Kerry Group PLC Kerry Group Capital Markets Day Update (2866T)

October 11 2017 - 3:00AM

UK Regulatory

TIDMKYGA

RNS Number : 2866T

Kerry Group PLC

11 October 2017

NEWS RELEASE

For Immediate Release

11 October 2017

Kerry Group Updates Medium Term Growth Targets at Capital

Markets Day

Kerry Group, the global taste & nutrition and consumer foods

group, at a Capital Markets presentation being held today, updates

the Group's medium term growth targets and objectives. The Group

also confirms the acquisition of US based Ganeden(R) -- a branded

technology company focused on probiotics and related

technologies.

Addressing investors, Kerry Group Chief Executive Edmond Scanlon

states that the Group expects to deliver in excess of 10% adjusted

earnings per share growth on a constant currency basis on average

per annum over the next five year cycle. "This will be delivered

through achievement of above industry-average volume growth and

continued business margin expansion. We expect to achieve 3% to 5%

volume growth annually on a Groupwide basis, with Taste &

Nutrition targeting 4% to 6% growth and Consumer Foods targeting 2%

to 3% growth".

In terms of trading profit margin progression, he confirms that

margin in Taste & Nutrition is targeted to grow by 40 basis

points per annum and margin in Consumer Foods is targeted to grow

by 20 basis points per annum, which will contribute a 30 basis

points Group margin improvement per annum on average across the

five year cycle.

"Kerry Group has a unique scalable business model which I am

confident can deliver the continued organic growth of the business

across developed and developing markets as planned. We are in a

strong position to lead the continued consolidation of our industry

benefiting from the Group's strong balance sheet, scalable business

model and geographic footprint. Return On Average Capital Employed

(ROACE) is the Group's key financial return metric, the target for

which remains to achieve a return in excess of 12% per annum", says

Edmond Scanlon.

The Group today also confirms the acquisition of Ganeden(R) -- a

leading technology innovation company focused on patented

probiotics and related technologies. Ganeden(R) based in Cleveland,

Ohio, with current year revenue of approximately US$25m, has an

extensive library of published studies and more than 135 patents

for technologies in the supplement, food, beverage, nutrition and

personal care markets. Complementing the Group's acquisition of

Wellmune(R) acquired in late 2015, the acquired Ganeden(R)

technologies will be extended into wider applications across

Kerry's global developed and developing markets.

Contact Information

Media

Frank Hayes Director of +353 66 corpaffairs@kerry.ie

Corporate Affairs 7182304

Investor

Relations

Brian Mehigan Chief Financial +353 66 investorrelations@kerry.ie

Officer 7182292

Ronan Deasy Group Financial +353 66 investorrelations@kerry.ie

Controller 7182292

William Head of Investor +353 66 investorrelations@kerry.ie

Lynch Relations 7182292

Website

www.kerrygroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDFFDSMFFWSELS

(END) Dow Jones Newswires

October 11, 2017 03:00 ET (07:00 GMT)

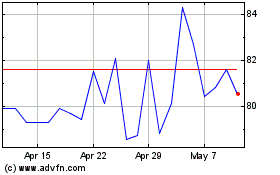

Kerry (LSE:KYGA)

Historical Stock Chart

From Apr 2024 to May 2024

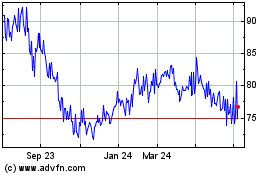

Kerry (LSE:KYGA)

Historical Stock Chart

From May 2023 to May 2024