De La Rue PLC Director/PDMR Shareholding (0807Q)

October 13 2023 - 5:27AM

UK Regulatory

TIDMDLAR

RNS Number : 0807Q

De La Rue PLC

13 October 2023

De La Rue plc

(the "Company")

Director/PDMR Shareholding

Notification of transactions by persons discharging managerial

responsibilities and persons closely associated with them

13 October 2023

De La Rue plc announces that on 12 October 2023 it granted

awards under the De La Rue Performance Share Plan 2020 (the "PSP")

and the De La Rue Investor Returns Plan (the "IRP") to Clive Vacher

and Ruth Euling, each of whom is an Executive Director and a Person

Discharging Managerial Responsibilities ("PDMR") of the Company.

The granting of the awards creates a change in the interests of

each of them in the ordinary shares of 44(152) /(175) p of the

Company ("Shares"). The awards were granted under the rules of the

PSP and IRP as follows:

Name of Director/PDMR Role Number of Shares Number of Shares

subject to the PSP subject to the IRP

Option Option

(40% of the award) (60% of the award)

Clive Vacher CEO 309,602 640,878

-------------- -------------------- ---------------------

Ruth Euling MD, Currency 102,454 212,079

-------------- -------------------- ---------------------

The Options were granted on 12 October 2023 (the "Award Date").

The number of Shares contained in each Option was calculated by

reference to a price of 62 pence, being the average of the closing

middle market quotations for the Company's Shares for the five

consecutive dealing days including and ending on 11 October

2023.

The awards are a blended mix of PSP and IRP Options offering

higher leverage and potential returns to participants for

associated share price growth.

The PSP Options are granted such that vesting is subject to two

equally-weighted performance conditions, which will be assessed

independently, as outlined below:

Performance Proportion Threshold Maximum

metric

Outcome 25% vesting 100% vesting

----------- ------------- --------------

Adjusted EPS 50% 3 pence 5 pence

(Average performance

over 3 years)

----------- ------------- --------------

Free Cash Flow 50% GBP10million GBP15 million

(3 year average)

----------- ------------- --------------

Performance below Threshold will result in zero vesting.

Performance between the Threshold and Maximum levels will result in

a pro-rata increase in the number of Shares vesting, on a

straight-line basis. Performance beyond the Maximum level will not

result in any additional vesting.

The IRP Options are granted subject to the following performance

condition:

Relative Total Shareholder Equivalent 100% will vest if

Return Underpin to 60% of award underpin met

Outperformance of the FTSE on a relative However, as the exercise

250 (ex Investment Trusts) face value price is set at a

over the three years from calculation premium to the share

date of grant. price at grant, participants

Calculated based on a net will only be able

return index with 30 day averaging to realise value if

at the start and end of the the share price exceeds

performance period. 80p.

Options under the IRP will only have value if the share price

exceeds the option price and vesting requires that the Company has

delivered market competitive total returns to shareholders. The

exercise price has been set at 80p (a premium of 29% to the share

price of 62p at grant date).

The performance conditions are also subject to the discretion of

the Remuneration Committee to adjust or over-ride the formulaic

outcome and determine the number of Shares in respect of which the

Option will v est, taking into account such factors it may in its

discretion determine, potentially including the underlying

performance of the Group and the Participant's individual

performance .

The normal vesting date for each of the Options is 12 October

2026. To the extent that an Option vests, it is subject to a

further holding period of two years, during which time it will not

be capable of exercise. This means that, i n line with the UK

Corporate Governance Code, each Option will be subject to an

aggregate vesting and holding period of five years and no value can

be realized by the option holder until 12 October 2028 at the

earliest.

The number of Shares shown in the first table above represents

the maximum that may be acquired if all performance conditions are

achieved in full. The Company may also transfer additional Shares

to reflect the value of dividends that would have been paid on the

Shares in respect of which the Option vests over the period between

the Award Date and the end of the post-vesting holding period.

The relevant information set out below is provided in accordance

with the requirements of Article 19 of the Market Abuse Regulation

as retained in UK law.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Clive Vacher

----------------------------- ------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Executive Director/Chief Executive

Officer

----------------------------- ------------------------------------

b) Initial notification Initial Notification

/Amendment

----------------------------- ------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name De La Rue plc

----------------------------- ------------------------------------

b) LEI 213800DH741LZWIJXP78

----------------------------- ------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the financial Ordinary shares of 44(152) /(175)

instrument, type of p

instrument

Identification code GB00B3DGH821

----------------------------- ------------------------------------

b) Nature of the transaction Grant of options under the rules

of the De La Rue Performance Share

Plan 2020 (PSP) and the De La Rue

Investor Returns Plan (IRP).

----------------------------- ------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

GBP0.00 PSP: 309,602

IRP: 640,878

--------------

----------------------------- ------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

- Aggregated total

----------------------------- ------------------------------------

e) Date of the transaction 12 October 2023

----------------------------- ------------------------------------

f) Place of the transaction Outside a trading venue

----------------------------- ------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Ruth Euling

----------------------------- ------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Executive Director/MD, Currency

----------------------------- ------------------------------------

b) Initial notification Initial Notification

/Amendment

----------------------------- ------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name De La Rue plc

----------------------------- ------------------------------------

b) LEI 213800DH741LZWIJXP78

----------------------------- ------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the financial Ordinary shares of 44(152) /(175)

instrument, type of p

instrument

Identification code GB00B3DGH821

----------------------------- ------------------------------------

b) Nature of the transaction Grant of options under the rules

of the De La Rue Performance Share

Plan 2020 (PSP) and the De La Rue

Investor Returns Plan (IRP).

----------------------------- ------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

GBP0.00 PSP: 102,454

IRP: 212,079

--------------

----------------------------- ------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

- Aggregated total

----------------------------- ------------------------------------

e) Date of the transaction 12 October 2023

----------------------------- ------------------------------------

f) Place of the transaction Outside a trading venue

----------------------------- ------------------------------------

Jon Messent, Company Secretary

Contact Number: 01256 605212

13 October 2023

De La Rue plc's LEI code is 213800DH741LZWIJXP78.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHEANEDFASDFEA

(END) Dow Jones Newswires

October 13, 2023 05:27 ET (09:27 GMT)

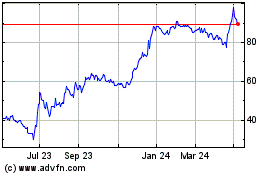

De La Rue (LSE:DLAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

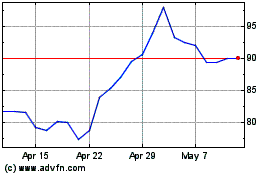

De La Rue (LSE:DLAR)

Historical Stock Chart

From Apr 2023 to Apr 2024