TIDMKIBO

RNS Number : 3509Y

Kibo Mining Plc

02 March 2017

Kibo Mining Plc (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM:KIBO

ISIN: IE00B97C031

("Kibo" or "the Company")

Dated: 02 March 2017

Update on Proposed Acquisition by Opera of the Imweru and

Lubando Gold Projects from Kibo Mining plc ("Kibo")

Further to the announcements made by Kibo and Opera on 23

September and 2 December 2016, Opera and Kibo are pleased to

announce the following update on the proposed transaction by Opera

to acquire the Imweru and Lubando Gold Projects from Kibo ("the

Proposed Transaction"). Opera and Kibo are pleased to confirm that

the transaction documentation in connection to the Proposed

Transaction is nearing completion.

Resource Update on Imweru and Lubando Gold Projects

As part of the Proposed Transaction, under applicable regulation

and commercial requirements, Opera has commissioned an

appropriately qualified expert, Minxcon (Pty) Ltd, to undertake a

Competent Person's Report, an evaluation of the geological assets

to be acquired from Kibo by Opera. As part of this review, the

directors of Opera and Kibo have received an update to the

resources of Imweru and Lubando Gold Projects.

The updated resources are as follows:

Measured Indicated Inferred Total

------------------------ ---------- ---------- --------- --------

Imweru

------------------------ ---------- ---------- --------- --------

Tonnes (millions) - 2.367 9.240

------------------------ ---------- ---------- --------- --------

Grade (g/t) - 1.19 1.43

------------------------ ---------- ---------- --------- --------

Contained Ounces (Oz) - 90,800 424,310 515,110

------------------------ ---------- ---------- --------- --------

Lubando

------------------------ ---------- ---------- --------- --------

Tonnes (millions) - - 6.78

------------------------ ---------- ---------- --------- --------

Grade (g/t) - - 1.10

------------------------ ---------- ---------- --------- --------

Contained Ounces (Oz) - - 239,870 239,870

------------------------ ---------- ---------- --------- --------

Total Contained Ounces

(Oz) - 90,800 664,180 754,980

------------------------ ---------- ---------- --------- --------

The information provided in relation to this resource update has

been reviewed and verified by Kibo's qualified person, Noel

O'Keeffe B.Sc. (Hons) Geology, PGEO, who is a qualified person for

the purposes of the AIM Rules for Companies.

The final Competent Person's Report will be included in the

admission document to be issued in due course.

Timings

Following the completion of the final aspects of relevant

documentation associated with the Proposed Transaction, the

directors of Kibo and Opera are pleased to report that they are

looking forward to interacting with potential investors in the

coming weeks in order to complete the Proposed Transaction as soon

as possible.

Summary of Proposed Transaction

A summary of the Proposed Transaction is as follows:

-- Subject to the finalisation of the commercial, technical

and legal due diligence, the consideration to acquire the

Imweru and Lubando Gold Projects will be satisfied by the

allotment and issue to Kibo on completion of the Proposed

Transaction of 61,000,000 ordinary shares of one pence

each in the capital of Opera at a price of 6 pence per

ordinary share immediately following completion of the

Proposed Transaction (and completion of the fundraising

by Opera referred to below).

-- As part of the Proposed Transaction, Opera and Kibo have

agreed that there will be a fundraising by way of the issue

of new ordinary shares in Opera at a price of 6 pence per

ordinary share. Following a detailed review of the costs

associated with the future work programme and operations

following the completion of the Proposed Transaction, the

directors of Kibo and Opera have determined that the minimum

fundraising required to complete the Proposed Transaction

will now be GBP1.7million, an increase from GBP1.2million

as announced in September 2016, due to movements in foreign

exchange and other prudent budgetary considerations.

-- As part of the Proposed Transaction, Opera will delist

from the Main Market of the London Stock Exchange and seek

admission to the AIM Market of the London Stock Exchange

(AIM) of the enlarged share capital of Opera.

-- On completion of the Proposed Transaction it is proposed

that Opera will be renamed Katoro Gold Mining plc.

-- Opera had appointed Strand Hanson Limited to act as its

Nominated Adviser and Beaufort Securities Ltd as its broker

with respect to the Proposed Transaction.

Shareholders should note that there remain a number of matters

upon which completion of the Proposed Transaction is

conditional.

Further announcements in relation to the Proposed Transaction

will be made as soon as appropriate.

Louis Coetzee, CEO of Kibo, said: "We are pleased to be nearing

completion of the above mentioned transaction and looking forward

to see work commence on the Imweru project, as per earlier

announcements in this regard.

We are also particularly pleased with the increase in gold

ounces in the restated resource statements."

Paul Dudley, Chairman of Opera commented: "We thank our

shareholders for their support and will provide updates as

appropriate in due course as we seek to make further progress

towards the completion of the transaction."

Contacts

Louis Coetzee +27 (0) 83 2606126 Kibo Mining plc Chief Executive Officer

------------------------ --------------------- ---------------------------- ---------------------------------------

Andreas Lianos +27 (0) 83 4408365 River Group Corporate Adviser and Designated

Adviser on JSE

------------------------ --------------------- ---------------------------- ---------------------------------------

Jon Belliss +44 (0) 207 382 8300 Beaufort Securities Limited Broker

------------------------ --------------------- ---------------------------- ---------------------------------------

Oliver Morse +61 8 9480 2500 RFC Ambrian Limited Nominated Adviser on AIM for Kibo

------------------------ --------------------- ---------------------------- ---------------------------------------

Liz Morley / Anna Legge +44 (0) 203 772 2500 Bell Pottinger Investor and Media Relations for Kibo

------------------------ --------------------- ---------------------------- ---------------------------------------

Kibo Mining - Notes to editors

Kibo Mining is listed on the AIM market in London and the AltX

in Johannesburg. The Company is focused on exploration and

development of mineral projects in Tanzania, and controls one of

Tanzania's largest mineral right portfolios. Tanzania provides a

secure and stable operating environment for the mineral resource

industry and Kibo Mining therein.

Kibo Mining holds a thermal coal deposit at Mbeya, which has a

significant NI 43-101 compliant defined resource, and is developing

a 250-350 MW mouth-of-mine thermal power station, the Mbeya Coal to

Power Project ("MCPP"), previously called Rukwa Coal to Power

Project ("RCPP"), with an established management team that includes

ABSA / Barclays as Financial Advisor. Kibo has completed a Coal

Mining Definitive Feasibility Study and a Power Pre- Feasibility

Study for the Mbeya project and has recently announced the

completion of an integrated Bankable Feasibility Study report for

the project. On 25 August 2016, Kibo signed an Agreement with China

based EPC contractor SEPCO III granting it the right to become the

sole bidder for the EPC contract to build the power plant component

of the MCPP in exchange for SEPCO III refunding 50% of the

development costs incurred by Kibo to date on the project. Kibo has

already received the first tranche of this funding in the amount of

US$1.8 million on the 5th September 2016

The Company also has extensive gold focused interests including

Lake Victoria Goldfields and Morogoro projects. At Lake Victoria,

the Company has 100% owned projects with a 550,000 oz. JORC

compliant gold Mineral Resource at the Imweru Project and a 168,000

oz. NI 43-101 compliant gold Mineral Resource at the Lubando

Project. The Company is currently undertaking a Definitive

Feasibility Study on its Imweru Project.

Kibo also holds the Haneti Project on which the latest technical

report confirms prospectivity for nickel, PGMs, gold and strategic

metals including lithium.

Kibo Mining further holds the Pinewood (coal & uranium)

project where the company has entered into a 50/50 Exploration

Joint Venture with Metal Tiger plc.

Finally, the Company also holds the Morogoro (gold) project

where the company has also entered into a 50/50 Exploration Joint

Venture with Metal Tiger plc.

The Company's projects are located in the established and gold

prolific Lake Victoria Goldfields, the emerging goldfields of

eastern Tanzania and the Mtwara Corridor in southern Tanzania where

the Government has prioritized infrastructural development

attracting significant recent investment in coal and uranium. The

Company has a positive working relationship with the Tanzanian

government at local, regional and national levels and works hard to

maintain positive relationships with all communities

where company interests are held. The Company recognizes the

potential to enhance the quality of life and opportunity for

Tanzanian citizens through careful development of its projects.

Updates on the Company's activities are regularly posted on its

website www.kibomining.com

Johannesburg

2 March 2017

Corporate and Designated Adviser

River Group

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQLIFSAVAIFIID

(END) Dow Jones Newswires

March 02, 2017 05:30 ET (10:30 GMT)

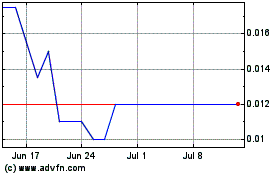

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024