $110K.

Significant Price Movement during 2020 (approximately 1% of NBDD

NAV or $130,000)

INDUSTRY INSTRUMENT TOTAL RETURN COMMENT

(US DOLLARS MILLIONS)

------------------------- --------------- ------------------------ ------------------------------------------------

Improvement in profitability on strong

Containers & packaging Private Equity 2.09 end-market demand

Improvement in profitability on strong

Containers & packaging Private Equity 0.29 end-market demand

COVID-19 related restructuring due to liquidity

Auto Components Private Equity (1.15) shortfall

Financial Intermediaries Private Note (0.14) COVID-19 impacted underlying asset performance

Exits

During the year, we saw five exits, which generated a total

return of $ (7.6m) and generated net cash inflows of $ 13.6m. This

brings the total number of exits since inception in NBDD to 50,

with a total return of $35.8m. Detailed descriptions of the exits

are at the end of this report.

Partial Realisations

The partial realisations generated a net realised gain of $8.8m

over the life of the fund. Detailed descriptions of the partial

realisations are at the end of this report.

Distributions

To date, $132.8m or 107% of original capital has been

distributed to investors in the form of capital distributions via

redemptions and income dividends. Total value to investors

including NAV and all distributions paid is $145.7m (117% of

original capital). For regulatory reasons, the final 10% of the

total return (NAV plus cumulative distributions) in respect of any

class of participating shares in NBDDIF will be returned to

shareholders with a final compulsory redemption of all of the

outstanding shares of that class. Our intent is to wind down the

share class as soon as practicable but there is one asset, we are

working through which will determine the final distribution date.

We will continue to update investors as we gain clarity on the

realisations.

Extended Life Share Class

Summary

The NAV per share decreased by 14.9% for the year ended 2020.

During the year, we saw significant volatility in the markets due

to the spread of COVID-19 and its impact on global growth

expectations and economic recovery. The effects of COVID-19 on the

global economy and timeframe for recovery remain unknown. With the

sale of the public equities in the first half of the year, the

remaining investments await realisation events. The Investment

Manager is committed to realising the investments in a timely

manner and winding down the share class as soon as practicable.

Portfolio Update

NBDX ended the year with a NAV per share of $0.7889 compared to

$0.9266 at end of 2019. At 31 December 2020, 96% of NBDX's NAV was

invested in distressed assets, and $2.8M in US Government

securities which represented a further 4% of NAV with a minimal of

cash net of payables (see table below). Cash balances will continue

to increase as assets are realised, subject to variations in

collateral cash, but as noted previously cannot be distributed

until the final liquidation of the share class. The NAV per share

decreased 14.9% during the year principally due to losses in public

equities and unrealised losses in the existing portfolio with the

impact of COVID-19. With the exit of the public equities, the NBDX

portfolio consists of 13 issuers across 9 sectors. The largest

sector concentrations were in surface transportation, containers

& packaging, shipping, lodging & casinos, and financial

intermediaries.

Cash Analysis

====================== ========

Balance Sheet - Cash $9.1m

====================== ========

Collateral cash ($8.5m)

====================== ========

Other payables ($0.3m)

====================== ========

Total available cash $0.3m

====================== ========

Notable events below describe activity in the investments during

2020:

-- During the period, Exide Technologies filed for Chapter 11

bankruptcy due to the global shutdown and COVID-19. The company

does not expect to reorganise and has begun a sales process for the

various business units. The valuation impact was a ($9.7m)

unrealised loss. The magnitude of the unrealised loss is due to the

decline in business operations as well as the decision not to

reorganise and sell off the business units.

-- The Company completed the exit of 11 investments. All but one

exit related to equity investments, in view of the market

uncertainties in early 2020.

-- The Financial Intermediary investment received approval to

make first distribution on surplus notes in July 2020 and received

approval in the fourth quarter to make another distribution in

early 2021 as a result of which the Company will receive

$1.37m.

Significant Price Movements during 2020 (approximately 1% of

NBDX NAV or $640,000)

INDUSTRY INSTRUMENT TOTAL RETURN COMMENT

(US DOLLARS MILLIONS)

-------------------------- ----------------------- ------------------------ ---------------------------------------

Improvement in profitability on strong

Containers & packaging Private Equity 5.38 end-market demand

Improvement in profitability on strong

Containers & packaging Private Equity 0.76 end-market demand

COVID-19 related restructuring due to

Auto Components Private Equity (9.78) liquidity shortfall

Shipping Bank Debt Investments (2.67) Lower dry bulk asset values

COVID-19 impacted underlying asset

Financial Intermediaries Private Note (1.73) performance

Exits

In 2020 we saw eleven exits for NBDX, which generated a total

return of $(51.5m) and generated net cash inflows of $46.2m. This

brings the total number of exits since inception in NBDX to 67 with

total return of $63.7m. Detailed descriptions of the exits are at

the end of this report.

Partial Realisations

The partial realisations generated a net realised gain of $22.7m

over the life of the Company. Detailed descriptions of the partial

realisations are at the end of this report.

Distributions

During 2020, NBDX approved distributions of $23m bringing total

distributions to date (dividends, redemptions and buy-backs) of

$287.0m or 80% of original capital. Total value to investors

including NAV and all distributions paid is $350.4m or 98% of

original capital. With the uncertainty as to how long the economic

downturn will last, certain realisations in NBDX have been delayed.

For regulatory reasons, the final 10% of total return in respect of

any class of participating shares in NBDDIF will be returned to

shareholders with the final compulsory redemption of all of the

outstanding shares of that class. The Investment Manager is

committed to realising the investments in a timely manner to

distribute cash to investors as soon as possible.

Share Buybacks

During 2020, NBDX purchased 3.7m of its own shares under the

buyback programme at a cost of $1.9m and a weighted average

discount of 33%. The shares have been cancelled.

Global Share Class

Summary

The NAV per share decreased by 31.9%. We continued to see

significant volatility in the markets due to the spread of COVID-19

and its impact on global growth expectations and economic recovery.

The effects of COVID-19 on the global economy remain unknown. With

the sale of the public equities in the first half of the year, the

remaining investments await realisation events. The Investment

Manager is committed to realising the investments in a timely

manner and winding down the share class as soon as practicable.

Portfolio Update

NBDG ended 2020 with a NAV per share of GBP0.5682 compared to

GBP0.8339 at the end of 2019. At 31 December 2020, 90% of NBDG's

NAV was invested in distressed assets, and $2M in US Government

securities which represented a further 7% of NAV (including cash

receivables and net payables held in subsidiaries) with 3% held in

cash (see table below). NAV per share decreased 31.9% during the

year principally due to losses in public equities and unrealised

losses in the existing portfolio with the impact of COVID-19. With

the exit of the public equity investments, the portfolio consisted

of 7 issuers across 6 sectors. The largest sector concentrations

were in lodging & casinos, commercial mortgage, surface

transportation and shipping.

Cash Analysis

====================================== ========

Balance Sheet - Cash $0.9m

====================================== ========

Cash held in wholly-owned subsidiary

accounts $0.0m

====================================== ========

Other payables ($0.1m)

====================================== ========

Total available cash $0.8m

====================================== ========

Notable events involving NBDG's investments during 2020 are

below :

-- During the period, Exide Technologies filed for Chapter 11

bankruptcy due to the global shutdown and COVID-19. The company

does not expect to reorganise and has begun a sales process for the

various business units. The valuation impact was a (GBP4.0m)

unrealised loss. The magnitude of the unrealised loss is due to the

decline in business operations as well as the decision to not

reorganise and sell off the business units.

-- The Company completed the exit of all public equities in

early 2020 in view of the market uncertainties at that time.

Significant Price Movements during 2020 (approximately 1% of

NBDG NAV or GBP230,000)

INDUSTRY INSTRUMENT TOTAL COMMENT

RETURN

(US DOLLARS

MILLIONS)

---------------- ------------------------------ -------------- -------------------------------

COVID-19 related restructuring

Auto Components Private Note (4.06) due to liquidity shortfall

Lodging & Bank Debt Investments/Private

Casinos Equity (1.51) Hotel closed due to COVID-19

Shipping Bank Debt Investments (1.08) Lower dry bulk asset values

Exits

During 2020, we saw eleven exits, which generated a total return

of GBP (15.2m) and generated net cash inflows of GBP46.9m. This

brought the total number of exits since inception to 30 with a

total return of GBP (7.2m). Detailed descriptions of the exits are

at the end of this report.

Partial Realisations

There were no partial realisations in NBDG during 2020.

Distributions

During 2020, the Company made GBP18.0m capital distributions via

redemption of shares, which brings total distributions to date

(dividends, redemptions and buy-backs) of GBP56.1m or 51% of

original capital. Total value to investors including NAV and all

distributions paid is GBP79.4m or 72% of original capital. With the

uncertainty as to how long the economic downturn will last, certain

realisations in NBDG have been delayed. For regulatory reasons, the

final 10% of total return in respect of any class of participating

shares in NBDDIF will be returned to shareholders with the final

compulsory redemption of all of the outstanding shares of that

class. The Investment Manager is committed to realising the

investments in a timely manner to distribute cash to investors as

soon as possible.

Share Buybacks

During 2020, NBDG purchased 3.0m shares under the buyback

programme at a cost of GBP1.6m and weighted average discount of

19%. The shares have been cancelled.

Summary of Exits across all Share Classes

The total exits during 2020 can be summarised as follows:

-- NBDD - Five exits

-- NBDX - Eleven exits

-- NBDG - Eleven exits

Exits experienced from inception to date were as follows:

NBDD 50 exits with a total return of $35.6m, IRR (1) of 10% and

ROR of 19%

NBDX 67 exits with a total return of $63.4m, IRR (1) of 5% and

ROR of 10%

NBDG 30 exits with a total return of GBP (7.27m), IRR (1) of (5)

% and ROR of (6) %

The annualised internal rate of return ("IRR") (1) is computed

based on the actual dates of the cash flows of the security

(purchases, sales, interest and principal pay downs), calculated in

the base currency of each portfolio. The Rate of Return ("ROR") (1)

represents the change in value of the security (capital

appreciation, depreciation and income) as a percentage of the

purchase amount. The purchase amount can include multiple

purchases. Total Return represents the inception to date gain/loss

on an investment.

Exit L (Exit 20 for NBDG and Exit 56 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

L Exit

======== ===== ================ ================ =============== ======= ======= =========

(32.3) (85.2)

NBDG 20 GBP1.5 GBP0.2 (GBP1.3) % % 59

======== ===== ================ ================ =============== ======= ======= =========

(34.2) (87.1)

NBDx 56 $5.7 $0.7 ($5.0) % % 59

======== ===== ================ ================ =============== ======= ======= =========

(1) Defined under Alternative Performance Measures ("APMs") in the Strategic Report below

Exit M (Exit 21 for NBDG and Exit 57 for NBDD)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

M Exit

======== ===== ================ ================ =============== ======= ======= =========

(29.2) (62.4)

NBDG 21 GBP1.6 GBP0.6 (GBP1.0) % % 59

======== ===== ================ ================ =============== ======= ======= =========

(30.5) (68.9)

NBDX 57 $1.7 $0.5 ($1.2) % % 59

======== ===== ================ ================ =============== ======= ======= =========

Exit N (Exit 46 for NBDD and Exit 58 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

N Exit

======== ===== ================ ================ =============== ======= ======= =========

(23.3) (21.0)

NBDD 46 $2.0 $1.6 ($0.4) % % 84

======== ===== ================ ================ =============== ======= ======= =========

(23.3) (21.0)

NBDX 58 $5.1 $4.0 ($1.1) % % 84

======== ===== ================ ================ =============== ======= ======= =========

Exit O (Exit 22 for NBDG and 60 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

O Exit

======== ===== ================ ================ =============== ======= ======= =========

(44.2) (61.1)

NBDG 22 GBP8.8 GBP3.4 (GBP5.4) % % 64

======== ===== ================ ================ =============== ======= ======= =========

(52.9) (69.9)

NBDX 60 $7.5 $2.3 ($5.2) % % 64

======== ===== ================ ================ =============== ======= ======= =========

Exit P (Exit 24 for NBDG, exit 47 for NBDD and Exit 62 for

NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

P Exit

======== ===== ================ ================ =============== ======= ======= =========

(23.1) (73.2)

NBDG 24 GBP7.2 GBP1.9 (GBP5.3) % % 71

======== ===== ================ ================ =============== ======= ======= =========

(7.1) (45.1)

NBDD 47 $3.0 $1.6 ($1.4) % % 111

======== ===== ================ ================ =============== ======= ======= =========

(9.1) (52.5)

NBDX 62 $10.1 $4.8 ($5.3) % % 111

======== ===== ================ ================ =============== ======= ======= =========

Exit Q (Exit 25 for NBDG and Exit 63 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

Q Exit

======== ===== ================ ================ =============== ====== ======= =========

(2.1) (9.4)

NBDG 25 GBP6.2 GBP5.6 (GBP0.6) % % 75

======== ===== ================ ================ =============== ====== ======= =========

(7.7) (32.1)

NBDX 63 $10.1 $6.8 ($3.3) % % 75

======== ===== ================ ================ =============== ====== ======= =========

Exit R (Exit 26 for NBDG)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

R Exit

======== ===== ================ ================ =============== ======= ======= =========

(20.1) (39.6)

NBDG 26 GBP1.3 GBP0.8 (GBP0.5) % % 44

======== ===== ================ ================ =============== ======= ======= =========

Exit S (Exit 27 for NBDG and Exit 64 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

S Exit

======== ===== ================ ================ =============== ====== ====== =========

NBDG 27 GBP5.8 GBP9.6 GBP3.8 11.8% 66.4% 74

======== ===== ================ ================ =============== ====== ====== =========

NBDX 64 $3.2 $4.9 $1.7 9.0% 53.8% 74

======== ===== ================ ================ =============== ====== ====== =========

Exit T (Exit 28 for NBDG and Exit 65 for NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

T Exit

======== ===== ================ ================ =============== ====== ======= =========

(3.4) (16.5)

NBDG 28 GBP5.4 GBP4.5 (GBP0.9) % % 74

======== ===== ================ ================ =============== ====== ======= =========

(9.0) (41.8)

NBDX 65 $11.8 $6.8 ($5.0) % % 80

======== ===== ================ ================ =============== ====== ======= =========

Exit U (Exit 29 for NBDG, exit 48 for NBDD and Exit 66 for

NBDX)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

U Exit

======== ===== ================ ================ =============== ======= ======= =========

(13.5) (26.8)

NBDG 29 GBP9.1 GBP6.7 (GBP2.4) % % 68

======== ===== ================ ================ =============== ======= ======= =========

(26.6) (66.3)

NBDD 48 $1.0 $0.3 ($0.7) % % 85

======== ===== ================ ================ =============== ======= ======= =========

(28.4) (69.0)

NBDX 66 $19.6 $6.1 ($13.5) % % 85

======== ===== ================ ================ =============== ======= ======= =========

Exit V (Exit 30 for NBDG and Exit 49 for NBDD)

Cash Invested Cash Received Total Return Months

Exit (millions) (millions) (millions) IRR ROR Held

V Exit

======== ===== ================ ================ =============== ====== ====== =========

(3.7) (6.0)

NBDG 30 GBP12.8 GBP12.0 (GBP0.8) % % 76

======== ===== ================ ================ =============== ====== ====== =========

(3.4) (9.5)

NBDD 49 $8.8 $7.9 ($0.9) % % 111

======== ===== ================ ================ =============== ====== ====== =========

Exit W (Exit 50 for NBDD and Exit 67 for NBDX)

EXIT CASH INVESTED CASH RECEIVED TOTAL RETURN MONTHS

W EXIT (MILLIONS) (MILLIONS) (MILLIONS) IRR ROR HELD

====== ===== ============== ============== ============= ======= ======= =======

(53.8) (67.3)

NBDD 50 GBP6.5 GBP2.1 ($4.4) % % 91

====== ===== ============== ============== ============= ======= ======= =======

(50.5) (66.9)

NBDX 67 $16.7 $5.5 ($11.2) % % 99

====== ===== ============== ============== ============= ======= ======= =======

Exit X (Exit 23 for NBDG and Exit 61 for NBDX)

EXIT CASH INVESTED CASH RECEIVED TOTAL RETURN MONTHS

X EXIT (MILLIONS) (MILLIONS) (MILLIONS) IRR ROR HELD

====== ===== ============== ============== ============= ======= ======= =======

(40.8) (38.9)

NBDG 23 GBP2.40 GBP1.50 ($0.9) % % 65

====== ===== ============== ============== ============= ======= ======= =======

(43.6) (41.2)

NBDX 61 $6.4 $3.7 ($2.7) % % 65

====== ===== ============== ============== ============= ======= ======= =======

Summary of Partial Realisations across all Share Classes

All partial realisations currently in the portfolio are reported

as at 31 December 2020 and it should be noted that their IRR and

ROR are likely to be different at the time of the final exit. These

were the following partial realisations:

-- NBDD - Two

-- NBDX - Two

-- NBDG - None

Partial Realisation B: NBDD and NBDX

NBDD and NBDX invested $7.1m to purchase first lien secured bank

debt with attached private equity of an international packaging

company. The debt was repaid in full shortly after the purchase

with the receipt of $5.8m and the Company retained the equity,

receiving dividends of $1.7m during the holding period. During the

second quarter the company's sale to a complementary packaging

company was announced. NBDX and NBDD elected to receive sale

proceeds in cash and newly created shares in the acquirer for a

combined value of $4.0m. In the third quarter of 2017, the Company

received $1.5m cash as part of the sale proceeds from the disposal

completed at the end of the second quarter of 2017 and $1.0m for

partial redemption of new shares received in the acquirer. The

company's operating performance declined due to raw material price

increases. The current value of the private equity position is

$1.8m generating a total return of $4.7m as of 31 December 2020.

IRR was 27% and ROR was 66% with a holding period of 98 months at

31 December 2020.

Value of

Cash Received Residual

Effective Cash Invested to Date Investment Total Return MonthS

B Period (millions) (millions) (millions) (millions) IRR ROR Held

====== ============= ================ ============== ============= =============== ====== ====== =========

NBDD H1 2017 $2.0 $2.8 $0.5 $1.3 27% 66% 98

====== ============= ================ ============== ============= =============== ====== ====== =========

NBDX H1 2017 $5.1 $7.2 $1.3 $3.4 27% 66% 98

====== ============= ================ ============== ============= =============== ====== ====== =========

Partial Realisation C: NBDD and NBDX

NBDD and NBDX invested $9.2m in preferred equity certificates

("PECs") and private equity of a European packaging company. The

PECs were retired in full in 2015 and the company paid dividends on

the equity during the holding period. Cash received to date is

$23.2m. In the second quarter, the company announced it was

purchasing another complementary packaging company (Partial

Realisation B, above) and completing a recapitalisation to

refinance existing debt, provide cash for the acquisition and pay a

dividend to shareholders. The company's operating performance

declined due to raw material price increases. The current value of

the private equity position is $12.9m, generating a total return of

$26.9m as at 31 December 2020. IRR was 54% and ROR was 291% with a

holding period of 101 months at 31 December 2020.

Cash Value of

Received Residual

Effective Cash Invested to Date Investment Total Return Months

C Period (millions) (millions) (millions) (millions) IRR ROR Held

====== ============= ================ ============ ============= =============== ====== ====== =========

NBDD H1 2017 $2.6 $6.5 $3.6 $7.5 54% 291% 101

====== ============= ================ ============ ============= =============== ====== ====== =========

NBDX H1 2017 $6.6 $16.7 $9.3 $19.4 54% 291% 101

Neuberger Berman Investment Advisers LLC Neuberger Berman Europe Limited

14 April 2021 14 April 2021

2020 PERFORMANCE REVIEW | Portfolio Information

Portfolio Information

Ordinary Share Class

Top 5(1) Holdings at 31 December 2020

Purchased % of

Holding Sector Instrument Status Country NAV Primary Asset

---------- ------------------------- ------------ ----------- ----------- ----- --------------------

Post-Reorg Manufacturing Plant

1 Specialty Packaging Equity Post-Reorg Luxembourg 28% and Equipment

========== ========================= ============ =========== =========== ===== ====================

2 Surface Transport Trade Claim Defaulted Brazil 21% Municipal Claim

========== ========================= ============ =========== =========== ===== ====================

Secured

3 Financial Intermediaries Notes Post-Reorg US 5% Cash & Securities

========== ========================= ============ =========== =========== ===== ====================

Post-Reorg Manufacturing Plant

4 Specialty Packaging Equity Post-Reorg Luxembourg 4% and Equipment

========== ========================= ============ =========== =========== ===== ====================

Building & Secured

5 Development Loan Defaulted US 1% Land

========== ========================= ============ =========== =========== ===== ====================

Total 59%

========== ========================= ============ =========== =========== ===== ====================

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 3 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/5119V_1-2021-4-14.pdf

Extended Life Share Class

Top 10 Holdings at 31 December 2020

Purchased % of

Holding Sector Instrument Status Country NAV Primary Asset

---------- ------------------ -------------- ----------- ------------ ----- -----------------------

Specialty Post-Reorg Manufacturing Plant

1 Packaging Equity Post-Reorg Luxembourg 15% and Equipment

========== ================== ============== =========== ============ ===== =======================

Secured Loan

/ Private Marshall

2 Shipping Equity Post-Reorg Islands 14% Ships

========== ================== ============== =========== ============ ===== =======================

Financial

3 Intermediaries Secured Notes Defaulted US 12% Cash and Securities

========== ================== ============== =========== ============ ===== =======================

4 Surface Transport Trade Claim Defaulted Brazil 11% Municipal Claim

========== ================== ============== =========== ============ ===== =======================

Commercial

5 Mortgage Secured Loan Defaulted Netherlands 9% Commercial Real Estate

========== ================== ============== =========== ============ ===== =======================

Lodging & Hotel/Lodging Real

6 Casinos Secured Notes Post-Reorg US 7% Estate and Casino

========== ================== ============== =========== ============ ===== =======================

7 Surface Transport Secured Loan Defaulted Spain 7% Concession

========== ================== ============== =========== ============ ===== =======================

Post-Reorg

8 Oil & Gas Equity Post-Reorg US 7% Ethanol Plant

========== ================== ============== =========== ============ ===== =======================

Lodging & Hotel/Lodging Real

9 Casinos Secured Loan Defaulted US 6% Estate and Casino

========== ================== ============== =========== ============ ===== =======================

Manufacturing Plant

10 Auto Components Secured Loan Post-Reorg US 4% and Equipment

========== ================== ============== =========== ============ ===== =======================

Total 92%

========== ================== ============== =========== ============ ===== =======================

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 4 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/5119V_1-2021-4-14.pdf

New Global Share Class

Top 7(1) Holdings at 31 December 2020

Purchased % of

Holding Sector Instrument Status Country NAV Primary Asset

---------- ----------------------- ------------------ ----------- ------------ ----- -------------------

Secured

Lodging & Loan / Private

1 Casino Equity Current Spain 27% Hotel/Casino

========== ======================= ================== =========== ============ ======= =================

Commercial Secured Commercial Real

2 Mortgage Loan Defaulted Netherlands 22% Estate

========== ======================= ================== =========== ============ ======= =================

Secured

3 Surface Transportation Loan Defaulted Spain 15% Legal Claim

========== ======================= ================== =========== ============ ======= =================

Secured

Loan / Private Marshall

4 Shipping Equity Post-Reorg Islands 11% Ships

========== ======================= ================== =========== ============ ======= =================

Lodging & Secured

5 Casino Notes Defaulted US 7% Hotel/Casino

========== ======================= ================== =========== ============ ======= =================

Private

6 Oil & Gas Equity Post-Reorg US 6% Ethanol Plant

========== ======================= ================== =========== ============ ======= =================

Secured Manufacturing

7 Auto Components Loan Post-Reorg US 3% Plant

========== ======================= ================== =========== ============ ======= =================

Total 91%

========== ========================= ================ =========== ============ ======= =================

[For Investment Structure of the Company, click on, or paste the

following link into your web browser, to view page 5 in the

associated PDF document]

http://www.rns-pdf.londonstockexchange.com/rns/5119V_1-2021-4-14.pdf

(1) Global Share Class holds seven investments by issuer

2020 PERFORMANCE REVIEW | Strategic Report

Strategic Report

Since 31 March 2017, the Portfolios have all been in their

respective harvest period. As such this strategic report is

presented in the context of the current positioning of the

Portfolios in their lifecycle. The Company's corporate umbrella

itself has an indefinite life to allow for flexibility for the

Company to add new share classes if demand, market opportunities

and shareholder approval supported such a move, although the

Company has no current plans to create new share classes.

Principal and Emerging Risks and Risk Management

The Board is responsible for the Company's system of internal

financial and operating controls and for reviewing its

effectiveness. The Board uses the Company's risk matrix as its core

element in establishing the Company's system of internal financial

and reporting controls. The Board has carried out a robust

assessment of the Company's emerging and principal risks and

uncertainties including those that would threaten its business

model, future performance, solvency or liquidity. The principal

risks, which have been identified, and the steps taken by the Board

to mitigate these areas are as follows:

RISK MITIGATION

===== ===========

Investment Activity and Performance

An unsuccessful investment strategy The Board has managed these risks

may result in underperformance by ensuring a diversification of

against the Company's objectives. investments, although the level

This might be due to the skills of diversification will diminish

of the Investment Manager falling as the respective Portfolios liquidate

short in its selection of sectors their positions during their harvest

or issues in which to invest periods. Please see "Principal Risks

and its management of the restructurings/reorganisations Specific to Harvest Periods" below.

which can ensure their success. The Investment Manager operates

in accordance with the investment

limits and restrictions policy set

out in the Company's Investment

Policy and Objectives and as further

determined by the Board. The Directors

review the limits and restrictions

on a regular basis and the Administrator

monitors adherence to the limits

and restrictions every month and

will notify any breaches to the

Board. The Investment Manager provides

the Board with management information

including performance data and reports,

and the Corporate Broker provides

shareholder analyses. The Directors

monitor the implementation and results

of the investment process with the

Investment Manager at each Board

meeting and monitor risk factors

in respect of the Portfolios. Investment

strategy is reviewed at each meeting.

Principal Risks Associated with Harvest Periods

There can be a significant period The Board has ensured that the Investment

between the date the Company Manager has operated in accordance

makes an investment and the date with the investment limits and restrictions

that any gain or loss on such policy set out in the Company's

investment is realised. Further, Investment Policy and Objectives,

towards the end of the Portfolios' although it acknowledges that the

respective harvest periods, a diversification of Portfolio investments

residual amount is required to will diminish as the Portfolios

be retained for each share class liquidate their positions and return

in accordance with regulatory capital to shareholders. The Board

requirements until such time also receives regular updates on

that all assets can be liquidated the status of the Portfolios' investments

and returned to shareholders. and anticipated realisation dates.

The Board monitors the Company's

As capital is returned through expenses on a regular basis and

compulsory partial redemptions ensures that contracts with the

and buybacks, the number of assets Investment Manager and other service

and shares in a Portfolio will providers are at competitive rates.

diminish which in turn may lead The Board also notes that the Company's

to an increased TER and reduced key expenses, such as the management

liquidity in a Portfolio's shares. fee, will diminish in line with

a reduction of assets.

The Company retains the services

of its broker, Jefferies International

Limited (1) to, amongst other things,

enhance liquidity in the underlying

shares.

(1) Stifel Nicolaus Europe Limited until 13 September 2020

Level of Premium or Discount

A discount or premium to NAV While the Directors may seek to

can occur for a variety of reasons, mitigate any discount or premium

including market conditions and to NAV per share through discount

the extent to which investors management mechanisms, such as buybacks

undervalue the management activities or share issuance, there can be

of the Investment Manager or no guarantee that they will do so

discount its valuation methodology or that such mechanisms will be

and judgement. successful and the Directors accept

no responsibility for any failure

of any such strategy to effect a

reduction in any discount or premium.

Market Price Risk

Market price risk is the potential The Board has, over the Investment

for changes in the value of an Periods of the various share classes,

investment or Portfolio. The ensured that the Investment Manager

market value of investments may has operated in accordance with

vary because of a number of factors the Company's investment guidelines.

including, but not limited to, The Directors monitor the status

the financial condition of the of the Portfolio investments with

underlying borrowers, the industry the Investment Manager at each quarterly

in which a borrower operates, Board meeting and monitor risk factors

general economic or political in respect of the Portfolios.

conditions, interest rates, the

condition of the debt trading

markets and certain other financial

markets, developments or trends

in any particular industry and

changes in prevailing interest

rates.

Further details on market price

risk are provided in Note 4 below.

Fair Valuation of Illiquid Assets

With respect to investments that With respect to investments comprised

do not have a readily ascertainable in the Company's Portfolios that

market quotation in an active do not have a readily available

market, the Investment Manager market quotation, such as unquoted

will value such investments at investments or investments which

fair value and such valuations are listed but deemed to be illiquid,

will be inherently uncertain. the Investment Manager values such

Because of the inherent uncertainty investments at fair value on each

and subjectivity in determining NAV calculation date in accordance

the fair value of investments with its customary valuation methods,

that do not have a readily ascertainable policies and procedures. Further

market quotation in an active information on the Company's valuation

market, the fair value of the process can be found in Note 2(g)

Company's investments as determined under "Investment Transactions,

in good faith by the Investment investment income/expenses and valuation",

Manager may differ significantly and Note 2(f), "Fair Value of Financial

from the values that would have Instruments", of the Audited Consolidated

been used had a ready market Financial Statements (the "Financial

existed for such investments. Statements").

The reliability of the NAV calculations

published by the Company will The Board monitors, reviews and

be impacted accordingly. challenges the Company's fair valued

assets on a regular basis to ensure

compliance with the agreed methodology.

The Board reviews the Investment

Manager's internal review process.