TIDMFERG

RNS Number : 1433S

Ferguson PLC

07 March 2023

March 7, 2023

Ferguson plc reports second quarter results

CONSISTENT EXECUTION DELIVERS SOLID PERFORMANCE

Second quarter highlights

- Sales growth of 4.9%, with 2.7% organic growth, on top of a

31.8% total prior year comparable.

- Gross margin of 30.2%.

- Delivered solid operating margins of 8.0% (8.5% on an adjusted

basis) in the quarter, with first half operating margins of 9.4%

(9.8% on an adjusted basis).

- Diluted earnings per sha re of $1.80 ($1.91 on an adjusted basis).

- Strong net cash provided by operating activities of $1.2

billion on a fiscal year to date basis.

- Declared quarterly dividend of $0.75, implying an annualized

increase of 9% over the prior year.

- Completed four acquisitions during the quarter with aggregate

annualized revenues of approx. $300 million.

- Share repurchases of $198 million during the quarter.

- Balance sheet remains strong with net debt to adjusted EBITDA of 1.1x.

- Full year net sales and adjusted operating margin guidance remain unchanged.

FY2023 Guidance

Total Company* 2023 Guidance

Net sales Low single digit growth

----------------------------

Adjusted operating margin 9.3% - 9.9%

----------------------------

Interest expense $185 - $205 million

----------------------------

Adjusted effective tax rate Approximately 25%

----------------------------

Capital expenditures $400 - $450 million

----------------------------

*Net sales guidance continues to reflect market outperformance,

completed acquisitions and one additional sales day. Adjusted

effective tax rate guidance remains unchanged. Interest expense and

capital expenditure guidance increased by $15 million and $50

million, respectively.

Kevin Murphy, Ferguson CEO, commented "The year is unfolding as

we expected and our associates continue to deliver solid results by

leveraging our scale and core strengths to help our customers

deliver their complex projects. We continue to appropriately manage

costs to position the business for challenging end markets.

Importantly, working capital management led to strong cash

generation which enables us to continue investing for organic

growth, consolidating our fragmented markets through acquisitions

and returning capital to shareholders.

"Looking forward, our balanced exposure to both residential and

non-residential end markets, combined with an agile business model,

positions us well for near term uncertainties. Our financial

guidance continues to reflect market outperformance, both

organically and from acquisitions, and we believe our scale and

advantaged platform position us to capture growth from emerging

structural trends in our end markets."

Three months ended January 31,

US$ (In millions, except per 2023 2022 Change

share amounts)

------------------------------------------------------ -----------------

Reported(1) Adjusted(2) Reported(1) Adjusted(2) Reported Adjusted

--------------------------------- ----------- ------------ ------------ ------------- ----------------- --------

Net sales 6,825 6,825 6,508 6,508 +4.9% +4.9%

(40)

Gross margin 30.2% 30.2% 30.6% 30.6% (40) bps bps

Operating profit 549 582 555 588 (1.1)% (1.0)%

(50)

Operating margin 8.0% 8.5% 8.5% 9.0% (50) bps bps

Earnings per share - diluted 1.80 1.91 1.97 1.93 (8.6)% (1.0)%

Adjusted EBITDA 630 648 (2.8)%

--------------------------------- ----------- ------------ ------------ ------------- ----------------- --------

Six months ended January 31,

US$ (In millions, except per 2023 2022 Change

share amounts)

------------------------------------------------------ -----------------

Reported(1) Adjusted(2) Reported(1) Adjusted(2) Reported Adjusted

--------------------------------- ----------- ------------ ------------ ------------- ----------------- --------

Net sales 14,756 14,756 13,311 13,311 +10.9% +10.9%

(50)

Gross margin 30.4% 30.4% 30.9% 30.9% (50) bps bps

Operating profit 1,380 1,446 1,294 1,355 +6.6% +6.7%

(40)

Operating margin 9.4% 9.8% 9.7% 10.2% (30) bps bps

Earnings per share - diluted 4.64 4.87 4.38 4.43 +5.9% +9.9%

Adjusted EBITDA 1,542 1,462 +5.5%

Net debt(2) : Adjusted EBITDA 1.1x 0.8x

--------------------------------- ----------- ------------ ------------ ------------- ----------------- --------

(1) The results are presented in accordance with U.S. GAAP on a

continuing operations basis.

(2) The Company uses certain non-GAAP measures, which are not

defined or specified under U.S. GAAP. See the section titled

"Non-GAAP Reconciliations and Supplementary Information."

Summary of financial results

Second quarter

Net sales of $6.8 billion were 4.9% ahead of last year, with a

sequential step down in growth rates from the first quarter as

expected, against a prior year comparable growth of 31.8%. Organic

revenue growth was 2.7% with a further 2.6% contribution from

acquisitions, partially offset by a 0.3% adverse impact from

foreign exchange rates and 0.1% impact from one fewer sales day in

Canada. Inflation in the second quarter was approximately 10%.

Gross margins of 30.2% were 40 basis points lower than last year

driven primarily by very strong prior year comparables. Operating

expenses continued to be diligently managed and we remain focused

on productivity and efficiencies while investing in core

capabilities for future growth.

Reported operating profit was $549 million ( 8.0% operating

margin), 1.1% lower than last year. Adjusted operating profit of

$582 million (8.5% adjusted operating margin) was 1.0% lower than

last year, during our seasonally weakest quarter.

Reported diluted earnings per share was $1.80 (Q2 2022: $1.97),

a decrease of 8.6% , and adjusted diluted earnings per share of

$1.91 decreased 1.0% with the decrease due to slightly lower

adjusted operating profit and higher interest expense, partially

offset by the impact of share repurchases.

USA - second quarter

The US business grew net sales by 5.4%, driven by 2.6% organic

growth with a further 2.8% from acquisitions.

Residential end markets, which comprise just over half of US

revenue, slowed meaningfully during the quarter as expected. New

residential housing start and permit activity declined while

repairs, maintenance and improvement ("RMI") work remained more

resilient. Overall, residential revenue grew by approximately 1% in

the second quarter.

Non-residential end markets, representing just under half of US

revenue, experienced continued growth. Non-residential revenu e

grew by approximately 11% in the second quarter.

Adjusted operating profit of $579 million was 0.5% or $3 million

ahead of last year.

We completed four acquisitions during the quarter that included

Airefco, a leading regional HVAC distributor serving customers in

the Pacific Northwest across 11 locations and Guarino Distributing

Company, an HVAC distributor operating in Louisiana and

Mississippi. Additionally, we acquired Pipelines, a waterworks

distributor serving markets in Eastern Ohio and Western

Pennsylvania; and Power Process Equipment, an industrial

distributor strengthening our position in the upper Midwest. In

aggregate these four businesses generate annualized revenues of

approximately $300 million and the annualized revenues of the five

businesses acquired year to date is approximately $330 million.

Canada - second quarter

Net sales compressed by 4.5%, with organic revenue growth of

3.0%, offset by 1.2% due to one fewer sales day, and a further 6.3%

due to the adverse impact of foreign exchange rates. Similar to the

US segment, non-residential end markets have been more resilient

than residential end markets. Adjusted operating profit of $14

million declined by $9 million compared to last year.

Segmental overview

Three months ended January Six months ended January

31, 31,

US$ (In millions) 2023 2022 Change 2023 2022 Change

----------- -------------- -------- ----------- --------- ----------

Net sales:

USA 6,504 6,172 5.4 % 14,036 12,590 11.5 %

Canada 321 336 (4.5)% 720 721 (0.1)%

----------- -------------- -------- ----------- --------- ----------

Total net sales 6,825 6,508 4.9 % 14,756 13,311 10.9 %

Adjusted operating profit:

USA 579 576 0.5 % 1,424 1,328 7.2 %

Canada 14 23 (39.1)% 47 57 (17.5)%

Central and other costs (11) (11) (25) (30)

----------- -------------- -------- ----------- --------- ----------

Total adjusted operating

profit 582 588 (1.0)% 1,446 1,355 6.7 %

--------------------------- ----------- -------------- -------- ----------- --------- ----------

Financial position

Net debt at January 31, 2023 was $3.4 billion and during the

quarter we completed share repurchases of $0.2 billion, leaving

approximately $0.4 billion remaining under our current share

repurchase program.

We have declared a quarterly dividen d of $0.75, having

transitioned from a semi-annual distribution schedule earlier in

the fiscal year. This implies a 9% increase, as compared to a

quarter of the prior year's total dividend, and will be paid on May

5, 2023 to shareholders on the register as of March 17, 2023.

There have been n o other significant changes to the financial

position of the Company.

Foreign private issuer status

As of January 31, 2023, we have determined that we no longer

qualify as a foreign private issuer, as defined under the

Securities Exchange Act of 1934, as amended (the "Exchange Act").

As a result, effective as of August 1, 2023, we will no longer be

eligible to use the rules designed for foreign private issuers and

will be considered a U.S. domestic issuer. We will be required to

comply with, among other things, U.S. proxy requirements and

Regulation FD and our officers, directors and principal

shareholders will become subject to the beneficial ownership

reporting and short-swing profit recovery requirements in Section

16 of the Exchange Act. We will continue to file annual reports on

Form 10-K, quarterly reports on Form 10-Q, and current reports on

Form 8-K with the Securities and Exchange Commission ("SEC").

For further information please contact

Ferguson

Brian Lantz, Vice President IR and Communications Mobile: +1 224 285 2410

Pete Kennedy, Director of Investor Relations Mobile: +1 757 603 0111

Media inquiries

John Pappas, Director of Financial Communications Mobile: +1 484 790 2727

Investor conference call and webcast

A call with Kevin Murphy, CEO and Bill Brundage, CFO will

commence at 8:30 a.m. ET (1:30 p.m. GMT) today. The call will be

recorded and available on our website after the event at

www.corporate.ferguson.com .

Dial in number UK: +44 (0) 20 3936

2999

US: +1 646 664 1960

Ask for the Ferguson call quoting 872421. To access the call via

your laptop, tablet or mobile device please go to

www.corporate.ferguson.com. If you have technical difficulties,

please click the "Listen by Phone" button on the webcast player and

dial the number provided.

About us

Ferguson plc (NYSE: FERG; LSE: FERG) is a leading value-added

distributor in North America providing expertise, solutions and

products from infrastructure, plumbing and appliances to HVAC,

fire, fabrication and more. We exist to make our customers' complex

projects simple, successful and sustainable. Ferguson is

headquartered in the U.K., with its operations and associates

solely focused on North America and managed from Newport News,

Virginia. For more information, please visit

www.corporate.ferguson.com or follow us on LinkedIn

www.linkedin.com/company/ferguson-enterprises.

Analyst resources

For further information on quarterly financial breakdowns, visit

www.corporate.ferguson.com on the Investors menu under Analyst

Consensus and Resources.

Provisional financial calendar

Q3 Results for period ending April June 6, 2023

30, 2023

Timetable for the quarterly dividend

The timetable for payment of the quarterly dividend of $0.75 per

share is as follows:

Ex-dividend date: March 16, 2023

Record date: March 17, 2023

Payment date: May 5, 2023

The quarterly dividend is declared in US dollars and since March

2021, the default currency for dividends is also US dollars. Those

shareholders who have not elected to receive the dividend in pounds

sterling and who would like to make such an election may do so

online by going to Computershare's Investor Center and returning

the completed form to the address located in the upper--right

corner of the form. The deadline to elect to receive the quarterly

dividend in pounds sterling, or to amend an existing election, is

5:00 p.m. ET on April 5, 2023 and any requests should be made in

good time ahead of that date.

The form is available at

www--us.computershare.com/investor/#home and navigating to Company

Info > FERG > GBP Dividend Election and Mandate Form.

The completion of cross-border movements of shares between the

U.K. and the U.S. is contingent upon the receiving broker

identifying and acknowledging any such movements. Where a

cross-border movement of shares has been initiated but not

completed by the relevant dividend record date (being March 17,

2023 for this quarterly dividend), there is a risk that the

dividend in respect of such shares will not be received on the

dividend payment date. Accordingly, shareholders are advised not to

initiate any cross-border movements of shares during the period

from March 15, 2023 through March 17, 2023 inclusive.

Cautionary note on forward-looking statements

Certain information included in this announcement is

forward-looking, including within the meaning of the Private

Securities Litigation Reform Act of 1995, and involves risks,

assumptions and uncertainties that could cause actual results to

differ materially from those expressed or implied by

forward-looking statements. Forward-looking statements cover all

matters which are not historical facts and include, without

limitation, statements or guidance regarding or relating to our

future financial position, results of operations and growth,

projected interest in and ownership of our ordinary shares by

domestic US investors, plans and objectives for future

capabilities, risks associated with changes in global and regional

economic, market and political conditions, ability to manage supply

chain challenges, ability to manage the impact of product price

fluctuations, our financial condition and liquidity, legal or

regulatory changes, and other statements concerning the success of

our business and strategies. Forward-looking statements can be

identified by the use of forward-looking terminology, including

terms such as "believes", "estimates", "anticipates", "potential",

"expects", "forecasts", "guidance", "intends", "continues",

"plans", "projects", "goal", "target", "aim", "may", "will",

"would", "could" or "should" or, in each case, their negative or

other variations or comparable terminology and other similar

references to future periods. Forward-looking statements speak only

as of the date on which they are made. They are not assurances of

future performance and are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Therefore, you

should not place undue reliance on any of these forward-looking

statements. Although we believe that the forward-looking statements

contained in this announcement are based on reasonable assumptions,

you should be aware that many factors could cause actual results to

differ materially from those in such forward-looking statements,

including but not limited to: weakness in the economy, market

trends, uncertainty and other conditions in the markets in which we

operate, and other factors beyond our control, including any

macroeconomic or other consequences of the current conflict in

Ukraine; failure to rapidly identify or effectively respond to

direct and/or end customers' wants, expectations or trends,

including costs and potential problems associated with new or

upgraded information technology systems; decreased demand for our

products as a result of operating in highly competitive industries

and the impact of declines in the residential and non-residential

markets, as well as the RMI and new construction markets; changes

in competition, including as a result of market consolidation;

failure of a key information technology system or process as well

as exposure to fraud or theft resulting from payment-related risks;

privacy and protection of sensitive data failures, including

failures due to data corruption, cybersecurity incidents or network

security breaches; ineffectiveness of or disruption in our domestic

or international supply chain or our fulfillment network, including

delays in inventory, increased delivery costs or lack of

availability; failure to effectively manage and protect our

facilities and inventory; unsuccessful execution of our operational

strategies; failure to attract, retain and motivate key associates;

exposure of associates, contractors, customers, suppliers and other

individuals to health and safety risks; inherent

risks associated with acquisitions, partnerships, joint ventures

and other business combinations, dispositions or strategic

transactions; regulatory, product liability and reputational risks

and the failure to achieve and maintain a high level of product and

service quality; inability to renew leases on favorable terms or at

all, as well as any remaining obligations under a lease if we close

a facility; changes in, interpretations of, or compliance with tax

laws in the United States, the United Kingdom, Switzerland or

Canada; our indebtedness and changes in our credit ratings and

outlook; fluctuations in foreign currency and product prices (e.g.,

commodity-priced materials, inflation/deflation); funding risks

related to our defined benefit pension plans; legal proceedings as

well as failure to comply with domestic and foreign laws and

regulations or the occurrence of unforeseen developments such as

litigation; risks associated with the relocation of our primary

listing to the United States and any volatility in our share price

and shareholder base in connection therewith; the costs and risk

exposure relating to environmental, social and governance matters;

adverse impacts caused by the COVID--19 pandemic (or related

variants); and other risks and uncertainties set forth under the

heading "Risk Factors" in our Annual Report on Form 10-K for the

fiscal year ended July 31, 2022 as filed with the SEC on September

27, 2022 and in other filings we make with the SEC in the

future.

Additionally, forward-looking statements regarding past trends

or activities should not be taken as a representation that such

trends or activities will continue in the future. Other than in

accordance with our legal or regulatory obligations, we undertake

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Ferguson plc

Non-GAAP Reconciliations and Supplementary Information

(unaudited)

Non-GAAP items

This announcement contains certain financial information that is

not presented in conformity with U.S. GAAP. These non-GAAP measures

include adjusted operating profit, adjusted operating margin,

adjusted net income, adjusted earnings per share, adjusted earnings

per share - diluted, adjusted EBITDA, adjusted effective tax rate,

net debt and net debt to adjusted EBITDA ratio. The Company

believes that these non-GAAP measures provide users of the

Company's financial information with additional meaningful

information to assist in understanding financial results and

assessing the Company's performance from period to period.

Management believes these measures are important indicators of

operations because they exclude items that may not be indicative of

our core operating results and provide a better baseline for

analyzing trends in our underlying businesses, and they are

consistent with how business performance is planned, reported and

assessed internally by management and the Board. Such non-GAAP

adjustments include amortization of acquired intangible assets,

discrete tax items, and any other items that are non-recurring.

Non-recurring items may include business restructuring charges,

corporate restructuring charges, which includes costs associated

with the Company's listing in the United States, gains or losses on

the disposals of businesses which by their nature do not reflect

primary operations, as well as certain other items deemed

non-recurring in nature and/or that are not a result of the

Company's primary operations. Because non-GAAP financial measures

are not standardized, it may not be possible to compare these

financial measures with other companies' non-GAAP financial

measures having the same or similar names. These non-GAAP financial

measures should not be considered in isolation or as a substitute

for results reported under U.S. GAAP. These non-GAAP financial

measures reflect an additional way of viewing aspects of operations

that, when viewed with U.S. GAAP results, provide a more complete

understanding of the business. The Company strongly encourages

investors and shareholders to review Company financial statements

and publicly filed reports in their entirety and not to rely on any

single financial measure.

The Company does not provide a reconciliation of forward-looking

non-GAAP financial measures to the most directly comparable U.S.

GAAP financial measures on a forward-looking basis because it is

unable to predict with reasonable certainty or without unreasonable

effort non-recurring items, such as those described above, that may

arise in the future. The variability of these items is

unpredictable and may have a significant impact.

Summary of Organic Revenue

Management evaluates organic revenue growth as it provides a

consistent measure of the change in revenue year-on-year. Organic

revenue growth is determined as the growth in total reported

revenue excluding the growth (or decline) attributable to currency

exchange rate fluctuations, trading days, acquisitions and

disposals, divided by the preceding financial year's revenue at the

current year's exchange rates.

A summary of the Company's historical revenue and organic

revenue growth is below:

Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022

Organic Organic Organic Organic Organic

Revenue Revenue Revenue Revenue Revenue Revenue Revenue Revenue Revenue Revenue

------------ ------- -------- ------- -------- ------- -------- ------- -------- -------

USA 5.4% 2.6% 17.4% 13.0% 22.1% 19.8% 23.9% 23.7% 32.6% 29.4%

Canada (4.5)% 3.0% 3.6% 8.2% 10.5% 14.2% 8.8% 11.3% 18.7% 13.8%

------------ ------- -------- ------- -------- ------- -------- ------- -------- -------

Continuing

operations 4.9% 2.7% 16.6% 12.7% 21.4% 19.5% 23.1% 23.1% 31.8% 28.5%

------------ ------- -------- ------- -------- ------- -------- ------- -------- -------

For further details regarding organic revenue growth, visit

www.corporate.ferguson.com on the Investors menu under Analyst

Consensus and Resources.

Reconciliation of Net Income to Adjusted Operating Profit and

Adjusted EBITDA

Three months ended Six months ended

January 31, January 31,

----------------------------------------------

(In millions) 2023 2022 2023 2022

---------------------- ---------------------- ---------------------- ----------------------

Net income $374 $436 $969 $996

Income from discontinued

operations

(net of tax) - - - (25)

Provision for income taxes 121 96 318 272

Interest expense, net 47 22 88 49

Other expense, net 7 1 5 2

---------------------- ---------------------- ---------------------- ----------------------

Operating profit 549 555 1,380 1,294

Corporate restructurings(1) - 6 - 7

Amortization of acquired

intangibles 33 27 66 54

---------------------- ---------------------- ---------------------- ----------------------

Adjusted Operating Profit 582 588 1,446 1,355

Depreciation & impairment of PP&E 36 34 73 70

Amortization & impairment of

non-acquired

intangibles 12 26 23 37

---------------------- ---------------------- ---------------------- ----------------------

Adjusted EBITDA $630 $648 $1,542 $1,462

====================== ====================== ====================== ======================

(1) For the three and six months ended January 31, 2022, corporate

restructuring costs related to the incremental costs of the Company's

listing in the United States.

Net Debt : Adjusted EBITDA Reconciliation

To assess the appropriateness of its capital structure, the

Company's principal measure of financial leverage is net debt to

adjusted EBITDA. The Company aims to operate with investment grade

credit metrics and keep this ratio within one to two times.

Net debt

Net debt comprises bank overdrafts, bank and other loans and

derivative financial instruments, excluding lease liabilities, less

cash and cash equivalents. Long-term debt is presented net of debt

issuance costs.

As of January 31,

(In millions) 2023 2022

----------------------- ----------------------

Long-term debt(1) $3,936 $2,749

Short-term debt(2) 91 296

Derivative liabilities (assets) 17 (10)

Cash and cash equivalents (597) (828)

----------------------- ----------------------

Net debt $3,447 $2,207

======================= ======================

(1) The increase in long-term debt as of January 31, 2023 primarily

reflects the Company's $1 billion bond financing completed in

April 2022, as well as the $500 million in term loans entered

into in October 2022, net of other borrowings and repayments

since January 2022.

(2) Includes bank overdrafts of $36 million and $46 million,

respectively.

Adjusted EBITDA (Rolling 12-month)

Adjusted EBITDA is net income before charges/credits relating to

depreciation, amortization, impairment and certain non-GAAP

adjustments. A rolling 12-month adjusted EBITDA is used in the net

debt to adjusted EBITDA ratio to assess the appropriateness of the

Company's financial leverage.

Twelve months ended

(In millions, except ratios) January 31,

2023 2022

------------------- -----------------------

Net income $2,095 $2,039

Loss from discontinued operations (net of tax) 2 (31)

Provision for income taxes 655 377

Interest expense, net 150 97

Other expense, net 4 (7)

Corporate restructurings(1) 10 13

Depreciation and amortization 317 318

------------------- -----------------------

Adjusted EBITDA $3,233 $2,806

------------------- -----------------------

Net Debt: Adjusted EBITDA 1.1x 0.8x

=================== =======================

(1) For the rolling twelve months ended January 31, 2023 and 2022,

the corporate restructuring costs primarily related to incremental

costs in connection with the Company's listing in the United States.

Reconciliation of Net Income to Adjusted Net Income and Adjusted

EPS

Three months ended Six months ended

January 31, January 31,

---------------------------------------------- ----------------------------------------------

(In millions, except

per share

amounts) 2023 2022 2023 2022

---------------------- ---------------------- ---------------------- ----------------------

Net Income $374 $436 $969 $996

Income from

discontinued

operations

(net of tax) - - - (25)

---------------------- ---------------------- ---------------------- ----------------------

Income from

continuing

operations 374 436 969 971

Corporate

restructurings(1) - 6 - 7

Amortization of

acquired

intangibles 33 27 66 54

Discrete tax

adjustments(2) (3) (39) (3) (39)

Tax impact on

non-GAAP

adjustments(3) (8) (4) (16) (10)

---------------------- ---------------------- ---------------------- ----------------------

Adjusted Net Income $396 $426 1,016 983

====================== ====================== ====================== ======================

Adjusted earnings

per share:

Basic $1.91 $1.94 $4.89 $4.45

Diluted $1.91 $1.93 $4.87 $4.43

Weighted average

number of shares

outstanding:

Basic 207.1 220.0 207.9 220.7

Diluted 207.8 221.2 208.8 222.0

(1) For the three and six months ended January 31, 2022, corporate

restructuring costs related to the incremental costs of the Company's

listing in the United States.

(2) For the three and six months ended January 31, 2023, discrete

tax items primarily related to adjustments in connection with amended

returns. For the three and six months ended January 31, 2022, the

discrete tax adjustments primarily related to prior year tax adjustments,

including amended tax return items.

(3) Represents the tax impact of non-GAAP adjustments, including

the tax impact on the amortization of acquired intangibles.

Ferguson plc

Condensed Consolidated Statements of Earnings

(unaudited)

Three months ended Six months ended

January 31, January 31,

------------------------------------------------------

(In millions,

except per

share

amounts) 2023 2022 2023 2022

-------------------------- -------------------------- -------------------------- --------------------------

Net sales $6,825 $6,508 $14,756 $13,311

Cost of sales (4,763) (4,519) (10,273) (9,195)

-------------------------- -------------------------- -------------------------- --------------------------

Gross profit 2,062 1,989 4,483 4,116

Selling,

general and

administrative

expenses (1,432) (1,362) (2,941) (2,676)

Depreciation

and

amortization (81) (72) (162) (146)

-------------------------- -------------------------- -------------------------- --------------------------

Operating

profit 549 555 1,380 1,294

Interest

expense, net (47) (22) (88) (49)

Other expense,

net (7) (1) (5) (2)

-------------------------- -------------------------- -------------------------- --------------------------

Income before

income taxes 495 532 1,287 1,243

Provision for

income taxes (121) (96) (318) (272)

-------------------------- -------------------------- -------------------------- --------------------------

Income from

continuing

operations 374 436 969 971

Income from

discontinued

operations

(net of tax) - - - 25

-------------------------- -------------------------- -------------------------- --------------------------

Net income $374 $436 $969 $996

========================== ========================== ========================== ==========================

Earnings per

share - Basic:

Continuing

operations $1.81 $1.98 $4.66 $4.40

Discontinued

operations - - - 0.11

-------------------------- -------------------------- -------------------------- --------------------------

Total $1.81 $1.98 $4.66 $4.51

========================== ========================== ========================== ==========================

Earnings per

share -

Diluted:

Continuing

operations $1.80 $1.97 $4.64 $4.38

Discontinued

operations - - - 0.11

-------------------------- -------------------------- -------------------------- --------------------------

Total $1.80 $1.97 $4.64 $4.49

========================== ========================== ========================== ==========================

Weighted

average number

of shares

outstanding:

Basic 207.1 220.0 207.9 220.7

Diluted 207.8 221.2 208.8 222.0

Ferguson plc

Condensed Consolidated Balance Sheets

(unaudited)

As of

January July 31,

(In millions) 31, 2023 2022

---------------------------- ------------------------------

Assets

Cash and cash equivalents $597 $771

Accounts receivable, net 3,166 3,610

Inventories 4,173 4,333

Prepaid and other current assets 813 834

Assets held for sale 19 3

---------------------------- ------------------------------

Total current assets 8,768 9,551

Property, plant and equipment, net 1,482 1,376

Operating lease right-of-use assets 1,294 1,200

Deferred income taxes, net 214 177

Goodwill 2,094 2,048

Other non-current assets 1,364 1,309

---------------------------- ------------------------------

Total assets $15,216 $15,661

============================ ==============================

Liabilities and shareholders' equity

Accounts payable $3,155 $3,607

Other current liabilities 1,759 2,192

---------------------------- ------------------------------

Total current liabilities 4,914 5,799

Long-term debt 3,936 3,679

Long-term portion of operating lease liabilities 961 878

Other long-term liabilities 680 640

---------------------------- ------------------------------

Total liabilities 10,491 10,996

---------------------------- ------------------------------

Total shareholders' equity 4,725 4,665

---------------------------- ------------------------------

Total liabilities and shareholders' equity $15,216 $15,661

============================ ==============================

Ferguson plc

Condensed Consolidated Statements of Cash Flows

(unaudited)

Six months ended

January 31,

--------------------------------------------------

(In millions) 2023 2022

------------------------ ------------------------

Cash flows from operating activities:

Net income $969 $996

(Income) from discontinued operations - (25)

------------------------ ------------------------

Income from continuing operations 969 971

Depreciation and amortization 162 146

Share-based compensation 27 30

Decrease (increase) in inventories 237 (463)

Decrease (increase) in receivables and other

assets 512 (117)

Decrease in accounts payable and other liabilities (634) (261)

Other operating activities (98) (77)

------------------------ ------------------------

Net cash provided by operating activities

of continuing operations 1,175 229

Net cash used in operating activities of discontinued

operations (4) -

------------------------ ------------------------

Net cash provided by operating activities 1,171 229

Cash flows from investing activities:

Purchase of businesses acquired, net of cash

acquired (179) (245)

Capital expenditures (242) (122)

Other investing activities (4) (5)

------------------------ ------------------------

Net cash used in investing activities of continuing

operations (425) (372)

Net cash provided by investing activities

of discontinued operations - 25

------------------------ ------------------------

Net cash used in investing activities (425) (347)

Cash flows from financing activities:

Purchase of own shares by Employee Benefit

Trusts - (92)

Purchase of treasury shares (564) (417)

Net change in debt and bank overdrafts 74 510

Cash dividends (403) (364)

Other financing activities (13) (9)

------------------------ ------------------------

Net cash used in financing activities (906) (372)

------------------------ ------------------------

Change in cash, cash equivalents and restricted

cash (160) (490)

Effects of exchange rate changes 19 (10)

Cash, cash equivalents and restricted cash,

beginning of period 785 1,342

------------------------ ------------------------

Cash, cash equivalents and restricted cash,

end of period $644 $842

======================== ========================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANDXEASDEEA

(END) Dow Jones Newswires

March 07, 2023 06:45 ET (11:45 GMT)

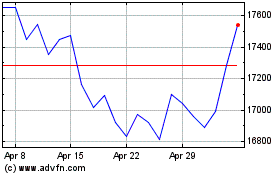

Ferguson (LSE:FERG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ferguson (LSE:FERG)

Historical Stock Chart

From Apr 2023 to Apr 2024