TIDMKWS

RNS Number : 5685D

Keywords Studios PLC

01 February 2018

1 February 2018

Keywords Studios plc

("Keywords Studios", "the Group")

Full year trading update

Strong financial performance- strengthening our market leading

position

Keywords Studios, the international technical services provider

to the global video games industry, today provides an unaudited

trading update for the year ended 31 December 2017, following a

year of further strong organic growth and geographic expansion,

complemented by a number of significant and successful

acquisitions.

The Board is pleased to announce that it expects revenues to be

not less than EUR150m (FY16: EUR96.6m) and adjusted PBT* of at

least EUR22.5m (FY16: EUR14.9m), both of which are comfortably

ahead of consensus market expectations. Strong organic growth

remains a feature of the Group's performance and this has been

supplemented by acquisitions as the Group continues to deliver on

its strategy in order to become the "go to" supplier of technical

services to the global video games industry. The Group is now

comprised of seven globally managed service lines operating from 42

production studios in 20 countries, compared to four service lines

operating from five production studios in five countries at the

time of our IPO in July 2013.

During the year, we welcomed eleven businesses into the Group

across all its existing service lines as well as its newly

established Engineering service line. 2017 saw two of the Group's

largest acquisitions to date, VMC and Sperasoft, which have further

strengthened our service offerings and client penetration and

extended our geographic reach and access to talent. Sperasoft

enabled our entry into Co-Development, in which multiple services

including game programming and art creation are delivered

holistically in the game development phase, whilst VMC has

bolstered our Engineering capabilities. These significant

acquisitions represent yet further steps in the pursuit of our

strategy and we are pleased with how smoothly they are being

integrated with the rest of the Group.

The Group has invested net cash of EUR89.1m in the acquisitions

described above, funded by the Group's strong cash generation,

available debt facilities and a successful GBP75m equity placing in

October 2017. The placing further demonstrated the support of our

existing shareholders as well as enhancing our shareholder base

through the addition of a number of new institutional investors.

Following these acquisitions, the Group had EUR30.5m in cash at the

year end and had utilised EUR18.3m of its EUR35m rolling credit

facility, which leaves the Group well placed to complete further

selective acquisitions in 2018.

The Group's effective tax rate has continued to decrease as we

make better use of our brands, operating models and tools from our

Dublin operational headquarters in support of our business around

the world, much of which is in higher tax rate jurisdictions

including Canada, the US, Japan, India and Italy. The Group's

effective tax rate based on Keywords Studios' measure of profit

before taxation in the period was 20.5% (2016: 21.7%). We note the

enactment of the Tax Cuts and Jobs Act in the United States on 22

December 2017. Our preliminary view is that we can expect a

devaluation of some of our deferred tax liabilities in 2017 due to

the reduction in the statutory federal tax rate to 21%. While we

continue to review the full future impact of the new US tax

legislation on the Group, we currently anticipate that the changes

will not have a material impact on the Group's effective tax rate.

We will give updated guidance on the impact of these provisions

together with our final results later this year.

Andrew Day, Chief Executive of Keywords, commented:

"We are delighted with the Group's performance as we grew

revenues and profits strongly again this year. Our ever-increasing

geographic footprint and broader range of services have combined to

grow market share, introduce additional services to established

clients and win new clients.

"The eleven acquisitions in 2017 demonstrate strong progress in

our strategy to selectively consolidate the fragmented video games

market and generate synergies through scale, and our entry into

Engineering and particularly Co-Development, enhances our

positioning as a strategic partner to game developers and

publishers, whilst continuing to ensure we are not directly exposed

to the commercial performance of individual titles. As games are

becoming bigger and are higher definition, game developers are

increasingly relying upon co-development arrangements with

companies like Keywords to provide them with broader capability to

develop both initial games and ongoing content and features

post-launch.

"We look forward to another year of strong progress as we

continue to invest in existing and new businesses, building our

talent pool and integrating the newer members of our Group."

*The Group reports adjusted PBT before acquisition and

integration expenses, share option charges, amortisation of

intangibles and foreign currency gains

For further information, please contact:

Keywords Studios (www.keywordsstudios.com)

Andrew Day, Chief Executive

Officer

David Broderick, Chief Financial

Officer +353 190 22 730

Numis (Financial Adviser)

Stuart Skinner / Kevin Cruickshank

(Nominated Adviser)

James Black / Tom Ballard

(Corporate Broker) 020 7260 1000

020 3128 8100

MHP Communications (Financial keywords@mhpc.com

PR)

Katie Hunt / Ollie Hoare

About Keywords Studios (www.keywordsstudios.com)

Keywords Studios is an international technical services provider

to the global video games industry. Established in 1998, and now

with 42 facilities in 20 countries strategically located in Asia,

the Americas and Europe, it provides integrated art creation,

software engineering, testing, localisation, audio and customer

support services across more than 50 languages and 16 games

platforms to a blue-chip client base of over 400 clients across the

globe. It has a strong market position, providing services to 23 of

the top 25 most prominent games companies, including Activision

Blizzard, Bandai Namco, Bethesda, Electronic Arts, Konami, Riot

Games, Sony, Square Enix, Supercell, TakeTwo, and Ubisoft. Recent

titles worked on include Uncharted 4: A Thief's End, Call of Duty:

WWII, Mortal Combat X, Assassin's Creed Origins, Battlefield 1,

Overwatch, World of Warcraft: Legion, Hearthstone, Clash Royale,

and Mobile Strike. Keywords Studios is listed on AIM, the London

Stock Exchange regulated market (KWS.L).

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDMGGZVMMGRZG

(END) Dow Jones Newswires

February 01, 2018 02:00 ET (07:00 GMT)

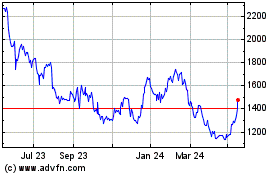

Keywords Studios (LSE:KWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

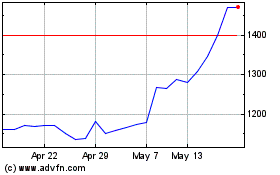

Keywords Studios (LSE:KWS)

Historical Stock Chart

From Apr 2023 to Apr 2024