GCP Asset Backed Income Fund Ltd Proposed C Share Issue (4665T)

January 05 2017 - 8:48AM

UK Regulatory

TIDMGABI

RNS Number : 4665T

GCP Asset Backed Income Fund Ltd

05 January 2017

GCP Asset Backed Income Fund Limited (the "Company" or "GCP

Asset Backed Income")

Proposed C Share issue

On 8 November 2016 GCP Asset Backed Income announced the results

of a substantially oversubscribed placing of ordinary shares in

November 2016, raising gross proceeds of c.GBP15.6 million (the

"Placing"). The net proceeds of the Placing have now been

substantially invested or committed for investment.

In light of the attractive pipeline of investment opportunities

identified by the Investment Manager, Gravis Capital Partners LLP,

in the near term, and the premium rating of its shares in the

secondary market, the Board of GCP Asset Backed Income is

considering increasing the Company's capital base through a

pre-emptive offer of c shares at a price of 100 pence per c share

and targeting gross proceeds of GBP100 million (the "Issue").

The Issue is expected to broaden the Company's investor base,

improve secondary market liquidity for shareholders, reduce its

ongoing charges ratio per ordinary share by providing a larger

equity base over which its fixed costs are spread and further

diversify its portfolio of investments.

The Company is taking legal, tax and financial advice and will

make a further announcement in due course.

Any issue of c shares will be subject to the approval of a

prospectus in connection with the Issue by the UK Listing

Authority.

Expected timetable: +44 (0)20 7518 1490

Publication of Prospectus in connection with the Issue late January 2017

Issue close and Admission mid February 2017

This announcement contains Inside Information as defined under

the Market Abuse Regulation (EU) No. 596/2014.

For further information, please contact:

Gravis Capital Partners LLP +44 (0)20 7518 1490

David Conlon david.conlon@gcpuk.com

Philip Kent philip.kent@gcpuk.com

Dion Di Miceli dion.dimiceli@gcpuk.com

Cenkos Securities plc +44 (0)20 7397 8900

Tom Scrivens tscrivens@cenkos.com

Oliver Packard opackard@cenkos.com

Sapna Shah sshah@cenkos.com

Buchanan +44 (0)20 7466 5000

Charles Ryland charlesr@buchanan.uk.com

Victoria Hayns victoriah@buchanan.uk.com

Notes to Editors

The Company

GCP Asset Backed Income is a closed ended investment company

traded on the London Stock Exchange's main market for listed

securities. Its investment objective is to generate attractive

risk-adjusted returns primarily through regular, growing

distributions and modest capital appreciation over the long

term.

The Company seeks to meet its investment objective through a

diversified portfolio of investments secured against contracted,

predictable medium to long term cash flows and/or physical assets

which are predominantly UK based

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCOKPDQNBKDADK

(END) Dow Jones Newswires

January 05, 2017 08:48 ET (13:48 GMT)

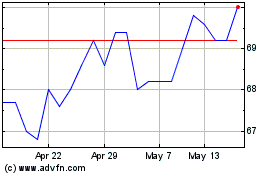

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From Apr 2024 to May 2024

Gcp Asset Backed Income (LSE:GABI)

Historical Stock Chart

From May 2023 to May 2024