K&C REIT PLC Correction re Grants to Former Chief Executive (8157D)

July 11 2016 - 6:00AM

UK Regulatory

TIDMKCR

RNS Number : 8157D

K&C REIT PLC

11 July 2016

11 July 2016

K&C REIT plc

("K&C" or the "Company")

Correcting Announcement

The announcement released earlier this morning contained an

error. The exercise price of the options granted to the former

chief executive is 10p per share, not 1p per share as previously

stated. The text of the corrected announcement is set out

below.

Grant of Options and Conditional Payment to former Chief

Executive

K&C REIT plc, the residential real estate investment trust

group, announces that the Board has agreed to grant options over

ordinary shares of 1p each, as detailed below, to George Rolls, the

former non-executive director and then chief executive who left the

Board in December 2015.

The Board has also agreed to make a payment of GBP25,000 to

George Rolls, conditional on a further fundraising being completed

by the Company.

These grants are in recognition of the significant contribution

that George Rolls, whilst unremunerated, made to ensuring that

K&C REIT successfully floated on AIM in July 2015.

Former Director Number of Options Total Number of

Granted Options Held

----------------- ------------------ ----------------

George Rolls 460,000 460,000

----------------- ------------------ ----------------

The options have an exercise price of 10p per share and they can

be exercised at any time within a five-year period commencing from

11 July 2016.

Contacts:

K&C REIT info@kandc-reit.co.uk

Tim James, Managing Director +44 (0) 7768 833

029

www.kandc-reit.co.uk

Stockdale Securities

Robert Finlay/Rose Ramsden +44 (0) 20 7601 6115

Yellow Jersey PR

Philip Ranger/Harriet Jackson +44 (0) 7768 534 641

Notes to Editors:

K&C's objective is to build a substantial residential

property portfolio that generates secure income flow for

shareholders through the acquisition of SPVs (Special Purpose

Vehicles) with inherent historical capital gains. The Directors

intend that the group will acquire, develop and manage residential

property assets in Central London and other key residential areas

in the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGURAMUPQUBG

(END) Dow Jones Newswires

July 11, 2016 06:00 ET (10:00 GMT)

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

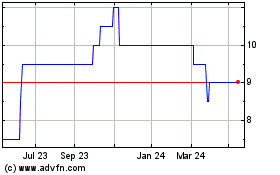

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2023 to Apr 2024