Zurich Insurance Dodges Pandemic-Related Interruption Payouts Following UK Court Ruling

September 15 2020 - 1:46PM

Dow Jones News

By Adriano Marchese

Zurich Insurance Group AG said Tuesday a U.K. High Court's

judgment confirmed the company doesn't have to provide cover for

pandemic-related business interruption.

The Swiss insurance giant said it welcomed the court decision

that confirms that the wording represented by the company don't

provide cover for businesses that have seen interruption due to

Covid-19.

Earlier Tuesday, the High Court found in favor of the Financial

Conduct Authority in its case against the "lack of clarity and

certainty" for policyholders when making claims against business

losses due to the pandemic.

RSA Insurance Group PLC said Tuesday it expected the ruling to

result in about 104 million pounds ($133.6 million) in further

payouts, after having already paid or reserved GBP57 million in

claims over Covid-19 losses.

While most small-to-mid-size enterprise policies focus on

property damage, some policies also cover business interruptions

from other causes, such as infectious diseases. However, not all

insurers accepted liability under these policies, which led to

widespread concern about the lack of clarity and certainty.

Separately, Hiscox Ltd. said estimated an extra GBP100 million

of Covid-19 claims from the ruling.

Zurich said that it is reviewing the broader implications of the

judgment in relation to wording represented by other insurers in

the FCA test case.

"While we welcome the judgment of the High Court in respect of

Zurich's wordings, we recognize that Covid-19 has caused immense

suffering for our customers, their families and their businesses,"

Zurich Insurance Chief Executive Mario Greco said.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

September 15, 2020 13:31 ET (17:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

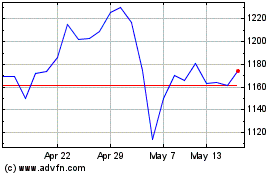

Hiscox (LSE:HSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

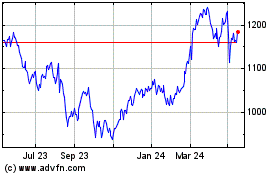

Hiscox (LSE:HSX)

Historical Stock Chart

From Apr 2023 to Apr 2024